- Home

- »

- Alcohol & Tobacco

- »

-

Disposable E-cigarettes Market Size & Trends Report, 2030GVR Report cover

![Disposable E-cigarettes Market Size, Share & Trends Report]()

Disposable E-cigarettes Market (2022 - 2030) Size, Share & Trends Analysis Report By Flavor (Non-Tobacco, Tobacco), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-165-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable E-cigarettes Market Summary

The global disposable e-cigarettes market size was valued at USD 5.7 billion in 2021 and is projected to reach USD 14.8 billion by 2030, growing at a CAGR of 11.2% from 2022 to 2030. The growing demand for non-tobacco products owing to rising health concerns among consumers is expected to drive the market during the forecast period.

Key Market Trends & Insights

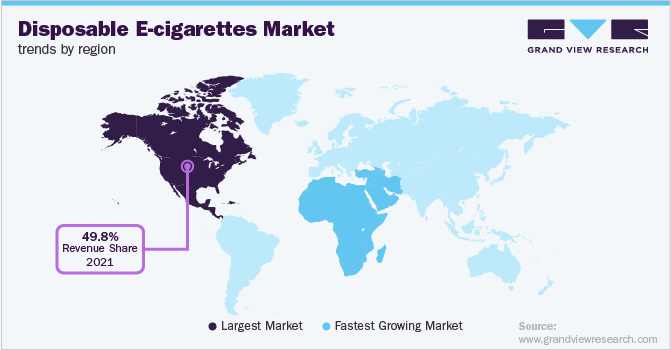

- North America dominated the disposable e-cigarettes market and accounted for a revenue share of 49.8% in 2021.

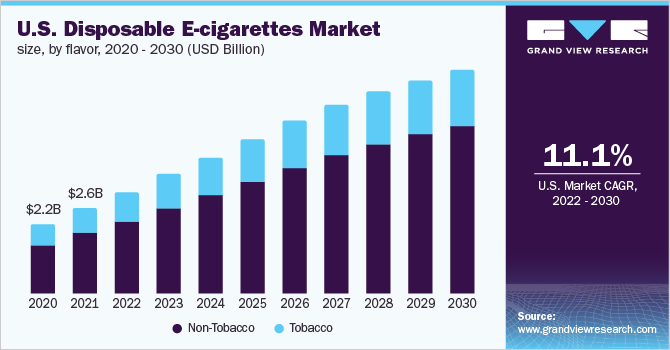

- The disposable e-cigarettes market in the U.S. is estimated to have substantial CAGR during the forecast period.

- Based on flovor, the non-tobacco segment held a larger revenue share of 70.2% in 2021.

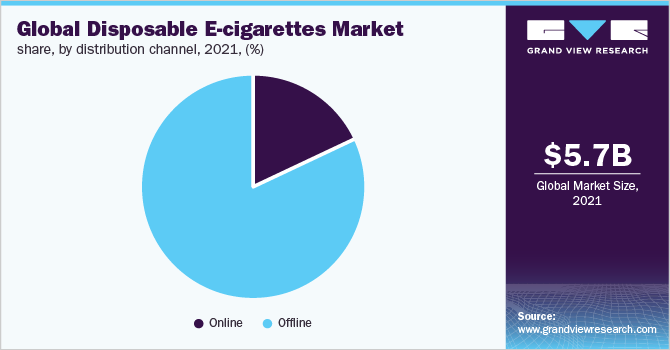

- Based on distribution channel, the offline segment accounted for the largest share of 82.2% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 5.7 Billion

- 2030 Projected Market Size: USD 14.8 Billion

- CAGR (2022-2030): 11.2%

- North America: Largest market in 2021

- Middle East and Africa: Fastest growing market

According to an article published by National Library of Medicine, in February 2022, the use of disposable e-cigarette among young adults in the U.S. increased to 50.2% from a former base line of 22.1%. Such data suggest a positive outlook for the growth of the industry.Amid the COVID-19 pandemic, e-cigarette vendors have adopted several COVID-19-based marketing strategies to increase product sales. The key players in the market started offering these products online through various e-commerce websites such as Amazon. According to an article published by Truth Initiative, in June 2021, online retail for e-cigarettes including disposable products was 28%. Furthermore, the availability of approved disposable e-cigarettes from various health bodies such as the National Medical Products Administration (NMPA), as a better alternative to tobacco smoking, will integrate well with the growth trend.

The rising traction of using disposable e-cigarettes among consumers, especially the millennial population, is expected to boost the market in the upcoming years. Key players are launching new and innovative products to comply with the growing demand for these products among consumers. For instance, in January 2021, Dinner Lady, a U.K.-based vape brand launched a disposable vape pen, available in eight flavors, including Lemon Tart, Banana Ice, Citrus Ice, and Strawberry Ice. The initiative was taken to support consumers in terms of health, and bring them towards more sustainable options from combustible cigarettes.

The changing consumer shift towards more hassle-free smoking, without the need for recharging or refills, would help the market gain momentum in the upcoming years. For instance, in May 2022, RELX International, entered the disposable market, adding two new disposable vape brands: RELX x BubbleMon and WAKA Mini to its line-up of premium vapes in the U.K. The product from the brand RELX x BubbleMon is available in two different styles - patterned color and plain block color. The devices feature a transparent oil cabinet that reveals the levels of e-liquid remaining within the device, enabling consumers to know when to purchase a new device.

The growing inclination of consumers towards different flavored products such as cinnamon, berry, vanilla, saffron, and apple would provide a lucrative opportunity for the players operating in the market for disposable e-cigarettes. For instance, in July 2021, BIDI Stick, a disposable e-cigarette brand unveiled new flavor names as direct translations from its previous flavors such as Marigold, (formerly Icy Mango), Arctic (formerly Mint Freeze), and Solar (formerly Berry Blast), among others. The approach was designed to subvert future restrictions on the sale of flavored disposable e-cigarettes that were not in accordance with government policy and modify its existing product characteristics.

However, the increasing potential risk caused at each stage of the disposable e-cigarette product lifecycle, including mining, manufacturing, using, and disposing of, could pose potential environmental harm, which is expected to alter the market growth rate. According to an article published by Truth Initiative, in March 2021, almost half (49.1%) of young people don’t know what to do with used e-cigarette pods and disposable devices. The resulting e-waste is often shipped from Western countries to developing countries, which places the environmental hazard of reprocessing, reclaiming, and incinerating waste on poorer nations. However, government initiatives for disposing of these products in a safe manner would help the market grow.

Flavor Insights

The non-tobacco segment held a larger revenue share of 70.2% in 2021 and is expected to maintain dominance during the forecast period. Growing consumer awareness about degenerating effect of tobacco consumption is expected to drive the market in the forecast period. According to an article published by the British Medical Journal (BMJ), in February 2020, approximately 11.2% of consumers in South California used disposable e-cigarettes. Among these product users, fruit/candy (80.7%), mint (77.4%), and menthol (67.7%) were commonly preferred flavors, while tobacco flavors were less commonly preferred (19.4%).

The tobacco segment is projected to register the second faster growth during the forecast period with a CAGR of 10.0% from 2022 to 2030. The shifting consumer preference toward electronic cigarettes to control daily nicotine dosage is expected to work as a favorable factor for the industry. For instance, in June 2022, NJOY Ace, a high-strength pod vape was authorized by FDA (Food and Drug Administration) to be sold in the U.S. with high-strength nicotine salt refills. The product range includes NJOY Ace Device, NJOY Ace Pod Classic Tobacco 2.4% (or 24 mg/mL) nicotine, NJOY Ace Pod Classic Tobacco 5% (or 50 mg/mL) nicotine, and NJOY Ace Pod Rich Tobacco 5% (or 50 mg/mL) nicotine.

Distribution Channel Insights

The offline segment dominated the market for disposable e-cigarettes and accounted for the largest revenue share of 82.2% in 2021. The availability of disposable e-cigarette in various stores, such as supermarkets and hypermarkets are the primary factor for its large value generation in the year 2021. For instance, Sainsbury's, the second largest chain of supermarkets in the U.K. offers disposable vape - Aqua Vape Smok Disposable Mbar Pro in the flavor of Mango Ice. Furthermore, easy accessibility of e-cigarette stores and vape shops to try out and test these devices before making a purchase decision is expected to drive the segment growth during the forecast period.

The online segment is projected to register faster growth during the forecast period with a CAGR of 11.9% from 2022 to 2030. The benefits of online marketplaces in terms of competitive pricing, convenience, and access to a wider variety of products encourage people to purchase these products online. For instance, the Puff E-Cig brand offers disposable e-cigarettes such as Synthetic Nicotine Disposable Devices and Zero Nicotine Disposable Devices with free shipping services on orders above USD 150. Such benefits from online platforms in regions including North America, Europe, and the Asia Pacific will prove beneficial for the growth of the segment.

Regional Insights

North America dominated the disposable e-cigarettes market and accounted for the maximum revenue share of 49.8% in 2021. The increasing popularity of flavored disposable e-cigarettes offered by brands such as Puff Bar, Vuse, and Suorin, is expected to drive the growth of the industry in the region. According to an article published by U.S. Food and Drug Administration in March 2022, among students in the U.S. who currently used disposable e-cigarettes, Puff Bar was the most commonly reported usual brand (26.8%), followed by Vuse (10.5%), and Suorin (2.1%). Furthermore, rising adoption of the product among millennials and Gen X is expected to boost the market growth.

In the Middle East and Africa, the market for disposable e-cigarettes is expected to witness a CAGR of 12.7% in the forecast period. The growing awareness among individuals about the harmful effects of tobacco and the increasing willingness to quit smoking are escalating the demand for disposable e-cigarettes in the Middle East and Africa region. Key players in the industry are launching products in the region to comply with the growing demand for the product. For instance, in September 2021, RELX, a premium vaping brand was launched in Saudi Arabia. Vaping products are also available in the UAE and Kuwait. The launch comes in the form of a healthier alternative to cigarettes.

Key Companies & Market Share Insights

The market is fragmented with the presence of many global and regional players. These players are engaging in the major acquisition and promotional activities to increase their customer base and brand loyalty. Some of the initiatives by the key players in the industry are:

-

For instance, in May 2022, Flawless, one of Europe's largest vaping distributors signed an exclusive agreement with the leading Chinese manufacturer of vape disposables, ELF BAR, to create the Gee600 disposable device, for the U.K.'s vape and FMCG sector.

-

In April 2022, Vaptex launched a new vape device GORIN MAX 4500 puffs adjustable airflow disposable pod, which extends some features between TAKIN and GORIN for a better combination for all vapers

-

In August 2019, VPR Brands, a market leader and pioneer in electronic cigarettes and vaporizers for nicotine, cannabis, and cannabidiol (CBD), announced the re-launch of its most popular e-cigarettes brand, KRAVE, an exceptional tasting, high-quality alternative to cigarettes.

Some of the prominent players in the disposable e-cigarettes market include:

-

Puff Bar

-

JUUL Labs, Inc.

-

British American Tobacco Plc

-

Imperial Brands Plc

-

Japan Tobacco Inc.

-

NJOY

-

YouMe Co. Ltd

-

Shenzhen IVPS Technology Co., Ltd.

-

Kaival Brands Innovations Group, Inc.

-

JAC Vapour

Disposable E-cigarettes Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.8 billion

Revenue forecast in 2030

USD 14.8 billion

Growth rate

CAGR of 11.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; New Zealand; Philippines; UAE; South Africa

Key companies profiled

Puff Bar; JUUL Labs Inc; British American Tobacco Plc; Imperial Brands Plc; Japan Tobacco Inc; NJOY; YouMe Co. Ltd; Shenzhen IVPS Technology Co., Ltd.; Kaival Brands Innovations Group, Inc.; JAC Vapour

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable E-cigarettes Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global disposable e-cigarettes market report based on flavor, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2017 - 2030)

-

Non-Tobacco

-

Tobacco

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

New Zealand

-

Philippines

-

-

Central & South America

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global disposable e-cigarette market size was estimated at USD 5.7 billion in 2021 and is expected to reach USD 6.77 billion in 2022.

b. The global disposable e-cigarette market is expected to grow at a compound annual growth rate of 11.2% from 2022 to 2030 to reach USD 14.84 billion by 2030.

b. North America dominated the disposable e-cigarette market with a share of more than 49% in 2021.The regional market is driven by the increasing consumption of hassle-free smoking over flammable cigarettes.

b. Some of the key players in the disposable e-cigarettes market are Puff Bar; JUUL Labs Inc; British American Tobacco Plc; Imperial Brands Plc; Japan Tobacco Inc; NJOY; YouMe Co. Ltd; Shenzhen IVPS Technology Co., Ltd.; Kaival Brands Innovations Group, Inc.; JAC Vapour

b. Key factors that are driving the disposable e-cigarettes market growth include growing interest in disposable e-cigarette market among the young people who are trying to quit, coupled with growing interest in alternative products that do not involve lung exposure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.