- Home

- »

- Homecare & Decor

- »

-

Dishwasher Tablet Market Size, Share, Industry Report 2030GVR Report cover

![Dishwasher Tablet Market Size, Share & Trends Report]()

Dishwasher Tablet Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Private-Label, Branded), By Distribution Channel (Supermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-183-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dishwasher Tablet Market Summary

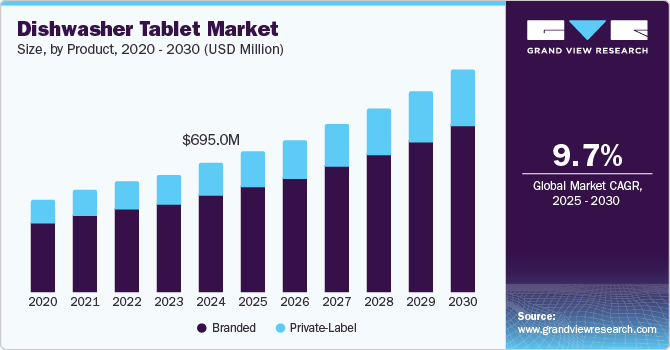

The global dishwasher tablet market size was estimated at USD 695.0 million in 2024 and is projected to reach USD 1,200.7 million by 2030, growing at a CAGR of 9.7% from 2025 to 2030. This growth can be attributed to several factors, such as increasing awareness about hygiene and cleanliness among consumers and a rise in the number of restaurants and eating joints worldwide.

Key Market Trends & Insights

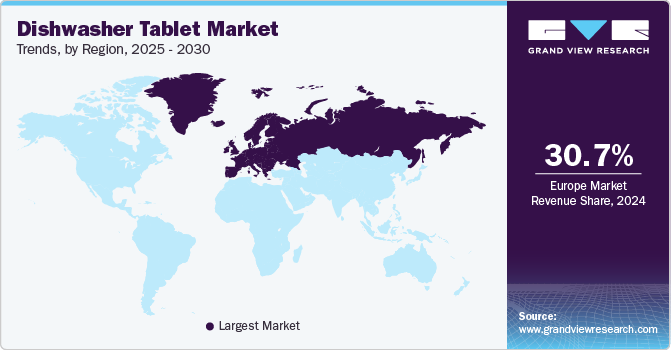

- The Europe dishwasher tablet market dominated the global market, with a revenue share of 30.7% in 2024.

- The Asia Pacific dishwasher tablet market is expected to grow at the fastest CAGR of 10.6% over the forecast period.

- Based on product, the branded segment dominated the dishwasher tablet industry with the largest revenue share of 73.7% in 2024.

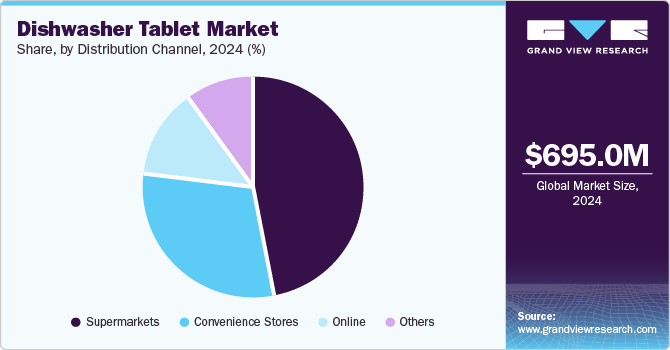

- Based on distribution channel, the supermarket segment dominated the dishwasher tablet industry with the largest revenue share of 47.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 695.0 Million

- 2030 Projected Market Size: USD 1,200.7 Million

- CAGR (2025-2030): 9.7%

- Europe: Largest market in 2024

Precisely formulated dishwasher tablets, contributing to energy and water savings during each wash cycle, are driving industry growth with their rising adoption. Furthermore, the growing trend toward sustainability and eco-friendly products is expected to drive the demand for the dishwashing tablets industry. Consumers are increasingly seeking products that offer convenience and minimize the environmental impact, prompting manufacturers to innovate and develop biodegradable dishwasher tablets. For instance, brands such as Seventh Generation have introduced eco-conscious dishwasher tablets that cater to environmentally aware consumers, demonstrating how sustainability can drive product adoption.

Moreover, the rise of e-commerce has transformed the way consumers purchase household products. Online platforms provide ease of access and competitive pricing, allowing consumers to easily compare products and find the best deals. This shift is illustrated by the increasing sales of dishwasher tablets through major e-commerce sites, such as Amazon and Alibaba, where consumers can access various brands and formulations with just a few clicks.

The expansion of the commercial sector is also contributing to the growth of the dishwasher tablet industry. Restaurants and hotels increasingly use dishwasher tablets to efficiently and effectively clean large volumes of dishes. Dishwasher tablets are pre-formed with efficient ingredients and eliminate the need for additional additives, which reduce the overuse of liquid or powder detergent in dishwashing. All-in-one tablets that clean various types of stains from utensils are gaining popularity in commercial establishments where presentation is critical. This trend highlights the demand from both residential and commercial users, further strengthening the market's potential for sustained growth in the coming years.

The shift in consumer preferences for dishwasher tablets owing to their hygiene aspects, convenience, and energy-saving qualities is boosting the market growth. Dishwasher tablets are available in the form of small bricks of concentrated powder, which makes it easier for the user to deliver a precise detergent dosage. Unlike powders, gels, and liquids, dishwasher tablets are less likely to spill everywhere. Rinse aids such as powerballs in the tablets remove the detergent residue from the dishes and improve the quality of the cleaning. Rinse agents provide a sparkly clean finish to the dishes.

In addition, an increasing number of restaurants and food joints are attracting consumers’ attention to dishwasher tablets. Dishwasher tablets reduce the amount of soap entering the water supply, which eases the burden on water treatment plants. Top players in the dishwasher tablet market, such as Eurotab, Reckitt Benckiser, and Henkel, are focusing on expanding their distribution channel owing to growing demand across developing regions, thus spurring the growth of the market. As the top players hold a significant share in the market, it is difficult for small firms to compete with them.

Product Insights

The branded segment dominated the dishwasher tablet industry with the largest revenue share of 73.7% in 2024 due to consumer preference for trusted and recognizable products. Branded dishwasher tablets are often associated with higher quality, reliability, and effective cleaning performance, encouraging repeat purchases from satisfied customers. In addition, established brands invest significantly in marketing and product innovation, ensuring they meet evolving consumer demand for comfort and sustainability. For instance, Finish, a Reckitt Benckiser product, offers multi-functional tablets that combine detergent, rinse aid, and other features in one product, enhancing their appeal.

The private-label segment is expected to grow significantly over the forecast period due to increasing consumer demand for cost-effective alternatives to branded products. As more consumers become price-sensitive, especially in emerging markets, private-label brands are launching products at competitive pricing for budget-conscious shoppers without sacrificing quality. Retailers are expanding their private-label offerings, thereby enhancing visibility and availability in stores and driving product sales. Major supermarket chains are launching their dishwasher tablets, which provide similar cleaning efficiency as established brands at lower prices, appealing to a wider audience looking for affordable alternatives. This trend is expected to continue as consumers increasingly seek reasonable yet effective cleaning solutions.

Distribution Channel Insights

The supermarket segment dominated the dishwasher tablet industry with the largest revenue share of 47.2% in 2024 due to the widespread accessibility of supermarkets and a broad range of options offered by them. As supermarkets typically stock various brands and products, customers can easily compare options and choose products depending on their requirements. Promotional displays and bulk purchasing options further encourage sales in these retail spaces. In addition, the ability to physically inspect packaging and read labels enhances the confidence of consumers in their choices, making supermarkets a preferred shopping destination for household cleaning products.

The online segment is expected to grow significantly over the forecast period due to changing consumer shopping habits and the increasing preference for convenience. As more consumers turn to e-commerce for shopping, online platforms provide easy access to various dishwasher tablet brands and formulations while offering price comparisons and product reviews. Major e-commerce portals offer an extensive range of dishwasher tablets, often with competitive pricing and fast delivery options, which particularly appeal to busy consumers. Moreover, subscribing to regular deliveries enhances customer loyalty and ensures that consumers never run out of essential cleaning products, further driving growth of the online sales channel.

Regional Insights

The Europe dishwasher tablet market dominated the global market, with a revenue share of 30.7% in 2024, primarily due to the high penetration of dishwashers in households and an increasing focus on cleanliness and convenience. European manufacturers lead in the development of sophisticated formulations that include multi-layered tablets, optimizing the release of active ingredients throughout the wash cycle for superior cleaning performance. The busy lifestyle of many Europeans increases the appeal of dishwashers, which offer a quick and easy way to clean dishes without extensive manual effort. Tablet formulations often include protective agents that help prevent etching and clouding on glassware, ensuring sparkling clean results after every wash. European consumers are increasingly inclined toward eco-friendly products, prompting manufacturers to innovate and offer biodegradable and phosphate-free options.

Germany Dishwasher Tablet Market Trends

Germany dominated the European dishwasher tablet market, driven by increasing awareness of cleanliness and food safety. The German population strongly emphasizes hygiene, particularly in kitchen environments, which has boosted the demand for effective cleaning solutions such as dishwasher tablets. In addition, there is a growth in consumer inclination toward non-toxic household products, propelling the demand for environment-friendly and safe dishwasher tablet formulations. This trend aligns with the broader movement toward sustainable living, where consumers prioritize effective and eco-conscious products.

North America Dishwasher Tablet Market Trends

The North America dishwasher tablet market is expected to grow significantly over the forecast period due to the widespread adoption of dishwashers in North American households and commercial spaces. This has created a strong demand for dishwasher tablets, making them a staple in many domestic and commercial kitchens. Certain products incorporate effervescent agents that help dissolve the tablet quickly upon contact with water, improving overall washing efficiency by ensuring even distribution of active ingredients throughout the wash cycle.

U.S. Dishwasher Tablet Market Trends

The U.S. dishwasher tablet market dominated North America, driven by increasing household penetration of dishwashers and the highest dishwasher ownership rates globally, leading to a strong demand for compatible cleaning products. The U.S. manufacturers are at the forefront of developing advanced formulations that enhance cleaning efficacy, including multi-layered and all-in-one tablets that address various cleaning needs. Increasing consumer concern about environmental sustainability has driven demand for eco-friendly dishwasher tablets that use biodegradable ingredients and recyclable packaging. Some brands offer child-safe options with natural ingredients that appeal to parents looking for safer cleaning solutions around children.

Asia Pacific Dishwasher Tablet Market Trends

The Asia Pacific dishwasher tablet market is expected to grow at the fastest CAGR of 10.6% over the forecast period due to increased spending on household appliances, including dishwashers, with rising disposable income among consumers in countries such as China and India. As more households adopt dishwashers, the demand for innovative and convenient cleaning products, such as dishwasher tablets, is expected to record growth. In addition, with growing awareness about hygiene, consumers seek efficient cleaning solutions that save time and effort. This combination of economic growth, changing lifestyles, and heightened awareness is expected to lead to robust expansion of the Asia Pacific dishwasher tablet market in the coming years.

China dominated the Asia Pacific dishwasher tablet market due to several factors, such as rapid urbanization and rising disposable income. An increase in households adopting dishwashers is leading to a surge in demand for effective cleaning solutions such as dishwasher tablets. The market in China is witnessing a significant shift toward eco-friendly products, with consumers seeking biodegradable and phosphate-free options that align with sustainability trends. For instance, brands are introducing innovative dishwasher tablets that provide superior cleaning performance and meet environmental standards.

Key Dishwasher Tablet Company Insights

Some key players in the dishwasher tablet market are EUROTAB, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, Unilever, McBride., Church & Dwight Co., Inc., Amway, Procter & Gamble, Seventh Generation Inc., and Colgate-Palmolive Company. These companies dominate the dishwasher tablet market by launching innovative products and developing advanced formulations for improved cleaning efficiency while addressing environmental concerns. Moreover, they are engaged in expanding distribution networks, including e-commerce, to reach a wider audience base and capitalize on the growing demand for eco-friendly solutions in both developed and emerging markets.

-

Eurotab specializes in the design and production of solid cleaning products. The company focuses on innovation and sustainability, offering a range of dishwasher tablets that include both classic and eco-friendly options. With multiple production facilities across Europe and a strong emphasis on research & development, Eurotab continues to enhance its product offerings to meet diverse customer needs.

-

Reckitt Benckiser Group emphasizes innovation by continuously improving its product formulations to enhance cleaning performance and efficiency. Reckitt Benckiser prioritizes sustainability, focusing on eco-friendly packaging and ingredients to align with consumer preferences for environmentally responsible products.

Key Dishwasher Tablet Companies:

The following are the leading companies in the dishwasher tablet market. These companies collectively hold the largest market share and dictate industry trends.

- EUROTAB

- Reckitt Benckiser Group PLC

- Henkel AG & Co. KGaA

- Unilever

- McBride.

- Church & Dwight Co., Inc.

- Amway Corp.

- Procter & Gamble

- Seventh Generation Inc.

- Colgate-Palmolive Company

Recent Developments

-

In May 2023, Reckitt launched a paper-based pouch for its Finish dishwasher tablets, marking a significant step toward sustainable packaging solutions. This innovative packaging, a switch from plastic to paper, addresses the challenging barrier requirements of dishwasher tablets, which are completely water soluble.

Dishwasher Tablet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 756.8 million

Revenue forecast in 2030

USD 1,200.7 million

Growth rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Argentina; South Africa; UAE

Key companies profiled

EUROTAB; Reckitt Benckiser Group PLC; Henkel AG & Co. KGaA; Unilever; McBride.; Church & Dwight Co., Inc.; Amway; Procter & Gamble; Seventh Generation Inc.; Colgate-Palmolive Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dishwasher Tablet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dishwasher tablet market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Private-Label

-

Branded

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.