- Home

- »

- Petrochemicals

- »

-

Transformer Oil Market Size, Share & Trends Report, 2030GVR Report cover

![Transformer Oil Market Size, Share & Trends Report]()

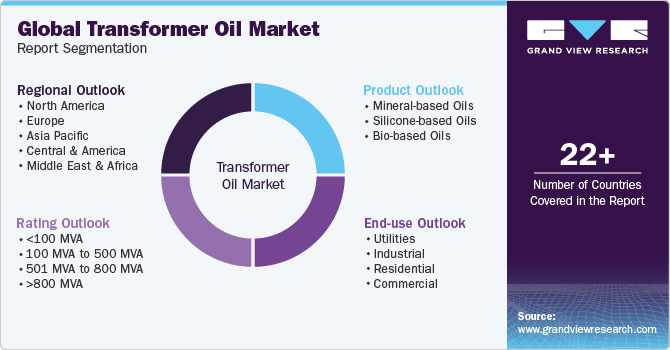

Transformer Oil Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mineral-based, Silicone-based), By Rating, By End-use (Utilities, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-799-5

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Transformer Oil Market Summary

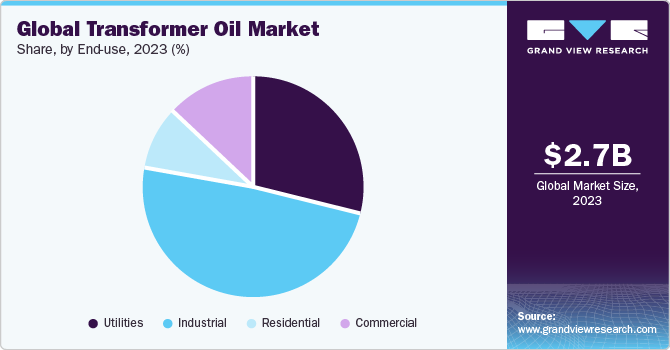

The global transformer oil market size was estimated at USD 2.73 billion in 2023 and is projected to reach USD 6.12 billion by 2030, growing at a CAGR of 12.3% from 2024 to 2030. This is attributed to the steadily growing power sector globally, along with advancements in electric grids in emerging economies.

Key Market Trends & Insights

- Asia Pacific dominated the transformer oil market with a revenue share of over 55.2% in 2023.

- Based on product, mineral-based oils dominated with a revenue share of over 75.6% in 2023.

- Based on rating, the 100 MVA to 500 MVA segment dominated with a revenue share of over 53.8% in 2023.

- Based on end-use, the industrial segment dominated with a revenue share of over 48.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.73 Billion

- 2030 Projected Market Size: USD 6.12 Billion

- CAGR (2024-2030): 12.3%

- Asia Pacific: Largest Market in 2023

Every power and distribution transformer contains dielectric insulating fluid with strong electricity resistance and the ability to keep a transformer cool. Bio-based products are more fire resistant than others, thus expected to witness the highest growth till 2030. Since bio-based oils are fully non-toxic, which further facilitates disposal, they provide reliable and cleaner products. The demand for bio-based products is also anticipated to grow as a result of an increase in the installation of transformers occurring globally. Power utilities are also focusing on upgrading the safety and performance of both new and existing transformers, which is predicted to boost demand for bio-based products globally.

Stringent regulation imposed by government bodies concerning energy wastage is expected to be the major challenge for product demand. For instance, the U.S. Environmental Protection Agency (EPA) has set up strict regulations on oil demand to control electricity wastage. Additionally, developed and developing economies are opting for green and environmental-friendly technologies, which are expected to restrain the growth of mineral-based products.

Market Dynamics

The power sector plays a major role in any nation's economic growth and contributes significantly to its GDP growth rate. The number of electricity generation plants and investments related to them primarily depend on the governments of respective countries. Various major countries shifting their focus to rural electrification is anticipated to provide impetus to the demand for distribution transformers, thereby leading to an increased consumption of transformer oil.

Political instability in oil-producing economies such as Iraq and Saudi Arabia in the Middle East has led to extreme fluctuations in crude oil prices. Countries such as Iraq, Libya, Nigeria, Iran, and Venezuela are witnessing social unrest, which has negatively impacted the industrial sector in these economies and affected their crude oil production greatly in the past few years. The average price of crude oil was USD 52.32 per barrel in 2015 and reached USD 100.08 per barrel in 2022 with a major slump of USD 41.69 per barrel witnessed in 2020 owing to trade restrictions imposed during the COVID-19 pandemic. Thus, fluctuating prices of crude oil are predicted to impact the cost of base oil, thereby resulting in volatile costs of transformer oil. This is anticipated to hamper the market growth.

Product Insights

Mineral-based oils dominated with a revenue share of over 75.6% in 2023. This is attributed to high compatibility and a wide range of applications of mineral-based oils in capacitors & circuit breakers. Mineral-based products are utilized in conditioning and shielding transformers, switchgear, and boilers. Additionally, it can be used for thermal transfer and to safeguard the interior field winding of transformers. Such wide usage of mineral-based oils is expected to drive growth from 2024 to 2030.

Bio-based products have recently gained significant demand. They perform better than other products as they are eco-friendly. Bio-based products use vegetable oil as a feedstock. This kind of oil does not contain halogens, silicone, and petroleum hydrocarbons. They are non-toxic and can quickly degrade in case of leakage or spill, which is expected to create growth opportunities for bio-based products.

Products produced from wax-free naphthenic mineral oil have various advantages such as low cost, easy availability, high efficiency, and thermal cooling capacity. However, non-biodegradability that results in environmental pollution and handling risks is projected to restrain demand for naphthenic-based mineral oil products from 2024 to 2030.

Rating Insights

The 100 MVA to 500 MVA segment dominated with a revenue share of over 53.8% in 2023. Application of such transformers in large-scale industrial settings, including refineries, power plants, and manufacturing facilities is expected to propel this growth. These transformers have been designed to handle large amounts of electrical power and have become vital components in the generation, transmission, and distribution of electrical power. Moreover, they can adequately distribute power in highly populated areas due to their capacity to handle high voltages, making them ideal for transferring power from source to desired destination.

The <100 MVA segment held the second-largest position in 2023 and is projected to grow at a CAGR of 12.0% from 2024 to 2030. This is attributed to its application in a variety of power distribution systems to step down or step up the voltage of electrical power, allowing it to be transmitted over long distances.

End-use Insights

The industrial segment dominated with a revenue share of over 48.8% in 2023. This is attributed to growing industrialization across the globe leading to an increased number of transformers. Industrial end-use includes transformers used in chemicals, food processing, steel, and automotive industries. Industrial processes require different types of electrical machinery that operate at discrete voltage levels. Power generation facilities typically generate electricity at high voltages, requiring the use of three-phase distribution transformers.

Thus, advancing steel and chemical manufacturing industries worldwide have increased demand for transformers used in them which in turn will drive the demand for transformer oils used for efficient functioning of these transformers.

The residential segment is expected to grow at the highest CAGR of 12.7% from 2024 to 2030. This is attributed to growing residential areas owing to the increasing global population. The residential segment includes transformers used in villas, apartments, and residential housing. In residential spaces and villas, typically single-phase transformers are used for individual homes, and three-phase distribution transformers for larger residential areas.

Regional Insights

Asia Pacific dominated the transformer oil market with a revenue share of over 55.2% in 2023. This is attributed to a rise in demand for electricity in Australia and developing countries such as China, India, and Japan. Additionally, the growth of the commercial and industrial sectors is anticipated to increase the number of substations, which, in turn, will fuel transformers’ demand.

Increasing investments in the power sector are enabling market penetration of Chinese manufacturers. Moreover, significant growth in renewable capacity in countries such as India and China is fueling demand in the sub-transmission segment. The presence of strong domestic manufacturers is a major challenge for foreign markets entering the Asia Pacific region.

Growth of industrial and manufacturing sectors in the U.S. and Canada is driving North America's market growth. Technical upgrades, modernization in existing transformers, and a declining crude oil market are anticipated to drive regional market expansion.

Key Companies & Market Share Insights

The market is moderately fragmented with key participants focusing on capacity and geographical expansions, as well as mergers & acquisitions, to expand their consumer base. These players are also focusing on R&D activities to formulate novel products to strengthen their market foothold. For instance, in May 2023 Cargill Inc. launched its FR3r natural ester, a new 100% biodegradable and environment-friendly transformer insulating fluid derived from more than 95% rapeseed oil. This new product launch will provide the company with a competitive edge.

Key players are focusing on bio-based oil production, along with various strategic initiatives, such as R&D activities, to develop eco-friendly oils and create innovative goods and solutions.

Key Transformer Oil Companies:

- China Petroleum & Chemical Corporation

- Cargill Inc.

- Shell Plc.

- Nynas AB

- Ergon, Inc.

- Engen Petroleum Ltd.

Transformer Oil Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.03 billion

Revenue forecast in 2030

USD 6.12 billion

Growth Rate

CAGR of 12.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, rating, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; China; India; Japan; South Korea; Australia; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; Turkey

Key companies profiled

China Petroleum & Chemical Corporation; Cargill Inc.; Shell Plc.; Nynas AB; Ergon, Inc.; Engen Petroleum Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transformer Oil Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global transformer oil market report based on product, rating, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Mineral-based Oils

-

Naphthenic Base Oils

-

Paraffinic Base Oils

-

-

Silicone-based Oils

-

Bio-based Oils

-

-

Rating Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

<100 MVA

-

100 MVA to 500 MVA

-

501 MVA to 800 MVA

-

>800 MVA

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Utilities

-

Industrial

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

-

Central & America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global transformer oil market size was estimated at USD 2.73 billion in 2023 and is expected to reach USD 3.03 billion in 2024.

b. The global transformer oil market is expected to grow at a compound annual growth rate of 12.3% from 2024 to 2030 to reach USD 6.12 billion by 2030.

b. Asia Pacific dominated the transformer oil market with a share of 55.2% in 2023. This is attributed to the rise in demand for electricity in developing countries such as China, India, Japan, and Australia.

b. Some key players operating in the transformer oil market include Sinopec Lubricant Company, Valvoline, Cargill Inc., Nynas AB, Ergon International Inc., PetroChina Lubricant Company, Calumet Specialty Products, Apar Industries Ltd., Engen Petroleum Ltd., Hydrodec Group Plc.

b. Key factors that are driving the transformer oil market include growth in the global power sector and the advancement of electric grids in emerging countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.