- Home

- »

- Pharmaceuticals

- »

-

Legal Cannabis Market Size & Share, Industry Report, 2033GVR Report cover

![Legal Cannabis Market Size, Share & Trends Report]()

Legal Cannabis Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Marijuana, Hemp), By Derivative (CBD, THC), By End Use (Medical Use, Recreational Use, Industrial Use), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-278-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Legal Cannabis Market Summary

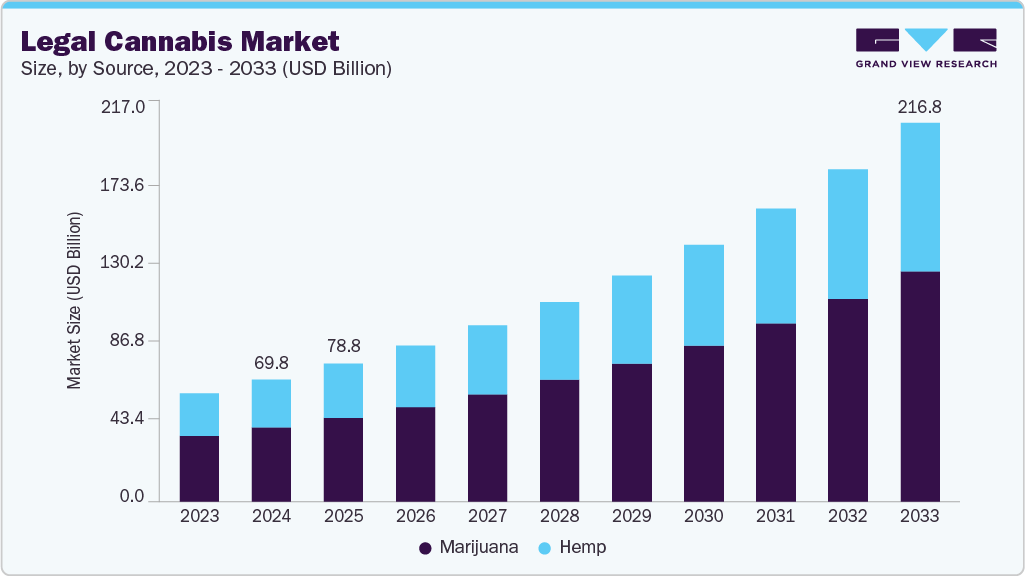

The global legal cannabis market size was estimated at USD 69.78 billion in 2024 and is projected to reach USD 216.76 billion by 2033, growing at a CAGR of 13.49% from 2025 to 2033. The rising global prevalence of chronic diseases, particularly cancer, is accelerating the adoption of medical marijuana.

Key Market Trends & Insights

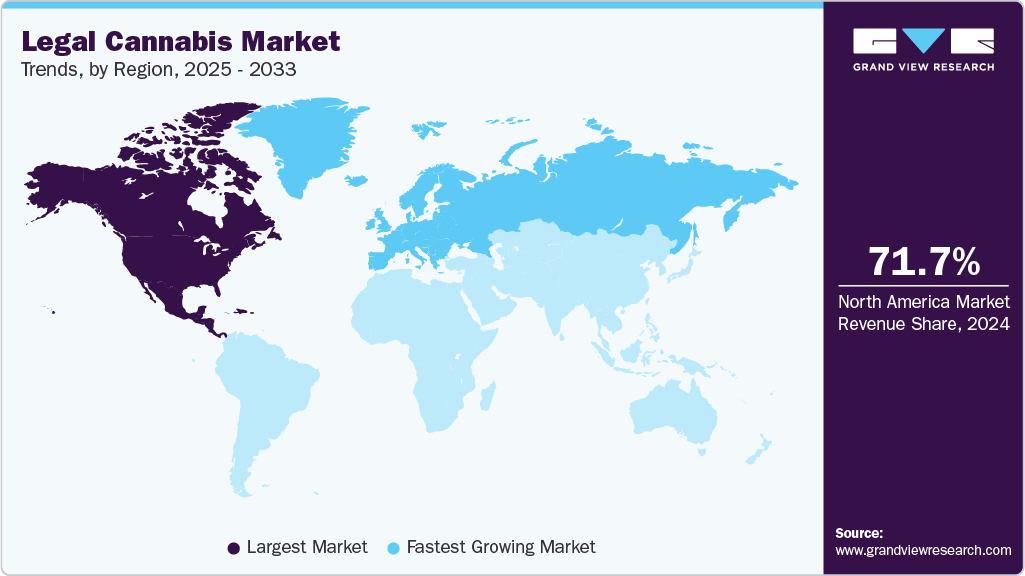

- The North America legal cannabis market dominated the global market in 2024, accounting for the largest revenue share of 71.69%.

- The Canada legal cannabis market is anticipated to register the fastest growth rate during the forecast period.

- In terms of source segment, the marijuana segment held the largest revenue share in 2024.

- In terms of derivatives segment, the CBD segment held the largest revenue share in 2024.

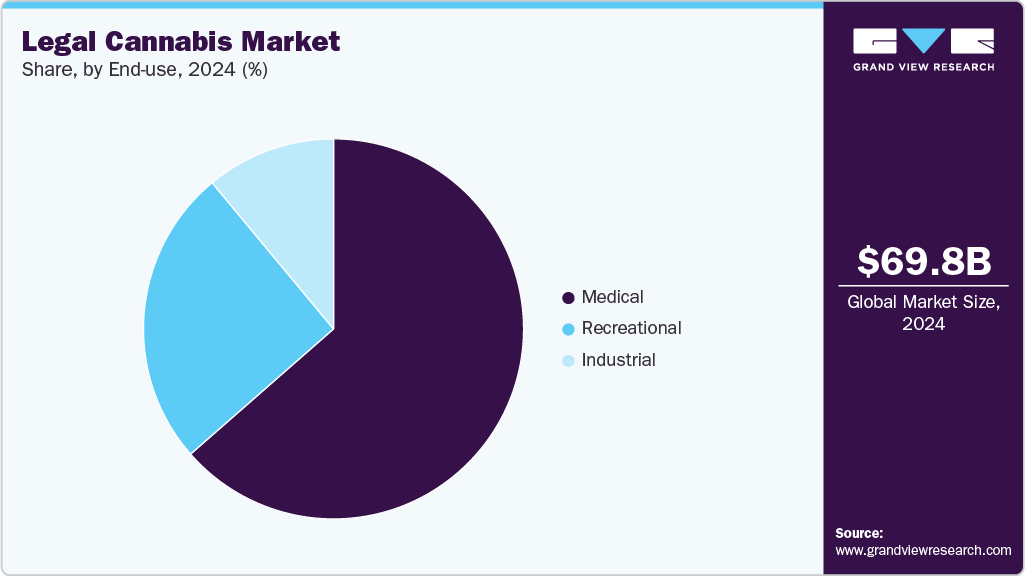

- In terms of the end use segment, the medical segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 69.78 Billion

- 2033 Projected Market Size: USD 216.76 Billion

- CAGR (2025-2033): 13.49%

- North America: Largest market in 2024

- Europe: Fastest growing market

According to the National Cancer Institute article published in May 2025,cancer alone accounted for nearly 20 million new cases and 9.7 million deaths worldwide in 2022, with projections indicating these numbers will rise to 33 million cases and 18.2 million deaths annually by 2050. This growing patient pool drives the demand for alternative and complementary therapies to manage symptoms and improve quality of life. Medical marijuana has gained recognition for its potential in alleviating cancer-related pain, reducing chemotherapy-induced nausea, stimulating appetite, and supporting palliative care. While more countries legalize cannabis for medical use, the increasing cancer burden is expected to be a significant aspect of the growth of the legal cannabis market.

The cannabis sector is experiencing rapid growth due to the expanding acceptance of cannabis for both medicinal and recreational purposes. In many U.S. states, legalization currently applies primarily to medical use, with broader adult-use legalization expected in the coming years. Such measures aim to reduce the impact of the illegal marijuana market while enabling governments to generate significant tax revenue from regulated cannabis sales. For example, in fiscal year 2023, Washington state reported USD 468.5 million in revenue from legal cannabis sales and licensing fees.

The Liquor and Cannabis Board Collected Revenues From License Fees, Penalties, And Legal Cannabis Taxes In 2023

Allocation Category

Revenue (USD Million)

Basic Health

230.0

General Fund

119.0

Washington State Health Care Authority

48.0

Local Governments

22.0

Department of Health

11.0

Washington State Patrol

2.4

Source: U.S. Department of Health and Human Services & GVR

The adoption of cannabis is anticipated to increase further with the growing number of medical and adult-use patients & customers. Furthermore, with the legalization of marijuana for adult use, a shift in patient preference for marijuana from medical to recreational purposes is anticipated due to the low cost and easy access to marijuana after legalization in the state. For instance, Delaware and Minnesota legalized cannabis for recreational/adult use in April 2023 and August 2023, respectively.

The cannabis industry is highly regulated, and the use of cannabis for medical purposes is still considered illegal in several states in the U.S. Cannabis is legalized in the majority of U.S. states and continuous political movements are supporting its legalization for medical and recreational purposes across several other states in the U.S. Furthermore, various other states are expected to follow suit, which is anticipated to fuel market growth. For instance, in March 2023, the state of Kentucky in the U.S. legalized cannabis for medical purposes.

Furthermore, rising awareness of cannabis's therapeutic benefits and the launch of cannabis certification programs through partnerships drive market growth. For instance, in December 2023, Bellarmine University introduced a cannabis education certificate program offered by a public Kentucky university focusing on agriculture, business, medicine, and law in the fast-changing cannabis industry.

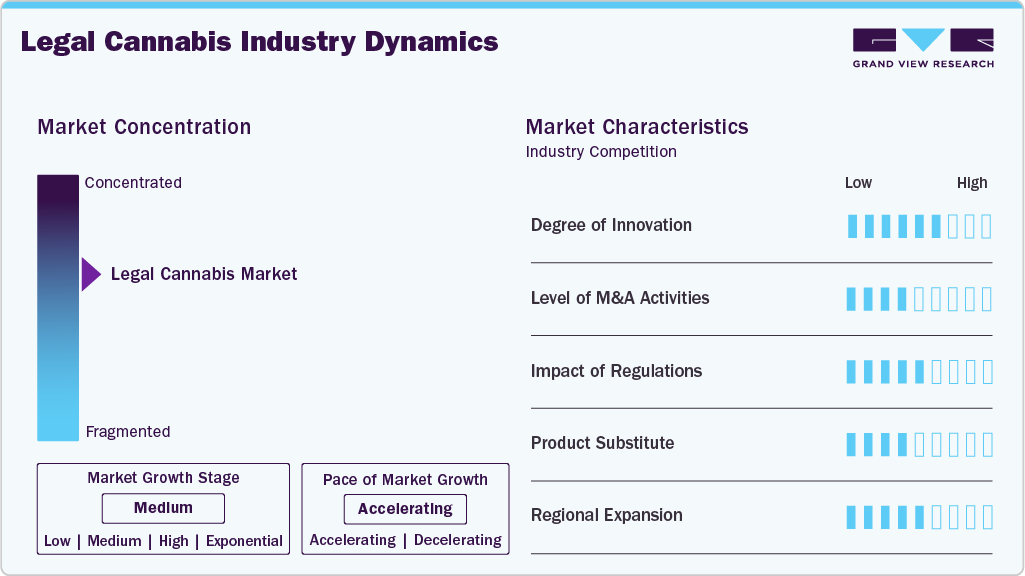

Market Concentration & Characteristics

The legal cannabis industry is witnessing significant innovation through improved cultivation methods, advanced extraction processes, and the development of new product formats such as edibles, beverages, and topicals. These advancements enhance product quality, ensure regulatory compliance, and cater to diverse consumer preferences.

The legal cannabis market is characterized by the leading players' high merger and acquisition (M&A) activity. This is due to several factors, including the desire to expand the business to cater to the growing demand for legal cannabis. In June 2025, Vireo Growth finalized a USD 102 million acquisition of Missouri-based Proper Brands, which includes 11 dispensaries and a large cultivation/manufacturing facility over 100,000 sq ft.

Regulatory changes significantly influence the legal cannabis industry by affecting product safety, licensing processes, and market access. For instance, in April 2025, Canada implemented a comprehensive set of regulatory amendments that relaxed packaging and labeling restrictions, including allowing transparent packaging and branded lids, streamlined licensing criteria to support small-scale producers (micro-cultivation and micro-processing), Adjusted reporting requirements, such as easing tracking obligations related to cultivation waste and these updates aim to balance public safety with industry growth and operational flexibility.

In the legal cannabis market, substitutes include products derived from sources other than traditional marijuana flowers, such as hemp-based CBD oils, industrial hemp products, and synthetic cannabinoids. These alternatives are increasingly popular among consumers seeking non-psychoactive options, wellness-focused products, or cannabis-like effects without THC.

Key cannabis players are actively expanding into new international territories to grow their market presence. For instance, in July 2025, Cronos Group, which partnered with Switzerland’s Dascoli Pharma AG to distribute its PEACE NATURALS medical cannabis across the Swiss market. This move marks a strategic foray into regulated European markets and diversifies the company’s global footprint.

Source Insights

By source, the marijuana segment dominated the legal cannabis market in 2024 and accounted for the largest revenue share of 60.80%. Growing adoption of medical marijuana for the treatment of chronic diseases and the launch of technologically advanced products by the key players drive the growth of the market. For instance, in June 2025, Aurora Cannabis Inc., has introduced two new high-potency cannabis cultivars in Poland. These premium dried flower products, named Farm Gas and Sourdough, are cultivated and processed in the company’s Canadian and European GMP-certified facilities. Designed to deliver superior quality and elevated THC levels, these offerings represent some of the strongest medical cannabis products available in the Polish market, underscoring Aurora’s commitment to innovation and regulatory compliance in the marijuana segment.

The hemp segment in the legal cannabis market is anticipated to witness the fastest CAGR over the forecast period. High nutritional value and beneficial fatty acid & protein profiles drive the demand for hemp products. The high absorbency of hemp fiber benefits personal hygiene, oil & gas cleanup, and the livestock bedding market. Moreover, the demand for hemp in paper, building materials, and textiles is increasing due to its favorable aesthetic & acoustic properties. In addition, strategic initiatives by the key players drive the market's growth. For instance, in March 2025, Edible Brands launched a new hemp product online marketplace: Edibles.com. The platform aims to provide a wide range of hemp-based products to consumers, expanding the accessibility and availability of hemp products in legal markets.

Derivative Insights

By derivative, the CBD segment dominated the legal cannabis market in 2024 and accounted for the largest revenue share of 66.90%. CBD is the non-psychoactive compound found in the cannabis plant, and its adoption is increasing for a wide range of health issues. Moreover, strategic initiatives by the key players drive the market's growth. For instance, in August 2025, ActivPure introduced a new line of CBD gummies, emphasizing a pleasant flavor profile without overly processed additives. These gummies are derived from high-quality hemp and produced under stringent manufacturing standards, ensuring users' safe and enjoyable experience.

The THC segment in the legal cannabis market is anticipated to witness the significant CAGR over the forecast period. Tetrahydrocannabinol (THC) is one of the active compounds found in the cannabis plant, which is mainly known for its psychoactive nature. Its production and consumption are not permitted in many areas due to its psychoactive nature. However, since the use of cannabis for recreational purposes was allowed in the U.S., the potential benefits of THC were being considered. Moreover, strategic initiatives by the key player drive the market's growth. For instance, in July 2025, Trulieve Cannabis Corp. introduced Upward, a premium THC-infused energy drink designed to support active and wellness-focused lifestyles. This non-alcoholic beverage is available online and in Florida and Illinois retail locations.

End Use Insights

By end use, medical use segment dominated the legal cannabis market in 2024 with a revenue share of 63.56%. The factors such as increasing acceptance of cannabis for the treatment of various chronic conditions such as diabetes, cancer, arthritis, depression and anxiety, and epilepsy, contributing to segment’s growth. The approval of cannabis drugs for treating various conditions is driving the growth. For instance, Syndros and Marinol are the two specific drugs approved by the FDA to treat the side effects of chemotherapy, such as vomiting and nausea. Moreover, increased legalization of cannabis in U.S. states fuels the segment growth.

The recreational use segment of the legal cannabis market is anticipated to register a significant growth rate over the forecast period, driven by increasing legalization and shifting social attitudes worldwide. More countries and states are embracing adult-use cannabis laws, expanding consumer access, and diversifying product offerings. Innovations such as THC-infused beverages, edibles, and vape products are gaining popularity for their convenience, discretion, and variety of effects. In addition, younger consumers and wellness-focused users are exploring cannabis as a social and relaxation aid, fueling demand for novel and premium recreational products. The rise of cannabis tourism in legalized regions further supports market expansion by attracting visitors seeking authentic and regulated experiences.

Regional Insights

North America dominated the legal cannabis market in 2024 and accounted for the largest revenue share of 71.69% owing to a well-established healthcare infrastructure and high healthcare expenditure. In addition, the rising incidence of chronic pain drives the market's growth. According to the CDC article published in November 2024, nearly 24.3% of adults in North America reported living with chronic pain in 2023, with a significant portion, about one-third of those individuals, suffering from high-impact chronic pain that substantially interferes with daily activities. Moreover, women were more prone to experiencing chronic pain compared to men. This widespread prevalence of chronic pain has contributed to the growing interest and demand for legal cannabis as an alternative or complementary approach to pain management in the region. While patients seek more natural and effective options for relief, the North American legal cannabis market continues to expand, driven in part by the need to address the challenges posed by chronic and high-impact pain conditions.

U.S. Legal Cannabis Market Trends

The legal cannabis market in the U.S. held the largest share in 2024. Increasing cancer incidence and the launch of technologically advanced products in the U.S. drive the market's growth. According to the American Cancer Society article published in June 2025, Cancer affects individuals of all ages, but the likelihood of diagnosis rises significantly with advancing age. In the U.S., the vast majority of cancer cases, about 88% occur in people aged 50 and above, with nearly 60% diagnosed at 65 years or older. In addition, almost 40% of men and 39% of women in the U.S. are expected to develop cancer at some point in their lives. This high prevalence has influenced the U.S. legal cannabis market, as many patients turn to cannabis-based products for symptom relief and supportive care during cancer treatment. The demand for medical cannabis is increasingly shaped by its potential to alleviate pain, nausea, and other side effects associated with cancer therapies, driving growth in this evolving market segment.

Europe Legal Cannabis Market Trends

Europe legal cannabis market is anticipated to register the fastest growth rate during the forecast period. Rising product launches and approvals in the region are accelerating the market growth. In May 2025, MediPharm Labs is set to launch its metered-dose cannabis inhalers in the European Union and the UK. These inhalers offer a smoke- and vapor-free method of cannabinoid delivery, aiming to provide patients with a precise and controlled dosage.

UK legal cannabis market is anticipated to register a considerable growth rate during the forecast period. Increasing cancer incidence and technologically advanced product launches in the UK drive the market's growth. According to the Cancer Research UK article published in June 2025, over the past five decades, the incidence of cancer diagnoses in Great Britain has risen significantly, with the rate increasing by nearly 47% from approximately 413 cases per 100,000 people in 1973 to about 607 per 100,000 in 2023. This upward trend in cancer prevalence has had a notable impact on the UK legal cannabis market, as more patients seek alternative therapies to manage symptoms associated with cancer and its treatments. The growing demand for medical cannabis products reflects an increased focus on improving quality of life for cancer patients through options that may help alleviate pain, nausea, and other treatment-related side effects, thereby driving expansion and innovation within the UK’s cannabis industry.

Switzerland legal cannabis market is anticipated to register a considerable growth rate during the forecast period. Increasing arthritis incidence drives the growth of the market. According to the MonAM article published in November 2024, a significant portion of Switzerland’s population faced musculoskeletal health challenges, with 13.5% diagnosed with arthrosis or arthritis and 4.1% affected by osteoporosis in 2022. Moreover, over 15% of Swiss residents lived with at least one of these chronic conditions. This prevalence has contributed to increased interest in the Switzerland legal cannabis industry, as many patients explore cannabis-based therapies for pain relief and improved mobility. The demand for medical cannabis in Switzerland is thus being driven by the need for alternative treatment options to manage symptoms associated with these widespread degenerative diseases, supporting growth and innovation within the country’s evolving cannabis sector.

Asia Legal Cannabis Market Trends

Asia legal cannabis market is projected to experience the fastest growth globally, driven by improving healthcare infrastructure, relatively flexible regulatory policies, and increasing economic development that attracts foreign investments. Leading market players actively pursue strategies to strengthen their regional presence, including expanding production capacities and distribution networks. Growth is further supported by initiatives from private companies, such as enhancing medical professional training and investing in research and development to introduce innovative cannabis-based products, reflecting a strong trend toward modernization and accessibility in the legal cannabis market.

Japan legal cannabis market is anticipated to register a significant growth rate during the forecast period. Regulatory reforms fuel the growth of the market. For instance, in October 2024 , the Japanese legal cannabis industry is witnessing gradual regulatory evolution as the government updates THC limits for CBD products. While experts note that these changes are modest compared to international standards, the Ministry of Health, Labour and Welfare (MHLW) has clarified product categories, including oils, powders, and aqueous solutions, to reduce confusion among industry stakeholders. These reforms, emerging from ongoing public consultations, indicate a slow but deliberate shift in Japan’s century-old cannabis regulations, laying the groundwork for cautious market growth and potential opportunities for domestic and international players.

The India legal cannabis market is anticipated to register a significant growth rate during the forecast period. Government initiatives for regulated cannabis cultivation drive the market's growth. For instance, in January 2025, Himachal Pradesh launched a pilot project for controlled cannabis cultivation tailored for industrial and medicinal purposes. The initiative, supervised by the state’s agriculture department and conducted in partnership with local universities, aims to establish guidelines for low-THC cultivation (below 0.3%) and includes seed bank development and SOP creation.

Latin America Legal Cannabis Market Trends

Latin America legal cannabis market is growing over the forecast period, driven by the increasing awareness of cannabis-based therapies for both medical and wellness applications. Rising recognition of its potential benefits in managing chronic conditions and evolving regulatory frameworks fosters wider acceptance across the region. This trend is further reinforced by initiatives to ensure product safety, quality, and accessibility, creating a favorable environment for market expansion.

Brazil's legal cannabis market is growing over the forecast period. Rising government initiatives drive the growth of the market. For instance, in May 2025, the Lula government unveiled an interministerial plan developed alongside ANVISA and other key ministries to regulate the full cannabis supply chain (from cultivation to distribution), with a target of implementing the framework by September 2025. The plan aims to increase medical access, reduce patient costs, and stimulate domestic production.

Africa legal cannabis market is growing over the forecast period, driven by the region’s economic diversification and evolving regulatory landscape. In particular, Gulf Cooperation Council (GCC) countries benefit from high per capita incomes and advanced healthcare infrastructure, creating a favorable environment for the adoption of cannabis-based medicinal products. In addition, increasing government focus on regulatory reforms and controlled legalization is expected to accelerate market expansion in the forecast years further.

Key Legal Cannabis Company Insights

Key participants in the legal cannabis market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Legal Cannabis Companies:

The following are the leading companies in the legal cannabis market. These companies collectively hold the largest market share and dictate industry trends.

- Tilray Brands

- Canopy Growth Corporation

- Aurora Cannabis, Inc.

- Jazz Pharmaceuticals, Inc.

- The Cronos Group

- Organigram Holding, Inc.

- Tikun Olam

- ENDOCA

- Isodiol International, Inc.

- Medical Marijuana, Inc.

- NuLeaf Naturals, LLC

- Maricann Inc.

Recent Developments

-

In August 2025, International cannabis lifestyle brand Cookies is expected to open its first retail store in Jamaica. This flagship location will be situated on the iconic Hip Strip in Montego Bay and will feature Cookies' exclusive range of premium wellness products, beverages, functional mushroom blends, branded apparel, and lifestyle goods.

-

In June 2025, Vireo Growth Inc. completed its previously announced acquisition of Deep Roots Holdings Inc., a Nevada-based cannabis company founded in 2023. Deep Roots operates ten retail dispensaries and a cultivation and manufacturing facility spanning 54,000 square feet in Nevada's well-established cannabis industry.

-

In June 2025, Tilray Medical, part of Tilray Brands, announced a key step in its European growth by launching three new medical cannabis flower varieties in Italy. Through its subsidiary FL Group, Tilray has gained approval from the Italian Ministry of Health to import and distribute its branded medical cannabis flowers for therapeutic use, strengthening patient care options in the country.

Legal Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 78.76 billion

Revenue forecast in 2033

USD 216.76 billion

Growth rate

CAGR of 13.49% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivative, end use, region

Regional scope

North America; Europe; Asia; Oceania; Latin America; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Poland; Czech Republic; Switzerland; Croatia; Netherlands; Spain; China; Japan; India; Thailand; Australia; New Zealand; Brazil; Mexico; Uruguay; Colombia

Key companies profiled

Tilray Brands; Canopy Growth Corporation; Aurora Cannabis, Inc.; Jazz Pharmaceuticals, Inc.; The Cronos Group; Organigram Holding, Inc.; Tikun Olam; ENDOCA; Isodiol International, Inc.; Medical Marijuana, Inc.; NuLeaf Naturals, LLC; Maricann Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Legal Cannabis Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes industry trends in each sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the legal cannabis market report based on source, derivative, end use, and region:

-

Source Outlook (Revenue USD Million, 2021 - 2033)

-

Marijuana

-

Flowers

-

Oil and Tinctures

-

-

Hemp

-

Hemp CBD

-

Industrial Hemp

-

-

-

Derivative Outlook (Revenue USD Million, 2021 - 2033)

-

CBD

-

THC

-

Others

-

-

End-Use Outlook (Revenue USD Million, 2021 - 2033)

-

Medical Use

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Recreational Use

-

Industrial Use

-

-

Regional Outlook Revenue USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Poland

-

Czech Republic

-

Switzerland

-

Croatia

-

Netherlands

-

Spain

-

-

Asia

-

China

-

Japan

-

India

-

Thailand

-

-

Oceania

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

Uruguay

-

Colombia

-

-

Africa

-

Frequently Asked Questions About This Report

b. The global legal cannabis market size was estimated at USD 69.78 billion in 2024 and is expected to reach USD 78.76 billion in 2025.

b. The global legal cannabis market is expected to grow at a compound annual growth rate of 13.49% from 2025 to 2033 to reach USD 216.76 billion by 2033.

b. The marijuana segment dominated the legal cannabis market in 2024 and accounted for the largest revenue share of 60.80%. Growing adoption of medical marijuana for the treatment of chronic diseases and the launch of technologically advanced products by the key players drive the growth of the market.

b. Some key players operating in the legal cannabis market include Tilray Brands, Canopy Growth Corporation, Aurora Cannabis, Inc., Jazz Pharmaceuticals, Inc., The Cronos Group, Organigram Holding, Inc., Tikun Olam, ENDOCA, Isodiol International, Inc., Medical Marijuana, Inc., NuLeaf Naturals, LLC, and Maricann Inc.

b. The rising global prevalence of chronic diseases, particularly cancer, is accelerating the adoption of medical marijuana. According to the National Cancer Institute article published in May 2025, cancer alone accounted for nearly 20 million new cases and 9.7 million deaths worldwide in 2022, with projections indicating these numbers will rise to 33 million cases and 18.2 million deaths annually by 2050. This growing patient pool drives the demand for alternative and complementary therapies to manage symptoms and improve quality of life.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.