- Home

- »

- Pharmaceuticals

- »

-

Dipeptide Peptidase 4 Inhibitors Market Size Report, 2030GVR Report cover

![Dipeptide Peptidase 4 Inhibitors Market Size, Share & Trends Report]()

Dipeptide Peptidase 4 Inhibitors Market Size, Share & Trends Analysis Report, By Brand (Tradjenta, Nesina, Onglyza, Januvia, Vipidia, Galvus), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-171-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

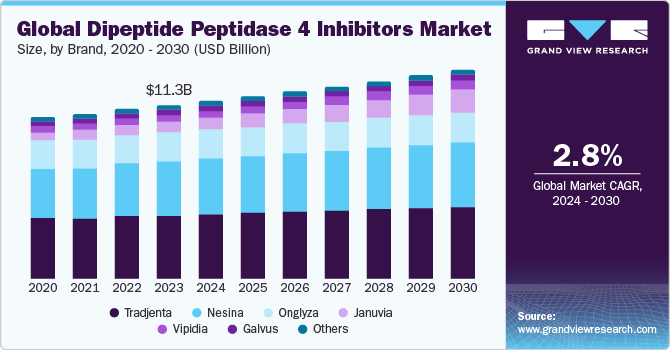

The global dipeptide peptidase 4 inhibitors market size was valued at USD 11.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 2.8% from 2024 to 2030. The market is driven by factors such as the increasing prevalence of diabetes, a growing number of diabetes cases among younger generations, and the continuous development of innovative treatment solutions. AstraZeneca reported a successful trial for Forxiga in the T2NOW Phase III trial, showing a significant decrease in A1C levels among patients treated with Forxiga (dapagliflozin) compared to those on a placebo. This emphasizes Forxiga's effectiveness in managing type 2 diabetes in pediatric patients, marking a significant advancement in pediatric diabetes treatment as of October 4, 2023.

According to the NCBI, the global prevalence of type 2 diabetes is projected to reach 7079 individuals per 100,000 by 2030. This trend is evident across all regions, with specific concern for its increasing prevalence in lower-income countries. The urgency for public health and clinical preventive measures underscores the growing market demand for effective solutions like dipeptide peptidase (Dpp-4) inhibitors to address the surging global diabetes prevalence.

The Dpp-4 inhibitors market is poised for growth due to the rising number of diabetes cases among the younger generation, as indicated by a recent modeling study published by the CDC. The study forecasts a substantial increase in the number of young people under 20 diagnosed with diabetes in the U.S. from 2017 to 2060. The projected uptrend suggests a potential 700% surge, leading to approximately 220,000 young individuals having type 2 diabetes by 2060. Furthermore, the study anticipates a 65% increase in young people with type 1 diabetes over the next 40 years. Even with consistent diagnosis rates, the market could witness a nearly 70% rise in type 2 diabetes cases and a 3% increase in type 1 diabetes cases by 2060, underscoring the critical need for Dpp-4 inhibitors to address this escalating health concern among the younger demographic.

Brand Insights

Based on the brand, the market includes Tradjenta, Nesina, Onglyza, Januvia, Vipidia, Galvus, and others. In 2023, Tradjenta emerged as one of the dominant segments in the Dipeptide Peptidase 4 (Dpp-4) Inhibitors market. Recent comprehensive research conducted by Boehringer Ingelheim Pharmaceuticals, Inc., involving nearly 7000 adults with type 2 diabetes and established heart and/or kidney disease, demonstrated that taking Tradjenta did not increase the risk of major cardiovascular events, such as heart attacks, strokes, or death when compared to a placebo. This robust safety profile positions Tradjenta as a reliable and well-tolerated choice within the Dpp-4 inhibitors market, contributing to its prominence in diabetes management.

Application Insights

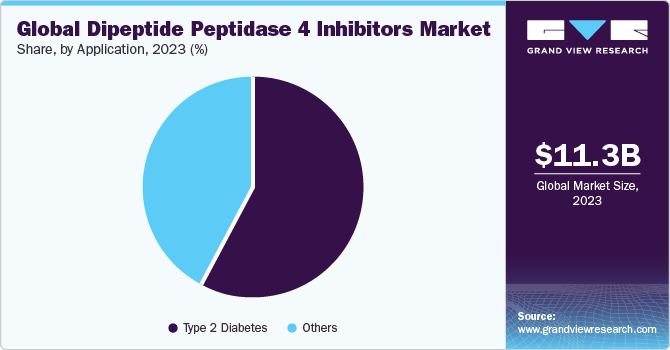

Based on application, the dipeptide peptidase 4 (Dpp-4) inhibitors market is divided into type 2 diabetes and others. Type 2 diabetes emerged as the dominating category in 2023. The overwhelming prevalence and global impact of Type 2 diabetes position it as the primary driver in the market segment. As a result, Dpp-4 inhibitors, designed to manage and treat type 2 Diabetes, play a pivotal role in meeting the specific needs of this prevalent health condition. This dominance underscores the significance of Dpp-4 inhibitors in addressing the growing challenges associated with type 2 diabetes on a global scale.

Regional Insights

North America dominated the market in 2023. This is owing to the prevalence of diabetes in the U.S. According to the CDC, affecting more than 37 million Americans (approximately 1 in 10), serves as a significant growth driver for the Dipeptidase Peptidase 4 (Dpp-4) inhibitors market. Remarkably, about 90-95% of individuals with diabetes have type 2 diabetes, and while it traditionally develops in those over 45, a concerning trend is the rising incidence among children, teens, and young adults. The expanding diabetic population underscores the increasing demand for effective treatments, making the Dpp-4 Inhibitors market a pivotal player in addressing this growing health concern. As more individuals, including younger demographics, contend with type 2 diabetes, the market for Dpp-4 inhibitors is poised for sustained growth in response to the escalating need for innovative and efficient solutions.

Key Companies & Market Share Insights

Key players operating in the market are Merck and Co., AstraZeneca, Bristol Myers Squibb, Novartis, Takeda Pharmaceuticals, Eli Lilly and Company, Boehringer Ingelheim, Pfizer, GlaxoSmithKline, among others. These are involved in partnerships & collaborations, R&D, and other strategic alliances to increase their market presence. Some of the recent initiatives implemented by the key market players are as follows:

-

In June 2023, China's National Medical Products Administration (NMPA) granted approval to AstraZeneca's Xigduo XR, a once-daily fixed-dose combination of metformin hydrochloride extended-release and dapagliflozin. This approval is specifically for the treatment of adults with type-2 diabetes (T2D) as an adjunct to diet and exercise to enhance glycemic control.

-

In February 2021, Takeda Pharmaceutical Company Limited entered into an agreement to transfer assets, marketing rights, and marketing authorization of select non-core products in Japan to Teijin Pharma Limited for USD 0.88 billion. The portfolio includes four non-core type 2 diabetes products, Liovel, Inisync, and Zafatek, with total sales of approximately JPY 0.20 billion in FY2019. While these products are essential for patient needs, they fall outside Takeda's chosen business areas, focusing on Gastroenterology, Rare Diseases, Plasma-Derived Therapies, Oncology, and Neuroscience, aligning with its global long-term growth strategy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."