- Home

- »

- Clinical Diagnostics

- »

-

DNA Microarray Market Size, Share, Industry Report, 2030GVR Report cover

![DNA Microarray Market Size, Share & Trends Report]()

DNA Microarray Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Complementary DNA Microarrays, Oligonucleotide DNA Microarrays), By Application (Gene Expression Analysis, Genotyping), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-038-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA Microarray Market Size & Trends

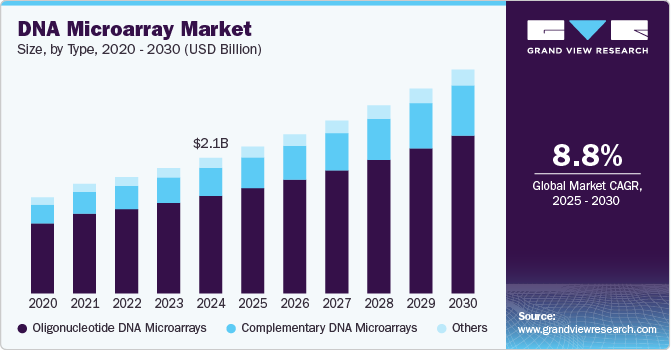

The global DNA microarray market size was estimated at USD 2.14 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2030. The increasing prevalence of cancer, advancements in information and software technology, and the emergence of bioinformatics are expected to propel the growth of the global market. Additionally, the rising adoption of DNA microarray in gene expression studies and an uptick in research activities further contribute to market expansion. For example, in January 2023, the NCBI announced the development of a microarray system designed to detect UDP-glucuronosyltransferase gene polymorphisms for clinical laboratory applications, particularly for patients undergoing irinotecan hydrochloride treatment, enabling high-density DNA fixation and advanced clinical applications

The field of genomics is undergoing rapid advancements, with emerging technologies both complementing and challenging traditional DNA microarray approaches. For instance, RNA sequencing (RNA-seq) provides a comprehensive view of the transcriptome by sequencing the entire RNA population in a sample. RNA-seq offers superior resolution and sensitivity, enabling the detection of novel transcripts and splice variants. Despite these advancements, DNA microarrays remain invaluable due to their affordability, ease of use, and well-established protocols. Leveraging nucleic acid hybridization principles, DNA microarrays have significantly advanced fields like functional genomics, molecular diagnostics, and personalized medicine, enabling the simultaneous analysis of thousands of genes to provide extensive insights into cellular activity and genetic variation.

DNA microarrays continue to evolve with innovations in array design and bioinformatics. Advancements like higher-density arrays and the integration of multi-omics data (e.g., proteomics and metabolomics) are set to broaden the scope of genomic analyses. Enhanced bioinformatics tools are expected to improve data interpretation, providing deeper insights into gene function and regulation. The rising burden of diseases like cancer is anticipated to further drive market growth. Studies have demonstrated DNA microarrays’ efficacy in determining primary tumor sites in metastatic cancers and classifying soft tissue sarcomas. For example, Canada reported 233,900 new cancer cases and 85,100 deaths, with leading cancers including breast, prostate, lung, and colorectal. DNA microarrays are also instrumental in discovering disease-related genes and biomarkers, creating new opportunities in diagnostics and research.

Strategic collaborations are bolstering the application of DNA microarrays in precision medicine. For instance, in May 2022, the Qatar Genome Program partnered with Thermo Fisher Scientific to accelerate genomic research and predictive genomics applications in Qatar. This collaboration introduced custom genotyping arrays to expand precision medicine benefits across the Middle East. The versatility of DNA microarrays in applications like gene expression, genotyping, and transcription studies is transforming areas such as clinical diagnostics, microbiology, and drug discovery. Increased adoption in drug discovery processes and research activities among pharmaceutical and biotechnology companies underscores the technology’s potential to address unmet scientific needs.

However, the market faces challenges, including competition from next-generation sequencing (NGS) technologies, which offer cost-effective and accurate alternatives to DNA microarrays. High costs associated with microarray technology, stringent regulatory frameworks, standardization issues, and a shortage of skilled professionals are additional barriers to growth. Nonetheless, introducing innovative solutions like the CovidArray test in April 2021, which detects COVID-19 markers and related genotypes, highlights the continuous evolution of DNA microarrays to address emerging healthcare challenges.

Type Insights

The oligonucleotide DNA microarrays segment dominated the market with a share of 72.0% in 2024 and is anticipated to grow at a lucrative rate during the projected period. The cost-effectiveness of the tool, with its higher capability to monitor the expression of every gene in the genome and increased market penetration, are driving the segment's growth. Moreover, these microarrays provide several benefits over other microarrays such as providing controlled specificity of hybridization, making it the most prominent technique for analysis of single nucleotide polymorphisms, further escalating their demand in the projected period.

The complementary DNA microarrays segment is expected to register the fastest growth rate throughout the forecast period. cDNA microarray is a powerful tool for studying gene expression in various organisms. Moreover, the increasing use of cDNA microarray in a wide range of applications in polymorphism screening, genomic DNA clones mapping, and gene discoveries are further propelling the segment’s growth.

Application Insights

The gene expression analysis segment dominated the market with a share of 48.5% in 2024. The segment growth is accounted by adopting gene expression in different applications such as clinical diagnostics, drug discovery, microbiology, and others. In addition, the application of gene expression in various processes of drug discovery has increased exponentially in the past few years. Moreover, the advantages of DNA microarrays over other technologies and leveraging the scope of gene expression analysis have propelled the demand for this technology in different end-use applications.

However, the genotyping segment is expected to grow at a lucrative rate over the forecast period. The increasing R&D funding for precision medicine research, rising target disease prevalence, and strategic initiatives undertaken by market players are anticipated to contribute to genotyping segment growth. For instance, in February 2021, 23andMe merged with VG Acquisition Corp. This merger would provide capital funds for their genetic consumer health business and genetic research activities.

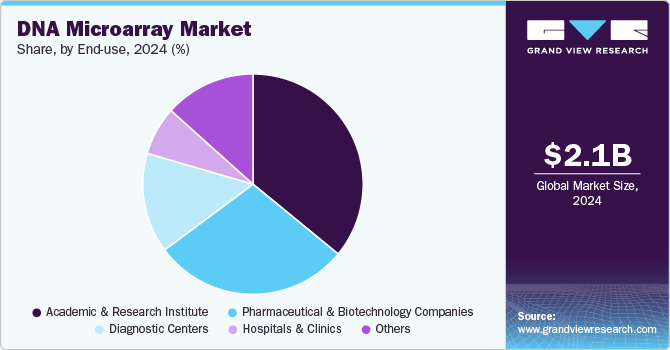

End Use Insights

The academic & research institutes segment dominated the market with a share of 35.9% in 2024 owing to the increasing adoption of microarrays in research and drug discovery applications. For instance, according to NIH, it was observed that DNA microarrays are utilized in the process of discovery of a drug used in cancer treatment.

Whereas diagnostic centers are likely to be the fastest-growing segment during the coming years. Diagnostic labs are projected to boost the demand for different products offered by leading companies that diagnose autoimmune diseases, cancers, infectious diseases, and other genetic mutation-related diseases. For instance, Applied Microarrays Inc. offers custom arrays to diagnose various infectious diseases and cancers. In addition, some other diseases diagnosed by these products include diet-related conditions like celiac, dysbiosis & general food intolerance.

Regional Insights

North America DNA microarray market dominated the market with largest revenue share of 48.3% in 2024 due to the presence of leading market players in the region and rising investments by them in developing technologically advanced DNA microarray products. Moreover, technological advancements in genomics and access to modern research facilities are projected to create exponential growth opportunities for the players. Also, the high adoption of DNA microarray technology across research settings, from academic laboratories to biopharmaceutical companies, is further escalating the region’s growth.

U.S. DNA Microarray Market Trends

The DNA microarray market in the U.S. is experiencing significant growth due to advancements in genomics and personalized medicine. Increased applications in disease diagnostics, drug discovery, and agriculture drive demand. For instance, DNA microarrays are widely used to identify gene expressions linked to cancers, enabling targeted therapies. Companies like Illumina are integrating microarray technology for precision medicine initiatives. The rising prevalence of chronic diseases and growing investments in R&D further fuel market expansion.

Europe DNA Microarray Market Trends

The Europe DNA microarray market is expanding, driven by advancements in genetic research, personalized medicine, and diagnostics. The increasing adoption of DNA microarrays in cancer genomics and drug discovery is boosting demand. For example, European research institutions use microarray platforms to study genetic markers for hereditary diseases. Government initiatives, such as the UK's Genomics England project, also support market growth.

The DNA microarray market in UK is growing due to increasing investments in precision medicine and cancer diagnostics. Government-backed initiatives like Genomics England are leveraging microarray technology to analyze genetic data for disease prevention and treatment. The market is also witnessing applications in agricultural genomics and drug discovery. For instance, UK-based biotech companies are utilizing DNA microarrays for studying genetic mutations in rare diseases. Collaborations between academic institutions and pharmaceutical firms are further driving innovation, enhancing the utility of microarrays across research and clinical diagnostics.

The DNA microarray market in France is driven by increasing research activities in genomics, advancements in molecular diagnostics, and a growing focus on personalized medicine. The market is benefiting from robust healthcare infrastructure and rising demand for technologies enabling gene expression analysis and genetic screening. Government support for innovation in biotechnology and expanding applications in drug development are further propelling growth. Enhanced adoption of bioinformatics tools and high-throughput analysis techniques are expected to sustain the market's upward trajectory.

The DNA microarray market in Germany is experiencing significant growth, largely driven by advancements in technology and increased adoption across various sectors like research and clinical diagnostics. This market is expanding due to innovations such as high-density microarrays, digital microarrays, and lab-on-a-chip technologies, which offer enhanced data accuracy and efficiency.

Asia Pacific DNA Microarray Market Trends

Asia Pacific is expected to exhibit the fastest growth rate throughout the projected period. The high prevalence of target diseases, surge in genomic research funding, and increasing awareness about genetic testing bolstered the region’s market. Moreover, increasing investment by local and international market players to develop novel DNA microarray products in the regions is further anticipated to drive market growth in the coming years.

The DNA microarray market in China is growing rapidly due to technological advancements and increasing applications in various fields, particularly in genomic research and diagnostics. The market is dominated by consumables, such as DNA microarray kits, driven by rising demand in personalized medicine and research. There is a growing focus on drug discovery and development, supported by increased investments in the pharmaceutical and biotechnology sectors. Additionally, the market is expanding as microarray technologies become integral to improving diagnostic accuracy and efficiency in clinical settings.

The DNA microarray market in Japan is experiencing growth due to advancements in biotechnology and increasing applications in genomics research, diagnostics, and personalized medicine. There is a rising demand for DNA microarrays to conduct gene expression analysis, genotyping, and disease diagnostics, supported by both private and public research investments. Furthermore, the market benefits from enhanced microarray technologies, such as improved data analysis and probe design, which increase the accuracy and efficiency of studies. This trend is reinforced by collaborations among academic institutions, biotech firms, and diagnostic labs, propelling innovations in microarray applications.

Latin America DNA Microarray Market Trends

The Latin America DNA microarray market is showing promising growth, driven by increased adoption in genomics research, diagnostics, and personalized medicine. Key applications include genetic disease and cancer diagnostics, where DNA microarrays offer a high-throughput means of analyzing gene expression patterns. The market is also benefiting from growing investments in biotechnology and healthcare infrastructure, particularly in Brazil and Mexico. However, high sequencing costs remain a challenge for broader adoption in the region, particularly for smaller research facilities and healthcare providers.

The DNA microarray market in Brazil is expanding due to several factors, including increasing applications in personalized medicine, cancer diagnostics, and genetic research. Advancements in technology, such as more precise and cost-effective microarrays, are driving adoption. As the healthcare system improves and more emphasis is placed on genetic diagnostics, DNA microarrays are becoming essential in clinical laboratories and research institutions.

MEA DNA Microarray Market Trends

The DNA microarray market in the Middle East and Africa (MEA) is expected to grow significantly over the next decade. The market benefits from increasing investments in genomic research and the expansion of healthcare infrastructure. Key drivers include rising healthcare awareness, the adoption of personalized medicine, and advancements in genetic testing technologies. Moreover, the market is supported by collaborations between biotech companies and medical institutions to improve disease diagnosis and treatment strategies. The increasing prevalence of chronic diseases, alongside improvements in regulatory frameworks, is also anticipated to spur demand.

The DNA microarray market in Saudi Arabia is experiencing steady growth due to the increasing demand for advanced diagnostics and personalized medicine. Key trends driving this market include the expanding use of DNA microarrays in oncology, infectious disease diagnostics, and genetic research. Technological advancements, such as high-throughput capabilities and automation, are further enhancing the adoption of microarray technologies in clinical and research settings. Additionally, Saudi Arabia’s investment in healthcare infrastructure and the growth of biotechnology and pharmaceutical industries are expected to bolster market expansion. Government initiatives aimed at improving healthcare services and research facilities are also contributing to the growth of this market.

Key DNA Microarray Company Insights

Key players are adopting new product development, merger & acquisition, and partnership strategies to increase their market share. Market players such as Illumina, Inc., Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., and others dominated the global DNA microarray market. These key players have been developing technologies for DNA microarray and providing products & services to different end-use applications. They have been introducing various innovations in the market and expanding their product portfolios to stay competitive in the market.

Key DNA Microarray Companies:

The following are the leading companies in the DNA microarray market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies, Inc.

- Merck KGaA

- BIOMERIEUX

- PerkinElmer, Inc.

- Applied Micro Arrays

Recent Developments

-

In October, 2024, Illumina Inc. announced the launch of its MiSeq i100 Series of sequencing systems, designed to provide exceptional speed and simplicity for benchtop next-generation sequencing (NGS). This new series promises to streamline genomic workflows, making it more accessible for laboratories to perform high-quality sequencing with reduced complexity. The MiSeq i100 systems are engineered to offer faster turnaround times and improved ease of use, enabling laboratories to conduct a wider range of genomic applications with enhanced efficiency.

-

In March 2023, Illumina Inc. introduced its innovative Illumina Complete Long Read technology on March 14, 2023, marking a significant step forward in DNA sequencing. This technology powers the Illumina Complete Long Read Prep, Human, a long-read human whole-genome sequencing assay that offers high performance. It is compatible with the NovaSeq X Plus, NovaSeq X, and NovaSeq 6000 Sequencing Systems, and uniquely provides both long- and short-read data on the same instrument. This product simplifies workflows by drastically reducing DNA input requirements compared to other long-read offerings, enhancing its accessibility and efficiency for researchers. This advancement is poised to support a broader range of genomic applications, from research to clinical diagnostics.

DNA Microarray Market Report Scope

Global DNA Microarray Market Report Segmentation

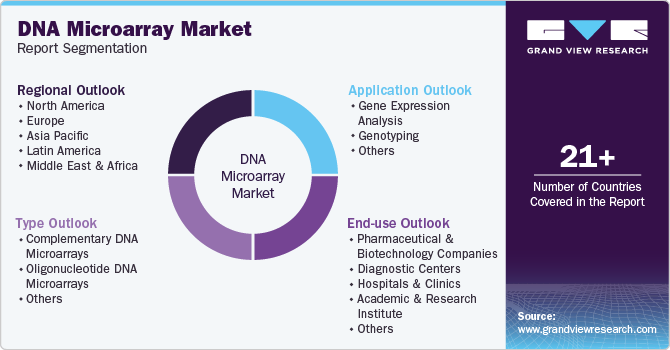

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DNA microarray market based on type, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Complementary DNA Microarrays

-

Oligonucleotide DNA Microarrays

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Gene Expression Analysis

-

Genotyping

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Diagnostic Centers

-

Hospitals and Clinics

-

Academic and Research Institute

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA microarray market size was estimated at USD 2.14 billion in 2024 and is expected to reach USD 2.32 billion in 2025.

b. The global DNA microarray market is expected to grow at a compound annual growth rate of 8.81% from 2025 to 2030 and is expected to reach USD 3.53 billion by 2030.

b. The oligonucleotide DNA microarrays segment is expected to dominate the DNA microarray market with a share of 72.00% in 2024 due to the high market penetration, cost-effectiveness, and advantages over other microarrays such as controlled specificity of hybridization.

b. Some key players operating in the DNA microarray market include Thermo Fisher Scientific, Inc., Illumina, Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd., and PerkinElmer, Inc. among others.

b. Rising prevalence of targeted diseases, emergence of bioinformatics, surge in genomic research activities, and strategic initiatives undertaken by market players are the major factors driving the DNA microarray market growth over the forecast period.

b. North America held the largest market share of 48.27% in 2024 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the presence of strong market players, technological advancements in genomics, and high adoption of DNA microarray technology in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.