- Home

- »

- Healthcare IT

- »

-

Disposable Ureteroscope Market Size, Industry Report, 2030GVR Report cover

![Disposable Ureteroscope Market Size, Share & Trends Report]()

Disposable Ureteroscope Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flexible Ureteroscope, Rigid Ureteroscope), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-969-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Ureteroscope Market Trends

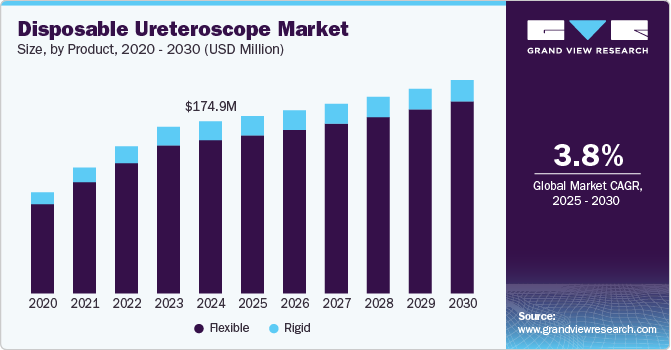

The global disposable ureteroscope market size was estimated at USD 174.9 million in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2030. The market is experiencing growth due to a rising number of ailments, such as urethral stricture, kidney stones (urolithiasis), and kidney cancer due to lifestyle changes such as less consumption of water, and higher intake of alcoholic beverages and aerated drinks, dietary changes, and lack of physical activities. Disposable ureteroscopes reduce the rate of hospital-acquired infections and decrease contamination risk, and thus provide higher-quality of patient care with improved economic viability. The introduction of stringent regulation to lower the risk of ureteroscopy-related infections has increased the demand for ureteroscopes for treating urolithiasis, urothelial carcinoma, and benign prostatic hyperplasia.

The rising trend of minimally invasive procedures also called one-day surgeries has led to a rise in the adoption of disposable ureteroscope by endoscopists and surgeons for diagnosing and treating renal diseases and multiple urological conditions. The benefits associated with these procedures are less collateral tissue damage, quicker recovery, which results in shortened hospitalization time, and reduced postoperative complications and care. Furthermore, compared to open surgeries, these minimally invasive procedures are more economically viable. Other factors, such as improvement in the visualization of endoscopic devices and the introduction of robot-assisted endoscopy, are further opening new opportunities for revenue growth. Major players are concentrating on creating technologically advanced products to cater the rising demand.

The increasing prevalence of chronic kidney diseases and rapid innovations in product performance and optical imaging are propelling the growth of the disposable ureteroscope market. According to the CDC data from 2023, in the U.S., chronic kidney disease was most prevalent among the population aged 65 years and above (34%), followed by the age group of 45-64 years (12%), and lastly, the 18-44 age group (6%). People with diabetes and cardiovascular diseases are at a higher risk of developing chronic kidney diseases. This will increase the demand for minimally invasive procedures such as ureteroscopy, leading to a steep rise in the procedural rate and boosting the adoption of ureteroscopy. The sudden shift to disposable ureteroscopes from reusable ureteroscopes in diagnosing and treating urologic conditions as it lowers post-operative complication and infection rates is driving market growth.

Increasing prevalence of obesity further drives the revenue growth as it has been observed that obese people have higher chances of developing kidney stones. The 2022 WHO report found that 1 out of 8 individuals worldwide were dealing with obesity. Additionally, the 2023 Obesity Fact Sheet from the National Library of Medicine indicates a significant rise in the occurrence of class II and III obesity, especially among young adults between 20 and 39 years old. In addition, for the diagnosis and treatment of obese population, ureteroscope are highly considered, thereby supplementing market growth.

Market Concentration & Characteristics

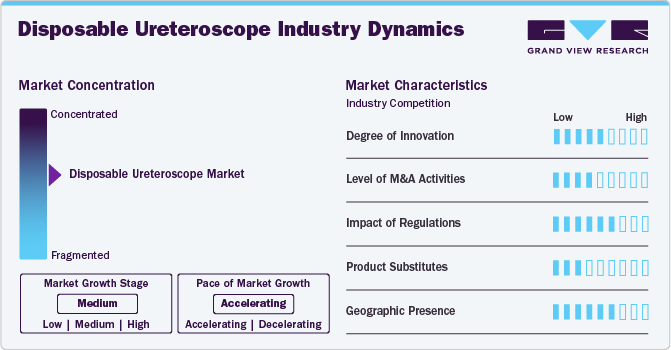

The disposable ureteroscope market demonstrates a high degree of innovation, driven by advancements in medical technology and the increasing demand for minimally invasive procedures. Manufacturers are focusing on developing lightweight, flexible, and single-use devices that enhance patient safety by reducing the risk of infection associated with reusable scopes. Innovations include improved imaging capabilities, such as high-definition cameras and integrated optical systems, which provide better visualization during procedures.

The disposable ureteroscope market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for disposable ureteroscopes.

The impact of regulations on the disposable ureteroscope market is significant, as stringent safety and efficacy standards govern the design, manufacturing, and distribution of these medical devices. Regulatory bodies, such as the FDA in the United States and the European Medicines Agency in Europe, require extensive clinical testing and documentation to ensure that new products meet safety benchmarks. This can lead to longer approval times, affecting the speed at which innovative products enter the market.

In the disposable ureteroscope market, product substitutes primarily include reusable ureteroscopes and other minimally invasive surgical tools. Additionally, alternative imaging technologies, such as flexible cystoscopes or other endoscopic instruments, can sometimes serve as substitutes depending on the specific medical procedure being performed.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions.

Product Insights

In 2024, the flexible segment dominated the disposable ureteroscope market and accounted for the largest revenue share of 89.0% and is anticipated to witness fastest CAGR growth over the forecast period. Disposable flexible ureteroscopes have undergone series of advancements and thus, are widely used for diagnosis and therapeutic applications for multiple upper urinary tract pathologies. The flexible ureteroscope allows complete mobility of 180 degrees and reduces the time frame of hospital stays. Furthermore, the introduction of a single-use digital flexible ureteroscope has opened new opportunities for the market as it provides detailed HD images for removing stones more efficiently and safely.

The rigid segment in the disposable ureteroscope market is anticipated to witness significant the fastest expansion over the forecast period. The increasing prevalence of urological conditions, such as kidney stones and urinary tract infections, elevates the demand for effective diagnostic and therapeutic tools. Rigid disposable ureteroscopes offer distinct advantages, including enhanced maneuverability and stability during procedures, which can lead to improved patient outcomes and reduced complication rates, thereby fostering segmental growth.

Application Insights

In 2024, the urolithiasis segment dominated the disposable ureteroscope market and accounted for the largest revenue share of 46.9%. The growth is majorly attributed to the worldwide prevalence of kidney stones. In a study released in February 2023, it was reported that the occurrence of kidney stones in India mirrors global rates, with a prevalence of approximately 12%. The condition is more widespread in northern India, where the prevalence is 15%. Growing innovations and rapid adoption of advanced technology are expected to drive the market growth of this segment. Growing awareness of disease among the patient population, the presence of a large number of specialty clinics, and favorable government policies further drive the market growth.

The urethral stricture segment in the disposable ureteroscope market is anticipated to witness significant growth over the forecast period. The rising incidence of urethral strictures significantly drives growth in the disposable ureteroscope market, particularly as these conditions necessitate effective diagnostic and therapeutic interventions. Urethral strictures, often resulting from trauma, infections, or previous surgical procedures, require precise endoscopic procedures for diagnosis and treatment, making disposable ureteroscopes an attractive option. The benefits of single-use devices, such as reduced risk of infection and improved patient safety, are boosting market growth.

End Use Insights

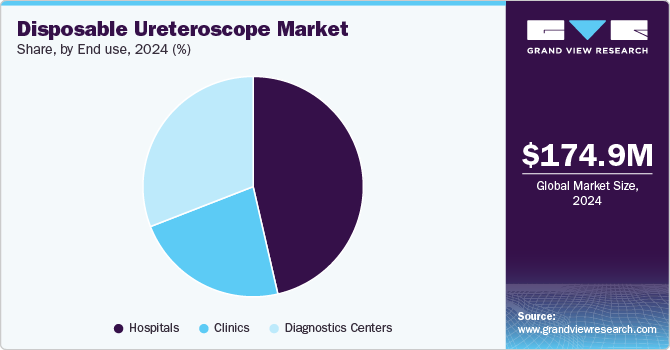

In 2023, the hospital segment dominated the disposable ureteroscope market and accounted for the largest revenue share of 46.4%. The growth is attributed as many patients majorly prefer hospitals for ureteroscopy procedures due to the presence of skilled healthcare professionals and favorable reimbursement policies. Expansion of healthcare infrastructure, adoption of advanced technology and worldwide increasing investment in the hospital sector further drives the market growth. Increasing healthcare spending, rising trend of minimally invasive procedures and advancements in the designing of products also contribute towards market growth.

The clinics segment in the disposable ureteroscope market is anticipated to witness fastest growth over the forecast period. The growth is attributed to growing number of specialty clinics throughout the world and increasing healthcare spending in the private sectors. Moreover, the rising demand for outpatient and minimally invasive procedures are boosting segmental growth. Furthermore, as healthcare shifts towards more efficient, cost-effective treatment models, clinics are increasingly adopting disposable ureteroscopes to enhance patient care while minimizing hospital stays.

Regional Insights

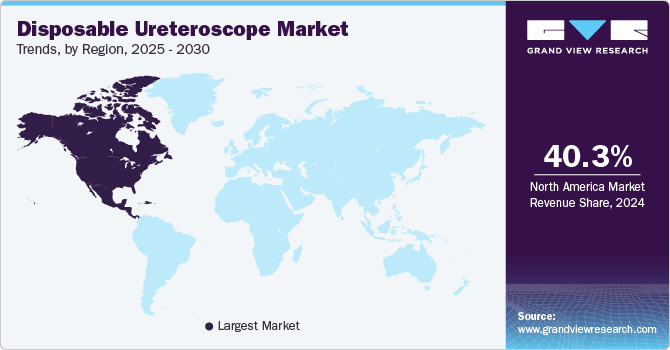

North America dominated the disposable ureteroscope market with a revenue share of 40.3% in 2024 and is anticipated to witness fastest growth over the forecast period. The growth of the market can be attributed to the presence of highly established healthcare systems and the presence of key players within the region, such as Elmed Medical Systems, Boston Scientific, and Stryker. Other factors, such as favorable reimbursement policies, patient awareness, and adoption of advanced instruments, are also supporting market growth.

U.S. Disposable Ureteroscope Market Trends

U.S. disposable ureteroscope market held the largest share of 91.1% in 2024, growth driven by advanced healthcare infrastructure, a strong emphasis on infection control, and an increasing prevalence of urological conditions. The widespread adoption of minimally invasive surgical techniques and the availability of innovative medical technologies further enhance the market growth.

Disposable ureteroscope market in Canada is anticipated to register the fastest growth during the forecast period. The growing focus on patient safety and quality of care is propelling the demand for disposable ureteroscopes. The Canadian healthcare system’s shift towards outpatient procedures and resource optimization encourages clinics and hospitals to adopt single-use devices that mitigate infection risks.

Europe Disposable Ureteroscope Market Trends

Disposable ureteroscope market in Europe is anticipated to register the fastest growth during the forecast period. Ongoing technological advancements in endoscopy and a rise in demand for minimally invasive procedures are among the factors driving the market growth. Favorable macro environment factors are driving key players to revise their market entry strategies through mergers & acquisitions and technological collaborations to expand their footprint.

Germany disposable ureteroscope market is anticipated to register a considerable growth rate during the forecast period. Cost reduction, time efficiency, and the need to control endoscopy-related infections are driving the demand for disposable ureteroscopes. Single-use ureteroscope eliminates the costs associated with sterilization procedures, leading to overall cost reduction in ureteroscopy procedures.

Disposable ureteroscope market in the UK is anticipated to register a considerable growth rate during the forecast period. The growing awareness and preference among physicians & patients for improving post-procedure outcomes and reducing the risk of cross-contamination is driving the demand for disposable ureteroscope. The rise in the incidence of surgical-site infections caused by contaminated endoscopes is another factor driving the demand for disposable endoscopes.

Asia Pacific Disposable Ureteroscope Market Trends

Asia Pacific disposable ureteroscope market is anticipated to register the significant growth rate during the forecast period owing to its rapidly improving healthcare infrastructure, a less stringent regulatory framework, and economic development attracting foreign investments. India and China are considered the most populous countries, providing a large patient pool and elderly population, especially in China. The growing patient pool in these countries is expected to boost the market.

China disposable ureteroscope market held the largest share in 2023. The demand for disposable endoscopes in China is surging due to the failure of standard cleaning and disinfection processes, as per the study published in the American Journal of Infection Control. The country’s growing production and manufacturing expertise in disposable medical devices are contributing to the disposable ureteroscope devices market growth.

Disposable ureteroscope market in Japan is anticipated to register a considerable growth during the forecast period. The growing geriatric population, high prevalence of chronic diseases, and consistent product advancements are some factors expected to drive the demand for endoscopy procedures including ureteroscopy which further propelling the market growth.

Latin America Disposable Ureteroscope Market Trends

Disposable ureteroscope market in Latin America is anticipated to register the fastest growth during the forecast period. The rising incidence of hospital-acquired infections due to contaminated ureteroscopes is a significant factor boosting the demand for disposable ureteroscopes.

Brazil disposable ureteroscope market is anticipated to register a considerable growth during the forecast period. The focus on infection control and reducing the risk of virus transmission has led to a greater preference for single-use devices, including ureteroscopes. In addition, rising awareness about disposable ureteroscopes is anticipated to boost their adoption, contributing to the overall market growth in the coming years.

Middle East & Africa Disposable Ureteroscope Market Trends

Disposable ureteroscope market in MEA is anticipated to register the fastest growth during the forecast period. MEA is a key economic and technologically advanced region with a high per capita disposable income. Government initiatives to increase reimbursement coverage are a key factor expected to boost market growth during the forecast period.

South Africa disposable ureteroscope market is anticipated to register a considerable growth during the forecast period. South Africa has a well-developed healthcare sector focused on providing advanced medical services and technologies to its population. The need to deliver high-quality healthcare services, accurate diagnoses, and minimally invasive treatments is increasing the demand for disposable ureteroscope devices in South Africa.

Key Disposable Ureteroscope Company Insights

Key participants in the disposable ureteroscope market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and expanding their business footprints.

Key Disposable Ureteroscope Companies:

The following are the leading companies in the disposable ureteroscope market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Richard Wolf GmbH

- Olympus Corporation

- FUJIFILM Holdings Corporation

- Karl Storz GmbH

- Smith & Nephew Inc.

- PENTAX Medical

- Elmed Electronics & Medical Systems S.A.

- Dornier MedTech

- OPCOM

- AED.MD

Recent Developments

-

In June 2024, Ambu discloses that its ureteroscopy solution, comprising the full-HD endoscopy system aBox 2 and the single-use ureteroscope aScope 5 Uretero, has received 510(k) regulatory clearance from the U.S. FDA.

-

In April 2024, Cook Medical launched the Ascend single-use flexible ureteroscope in the U.S. and Canada, this new development will enable Cook to enhance its ability to cater to a wider range of urology customers with a comprehensive selection of stone management products.

-

In April 2024, Olympus, a worldwide medical technology corporation dedicated to improving people's well-being, safety, and satisfaction, revealed that its initial single use ureteroscope system, RenaFlex, had obtained clearance from the U.S. FDA 510(k).

-

In February 2023, Boston Scientific Corporation revealed that the Single-Use Digital Flexible Ureteroscope System, LithoVue Elite had obtained 510(k) clearance from the U.S. FDA. This system is the initial ureteroscope system capable of monitoring intrarenal pressure in real-time throughout ureteroscopy procedures.

Disposable Ureteroscope Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 180.2 million

Revenue forecast in 2030

USD 216.7 million

Growth rate

CAGR of 3.8% from 2025 to 2030

Historical data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boston Scientific Corporation; Richard Wolf GmbH; Olympus Corporation; FUJIFILM Holdings Corporation; Karl Storz GmbH; Smith & Nephew Inc.; PENTAX Medical; Elmed Electronics & Medical Systems S.A.; Dornier MedTech; OPCOM; AED.MD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Disposable Ureteroscope Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global disposable ureteroscope market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible Ureteroscopes

-

Rigid Ureteroscopes

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Urolithiasis

-

Urethral Stricture

-

Kidney Cancer

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disposable ureteroscope market size was estimated at USD 174.9 million in 2024 and is expected to reach USD 180.2 million in 2025.

b. The global disposable ureteroscope market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 216.7 million by 2030.

b. On the basis of product, flexible ureteroscope holds the largest market share of 89% in 2024 and is also expected to grow with the fastest CAGR over the forecast period. Introduction of single-use digital flexible ureteroscope has opened new opportunities for the market as it provides detailed HD images for removing stones more efficiently and safely.

b. Some of the key players are: Boston Scientific Corporation, Richard Wolf GmbH, Olympus Corporation, FUJIFILM Holdings Corporation, Karl Storz GmbH, Smith & Nephew Inc., PENTAX Medical, Elmed Electronics & Medical Systems S.A., Dornier MedTech, OPCOM, AED.MD

b. The market is experiencing growth due to rising number of ailments, such as urethral stricture, kidney stones (urolithiasis), and kidney cancer due to lifestyle changes like less consumption of water, and higher intake of alcoholic beverages and aerated drinks, dietary changes, and lack of physical activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.