- Home

- »

- Electronic Devices

- »

-

Dissolved Gas Analyzer Market Size & Share Report, 2030GVR Report cover

![Dissolved Gas Analyzer Market Size, Share & Trend Report]()

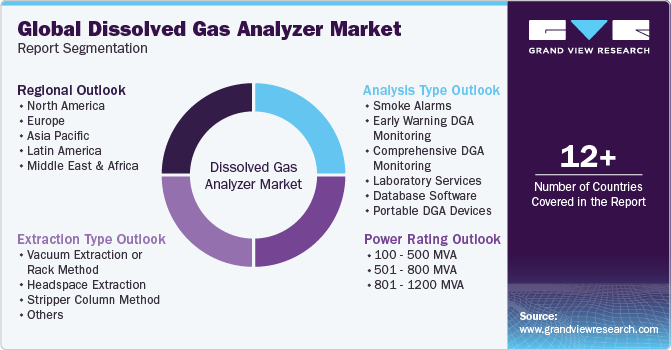

Dissolved Gas Analyzer Market Size, Share & Trend Analysis Report By Extraction Type (Vacuum Extraction, Headspace Extraction, Striper Column Method), By Power Rating, By Analysis Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-996-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Dissolved Gas Analyzer Market Trends

The global dissolved gas analyzer market size was valued at USD 382.3 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 1.8% from 2023 to 2030. The growth is primarily attributed to the rising attention to the likelihood of faults in the high-voltage transformers and the high cost of replacing the depreciating transformers. Incorporating DGA aids companies in detecting faults in the installed power transformers at an early stage. The early diagnosis empowers firms to organize maintenance programs to repair and avert faults and extend the endurance of power transformers. It is anticipated to significantly fuel the extraction type demand over the next few years.

The snowballing adoption of online DGA is also one of the key factors contributing to industry growth. In the current scenario, aging transformers are loaded heavily, which is one of the primary reasons for diagnosing the health of transformers at the initial stage. Other factors, such as increased service reliability requirements and deferred capital expenditures on novel equipment to explore innovative transformer condition assessment and management tools, are expected to poise the market's growth in the coming years.

Online DGA plays a vital role in increasing the reliability of grids as it displays ratios of the key gases and real-time values, which are essential parameters for monitoring the transformer's health during its operation. It reduces the transformer failure rate substantially, thereby decreasing the outages caused by it. In addition, the efficiency and safety regulatory standards mandated by the government, including the U.S. government, for power transformers are expected to promote the DGA adoption over the forecast period.

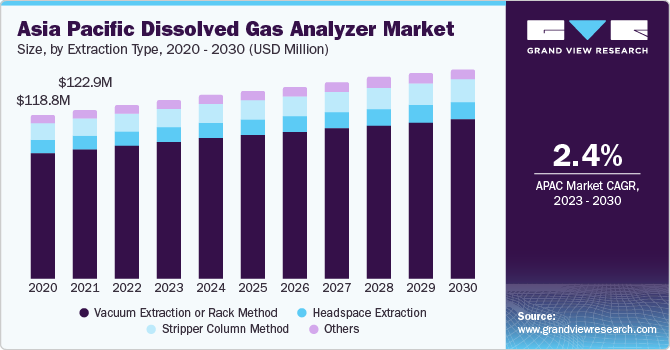

Extraction Type Insights

The vaccum extraction or rack method held the largest market share of 76.6% in 2022. The vacuum extraction method is a non-destructive testing technique, meaning it does not damage the equipment or interrupt its operation. The non-destructive nature of the vacuum extraction method enables routine DGA monitoring without the need for extensive maintenance or equipment shutdowns.

The head space extraction segment is projected to register the fastest CAGR of 3.1% over the forecast period. The growth is supported by the benefits offered by this extraction technique, which include reduced operator error from excessive sample handling during injection and preparation and increased operational efficiency by automating the process. Furthermore, headspace extraction offers benefits, including rapid analysis, sensitivity, and minimal equipment investment.

The other segment mainly comprises multiple gas extractors and is estimated to exhibit a CAGR of 3.0% over the forecast period. The revenue growth of this segment is mainly driven by its increased adoption due to the ability of multiple gas extractors to extract even small traces of fault gasses in the transformer oil at the initial stages. Multiple gas extractors also offer high efficiency as the sample oil is exposed to a vacuum several times until the process of extracting gas is accomplished.

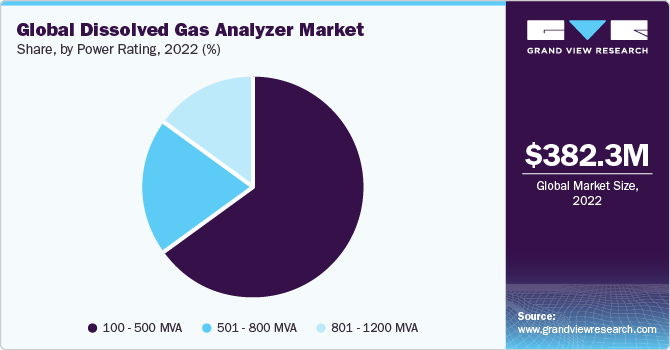

Power Rating Insights

The 100 - 500 MVA segment dominated the dissolved gas analyzer market with the highest revenue share of 65.1% in 2022. Power plants with a 100-500 MVA extraction type are becoming more prevalent, particularly in utilities, manufacturing, and heavy industries. These high-power facilities often consist of large transformers critical in electricity distribution. The growth of the 100-500 MVA power rating segment reflects the expansion of power generation extraction type and the subsequent need for effective condition monitoring solutions such as DGA.

On the other hand, the 801 - 1200 MVA segment is expected to grow at the fastest CAGR of 2.7% over the forecast period. The extensive presence of Tier I and II data centers in developing regions like Asia Pacific and Latin America has contributed to the growth of this segment. The 1 MW extraction type segment is likely to witness steady growth.

The 501 - 800 MVA segment is estimated to witness a significant CAGR over the forecast period, owing to the ability of these DGA devices to combine data from the additional transformer condition-based monitoring devices and offer legitimate identification of critical transformer fault types.

Analysis Type Insights

Laboratory services dominated the market with the highest revenue share of 37.9% in 2022, owing to the snowballing R&D investments for developing innovative and efficient methods for aging diagnostics. Moreover, the rising awareness regarding transformer supervising and the need for advanced process analytics to deal with complex gas formation procedures, particularly in high-voltage power transformers, are also expected to contribute to the segment growth.

The early warning DGA monitoring segment is expected to witness significant growth of CAGR 2.5% DGA monitoring helps utilities and industries detect and identify potential faults and abnormalities in electrical equipment, such as transformers. DGA can provide early indications of developing faults, such as overheating, partial discharges, or insulation degradation, by analyzing the gases dissolved in the insulating oil. It allows proactive maintenance actions to be taken, minimizing the risk of equipment failure and optimizing operational efficiency.

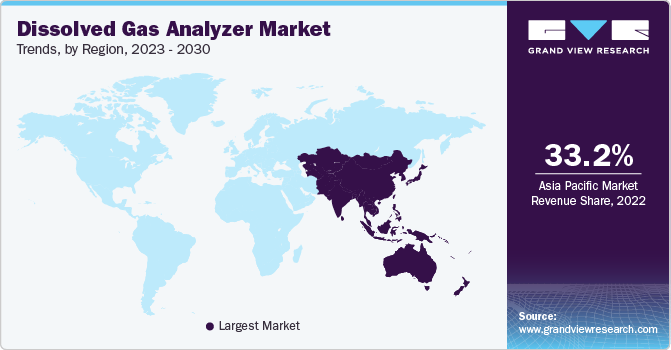

Regional Insights

Asia Pacific dominated the market with the largest revenue share of 33.2% in 2022. It can be attributed to the rising adoption of online DGA analysis and the increasing application of dissolved gas analyzers in large power transformer bases in the region. Furthermore, the rise in government spending on industrial infrastructure projects and power transformers to expand the power extraction type to meet the electricity shortage, especially in emerging economies including India, China, and Indonesia, is expected to favorably impact the extraction type demand in the region.

Latin America is expected to grow at a significant CAGR of 2.1% during the forecast period. Technological advancements in DGA equipment have made it more accessible and cost-effective for Latin American markets. Advanced DGA systems offer improved accuracy, sensitivity, and data analysis capabilities, allowing for more precise detection and analysis of dissolved gases. These advancements and competitive pricing and cost-efficiency make DGA systems attractive for power utilities and industrial sectors in Latin America.

The market in North America is estimated to show considerable growth due to the escalating need to detect faults among newly installed transformers and the growing demand for increasing the lifespan of old transformers.

Key Companies & Market Share Insights

Manufacturers increasingly emphasize entering into commodity contracts with suppliers to balance the fluctuating raw material cost and avoid the risk of exposure on the forecast purchases of commodity raw materials to maintain sustainability in the operating cost.

Prominent players in the industry invest heavily in R&D to build their intellectual property (patents) and develop extraction types with high efficiency and low maintenance and operating costs to increase revenue and market share.

Key Dissolved Gas Analyzer Companies:

- ABB

- Doble Engineering Company.

- Vaisala

- General Electric

- Weidmann Electrical Technology AG

- SDMyers

- Qualitrol Company LLC

- LumaSense Technologies A/SGATRON

- Gatron

Recent Developments

-

In March 2023, ABB's Sensi+ analyzer introduced a revolutionary and dependable solution to streamline pipeline operation and maintenance while reducing costs. This cutting-edge device provides a single real-time platform for analyzing up to three contaminants (H2S, H2O, CO2), making pipeline monitoring and operations safer, more straightforward, and more efficient. By addressing the challenges natural gas pipeline operators, process industries, and utilities face in mitigating the risks and impacts of gas contaminants, the Sensi+ analyzer offers an innovative and comprehensive solution.

-

In November 2022, GE Digital, an energy software provider, unveiled a strategic partnership with TrendMiner Software AG Company, merging process analytics with its Asset Performance Management (APM) portfolio. This partnership aims to deliver comprehensive solutions that enhance operational efficiency and performance across various industries by seamlessly integrating plant-level operations with enterprise-level functions.

-

In August 2022, Doble Engineering Companyunveiled the Calisto R9 Dissolved Gas Analysis (DGA) monitor, a groundbreaking technology that provides precise readings without needing consumable gas cylinders. This innovative approach eliminates the maintenance costs typically associated with traditional DGA monitors. By introducing this new solution, Doble Engineering Company seeks to significantly improve the efficiency and cost-effectiveness of DGA monitoring for asset management purposes.

Dissolved Gas Analyzer Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 391.5 million

Revenue forecast 2030

USD 444.9 million

Growth Rate

CAGR of 1.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Extraction type, power rating, analysis type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ABB; Doble Engineering Company.; General Electric; Vaisala; Weidmann Electrical Technology AG; SDMyers; Qualitrol Company LLC; LumaSense Technologies A/S; GATRON

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dissolved Gas Analyzer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global dissolved gas analyzer marketon the basis of extraction type, power rating, analysis type, and region:

-

Extraction Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Vacuum Extraction or Rack Method

-

Headspace Extraction

-

Stripper Column Method

-

Others

-

-

Power Rating Outlook (Revenue in USD Million, 2017 - 2030)

-

100 - 500 MVA

-

501 - 800 MVA

-

801 - 1200 MVA

-

-

Analysis Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Smoke Alarms

-

Early Warning DGA Monitoring

-

Comprehensive DGA Monitoring

-

Laboratory Services

-

Database Software

-

Portable DGA Devices

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dissolved gas analyzer market size was estimated at USD 382.29 million in 2022 and is expected to reach USD 391.5 million in 2023.

b. The global dissolved gas analyzer market is expected to grow at a compound annual growth rate of 1.8% from 2023 to 2030 to reach USD 444.9 million by 2030.

b. Asia Pacific dominated the dissolved gas analyzer market with a share of 33.2% in 2022. This is attributable to the imminent need to detect faults among newly installed transformers and increase the lifespan of old transformers.

b. Some key players operating in the dissolved gas analyzer market include LumaSense Technologies, General Electric, Siemens, Weidmann, Morgan Schaffer Inc., Doble Engineering, and ABB Ltd.

b. Key factors that are driving the market growth include the rising attentiveness concerning the likelihood of faults in high-voltage transformers coupled with high cost of substituting the depreciating transformers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."