- Home

- »

- Clinical Diagnostics

- »

-

Drug Testing Market Size, Share And Growth Report, 2030GVR Report cover

![Drug Testing Market Size, Share & Trends Report]()

Drug Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Sample (Urine Samples), By Drug (Alcohol, Opioids), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-364-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Drug Testing Market Summary

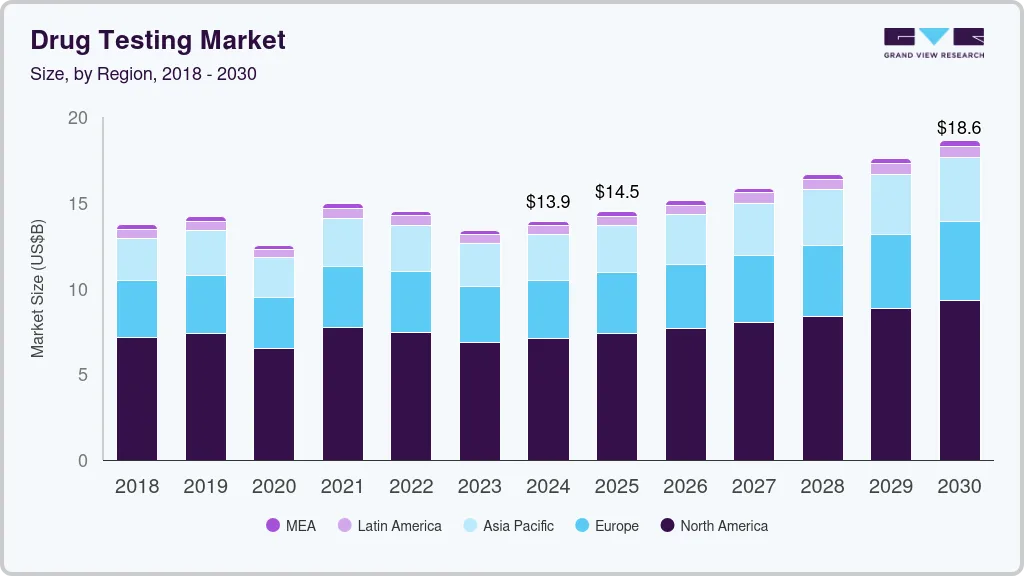

The global drug testing market size was estimated at USD 13.91 billion in 2024 and is projected to reach USD 18.62 billion by 2030, growing at a CAGR of 5.1% from 2025 to 2030.The rising prevalence of substance abuse worldwide has increased the demand for testing solutions.

Key Market Trends & Insights

- North America drug testing market dominated and accounted for a 51.0% share in 2024.

- The U.S. drug testing market is projected to grow significantly during the forecast period, driven by rising alcohol consumption.

- By sample, urine samples segment accounted for the largest share of 77.7% in 2024.

- By drug, the cannabis/marijuana segment dominated the market in 2024. the segment accounted for 57.5% of the overall market.

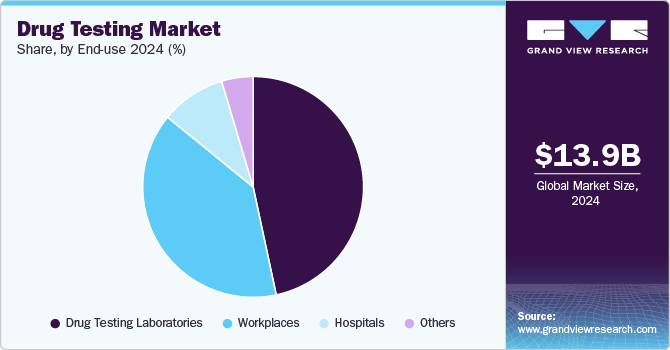

- By end-use, the drug testing laboratories segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.91 Billion

- 2030 Projected Market Size: USD 18.62 Billion

- CAGR (2025-2030): 5.1%

- North America: Largest market in 2024

Additionally, strict regulations from various government bodies requiring alcohol and substance testing for safety reasons, along with increased initiatives to monitor and address substance abuse, are anticipated to enhance market growth further.

The rising global rates of substance abuse have considerably increased the demand for testing solutions. In 2023, approximately 48.5 million Americans aged 12 and older experienced a substance use disorder, with 10.2% having an alcohol use disorder and 9.7% facing a substance use disorder. Notably, 7.5 million struggled with both alcohol and substance use disorders. The statistics show significant variations by demographics, with 27.1% of young adults (ages 18-25) affected, and 8% of seniors (65+) suffering from substance use disorders. Alcohol remains a major concern, with 28.9 million affected. Treatment statistics reveal that only 23% of those needing help received it, often due to perceived costs or readiness issues. Recovery is attainable, with about 73.1% of those acknowledging a problem claiming to be in recovery. Rising substance abuse statistics highlight the need for effective testing solutions across demographics, driving demand for products in workplaces, rehabilitation centers, and law enforcement. Increased awareness and regulations surrounding substance use disorders propel innovation and growth in the market.

Moreover, the alarming rise in alcohol and substance-related deaths emphasizes the urgent need for reliable testing solutions, driving demand for innovative technologies and services to support substance abuse detection, treatment, and prevention efforts in healthcare and public safety sectors. In June 2024, WHO report shows that over 3 million annual deaths are linked to alcohol and substance use, predominantly affecting men. Of these, 2.6 million deaths are due to alcohol, while 0.6 million are attributed to psychoactive drugs. The report highlights that around 400 million people suffer from alcohol use disorders globally, with 209 million experiencing dependence. Despite some declines in alcohol-related death rates, the overall figures remain alarmingly high, especially in low-income countries. The report calls for urgent actions to reduce alcohol and drug consumption and improve access to treatment, emphasizing the need for a coordinated global advocacy campaign and enhanced treatment capabilities in healthcare systems to achieve Sustainable Development Goal 3.5 by 2030.

Increased resources for treatment programs may lead to a higher demand for testing services to monitor compliance and effectiveness of treatments. The emphasis on addressing substance use disorders, especially among underserved populations, can spur innovations in technologies and methodologies. Furthermore, with comprehensive opioid recovery initiatives, there may be a greater need for accurate screening to prevent misuse, ultimately supporting growth in the market. In July 2024, The Biden-Harris Administration has awarded USD 45.1 million to expand services for substance use disorders. Key initiatives include USD 7.5 million for homeless individuals with substance use disorders, USD4 million for minorities at high risk for HIV/AIDS, and USD 1.7 million for comprehensive opioid recovery centers.

Product Insights

The consumables segment captured the largest revenue share of 34.6% in 2024. Consumables are vital for testing and encompass a variety of items, including reagents, columns, kits, calibrators, specimens, blue dye tablets, temperature test strips, and controls. They are extensively used to enhance confirmation testing. Various kits incorporate calibration verification tools for reagents and instruments, addressing potential issues related to these components. The increasing demand for consumables is expected to further propel market growth during the forecast period. For instance, in June 2023, the Office of Addiction Services and Supports (OASAS) announced the successful launch of a new statewide ordering system, resulting in nearly 100,000 xylazine test strips being ordered within the first week. This initiative aims to combat the increasing presence of xylazine in the illicit substance supply, which poses significant health risks. Xylazine, a veterinary sedative not approved for human use, is often mixed with fentanyl and is not detectable through taste or smell, making testing essential for users to assess potential dangers.

Rapid testing devices has been anticipated to grow at the fastest CAGR of 6.3% during the forecast period. The conventional approach to drug detection involves a difficult procedure for removing possible drug components from biological specimens, such as urine, hair, & blood, and then analyzing the drugs using Gas/Liquid Chromatography &/or Mass Spectrometry (GC/MS or LC/MS). It requires more time to test and a large room for the instrument & knowledgeable technicians. However, rapid test kits have low sensitivity and can only identify one component in a single test, even though they can identify drugs in urine.

Sample Insights

Urine samples segment accounted for the largest share of 77.7% in 2024, primarily due to their widespread acceptance and reliability. Urine is the preferred method for sample collection as it provides accurate results for diagnosing various solutes, cells, and particulates in the body. This sample type is particularly effective in detecting the presence of illicit metabolites and substances, as the body metabolizes drugs into detectable compounds. The presence of these metabolites indicates the intake of the parent drug. Additionally, urine analysis is one of the few methods endorsed by regulatory bodies, such as the Department of Health and the Department of Transportation, for both point-of-care and laboratory diagnostics.

Oral fluid samples has been anticipated to grow at the fastest CAGR of 7.7% during the forecast period due to several key factors, such as oral fluid examination being non-invasive and easier to administer compared to traditional methods, making it more appealing to both employers and individuals. Additionally, advancements in technologies have improved the accuracy and reliability of results. Oral fluid samples provide a broader detection window for recent substance use, which is critical for effective substance monitoring. Furthermore, the increasing focus on workplace safety and compliance is driving organizations to adopt oral fluid testing as a viable alternative for screening.

Drug Insights

The cannabis/marijuana segment dominated the market in 2024. The segment accounted for 57.5% of the overall market. This can be attributed to the increasing use of marijuana or cannabis as an illicit drug in the world, creating a demand for its kits and instruments. As marijuana or cannabis is the most commonly used illicit drug worldwide, the demand for its solutions is expected to remain high over the forecast period. According to the Substance Abuse & Mental Health Services Administration report, in 2021, the most commonly used illicit drug in U.S. was marijuana, used by about 52.2 million people. In addition, nearly one in three young adults aged 18 to 25 years used marijuana in U.S., which increased the prevalence of substance use disorders in the country with marijuana as the most used drug.

Opioids has been anticipated to grow at a significant rate during the forecast period. As per the data published by the Substance Abuse and Mental Health Services Administration (SAMHSA), in 2020, around 9.5 million people in U.S. had opioid use disorder (including heroin abuse and prescription pain relievers). Furthermore, WHO stated that about 25% of 80% of deaths caused by opioid was related to opioid overdose. In addition, exposure to prescription opioids has increased by 93% every year over the past 9 years. In U.S., opioid use among athletes and at the workplace has steadily increased. As per the data published by the National Council on Alcoholism and Drug Dependence, around 8% of female athletes and 12% of male athletes used prescription opioids in a year. Hence, the increasing opioid use by athletes and at workplaces is anticipated to drive the demand for opioid testing products.

End-use Insights

The drug testing laboratories segment dominated the market in 2024. This can be attributed to drug testing laboratories' large presence and offerings. Advantages of these laboratories include the availability of sophisticated equipment, such as High-Performance Liquid Chromatography (HPLC) & spectroscopy, and trained personnel for conducting tests for effective results. Hence, laboratories provide more sensitivity and specificity testing results than rapid tests. These laboratories conduct tests and are certified by the health department. These laboratories also conduct tests for validating the samples to ensure that samples are not adulterated. In countries like the U.S., only Department of Health & Human Services (HHS) certified laboratories can participate in drug testing.

The workplace segment is projected to witness the highest growth rate in the market due to the increasing emphasis on employee safety and organizational productivity. Several companies are implementing pre-employment drug tests and ongoing screening to ensure a drug-free environment. This trend is driven by the need to reduce workplace accidents, enhance employee performance, and comply with legal and regulatory requirements. Additionally, as substance abuse becomes a growing concern, employers are recognizing the importance of safeguarding their workforce and company reputation. The widespread adoption of urine testing methods further supports this growth, as they are cost-effective and reliable for detecting drug use.

Regional Insights

North America drug testing market dominated and accounted for a 51.0% share in 2024. This high share is attributable to the local presence of key global market players, such as Laboratory Corporation of America Holdings, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories and others. Moreover, the market growth in the region is attributed to the increasing incidence of abuse, active screening programs and stringent government regulations. The governments are actively engaged in controlling the consumption of hazardous drugs to minimize the cost burden associated with it. Furthermore, regulatory body initiatives are further contributing to market growth. In September 2023, San Francisco Human Services Agency (SFHSA) announced a new initiative that would need people suffering from substance use disorder who wish to gain access to county funds to enroll in treatment and services.

U.S. Drug Testing Market Trends

The U.S. drug testing market is projected to grow significantly during the forecast period, driven by rising alcohol consumption. Additionally, data from the National Center for Drug Abuse Statistics (NCDAS) published in February 2023 shows that approximately 46% of drug users in the U.S. reported using cannabis and prescription stimulants. This includes 10% of the population consuming cocaine, 36% using opioids and methamphetamine, and 15% using heroin. Authorities are implementing measures to curb the spread of illicit drug use in response to these trends.

Europe Drug Testing Market Trends

The Europe drug testing market is emerging as a lucrative region in the industry, driven by the growing focus on workplace safety, heightened awareness of substance abuse issues, and initiatives to enhance public safety, particularly in transportation and heavy industries. Additionally, the rising incidence of illicit drug trade is expected to create further growth opportunities for the market during the forecast period. These factors are contributing to the expansion of testing services across various sectors in Europe.

The UK drug testing market is projected to grow during the forecast period, driven by increased government focus and significant investments aimed at curbing substance abuse. For instance, in August 2023, the Office for Life Sciences in the UK allocated USD 6.24 million to fund the development of new technologies to enhance testing services. Additionally, government efforts are focused on reducing addiction-related deaths and overdoses, further fueling the demand for drug testing solutions.

Drug testing market in France is expected to experience substantial growth during the forecast period, driven by the increasing use of illegal substances, prescription misuse, and strict government regulations. Additionally, the rise in illegal distribution and handling is likely to positively influence market growth. Government initiatives aimed at enhancing drug abuse testing are also expected to boost the demand for testing solutions across the country.

The Germany drug testing market is projected to expand during the forecast period, driven by ongoing advancements in the country, including the implementation of strict government regulations, changing societal perspectives on substance use, and improvements in testing technologies. Germany prioritizes employee rights and privacy, which impacts the adoption of testing practices within legal parameters. In August 2023, the German Federal Cabinet approved a new draft law for the regulated use of cannabis, emphasizing its medicinal applications, supply management, and handling issues.

Asia Pacific Drug Testing Market Trends

The Asia Pacific drug testing market is expected to experience the highest growth rate of 6.1% CAGR during the forecast period. Several significant trends are transforming the drug testing landscape in this region. A key trend is the heightened focus on curbing illicit drug use. Both healthcare providers and government agencies in Asia Pacific are acknowledging the necessity of raising awareness about the dangers associated with illicit drug consumption. Additionally, there is an increasing emphasis on innovating new testing technologies and boosting investments in product development. In March 2023, Singapore's Ministry of Home Affairs (MHA) announced a plan to introduce a new saliva test kit designed for drug detection at roadblocks and checkpoints, with results available in approximately 10 minutes.

The China drug testing market is projected to expand throughout the forecast period, driven by the increasing rates of drug abuse, particularly alcohol and illicit drugs, which are prevalent among the youth. Additionally, the market's growth can be linked to a rising number of product launches and the increasing accessibility of rapid test kits. For instance, in March 2021, the Hong Kong police force implemented DrugWipe 6 S Ketamine for rapid roadside drug screening tests.

Drug testing market in Japan is anticipated to grow during the forecast period, primarily due to government initiatives aimed at enhancing drug testing in the region. In October 2023, the Japanese government distributed drug assessment kits to the Maldives Customs Service and the Maldives National Defense Force (MNDF). Additionally, in April 2023, the Metropolitan Police Department (MPD) launched Japan's first simple test kit specifically designed to detect "date rape drugs."

Latin America Drug Testing Market Trends

The Latin America drug testing market is expected to experience significant growth throughout the forecast period. This growth is driven by the increasing presence of major industry players in the region. Several key companies have set up testing laboratories in countries such as Brazil and Mexico to enhance their competitive advantage. Additionally, the rising prevalence of substance use disorders are likely to create valuable opportunities within the market.

The Brazil drug testing market is projected to expand during the forecast period, primarily driven by the high rates of drug abuse in the country. This rising prevalence is expected to significantly increase the demand for drug examination services. In response to this growing need, several key players in the industry are entering the Brazil market, employing both organic and inorganic growth strategies to enhance their presence and capabilities.

MEA Drug Testing Market Trends

The Saudi Arabia drug testing market is anticipated to experience substantial growth during the forecast period. This growth is largely due to rising rates of substance abuse and the increasing trend of workplace drug testing. For instance, in September 2022, Saudi authorities confiscated amphetamine pills valued at USD 47 million. Over the past few decades, pre-employment drug scanning has become a widely adopted requirement in many workplaces. Government-accredited laboratories in Saudi Arabia typically process approximately 46,000 samples annually for pre-employment screenings.

Key Drug Testing Company Insights

The competitive scenario in the drug testing market is high, with key players offering diverse testing solutions for clinical, workplace, and home settings. Leading players include Abbott Laboratories, Quest Diagnostics, OraSure Technologies, Thermo Fisher Scientific, and LabCorp. These companies provide a wide array of technologies, including urine, saliva, and hair analysis for substances like narcotics and alcohol. Abbott Laboratories holds a significant share with its rapid diagnostic tests, while Quest Diagnostics leads in laboratory-based examination services. OraSure Technologies specializes in oral fluid drug analysis, recently expanding its portfolio with SwabTek surface test kits. Strategic partnerships, product innovation, and regulatory compliance drive market growth, as businesses, law enforcement, and healthcare providers increasingly adopt drug testing solutions for safety and regulatory purposes.

Key Drug Testing Companies:

The following are the leading companies in the drug testing market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Incorporated

- Abbott

- F. Hoffmann-La Roche Ltd.

- Quidel Corporation

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare GmbH

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Laboratory Corporation of America Holdings

- Clinical Reference Laboratory, Inc.

- Cordant Health Solutions

Recent Developments

-

In February 2024, Veriteque USA has entered a distribution agreement with OraSure Technologies, allowing OraSure to offer Veriteque's SwabTek surface test kits alongside its oral fluid drug screening products. SwabTek provides single-use, dry reagent tests for narcotics and explosives, making drug identification accessible for home, educational, and workplace use. This partnership broadens OraSure's drug testing portfolio and enhances its ability to offer comprehensive solutions to businesses, educators, and security professionals.

-

In April 2023, MIP Discovery launched its first drugs of abuse reagent, targeting norfentanyl, the main urinary metabolite of fentanyl, addressing the growing synthetic opioid crisis. Using their nanoMIP technology, which is sensitive and robust, MIP Discovery aims to support the development of portable, field-based tests for detecting fentanyl metabolites. This innovation comes as synthetic opioids, including fentanyl, contribute to increasing overdose deaths. The company is committed to reducing synthetic opioid-induced fatalities through advanced detection solutions.

-

In September 2023, BRITISH CANNABIS acquired PhytoVista Laboratories, a UKAS-accredited cannabinoid testing lab, ensuring its continued operation and upholding regulatory compliance. PhytoVista specializes in cannabinoid analysis, terpene content, and product safety, providing essential testing for CBD and medical cannabis. PhytoVista ensures compliance with UK Home Office regulations for THC testing, aiming to promote higher standards in cannabinoid testing, consumer safety, and industry trust in the growing cannabis market.

Drug Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.49 billion

Revenue forecast in 2030

USD 18.62 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sample, drug, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; Denmark; Sweden ; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; and South Africa.

Key companies profiled

Quest Diagnostics Incorporated; Abbott; F. Hoffmann-La Roche Ltd.; Quidel Corporation; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Laboratory Corporation of America Holdings; Clinical Reference Laboratory Inc.; Cordant Health Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drug Testing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drug testing market report based on product, sample, drug, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Instruments

-

Rapid Testing Devices

-

Services

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Urine Samples

-

Oral Fluid Samples

-

Hair Samples

-

Other Samples

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcohol

-

Cannabis/Marijuana

-

Cocaine

-

Opioids

-

Amphetamine & Methamphetamine

-

LSD

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Testing Laboratories

-

Workplaces

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global drug testing market size was estimated at USD 13.91 billion in 2024 and is expected to reach USD 14.49 billion in 2025

b. The global drug testing market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 18.62 billion by 2030.

b. The consumables segment dominated the drug testing market in 2024 with a revenue share of 34.6%.

b. The urine samples segment dominated the drug testing market and accounted for the largest revenue share of 77.7% in 2024.

b. The cannabis/marijuana segment dominated the market for drug testing and accounted for the largest revenue share of 57.5% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.