- Home

- »

- Distribution & Utilities

- »

-

Drill Pipe Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Drill Pipe Market Size, Share & Trends Report]()

Drill Pipe Market (2024 - 2030) Size, Share & Trends Analysis Report By Grade (API Grade, Premium Grade), By Application (Onshore, Offshore), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-130-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drill Pipe Market Size & Trends

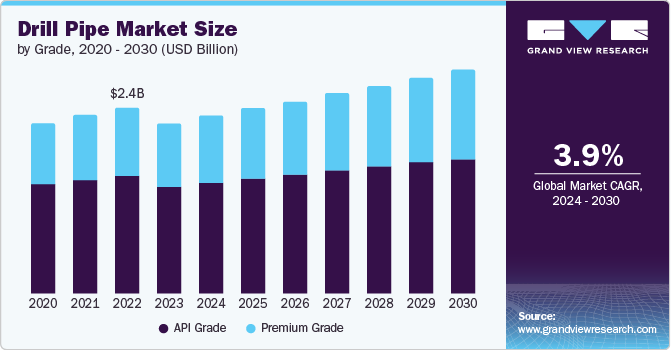

The global drill pipe market size was estimated at USD 2.21 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. Significant oilfield expansions, particularly in North America and the Middle East, along with improving drilling techniques with enhanced productivity, have been the key factors steering industry growth over the past few years. The crude oil price slump since mid-2020 has led to substantial decline or discontinuation of drilling activities majorly in the U.S., Saudi Arabia, the UK, and Canada.

This has earnestly affected the overall operating profitability of most of the E&P companies operating globally. The above factors have dramatically hindered the drill pipes industry's growth over the past two years.

High production costs are estimated to hamper the overall market over the forecast period. Regulatory agencies such as the Fund for Wild Nature (FWN) have issued numerous directives concerning petroleum production. This is expected to retard the overall industry, thereby hindering market growth over the forecast period. Growing atmospheric distress concerning hazardous fumes emission due to exploration is also expected to hinder market development.

The equipment rental services sector has also witnessed a steep decline in new contracts over the past two years. This is expected to rebound by the end of 2016 with a recovery in oilfield activities and anticipated stabilized petroleum prices by then. Discovery of new hydrocarbon reserves, especially in the South China Sea, Pakistan, Israel, Australia, Senegal, and Egypt in the past few years, is anticipated to provide lucrative opportunities to industry participants in the near future.

Increasing R&D spending by key vendors to optimize the production of drill pipes and improve the overall material strength to meet the API specifications is projected to support future demand.

Market Characteristics

The drill pipe industry is moderately consolidated in nature, with key industry players such as NOV Inc., Inter Drill Asia Ltd., Superior Drill Pipe Manufacturing Inc., DP Master Manufacturing Pte Ltd., Shanghai Hilong Drill Pipe Co. Ltd., and TPS TECHNITUBE RÖHRENWERKE GmbH, which dominate a significant market share. These companies often engage in aggressive marketing strategies, research and development initiatives, and mergers and acquisitions to strengthen their market position and expand their product offerings.

Regulations significantly impact the market by setting standards for safety, environmental protection, and operational practices. Compliance with these regulations often requires drill pipe manufacturers to invest in higher-quality materials and manufacturing processes, which can increase production costs. Moreover, regulatory requirements drive innovation towards more sustainable technologies and practices, such as improved waste management and emissions control systems.

The target market has significant end-user concentration. Large drilling companies and oilfield service providers often dominate demand due to their extensive drilling operations and requirements for high-quality, durable drill pipes. These major end-users wield significant purchasing power, influencing market trends and supplier relationships.

Drivers, Opportunities & Restraints

According to the Environmental Impact Assessment (EIA), global energy consumption is growing at a rapid rate owing to increased electricity consumption. This is further supported by the increasing per capita income and the rise in the global Gross Domestic Product (GDP). Increasing disposable income and economic growth have led to an increase in energy demand globally, especially in the non-OECD Asia Pacific and Latin America. In addition, increased supply sufficiency coupled with energy sustainability and security has further escalated the energy demand globally. Increasing primary energy demand has impacted petroleum E&P activities.

Increasing petroleum E&P activities in the U.S., Indonesia, Venezuela, China, Nigeria, and Canada have been a major factor contributing to the increased drilling pipe requirement over the past few years. Secondly, there has been an increase in production in the associated oil & gas reserves globally. Most of the reservoirs have several rock strata, which require different types of bits. Drilling activities in shale or tight reserves require a frequent change of bits, which is expected to boost sales over the forecast period.

Global natural gas production has been growing at a rapid pace, particularly in North America and Asia Pacific, on account of its environment-friendly characteristics. To meet the ever-rising energy demands, major E&P companies have been shifting their focus to develop unconventional oil & gas reserves, including shale oil, shale gas, tight oil, tight gas, and coal bed methane (CBM).

The development of unconventional gases in the U.S. since 2006 has not only created a sustainable impact on gas supply in North America but has also triggered fundamental changes in the global gas market. Shale reserves and tight gas are expected to account for the majority of natural gas production from 2023 to 2030.

Crude oil prices have declined, and due to this, rig activities have dropped. This has affected oil industry players including the oil producers and service providers, which has adversely affected the market. Exploration and production from deep-water and ultra-deep-water wells involve significant capital expenditures and need to be supported by high oil prices that can yield an attractive return on investment and justify the risks. While these projects have lower break-even costs compared to onshore shale wells, they have longer planning cycles and significantly higher upfront costs, which are making oil companies more circumspect about committing to these projects in the current environment.

Grade Insights

API grade drill pipes dominated the global market in the grade segment and accounted for more than 63.0% of the overall revenue share in 2023. Standardization of the finished products, along with the relatively low prices of this grade, is anticipated to promote market penetration. Utilizing these products also ensures the reduced operational cost to the E&P and operator companies.

API grade products are mostly preferred in a normal environment and conventional basins owing to the easy availability and reduced OpEx to both E&P and contractor companies. Exploration in unconventional and harsh environmental conditions particularly in shale, CBM, and tight reserves are expected to steer premium grade drill pipes demand over the forecast period.

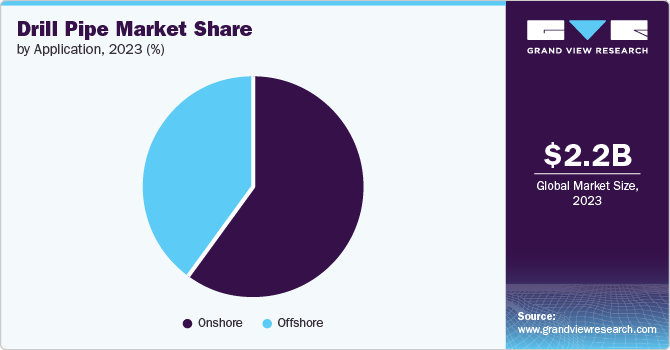

Application Insights

The onshore application segment dominated the market and accounted for the largest revenue share in 2023. Significant developments in onshore basins, particularly in the Middle East, Venezuela, Nigeria, and the U.S., over the last decade have led to the domination of the segment in the global petroleum industry.

The key factors responsible for the segment's market penetration are its high IRR, high rate of rig activities, low risk compared to offshore drilling and significant familiarity with the key operators in the sector. The petroleum industry witnessed an estimated decline of around 35% to 40% in the overall rig count across all the regional markets.

Regional Insights

North America drill pipe market dominated globally in 2023 with the largest revenue share of more than 26.1%. Large investments by major E&P companies in both conventional and unconventional fields have been the major factor responsible for initial market penetration in the region.

U.S. Drill Pipe Market Trends

The U.S. drill pipe marketdominated the North America region in terms of revenue, with a share of 72.5% in 2023. The U.S. is the world’s largest crude oil producer; crude oil is produced in 32 U.S. states and coastal waters and is exported on a large scale, which is driving the market in the country.

The Canada drill pipe market is expected to grow at a significant rate over the forecast period owing to the increasing investment in the oil & gas industry. As per the Canadian Association of Petroleum Producers (CAPP), an investment of USD 29.4 billion in 2023, which is 11%, more than Canada’s economy is additional spending in 2023.

Europe Drill Pipe Market Trends

The Europe drill pipe market is anticipated to grow at a moderate pace during the forecast period. Significant demand for oil country tubular goods (OCTG) products in Russia is expected to boost the market in Europe. Increasing drilling activity in the region and higher growth in oil production are expected to drive the demand for drill pipes in the region over the forecast period.

The drill pipe market in the UK held a significant revenue share of the region in 2023. Growing demand for oil & gas production in the country is expected to drive the demand for drill pipes. Some of the key oil & gas production well sites are the Irish Sea, West of Shetlands, and the North Sea, which constantly require the installation of new rigs; this, over a period of time, can drive the growth in demand for the market.

The Russia drill pipe market is expected to grow at a moderate rate owing to the ongoing Russia-Ukraine conflict. Russia is the third-largest oil & gas producer globally. After Russia initiated a full-scale invasion of Ukraine, the European Union imposed various sanctions that hindered crude oil exports from Russia. These factors directly impacted the production of oil & gas and the market in the country.

Asia Pacific Drill Pipe Market Trends

The Asia Pacific drill pipe market growth is driven by the surging number of activities related to the exploration of oil & gas and their increased production, along with the rising adoption of the shale gas drilling process over the forecast period.

The drill pipe market in China is the fastest-growing in the Asia Pacific region. This growth can be attributed to the discoveries of new oil and gas reserves and an increase in oil and gas investments. For instance, in March 2023, Petro China announced the completion of the drilling of a well in the Tarim Oilfield in China. The company also plans to carry out a large number of oil drilling activities in the country in the coming years.

The India drill pipe market is expected to witness significant growth during the forecast period owing to the surging oil demand and the ongoing expansion of the oil & gas industry in the country. According to the India Brand Equity Foundation, the demand for diesel in the country is expected to double to reach 163 MT by 2030. Diesel is expected to cater to approximately 58% of oil requirements in India by 2045. In May 2023, ONGC announced an investment of USD 4 billion to increase oil & gas exploration activities in the country.

Central & South America Drill Pipe Market Trends

Central and South America drill pipe market growth is driven by several factors, such as it is located on major oil & gas deposits; it has increased its presence in the field of petroleum production, particularly in Brazil, Argentina, Ecuador, and Venezuela. Argentina has a higher number of crude reserves than the entire Latin America region. In addition, Venezuela and Argentina are the largest producers of natural gas, which is expected to drive the demand for drill pipes over the coming years.

Middle East & Africa Drill Pipe Market Trends

The Middle East & Africa drill pipe market is the second-largest market, with 48% of oil reserves and 43% of gas reserves in the world. Iran holds the fourth position globally in terms of the largest oil reserves and second place in the natural gas reserves, which corresponds to drill pipe demand in the Middle East. The region mainly operates in the production of onshore oil and gas; it is active in the offshore sector, from shallow to deep operations, which propels the demand for drill pipes.

Key Drill Pipe Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers and acquisitions, new product launches, capacity expansion, and joint ventures, to maintain and expand their market share.

-

In October 2023, Oceaneering International, Inc., a global technology company, announced a five-year contract with Petróleo Brasileiro S.A. (Petrobras) to operate 3 existing drill pipe riser (DPR) systems in Brazil. The agreement, valued at up to USD 75 million, will commence when the current contract expires or 18 months after the award.

-

In November 2023, Hilong Holding Limited, an oilfield equipment and services provider, announced the signing of two coating service contracts and seven drill pipe supply contracts, valuing USD 41.5 million. The drill pipe supply contracts were signed with companies in the South American and North American markets, including Ventura Petroleo S.A. in South America and several Canadian companies such as Precision Drilling Canada, Horizon Drilling, Savanna Drilling, Complete Tubular Products, and Bonanza Drilling. The company also renewed a contract with Ensign US Southern Drilling LLC, a subsidiary of Ensign Energy Services Inc.

Key Drill Pipe Companies:

The following are the leading companies in the drill pipe market. These companies collectively hold the largest market share and dictate industry trends.

- Hilong Group

- NOV Inc.

- Tenaris S.A.

- Vallourec S.A.

- TMK Group

- Oil Country Tubular Limited

- Tejas Tubular Grades Inc.

- Texas Steel Conversion Inc.

- DP Master

- Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd.

- Drill Pipe International LLC

- Superior Drill Pipe Manufacturing, Inc.

Drill Pipe Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,305.08 million

Revenue forecast in 2030

USD 2,895.21 million

Growth rate

CAGR of 3.9% from 2024 to 2030

Base Year

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Russia, Italy, China, India, Indonesia, Brazil, Venezuela, Argentina, Saudi Arabia, UAE, Qatar, Kuwait, Africa

Key companies profiled

NOV Inc., Inter Drill Asia Ltd., Superior Drill Pipe Manufacturing Inc., DP Master Manufacturing Pte Ltd., Shanghai Hilong Drill Pipe Co. Ltd., TPS TECHNITUBE RÖHRENWERKE GmbH, Tenaris Company, Drill Pipe International LLC, Vallourec, and RK Pipe LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drill Pipe Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drill pipe market report based on grade, application, and region:

-

Grade Outlook (Revenue, USD Million, 2018 - 2030)

-

API Grade

-

Premium Grade

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Russia

-

Norway

-

-

Asia Pacific

-

China

-

Indonesia

-

India

-

-

Central & South America

-

Brazil

-

Venezuela

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Kuwait

-

Africa

-

-

Frequently Asked Questions About This Report

b. The global drill pipe market size was estimated at USD 2.21 billion in 2023 and is expected to reach USD 2,305.08 million in 2024.

b. The global drill pipe market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 2,895.21 million by 2030.

b. API grade drill pipes dominated the global drill pipes market in the grade segment and accounted for more than 63.0% of the overall revenue share in 2023. This is attributed to the standardization of the finished products along with the relatively low prices.

b. Some key players operating in the drill pipe market include NOV Inc., Inter Drill Asia Ltd., Superior Drill Pipe Manufacturing Inc., DP Master Manufacturing Pte Ltd., Shanghai Hilong Drill Pipe Co. Ltd., TPS TECHNITUBE RÖHRENWERKE GmbH, Tenaris Company, Drill Pipe International LLC, Vallourec, and RK Pipe LLC.

b. Rising global hydrocarbon exploration and production and the global shift in trend toward developing unconventional resources is anticipated to boost the demand for the drill pipe market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.