- Home

- »

- Medical Devices

- »

-

Durable Medical Equipment Market Size, Share Report, 2030GVR Report cover

![Durable Medical Equipment Market Size, Share & Trends Report]()

Durable Medical Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Personal Mobility Devices, Monitoring And Therapeutic Devices), By End Use (Hospitals, Nursing Homes), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-084-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Durable Medical Equipment Market Summary

The global durable medical equipment market size was estimated at USD 221.35 billion in 2023 and is projected to reach USD 331.14 billion by 2030, growing at a CAGR of 5.90% from 2024 to 2030. The prevalence of chronic diseases, such as urological disorders, cancer, cardiovascular disease, neurovascular diseases, and various other chronic conditions, is significantly increasing, leading to a considerable rise in hospital admission rates, thus driving the growth of the durable medical equipment market globally.

Key Market Trends & Insights

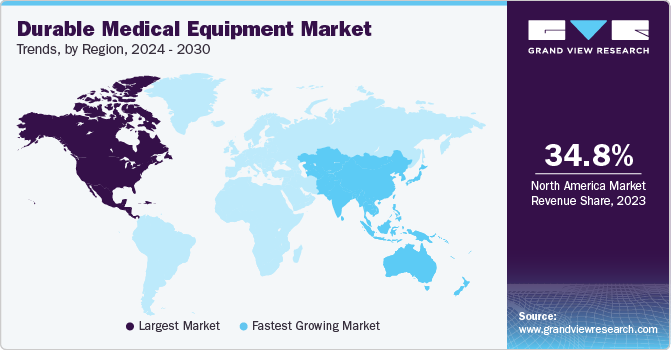

- North America accounted for the highest market share 34.83% in 2023.

- Asia Pacific is expected to be the fastest-growing region during the forecast period.

- Based on product, the monitoring and therapeutic devices segment led the market and accounted for 89.35% of the total revenue share in 2023.

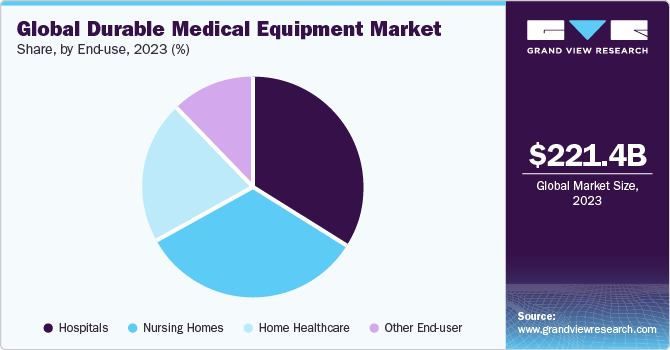

- Based on end use, the Hospitals segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 221.35 Billion

- 2030 Projected Market Size: USD 331.14 Billion

- CAGR (2024-2030): 5.90%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing region

For instance, as per the WHO, every year, 17 million people die from Non-Communicable Diseases (NCDs) before age 70, and most of these early deaths, around 86%, happen in low- and middle-income countries. Among NCDs, cardiovascular diseases cause the most deaths, affecting 17.9 million people annually. Following closely are cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, which includes deaths from kidney disease caused by diabetes).

The COVID-19 pandemic disrupted the supply chain of durable medical equipment (DME) due to the lockdown imposed by the government. This has impacted the operations and financial liquidity of market players. The supply chain interruptions have occurred for items such as oxygen equipment, CPAPs and RADs, and nebulizers. The storage of the supply has created complications for the high-risk patients which has further increased the overall demand for the products in the market.

Durable medical equipment helps improve accessibility to perform the task in daily living. DME is covered under Medicare but does not cover disposable items. Medicare Part-B beneficiaries pay 20% of the approved cost of the product and the remaining 80% is paid by Medicare. Better coverage and reimbursement policies for DME products are also likely to help boost the DME market growth. In addition, the rising number of elderly care centers because of the increasing geriatric population base across the globe is projected to drive the DME market further.

Elderly people have low immunity levels and thus, are prone to skeletal, cardiac, and neurological problems, which increases the need for long-term care and recovery. Rising geriatric population is a significant factor propelling the growth of the DME market. As the world's population ages, there is a subsequent increase in the demand for healthcare services and infrastructure to address the unique & evolving healthcare needs of older adults. According to the WHO data published in 2022, by 2030, one out of every six people worldwide will be 60 years or older. During this period, the number of individuals in this age group will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of those aged 60 and above is anticipated to double, reaching 2.1 billion. Moreover, the number of people aged 80 years or older is projected to triple by 2050, reaching a total of 426 million, compared to the figures recorded in 2020. This, in turn, is estimated to augment the demand for DME products over the coming years.

Durable medical equipment plays an important role in long-term care after surgery at home or any other healthcare setting. This is also estimated to propel home medical equipment market growth. On the other hand, stringent regulatory guidelines in developed economies and the lack of skilled professionals for this equipment are said to hinder industry growth.

Market Concentration & Characteristics

The market growth stage is moderate, and pace of the market growth is accelerating. The DME market is characterized by a moderate-to-high degree of growth. Key drivers include the global aging population, prevalence of chronic diseases, and advancements in technology leading to more advance and user-friendly devices. Regulatory compliance, reimbursement policies, and trend towards home healthcare also shape the market dynamics. In addition, emerging trends involve the integration of DME with telehealth solutions and the demand for personalized and customized equipment.

Key strategies implemented by players in DME market are new product launches, expansion, acquisitions, partnerships, and other strategies. In February 2022, Stryker completed the previously announced acquisition of Vocera Communications, Inc. With this acquisition, the company now possesses the capability to wirelessly communicate crucial patient information in near real-time to the Vocera Badge or the nurses' station via Vision, a protocol management dashboard. This integration streamlines workflows, facilitating on-the-go monitoring and presenting significant opportunities for driving innovations and accelerating digital aspirations in healthcare. The acquired capabilities are expected to contribute to market growth, with IoT and connectivity emerging as key drivers in shaping the future of DME market.

Degree of Innovation: The durable medical equipment (DME) market is witnessing a substantial degree of innovation driven by rapid technological advancements and the increasing adoption of advanced products, particularly in home care settings. The growing demand for home care services has fueled the development of innovative technologies like artificial intelligence (AI), big data analytics, and remote monitoring within the DME sector. Companies investing significantly in these advanced technologies are gaining a competitive edge, contributing to the overall market growth. The infusion of AI, analytics, and remote monitoring in DME reflects a dynamic landscape that not only meets the evolving healthcare needs but also propels the market forward through continuous advancements and innovations. Such advancements and innovations in DME drive market growth.

Impact of Regulations: The DME market is significantly influenced by stringent quality protocols and regulatory norms enforced by various nations, aimed at ensuring patient safety and data integrity. These regulations have a profound impact on the operational capabilities of companies within the DME sector. Market participants with robust compliance measures and a proven track record of meeting regulatory standards not only enhance patient trust but also gain preference from MedTech sponsors. However, compliance with these rigorous regulations requires substantial resources, posing challenges and acting as a barrier for smaller or newer firms entering the market. The regulatory landscape, while essential for maintaining industry standards, creates a dynamic wherein established entities with a strong regulatory history hold a competitive advantage.

Level of M&A Activities: Companies are actively acquiring development-stage firms to broaden their service portfolios, catering to a larger patient base. Additionally, strategic partnerships with national DME providers under a value-based arrangement align with the goal of enhancing primarily home care services offered to patients nationwide. These collaborative efforts aim to strengthen relationships and improve the implementation of clinical programs pitched towards reducing hospitalizations for members. For instance, in November 2023 Humana Inc., a health and well-being company, has partnered with national organizations Rotech Healthcare Inc. and AdaptHealth Corp. to provide DME services. This collaboration, set to commence on July 1 under a value-based structure which aims to enhance the health support for Humana Medicare Advantage HMO members in their homes. Each national DME provider will serve specific regions of the country, marking a strategic move in the evolving DME market.

Market Highly Fragmentation: The market comprises a large number of medical device manufacturers leads to a highly fragmented market scenario.

Regional Expansion: Companies in the DME market are strategically focusing on regional expansion to capitalize on emerging opportunities and broaden their market presence. This entails establishing a stronger footprint in key geographical areas through partnerships, acquisitions, and localized marketing strategies. By tailoring their products and services to meet regional healthcare needs, DME firms aim to enhance accessibility and responsiveness, ensuring a more comprehensive and effective market penetration. Regional expansion serves as a critical factor for industry leaders to tap into diverse markets, address specific healthcare demands, and ultimately drive sustained growth.

Product Insights

The monitoring and therapeutic devices segment led the market and accounted for 89.35% of the total revenue share in 2023 owing to growing incidence of lifestyle-related diseases, which need vital statistics analysis, and increasing demand for wireless monitoring devices. The market is gaining prominence due to the rising number of health and fitness monitoring applications and devices globally such as wristwatch, fitness band and smart glasses which can monitor heart rate, oxygen, temperature and provide critical health analysis to avoid uncertainty.

The bathroom safety device and medical furniture is expected to witness considerable growth over the analysis period. This is due to the increasing prevalence of obesity and bariatric surgeries worldwide. The introduction of technologically advanced products with supreme patient comfort and portability is expected to fuel the segment growth.

End Use Insights

Hospitals segment dominated the market in 2023 on account of a high volume of patients due to the increasing chronic diseases globally. Hospitals serve as the primary site for handling these disorders since they frequently have access to cutting-edge medical technology and a staff of trained healthcare specialists. In addition, hospitals are taking initiatives to deal with the damages from accidental pullouts. For instance, in January 2022, Sanford Health announced the launch of its first-in-human clinical study of its device to reduce accidental catheter dislodgment. Thus, in turn is expected to drive the segment growth.

Nursing homes are considered to provide the most extensive care that can be offered in a non-hospital setting. Along with the basic line of treatment, nursing homes also offer custodial care, which includes skilled care, such as bathing, dressing, and providing meals. The segment is anticipated to witness a lucrative share over the forecast period on account of the increasing number of these establishments across the globe. Home healthcare is expected to witness the highest growth rate over the forecast period due to the cost-saving approach for the patient to get remote healthcare services.

Regional Insights

North America accounted for the highest market share34.83% in 2023. The rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. The presence of leading manufacturers and quick adoption of advanced products are projected to boost the region’s growth further. The region is continuously developing cost-efficient and advanced devices for the patients to capture a huge share of the market. In addition, the rise in the number of hospitals and the growing geriatric population are factors responsible for the regional market growth.

Furthermore, the strategic focus on market expansion is a significant opportunity in the U.S. durable medical equipment market. This involves capturing revenue synergies by integrating various companies and extending geographic diversification, channel expansion, and enhanced product utilization through market development initiatives. For instance, in October 2023, Numotion officially launched SpinKids, a brand catering to the mobility and equipment needs of the pediatric market. This strategic addition not only enables manufacturers to broaden their capabilities but also provides an additional avenue to serve a wider customer base, contributing to the growth of the DME market.

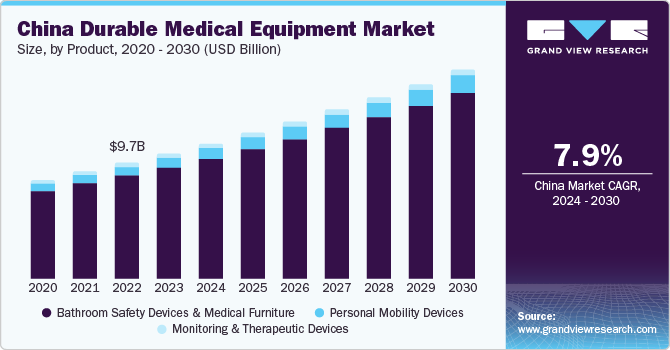

Asia Pacific is expected to be the fastest-growing region during the forecast period because of the rising target population base with increasing chronic diseases, the need for medical equipment by the patients, and supportive government initiatives. Moreover, economic strides made by countries, such as China, India, and South Korea, coupled with improvements in healthcare infrastructure will contribute to the region’s growth.

-

India DME Market: Indian market is anticipated to grow at a CAGR of 6.57% over the forecast period. Key factors estimated to drive the market growth are an aging population, increasing prevalence of chronic diseases, and rising healthcare awareness. The market witnessed a surge in demand for technologically advanced and portable medical devices, including home-use equipment. In addition, continued innovation, emphasis on affordability, and strategic collaborations within the industry were key aspects driving the growth of DME market in India.

Key Companies & Market Share Insights

Durable medical equipment market trends are shaping industry leaders strategies. Heavy investments in research and development for technological innovations reflect a commitment to connected healthcare solutions. Top players are adapting to the shift towards home healthcare through strategic partnerships and acquisitions, expanding their offerings for patients seeking accessible solutions. The rise of telehealth services is driving the integration of DME with virtual care platforms, emphasizing a holistic patient management approach. Stringent regulations and evolving reimbursement models are guiding leaders towards compliance and operational efficiency. To stay relevant, market leaders are agilely adjusting their business models to align with the dynamic healthcare landscape, ensuring competitiveness in the rapidly evolving durable medical equipment industry.

Key DME Companies:

- Invacare Corporation

- ArjoHuntleigh

- Stryker Corporation

- Hill Rom, Inc.

- Drive Medical

- GF Health Products, Inc.

- Sunrise Medical

- Medline Industries

- Hill Rom, Inc.

- Carex Health Brands, Inc

- Becton, Dickinson and Company

- General Electric Company

- Medtronic PLC

- Compass Health Brands

- Getinge AB

- Resmed Inc.

Recent Developments

-

In January 2024,Sunrise Medical has launched the Switch-It Vigo head control, a wireless and proportional alternative drive system designed for power wheelchairs. The system developed by Now Technologies LTD which joined Sunrise Medical in 2022. Vigo allows users to navigate their power wheelchairs and devices with subtle head movements. Its innovative technology has received acclaim in various markets and secured awards, including the 2023 Mobility Product Award in the "Alternative Driving Controls" category from Mobility Management publication. Vigo's addition complements Switch-It's range of advanced controls for power wheelchairs. This strategic move is anticipated to contribute to the increased adoption of durable medical equipment in the near future.

-

In January 2024, Medline introduced the OptiView Transparent Dressing with HydroCore technology as the latest addition to its advanced wound care portfolio. The company aim is to enhance efficiency with tools like OptiView, addressing healing barriers and elevating care standards. Users have reported benefits such as improved treatment and prevention of pressure injuries, along with cost savings due to longer wear time and reduced dressing changes. Thus, due to such advancements, the market is expected to grow in the near future.

-

In October 2023, Home Care Delivered, Inc., successfully acquired Medline Industries, LP's DMEPOS supplier business unit. This strategic acquisition aims to boost HCD's market presence, expand its geographical reach, and broaden its customer base. The move reinforces relationships with patients, healthcare plans, providers, and manufacturers.This strategic move is anticipated to contribute to the increased adoption of durable medical equipment in the near future.

-

In March 2023, GF Health Products, Inc. (Graham-Field) expanded its Sub-Acute Care and Extended Care Beds. The new beds utilize enhanced manufacturing resources, including computer-controlled laser welding, robotic assembly, and an upgraded automated coating line.

Durable Medical Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 234.82 billion

Revenue forecast in 2030

USD 331.14 billion

Growth rate

CAGR of 5.90% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Product, End-use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Invacare Corporation; ArjoHuntleigh; Stryker Corporation; Hill Rom, Inc.; Drive Medical; GF Health Products, Inc.; Sunrise Medical; Medline Industries, Inc.; Carex Health Brands, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Durable Medical Equipment Market Report Segmentation

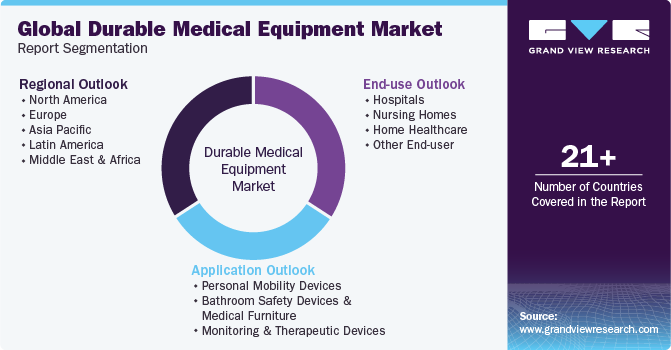

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the durable medical equipment (DME) market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Personal Mobility Devices

-

Wheelchairs

-

Scooters

-

Walker and Rollators

-

Canes and Crutches

-

Door Openers

-

Other Devices

-

-

Bathroom Safety Devices and Medical Furniture

-

Commodes and Toilets

-

Mattress & Bedding Devices

-

-

Monitoring and Therapeutic Devices

-

Blood Sugar Monitors

-

Continuous Passive Motion (CPM)

-

Infusion Pumps Market

-

Nebulizers

-

Oxygen Equipment

-

Continuous Positive Airway Pressure (CPAP)

-

Suction Pumps

-

Traction Equipment

-

Others Equipment

-

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Nursing Homes

-

Home Healthcare

-

Other End-user

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global durable medical equipment market size was estimated at USD 208.5 billion in 2022 and is expected to reach USD 221.3 billion in 2023.

b. The global durable medical equipment market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 331.1 billion by 2030.

b. North America dominated the global durable medical equipment market with a share of 34.9% in 2022. This is attributable to the growing incidence of cancer, cardiac disorders, ophthalmic ailments, neurological conditions, and increasing gynecological complications in this region.

b. Some key players operating in the global durable medical equipment market include Invacare Corporation; ArjoHuntleigh; Stryker Corporation; Hill Rom, Inc.; Drive Medical; GF Health Products, Inc.; Sunrise Medical; Medline Industries, Inc.; and Carex Health Brands, Inc.

b. Key factors that are driving the durable medical equipment market growth include the rising prevalence of chronic disease, increasing geriatric population base across the globe, and better coverage and reimbursement policies for DME products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.