- Home

- »

- Next Generation Technologies

- »

-

Disaster Recovery As A Service Market Size Report, 2030GVR Report cover

![Disaster Recovery As A Service Market Size, Share & Trends Report]()

Disaster Recovery As A Service Market Size, Share & Trends Analysis Report By Service Type (Recovery & Backup Services, Data Protection Services), By Deployment, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-129-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global disaster recovery as a service market size was estimated at USD 10.62 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 27.2% from 2023 to 2030. The primary driver behind the growth is the heightened demand for business continuity. Rising adoption of advanced technology, an increasing need for secure storage and recovery networks, and substantial investments in research and development (R&D) within the DRaaS sector. Furthermore, the market is expanding due to the growing appeal of disaster recovery as a service among both small and large businesses.

The increasing frequency of cyberattacks, including ransomware and data breaches, has emerged as a significant driver for the Disaster Recovery as a Service (DRaaS) market. Organizations are now more aware of the need for resilient disaster recovery solutions, with DRaaS offering rapid and effective solutions to recover from these malicious incidents. Moreover, DRaaS offers a cost-effective alternative, as it eliminates the need for significant upfront investments in hardware and infrastructure, which is augmenting the robust growth of disaster recovery as a service market.

Key organizations are continuously launching new products to enhance the end-user experience, which is contributing to the growth of the DRaaS market. For instance, in July 2022, IBM Corporation launched a Cloud Pak update for Data 4.5.1 to assist businesses in connecting with their data and achieving smart business outcomes. IBM Cloud Pak for Data 4.5.1 includes disaster recovery and interruption-free backup along with new features and capabilities. Such product launches by key market players are expected to boost the market expansion over the forecast period.

The COVID-19 pandemic led to the subsequent lockdown restrictions and temporarily forced manufacturing units and factories to remain shut, affecting the demand and supply chain worldwide thereby hampering numerous industries. However, the pandemic had a positive impact on the Disaster Recovery-as-a-Service (DRaaS) market, owing to the increased awareness among organizations regarding the critical importance of robust disaster recovery and business continuity planning. The sudden and widespread shift to remote work highlighted vulnerabilities in existing IT infrastructure, prompting many businesses to turn to DRaaS solutions to strengthen their resilience against unexpected disruptions. Moreover, the ongoing innovation and development in the market are anticipated to propel the market growth over the forecast period.

Moreover, the widespread adoption of cloud computing as the preferred platform for businesses of all sizes is a significant market driver for DRaaS. With DRaaS solutions readily available on major cloud providers, organizations can seamlessly integrate disaster recovery without the need for substantial investments in their infrastructure. This accessibility and compatibility with cloud platforms have lowered barriers to entry, making it increasingly convenient for businesses to implement DRaaS solutions, which is expected to propel market growth over the forecast period.

Service Type Insights

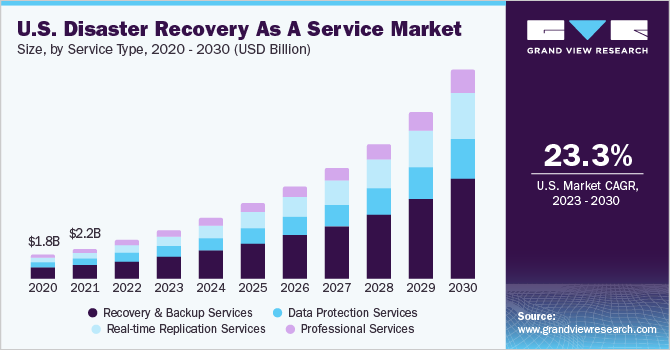

Based on service type, the recovery & backup held the largest market share of around 45% in 2022. This is attributed to the rising adoption of automated backup and recovery services by numerous organizations. In addition, organizations are increasingly relying on automated solutions to ensure the reliable execution of data backup procedures and the immediate initiation of recovery protocols when unforeseen challenges arise. This trend is expected to enhance confidence in automation's ability to mitigate the risk of human error, which is expected to drive the segment’s growth over the forecast period.

The real-time replication services type segment is expected to register the fastest CAGR of around 29% over the forecast period. Many organizations aspire to maintain multiple copies of their critical business data distributed across diverse data nodes and replicas. By replicating data across compatible technology platforms, organizations can ensure that their data remains accessible and recoverable even when disaster strikes. This initiative-taking approach enhances data resilience and business continuity, reducing the impact of disruptions. As a result, organizations are increasingly turning to DRaaS solutions that offer robust data replication features, which is expected to drive the segment growth further.

Deployment Insights

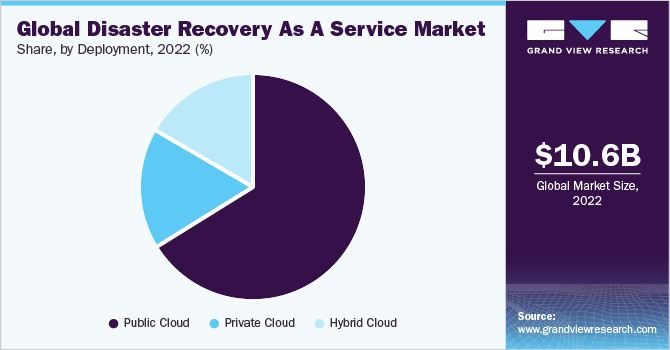

Based on deployment, the public cloud segment held the largest market share of over 65% in 2022. The ability of public cloud providers to easily expand DRaaS solutions without large upfront hardware costs is one of the significant reasons for the growth of the segment. This cost-effective flexibility has made DRaaS accessible to many types of businesses. It allows companies to adjust to changing needs quickly, making better use of resources and saving money, which is driving the segment growth over the forecast period.

The hybrid cloud deployment segment is expected to grow at the fastest CAGR of over 32% during the forecast period. Hybrid cloud solutions are driving the adoption of Disaster Recovery as a Service (DRaaS) by offering a cost-effective approach. It places non-critical data in the public cloud and mission-critical data in the private cloud. This strategy aligns well with organizations that need to manage their budgets while making disaster recovery a priority. This financial flexibility encourages more businesses to embrace DRaaS solutions, ensuring that resources are used efficiently to protect their data, which is expected to augment the segment demand over the forecast period.

The hybrid cloud deployment segment is expected to grow at the fastest CAGR of over 32% over the forecast period. Hybrid cloud solutions are driving the adoption of Disaster Recovery as a Service (DRaaS) by offering a cost-effective approach. It places non-critical data in the public cloud and mission-critical data in the private cloud. This strategy aligns well with organizations that need to manage their budgets while making disaster recovery a priority. This financial flexibility encourages more businesses to embrace DRaaS solutions, ensuring that resources are used efficiently to protect their data, which is expected to augment the segment demand over the forecast period

End-use Insights

Based on end-use, the BFSI segment held the largest revenue share of over 22% in 2022 and is expected to continue the trend over the forecast period. BFSI organizations operate non-stop without downtime. DRaaS provides continuous data availability and rapid recovery, minimizing disruptions in banking services, trading, and customer transactions. This uninterrupted operation is crucial for maintaining customer trust and financial market stability. Furthermore, DRaaS is essential for minimizing disruptions and meeting the sector's stringent uptime requirements, which is expected to fuel the segment growth during the forecast period.

The IT & telecommunication segment is expected to grow at the fastest CAGR of around 29% over the forecast period. The reliance of IT & telecommunication organizations on data for service delivery, network operations, and communication infrastructure maintenance is significant, and any momentary downtime or data loss can lead to substantial disruptions and financial setbacks. DRaaS ensures data availability and streamlines instant recovery procedures. This proactive strategy minimizes the risk of service interruptions, safeguarding the consistency and dependability of their operations, which is anticipated to fuel the segment growth over the forecast period.

Regional Insights

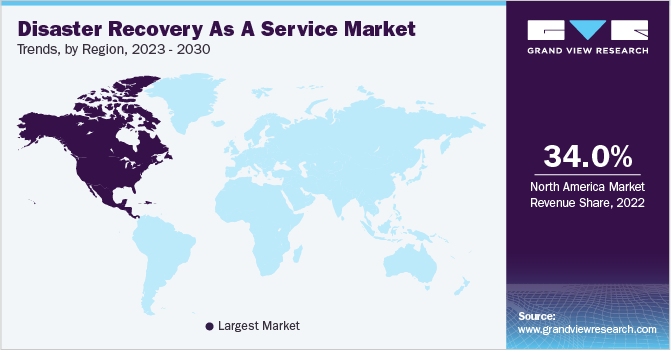

North America captured the highest market share of over 34% in 2022. The substantial share is primarily the result of substantial investments and technological advancements within the disaster recovery industry. The rising imperative to safeguard critical data for numerous organizations in sectors such as BFSI, government, healthcare, and others has led to an increased demand for innovative products and the adoption of disaster recovery as a service (DRaaS), which is expected to drive the market growth. For instance, in September 2023, Amazon Web Services, Inc. launched AWS Elastic Disaster Recovery. It offers a cost-effective solution for swiftly and dependably recovering on-premises and cloud-based applications. It minimizes downtime and data loss by employing efficient storage, minimal compute resources, and point-in-time recovery capabilities.

The Asia Pacific region is expected to grow at the highest CAGR of over 30% over the forecast period. A significant trend in the region is the rising focus on data sovereignty and compliance. With evolving data privacy regulations in different countries such as India, organizations are moving towards DRaaS solutions that ensure the data stays within their own national borders and complies with local laws. For instance, in August 2023, the Ministry of Electronics & Information Technology by the Government of India initiated a project known as "Meghraj," as part of its efforts to fully leverage the advantages of cloud computing. This ambitious endeavor is aimed at advancing the delivery of electronic services across the nation, all the while streamlining the government's expenditures on Information and Communication Technology (ICT). Such government initiatives are expected to boost the demand in the market over the forecast period.

Key Companies & Market Share Insights

The market is classified as highly competitive, with the presence of several companies. The key players operating in the industry are focusing on strategic alliances, product development, expansion, and partnerships to remain competitive in the industry. For instance, in July 2023, Recovery Point Systems, Inc. partnered with Mazars, an international global audit, tax, and advisory firm. The partnership is expected to enhance business continuity and offer comprehensive protection against ransomware. This collaboration also aims to assist clients in evaluating, preparing for, and safeguarding themselves against potential threats. Such strategic partnerships by the key players are anticipated to augment the market growth over the forecast period. Some prominent players in the global Disaster Recovery as a Service market include:

-

Acronis International GmbH

-

Amazon Web Services, Inc.

-

IBM Corporation

-

InterVision Systems, LLC

-

Infrascale, Inc.

-

Microsoft Corporation

-

Recovery Point Systems, Inc.

-

Sungard Availability Services LP

-

TierPoint, LLC

-

VMware, Inc.

Disaster Recovery As A Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.81 billion

Revenue forecast in 2030

USD 74.34 billion

Growth rate

CAGR of 27.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; South Africa; UAE; KSA

Key companies profiled

Acronis International GmbH; Amazon Web Services, Inc.; IBM Corporation; InterVision Systems, LLC; Infrascale, Inc.; Microsoft Corporation; Recovery Point Systems, Inc.; Sungard Availability Services LP; TierPoint, LLC; VMware, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disaster Recovery as a Service Market Segmentation

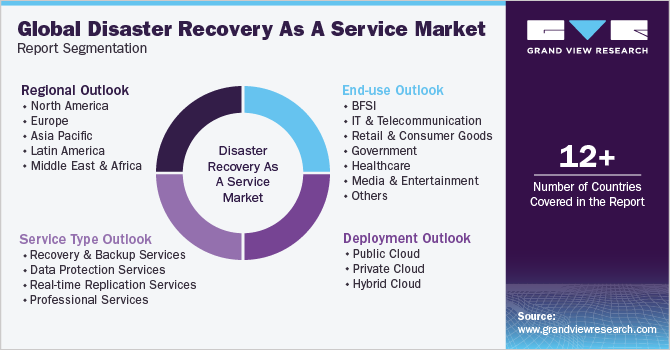

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disaster recovery as a service market report based on service type, deployment, end-use, and region:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Recovery & Backup Services

-

Data Protection Services

-

Real-time Replication Services

-

Professional Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Retail & Consumer Goods

-

Government

-

Healthcare

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global disaster recovery as a service market size was estimated at USD 10.62 billion in 2022 and is expected to reach USD 13.81 billion in 2023.

b. The global disaster recovery as a service market is expected to grow at a compound annual growth rate (CAGR) of 27.2% from 2023 to 2030 to reach USD 74.34 billion by 2030.

b. The North America region accounted for the largest share of more than 34.0% in the DRaaS market in 2022 and is expected to continue its dominance over the forecast period.

b. Some key players operating in the DRaaS market include Acronis International GmbH, Amazon Web Services, Inc., IBM Corporation, InterVision Systems, LLC, Infrascale, Inc., Microsoft Corporation.

b. Key factors that are driving the disaster recovery as a service market growth include the rising adoption of advanced technology, an increasing need for secure storage and recovery networks, and substantial investments in research and development within the DRaaS sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."