- Home

- »

- Medical Devices

- »

-

Drug Eluting Stent Market Size, Share & Trends Report, 2030GVR Report cover

![Drug Eluting Stent Market Size, Share & Trends Report]()

Drug Eluting Stent Market Size, Share & Trends Analysis Report By Coating Type (Polymer-based Coatings (Non-biodegradable, Biodegradable)), Polymer-free Coatings, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-999-9

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global drug eluting stent market size was valued at USD 7.20 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. The continuous rise in the global geriatric population has emerged as a primary driver for the growth of the drug-eluting stent market. As the elderly population increases, so does the risk of developing arterial diseases, leading to a greater demand for effective treatment options like drug-eluting stents. Atherosclerosis, characterized by plaque buildup in arteries, has also seen an upsurge due to sedentary lifestyles and unhealthy dietary habits.

According to research reports published in the American Journal of Preventive Cardiology in March 2020, the prevalence of atherosclerotic cardiovascular disease (ASCVD) among adults in the U.S. is 18.3 million (8.0%). This condition significantly contributes to various cardiovascular diseases, including heart attacks and strokes. In response to this mounting health concern, medical professionals are increasingly turning to drug-eluting stents as a preferred treatment for atherosclerosis.

The transition from traditional angioplasty to DES has been significant, offering an advanced approach by integrating drug therapy directly into the stent. This minimally invasive technique provides numerous benefits, including reduced trauma to blood vessels, shorter recovery times, and lower complication risks. Recently, there was a significant development in the field of drug-eluting stents, with the FDA's approval of the Orsiro Mission Drug-Eluting Stent System in September 2021, marking its introduction into the U.S. market.

The Orsiro Mission represents cutting-edge technology designed to deliver drug therapy directly to the targeted artery, promising better patient outcomes. With this approval, the first Orsiro Mission implant was completed successfully, providing a viable approach for treating artery disorders and improving medical technology in the industry.

Adoption of novel technologies such as the Orsiro Mission contributes to the market's upward trend, as medical practitioners attempt to give more effective and less invasive treatment choices for patients with arterial diseases As the healthcare industry continues its focus on patient-centric care and minimally invasive interventions, drug-eluting stents are positioned to retain their leading role in managing arterial diseases, solidifying their critical position in the global medical devices market.

During the COVID-19 pandemic, the DES market encountered challenges, including disruptions in the supply chain and a temporary decline in non-urgent DES implantations due to overwhelmed healthcare systems. Nevertheless, as healthcare systems adapted, the market displayed signs of recovery, highlighting the benefits of DES for patient safety and minimally invasive interventions. Moreover, COVID-19 survivors facing cardiovascular complications have created fresh opportunities for the DES market, positioning it as a critical element in managing cardiovascular issues both during and beyond the pandemic.

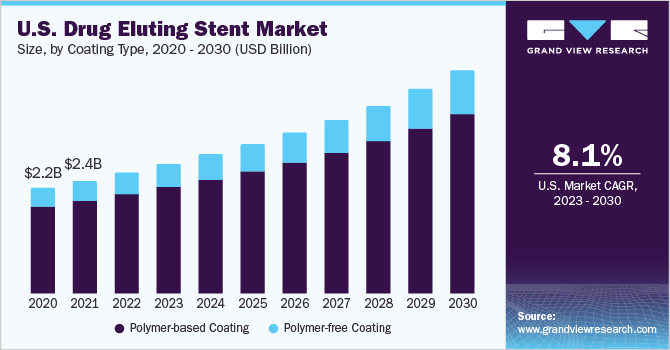

Coating Type Insights

The polymer-based coatings segment dominated the market with an 82.90% share in 2022. The dominance of polymer-based coatings in the DES market is due to their established efficacy and versatility. Extensively studied and utilized in stent development, these coatings offer a reliable choice for manufacturers. The controlled drug release ensures sustained delivery, preventing restenosis and enhancing patient outcomes.

For instance, in June 2021, the launch of Abbott's XIENCE Skypoint stent, featuring a unique polymer coating with a shorter blood thinner course for high bleeding risk patients, exemplified the advancements driving the appeal of polymer-based coatings, solidifying their leading position in the market. On the basis of coating type, the drug eluting stent market is classified into polymer-based coatings and polymer-free coatings.

The polymer-free coating segment is anticipated to witness the highest CAGR of 9.6% during the forecast period. The increasing demand for polymer-free coatings in the DES market is fueled by their potential to address long-term concerns associated with traditional polymer-based coatings. Polymer-free coatings have shown promise in minimizing the risk of delayed healing and late adverse events, such as restenosis and thrombosis.

For instance, in a study published in the Journal of the American College of Cardiology in 2022, the use of a polymer-free sirolimus-eluting stent showed favorable outcomes with a reduced risk of target lesion failure in patients with coronary artery disease. Such positive results are encouraging healthcare providers to consider polymer-free drug eluting stents as a viable and promising option for their patients. Furthermore, ongoing advancements in materials science and surface engineering techniques have contributed to the development of innovative polymer-free coatings with enhanced biocompatibility and drug-delivery capabilities.

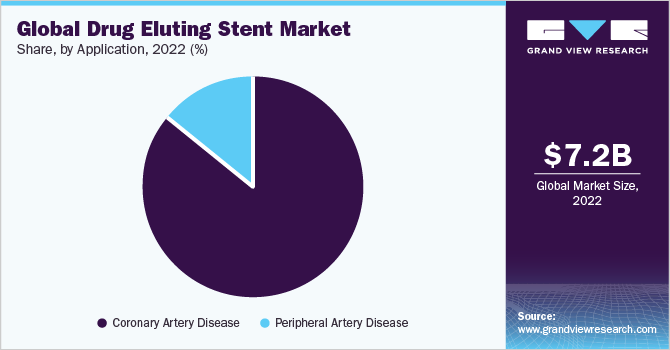

Application Insights

The coronary artery disease segment dominated the market with a revenue share of 85.89% in 2022. The coronary artery disease segment's dominance in the DES market can be attributed to the rising prevalence of coronary artery disease (CAD) globally, making it a significant cardiovascular concern. An article published by Stat Pearls journal estimated that coronary artery disease (CAD) is responsible for approximately 610,000 deaths annually, accounting for an estimated 1 in 4 deaths, making it the leading cause of mortality in the United States.

Moreover, CAD ranks as the third leading cause of mortality worldwide, corresponding to approximately 17.8 million deaths annually. DES has proven to be highly effective in treating coronary artery disease, providing patients with a minimally invasive and efficient solution to address the condition. The continuous advancements in drug eluting stent technology, demonstrated by SINOMED's HT Supreme Drug Eluting Stent with its successful commercial implantation and European launch in August 2021, further strengthen the segment's growth by offering promising outcomes and encouraging greater adoption of these devices in the market.

On the basis of application, the market for drug eluting stents is classified into coronary artery disease and peripheral artery disease. The peripheral artery disease segment is anticipated to witness the highest CAGR of 9.9% during the forecast period. The growth is expected to be driven by the increasing prevalence of PAD globally. The rising number of patients affected by this vascular disease, particularly in the aging population with risk factors such as diabetes and obesity, has created a significant demand for effective treatment solutions, leading to the extensive use of drug eluting stents in managing PAD.

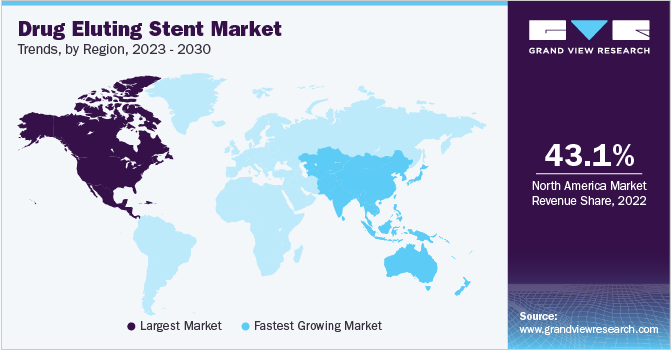

Regional Insights

North America dominated the market for drug eluting stents and accounted for 43.08% of the total revenue share in 2022. The growth of the market is attributed to the well-established healthcare infrastructure and the high adoption of advanced medical technologies in the region. The increasing regional prevalence of cardiovascular diseases has driven the demand for effective treatments like DES. Key market players and ongoing advancements in stent technology further contribute to market dominance. For instance, in June 2021, Abbott received FDA approval for its XIENCE Skypoint stent with a unique polymer coating, showcasing the region's commitment to innovative solutions.

On the other hand, Asia-Pacific is expected to witness the fastest CAGR of 9.3% over the forecast period. The regional growth is driven by an increase in cardiovascular disease prevalence and advancements in healthcare facilities with improved access to quality medical care, particularly in rural areas of the region. For instance, Terumo Corporation's launch of the Ultimaster Tansei Drug-Eluting Stent in Japan in September 2018 showcased the continuous progress and opportunities in the Asia-Pacific market for innovative stent technologies.

Key Companies & Market Share Insights

Market players are introducing advanced products at affordable prices to increase their market share. Key players are implementing strategic initiatives, such as mergers, acquisitions, and collaborations, to maximize their market dominance. For instance, in August 2022, Medtronic introduced its latest generation drug-eluting coronary stent system, the Onyx Frontier, after receiving CE Mark approval. Abbott Laboratories, Boston Scientific, Terumo Corporation, and Medtronic account for a significant presence in the overall market. These companies have gained a notable position due to strong performances in the lucrative DES market. Some of the key players operating in the global drug eluting stent market include:

-

Abbott Laboratories

-

Boston Scientific Corporation

-

Terumo Corporation

-

Medtronic plc

-

Biosensors International

-

Cook Medical

-

B. Braun

-

Biotronik

-

Lepu Medical Technology

Drug Eluting Stent Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.74 billion

Revenue Forecast in 2030

USD 13.65 billion

Growth rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Coating type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott Laboratories; Boston Scientific Corporation; Terumo Corporation; Medtronic; Biosensors International; Cook Medical; B. Braun; Biotronik; Lepu Medical Technology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to Country, regional & segment scope.

Global Drug Eluting Stent Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global drug eluting stent market reportbased on coating type, application, and region:

-

Coating Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Polymer-based Coating

-

Non-biodegradable Polymers

-

Biodegradable Polymers

-

-

Polymer-free Coating

-

Micro porous Surface

-

Micro structured Surface

-

Slotted tubular Surface

-

Nanoporous Surface

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Coronary Artery Disease

-

Peripheral Artery Disease

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global drug eluting stent market size was estimated at USD 7.20 billion in 2022 and is expected to reach USD 7.74 billion in 2023

b. The global drug eluting stent market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 13.65 billion by 2030.

b. North America dominated the drug eluting stent market with a share of 43.08% in 2022. This is attributable to supportive reimbursement coverage coupled with a high incidence rate of artery diseases.

b. Some key players operating in the drug eluting stent market include Boston Scientific Corporation, Medtronic, Inc., Abbott Laboratories, Biosensors International Group, Biotronik, Lepu Medical Technology, Terumo Medical Corporation, Cook Medical, Shandong JW Medical Systems, B.Braun

b. Key factors that are driving the market growth include sedentary lifestyles, unhealthy food habits, and lack of exercise leading to a high risk of developing arterial diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."