- Home

- »

- Clinical Diagnostics

- »

-

Disruptive Behavior Disorder Treatment Market Report, 2030GVR Report cover

![Disruptive Behavior Disorder Treatment Market Size, Share & Trends Report]()

Disruptive Behavior Disorder Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Oppositional, Conduct, Intermittent), By Treatment (Medication Management), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-608-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

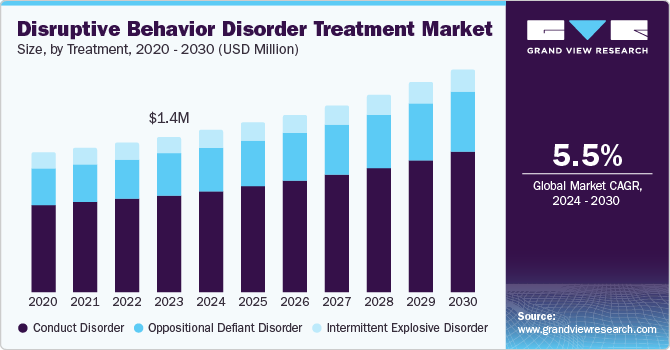

The global disruptive behavior disorder treatment market size was valued at USD 1.42 million in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. This growth is attributed to increased awareness, enhanced diagnostic abilities, and a changing societal emphasis on mental wellness. In addition, the growing response to the impacts of DBD on people and their families has caused a rise in the need for successful therapies and treatments. Moreover, integrating technology such as telehealth and digital tools has increased access, reaching a wider demographic. Encouraging individuals and caregivers to seek professional support for mental health issues without stigma promotes the growth of the disruptive behavior disorder treatment market by implementing innovative solutions.

In addition, advancements in treating disruptive behavior are creating new market opportunities for disruptive behavior disorder treatment. Increasing awareness about the significance of early detection of mental health problems propels the disruptive behavior disorder treatment market projection. The expansion of the market for treating disruptive behavior disorders is predicted to be fueled by favorable opportunities in developing markets, supported by better healthcare facilities, growing healthcare demands, and surging rates of mental illnesses in young individuals. Moreover, the healthcare sector in emerging nations is advancing rapidly due to rising demands for improved medical services, substantial government funds for enhancing healthcare infrastructure, and the growth of medical tourism in developing countries.

Furthermore, increased awareness of people for preventive healthcare and treatments increases disruptive behavior disorder treatment implementation. Moreover, there has been a rise in the number of campaigns conducted by hospitals, clinics, and institutes to promote patient awareness. The significant market players investing resources in research and development of advanced technology services or products have contributed to an increase in the adoption of disruptive behavior disorder, thereby propelling market growth. However, the increasing occurrence of mental illnesses in youngsters and the growing prevalence of treatment options are driving the market expansion of disruptive behavior disorder treatment.

Type Insights

Conduct disorder (CD) dominated the market and accounted for the largest revenue share of 62.6% in 2023. It is a more severe type of DBD and is identified by repeating behaviors of rule-breaking and violating the rights of others. Youngsters with conduct disorders may face challenges with substance abuse and engaging in criminal behaviors such as theft or physical violence. Moreover, conduct disorders are impacted by environmental and genetic factors, exposure to violence, or a family history of mental illness. The care for CD typically includes various methods, such as one-on-one therapy, family counseling, and interventions in the community to help with trauma, improve social skills, and encourage positive behavior.

Oppositional defiant disorder is projected to grow significantly during the forecast period. ODD is a prevalent disorder known for defiant, disobedient, and hostile actions towards those in positions of authority. People with ODD frequently show continuous negativity, the tendency to argue, and the refusal to follow rules and instructions, impacting their social and academic performance. The usual approach to dealing with ODD includes a mix of behavioral therapy, training for parents, and interventions in school that focus on enhancing communication, managing anger, and resolving conflicts. Furthermore, pharmacological treatments may be taken into account when other conditions such as ADHD or anxiety are present, further influencing the global disruptive behavior treatment market.

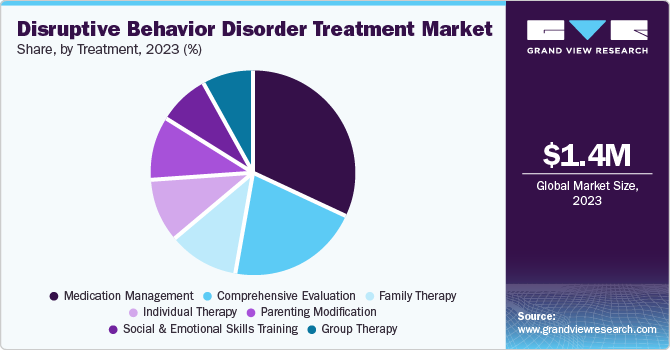

Treatment Insights

Medication management led the market and accounted for the largest revenue share of 31.5% in 2023. Medication management is a key component of treatment, using drugs to relieve symptoms and address neurochemical imbalances linked to DBD. Commonly prescribed medications such as stimulants, antipsychotics, mood stabilizers, and selective serotonin inhibitors (SSRIs) are used to address symptoms such as impulsivity, aggression, and inattention. However, psychosocial interventions are frequently supplementary to medication management to offer comprehensive care and enhance treatment results in the global disruptive behavior treatment market.

Parenting modification is expected to witness significant growth over the forecast period. The rise in parenting therapy is believed to be the reason for the increase in managing disruptive behavior disorder. In this form of parent coaching in behavior therapy, parents collaborate with a therapist to acquire techniques in establishing structure, incentivizing positive behavior, enforcing consistent discipline, and enhancing their bond with their child using constructive communication. Moreover, the rise in awareness of disruptive behavior disorders has increased the need for treatments such as parenting therapy to address this issue and propel market expansion.

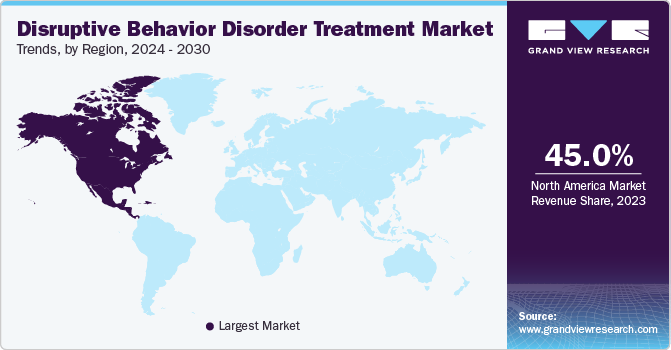

Regional Insights

North America disruptive behavior disorder treatment market dominated the global market and accounted for the largest revenue share of 45.0% in 2023. The increase in the market is mainly due to the widespread occurrence of disruptive behavior disorders, increased awareness and efforts by both government and private organizations for diagnosis and treatment, and the involvement of major market leaders in the area.

U.S. Disruptive Behavior Disorder Treatment Market Trends

The disruptive behavior disorder treatment market in the U.S. dominated the North American market and accounted for the largest revenue share of 88.3% in 2023. The U.S. has the largest market share in North America due to the increasing prevalence of disruptive behavior disorders in the nation. Disruptive behavior disorders affect children in the country, as reported by the Centers for Disease Control and Prevention (CDC). Moreover, the market growth in the region is anticipated to be driven by the rising investment in research and development activities and the advancement of innovative diagnostic and therapeutic products.

Europe Disruptive Behavior Disorder Treatment Market Trends

The Europe disruptive behavior disorder treatment market is expected to experience substantial growth in upcoming years. This is projected to be due to the growing number of cases of disruptive behavior disorders, increasing public awareness, and the presence of advanced diagnostic and treatment options.

The growth of the disruptive behavior disorder treatment market in the UK is expected to be driven by its targeted patient population, rising government initiatives, and access to advanced treatments. Research efforts in the country to create better treatment alternatives for disruptive behavior disorders are also growing, which will positively boost market expansion.

Asia Pacific Disruptive Behavior Disorder TreatmentMarket Trends

Asia Pacific disruptive behavior disorder treatment market is anticipated to witness lucrative growth with a 7.2% CAGR in the forecast period. The increase in government efforts to support healthcare, the rising health consciousness of the population, the demand for advanced therapeutic technology for treating neurological disorders, and the growing need for high-quality healthcare are leading factors in the region. The increasing recognition of the illness and the rising number of elderly individuals in nations such as China, India, Japan, and South Korea.

The disruptive behavior disorder treatment market in China is expected to grow significantly over the forecast period. This growth is attributed to the increasing healthcare costs. The country is predicted to experience substantial market growth due to government and private entities investing more in healthcare infrastructure and having a large patient population. In addition, the rising disposable income and evolving lifestyle of individuals in these nations are projected to boost the need for cutting-edge diagnostic and therapeutic products for disruptive behavior disorders.

Key Disruptive Behavior Disorder Treatment Company Insights

Some of the key companies and hospitals in the disruptive behavior disorder treatment market include Lilly., Pfizer Inc., Johnson & Johnson Services, Inc., Bionomics, Highland Ridge Hospital, Lakeview Health, Boston Children's Hospital, INTEGRIS Health; in the market & are focusing on continuous development and innovation to gain a competitive edge in the industry.

-

Amneal Pharmaceuticals, Inc. develops and manufactures a wide range of generic and specialty medications. Amneal offers the treatment of disruptive behavior disorders (DBDs) through its portfolio of psychotropic medications. The company emphasizes R&D, particularly in central nervous system disorders, aiming to enhance therapeutic options for children and adolescents suffering from DBDs.

-

Zydus Pharmaceuticals, Inc. is a healthcare provider company that actively engages in the development of treatments for various psychiatric disorders, including disruptive behavior disorders. Zydus aims to provide effective solutions that address the complex needs of patients with DBDs, ultimately contributing to improved behavioral management and overall mental health outcomes.

Key Disruptive Behavior Disorder Treatment Companies:

The following are the leading companies in the disruptive behavior disorder treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Lilly

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Bionomics

- Highland Ridge Hospital

- Lakeview Health

- Boston Children's Hospital

- INTEGRIS Health

- Chelsea Therapeutics International, Ltd.

- Springwoods Behavioral Health.

Recent Developments

-

In June 2023, Eli Lilly announced a collaboration with QurAlis, a biotech company focused on neurodegenerative diseases. This partnership involves licensing QRL-204, an experimental antisense oligonucleotide therapy currently in preclinical development for amyotrophic lateral sclerosis (ALS) and frontotemporal dementia (FTD). QRL-204 aimed to restore UNC13A function, a critical regulator of neurotransmitter release.

-

In March 2023, Johnson & Johnson expanded its mental health portfolio by launching a novel treatment specifically designed for pediatric patients with disruptive behavior disorders. This innovative medication aims to enhance the management of symptoms, providing a more effective therapeutic option for children facing these challenges. By focusing on a streamlined administration process, the treatment seeks to reduce the overall burden on patients and their families, making it easier to integrate into daily routines. This initiative reflects Johnson & Johnson's commitment to improving mental health outcomes for young individuals.

Disruptive Behavior Disorder Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.48 million

Revenue forecast in 2030

USD 2.04 million

Growth Rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, treatment, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Lilly.; Pfizer Inc.; Johnson & Johnson Services, Inc.; Bionomics; Highland Ridge Hospital; Lakeview Health; Boston Children's Hospital; INTEGRIS Health; Chelsea Therapeutics International, Ltd.; Springwoods Behavioral Health.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

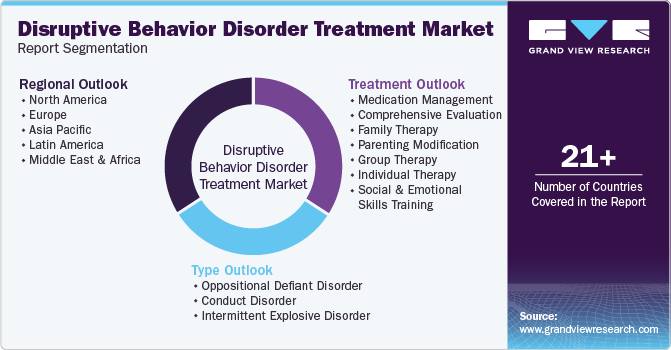

Global Disruptive Behavior Disorder Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global disruptive behavior disorder treatment market report based on type, treatment, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oppositional Defiant Disorder

-

Conduct Disorder

-

Intermittent Explosive Disorder

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Medication Management

-

Comprehensive Evaluation

-

Family Therapy

-

Parenting Modification

-

Group Therapy

-

Individual Therapy

-

Social and Emotional Skills Training

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.