- Home

- »

- Homecare & Decor

- »

-

Disinfectant Spray Market Size, Share, Industry Report, 2030GVR Report cover

![Disinfectant Spray Market Size, Share & Trends Report]()

Disinfectant Spray Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By End Use (B2B (Hospitals, Nursing Homes, Medical Laboratories), B2C (Hypermarket & Supermarket, Convenience Stores, Online)), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-912-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disinfectant Spray Market Summary

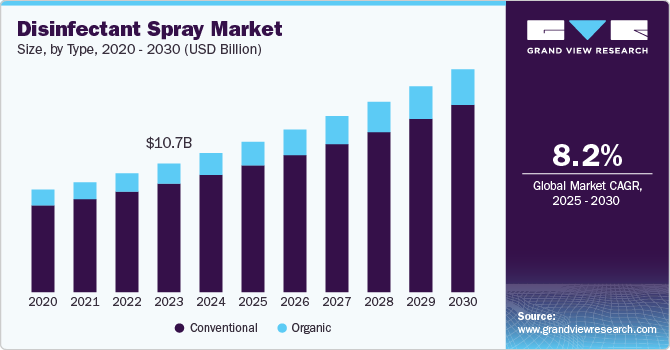

The global disinfectant spray market size was valued at USD 11.57 billion in 2024 and is projected to reach USD 18.56 billion by 2030, growing at a CAGR of 8.2% from 2025 to 2030. The market is driven by increasing consumer awareness of hygiene and cleanliness, rising demand for disinfectant products in healthcare and residential settings, and ongoing concerns over viral outbreaks and infections.

Key Market Trends & Insights

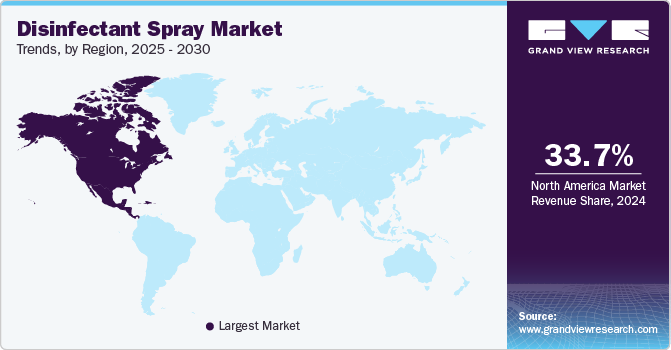

- The North America disinfectant spray market is accounted for a share of 33.7% of the global market revenue in 2024.

- The U.S. disinfectant spray market is expected to grow at a CAGR of 9.2% from 2025 to 2030

- By type, the consumables, reagents, and kits segment dominated the market and accounted for the largest revenue share in 2024.

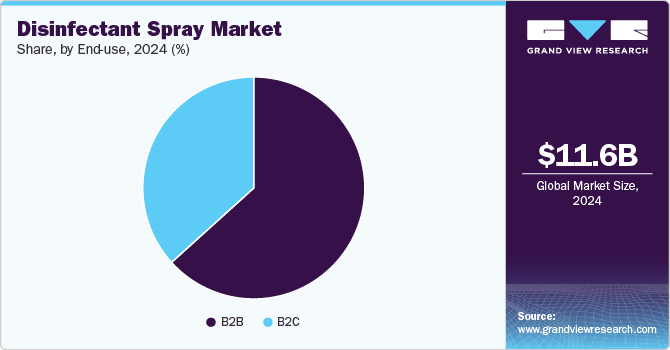

- By end use, B2B disinfectant spray sales accounted for a share of over 63% in 2024

Market Size & Forecast

- 2024 Market Size: USD 11.57 Billion

- 2030 Projected Market Size: USD 18.56 Billion

- CAGR (2025-2030): 8.2%

- North America: Largest market in 2024

The market's growth is further supported by innovations in product formulations, such as eco-friendly and surface-specific sprays, and expanding distribution channels through e-commerce. The COVID-19 pandemic has had a positive impact on the disinfectant spray industry.

The outbreak of COVID-19 has created extensive demand for disinfectant spray across hospitals, nursing homes, and households. Companies have been responding positively to the crisis by increasing the supply of disinfectant sprays and offering it through both offline and online mediums, as household consumers preferred online shopping over offline, owing to safety concerns.

An increase in demand for disinfecting air and surfaces due to the presence of coronavirus across the globe is one of the major factors driving the market for disinfectant sprays. In April 2020, U.S. Environmental Protection Agency (EPA) and the Centers for Disease Control released a list of disinfectant sprays that were effective against COVID-19 and guidance for disinfecting public spaces, workplaces, businesses, schools, and homes, and falls in line with the Opening up America Again guidelines, that promoted the adoption of disinfectant sprays across North America.

Furthermore, according to the CDC, in the U.S. alone, HAIs (Hospital Acquired Infections) account for an estimated 1.7 million infections and 99,000 associated deaths each year, out of which, 32% are UTIs, 22% are surgical site infections, 15% are lung infections, and 14% are bloodstream infections. Among these, UTI is one the most common HAI diagnosed among patients, for which strict rules have been authorized by governments around the world. With the rise in hospital-acquired infections across the globe, there is a rise in demand for disinfectant spray to reduce such infections.

Type Insights

Conventional disinfectant spray sales accounted for a share of over 84.4% in 2024. Conventional disinfectant sprays refer to air and surface disinfectants that kill more than 60 types of organisms instantly with more than 60% alcohol content. Owing to the rise of HAIs across the globe, hospitals are adhering to strict infection prevention practices that promote the adoption of disinfectant spray. For instance, in U.S. Veterans Affairs (VA) hospitals, the number of infection prevention practices increased to 12 between 2005 and 2017 and 92% to 100% of VA hospitals reported regular adherence to key infection prevention practices. Such initiatives by medical facilities are anticipated to boost the growth of conventional disinfectant sprays.

Organic disinfectant spray sales are projected to grow at a CAGR of 8.5% from 2025 to 2030. Organic or natural disinfectant sprays have germ-fighting, antifungal, and antibacterial abilities but do not contain any alcohol or bleach. In addition, a rise in demand for environment-friendly products with no adverse effects is driving the market. The rising focus of major manufacturers, such as AIRZAI and Organic Harvest, in expanding their organic disinfectant spray portfolio, is leading to the growth of this segment.

End Use Insights

B2B disinfectant spray sales accounted for a share of over 63% in 2024, driven by a rise in demand for disinfectant sprays from hospitals, nursing homes, and medical laboratories, among others. The heightened focus on infection control and stringent sanitation protocols in these environments has driven the need for effective disinfectant solutions. For instance, hospitals often use specialized disinfectant sprays like SaniSpray HP from Graco, which offers fast, consistent coverage for large areas, reducing the risk of cross-contamination. Additionally, medical laboratories are increasingly adopting high-grade disinfectants, such as Lysol Pro Solutions, to maintain sterile conditions and prevent the spread of infections during testing and research processes.

According to the Centers for Disease Control and Prevention (CDC), there was a rise in the patient count since the new Omicron variant and approximately 77,000 Americans were hospitalized with COVID-19 in December 2021. U.S. states such as Hawaii, New Jersey, New York, and Virginia witnessed a weekly increase in the patient count of 20% or more in mid-December 2021. With the rise in hospitalization, the market witnessed an increase in demand for disinfecting all hospital surfaces and environments for every new patient getting hospitalized, which, in turn, is leading to increased adoption of disinfectant sprays.

B2C disinfectant spray sales are projected to grow at a CAGR of 9.0% from 2025 to 2030. The online B2C distribution channel has significantly changed the shopping habits of people as it offers benefits such as doorstep delivery, easy payment methods, heavy discounts, and the availability of a wide selection of disinfectants on a single platform. Key players in the market for disinfectant spray are increasingly launching e-commerce websites in large lucrative markets owing to the rising internet penetration and increasing propensity of mobile shopping among consumers.

Regional Insights

The North America disinfectant spray market is accounted for a share of 33.7% of the global market revenue in 2024, driven by increased hygiene awareness across various sectors, including healthcare, education, and residential spaces. Major players like Clorox, Lysol, and SC Johnson have capitalized on this trend by introducing innovative products tailored to the region's needs. For example, Clorox's Total 360 System, which is widely used in schools and hospitals, has become popular for its efficient coverage and disinfection capabilities. The region’s preference for eco-friendly and plant-based products, such as CloroxPro's EcoClean line, has also contributed to market growth.

U.S. Disinfectant Spray Market Trends

The U.S. disinfectant spray market is expected to grow at a CAGR of 9.2% from 2025 to 2030 fueled by ongoing demand for high-efficiency germ-killing solutions in both residential and commercial spaces. The rise of multifunctional products, such as SC Johnson’s FamilyGuard disinfectant sprays, which disinfect and deodorize in one step, caters to busy households and businesses. Additionally, increased focus on public health safety in facilities like gyms, offices, and public transport systems further supports the demand for advanced disinfectants that ensure long-lasting protection against viruses and bacteria.

Europe Disinfectant Spray Market Trends

The Europe disinfectant spray market is accounted for a share of over 19% of the global market revenue in 2024. Based on a study by ACS Health and Safety Organization, between March 2020 to February 2021, more than 60.0% increase in sales of hand sanitizers and disinfectants were observed in European countries such as the UK and Germany, owing to the rise in demand for COVID-19 infection prevention.

Asia Pacific Disinfectant Spray Market Trends

The Asia Pacific disinfectant spray market is expected to grow at a CAGR of 9.5% from 2025 to 2030. The rising guidelines for infection prevention in India, China, and Japan, both of which are backed by regulatory support, are expected to ensure continuous demand for disinfectant spray. Furthermore, Asia Pacific accounts for the largest number of hospitals across the globe. Based on a study by World Bank, Japan accounts for the highest number of hospital establishments across the globe as of 2020. The growing number of hospitals in the region will contribute to the demand for disinfectant sprays; hospitals, being key end-users of disinfectant sprays.

Key Disinfectant Spray Company Insights

The market for disinfectant spray is fairly concentrated in nature. The market is characterized by the presence of a few established players and new entrants. Companies have been expanding their production capabilities to widen their supply, thereby enhancing their consumer base. Key market players focus on strategies such as strategic partnerships, innovation, and new product launches to enhance their product portfolio and customer base in the market.

Key Disinfectant Spray Companies:

The following are the leading companies in the disinfectant spray market. These companies collectively hold the largest market share and dictate industry trends.

- Reckitt Benckiser Group

- Ecolab Inc.

- Procter and Gamble

- 3M

- Gojo Industries Inc.

- Whiteley Corporation

- Kimberly- Clark

- S.C. Johnson & Son Inc.

- Medline Industries

- Clorox Company

Recent Developments

-

In July 2024, CloroxPro Canada launched its EcoClean line of disinfectants and cleaners, featuring plant-based active ingredients like lactic acid, following success in the U.S. market. The EcoClean products offer effective disinfection-killing 99.9% of flu viruses and the COVID-19 virus in 30 seconds-while addressing concerns from cleaning professionals about cost, efficacy, and efficiency, as highlighted in the 2023 Clean Index Survey. Designed for use in shared spaces like schools and offices, EcoClean provides a safer, eco-conscious alternative without sacrificing performance, aligning with growing demand for natural cleaning solutions.

-

In 2024, Byotrol launched a new 4-in-1 Multi-Surface Cleaner Disinfectant Spray that consolidates multiple cleaning and disinfectant credentials with exceptional performance against stains, odors, and a wide range of microbes including Norovirus, Influenza, Listeria, and MRSA. Backed by extensive testing and approvals, this fast-acting, long-lasting spray is well-suited for professional environments, offering cost-benefits and peace of mind by replacing the need for multiple single-purpose products.

-

In May 2023, SC Johnson launched the FamilyGuard Brand, a new line of disinfectant products designed to protect families by disinfecting over 100 hard, non-porous surfaces, including areas where children and pets play. The products kill 99.9% of germs, including the viruses that may cause COVID-19 and H1N1. The Disinfectant Cleaner tackles dirt and grime, while the Disinfectant Spray eliminates tough odors with a pleasant scent. FamilyGuard was voted #1 by 40,000 American shoppers and named a 2023 Product of the Year in Home Cleaning, as well as a winner of the Better Homes & Gardens Clean House Award.

-

In March 2021, Clorox Company partnered with Cleveland Clinic and CDC to offer disinfectant sprays and best practices for cleaning and disinfecting to a number of U.S.-based clients, such as United Airlines, Uber Technologies, Inc., Enterprise Holdings car rental brands and transportation services, and AMC Theatres. This helped the company to expand its consumer base across North America.

Disinfectant Spray Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.52 billion

Revenue forecast in 2030

USD 18.56 billion

Growth Rate

CAGR of 8.2% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, End Use, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; UAE

Key companies profiled

Reckitt Benckiser Group; Ecolab Inc.; Procter and Gamble; 3M; Gojo Industries Inc.; Whiteley Corporation; Kimberly- Clark; S.C. Johnson & Son Inc.; Medline Industries; Clorox Company

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disinfectant Spray Market Report Segmentation

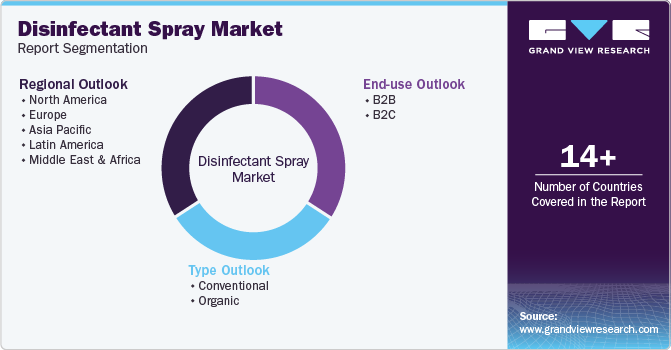

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disinfectant spray market on the basis of type, end use, and region.

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Conventional

-

Organic

-

-

End Use Outlook (Revenue, USD Billion; 2018 - 2030)

-

B2B

-

Hospitals

-

Nursing Homes

-

Medical Laboratories

-

Others

-

-

B2C

-

Hypermarket & Supermarket

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global disinfectant spray market size was estimated at USD 11.57 billion in 2024 and is expected to reach USD 12.52 billion in 2025.

b. The global disinfectant spray market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 18.56 billion by 2030.

b. North America dominated the disinfectant spray market with a share of 33.7% in 2024. This is attributable to the increasing presence of well-established manufacturers in the region and the wide availability of products.

b. Some key players operating in the disinfectant spray market include Reckitt Benckiser Group, Ecolab Inc., Procter and Gamble, 3M, Gojo Industries Inc., Whiteley Corporation, Kimberly- Clark, S.C. Johnson & Son Inc., Medline Industries, and Clorox Company.

b. Key factors that are driving the disinfectant spray market growth include increasing focus on adopting a healthy and hygienic lifestyle and rise in hospital-acquired infections such as central line-associated bloodstream infections, surgical site infections, and catheter-associated urinary tract infections among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.