- Home

- »

- Clothing, Footwear & Accessories

- »

-

E-commerce Footwear Market Size, Global Report, 2028GVR Report cover

![E-commerce Footwear Market Size, Share & Trends Report]()

E-commerce Footwear Market (2022 - 2028) Size, Share & Trends Analysis Report By Type (Leather Footwear, Athletic Footwear, Athleisure Footwear), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-947-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

E-commerce Footwear Market Summary

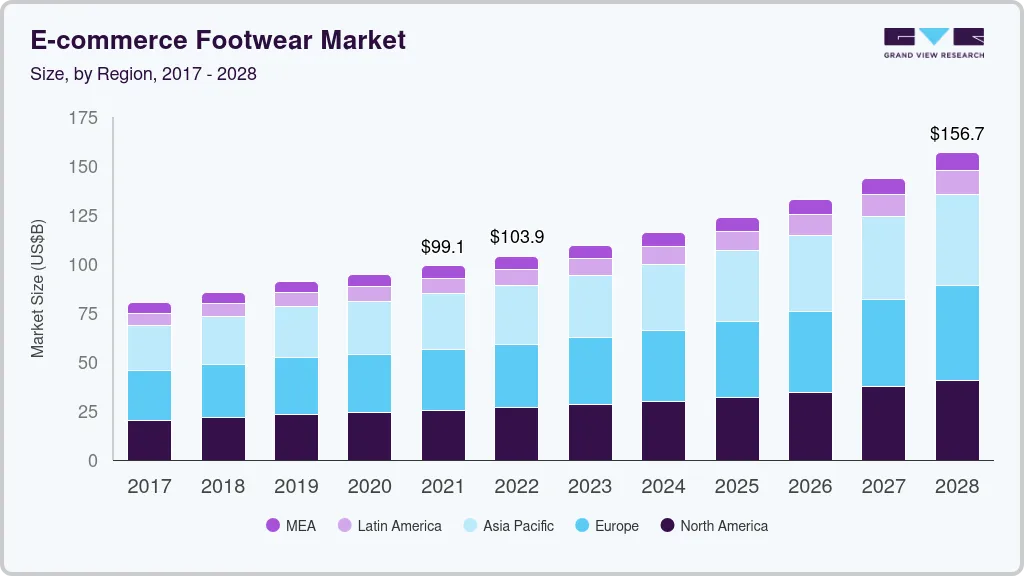

The global e-commerce footwear market size was estimated at USD 99.1 billion in 2021 and is projected to reach USD 156.73 billion by 2028, growing at a CAGR of 6.8% from 2022 to 2028. This can be attributed to the growing demand for footwear products on e-commerce platforms from developed countries such as the UK and the U.S.

Key Market Trends & Insights

- Europe led the global market with a revenue share of more than 31% in 2021.

- Asia Pacific is expected to register a significant CAGR of 7.3% from 2022 to 2028.

- Based on type, the leather footwear type segment accounted for the largest revenue share of around 70% in 2021.

- Based on type, the athletic footwear type segment is projected to advance at 7.4% CAGR from 2022 to 2028.

Market Size & Forecast

- 2021 Market Size: USD 99.1 Billion

- 2028 Projected Market Size: USD 156.73 Billion

- CAGR (2022-2028): 6.8%

- Europe: Largest market in 2021

Also, the market growth is principally accredited to the high demand for comfortable and convenient footwear. Furthermore, companies are concentrating on a few major parameters, such as advanced technical fabrications, product developments, and innovative designs, to boost product sales. Rising awareness and enthusiasm about the health benefits of fitness & sports activities among people is likely to flourish the demand for footwear on e-commerce portals during the forecast period. Moreover, the flourishing e-commerce sector is estimated to boost the market growth. The increasing level of consumer disposable income is also expected to be a key trend stoking market advancement.

The effect of COVID-19 has been variable in the industry. Low demand for footwear, in general, is consequently projected to lower the sales of shoes. Several manufacturers in the market generally rely on China for raw materials as well as finished products used in the manufacturing of a variety of leather goods. The pandemic has, however, interrupted the supply chain, leading to severe losses in terms of on-time delivery and product shipment. However, all these factors are anticipated to show some impact on this market growth during the forecast period.

The popularity of digital payment systems is one of the key factors driving the expansion of the e-commerce footwear market. A wide range of merchandise offerings, 24/7 customer support with technical assistance, multiple payment methods such as credit card, online banking, cash on delivery (COD), as well as other payment service providers such as PayPal, are aiding customers in safe and secure online payment.

In addition, mobile wallets such as Apple Pay, Android Pay, and Samsung Pay are expected to drive the growth of this target market to a certain extent. Major operating players such as Amazon.com, Google, Mastercard, and PayPal are investing heavily in technology to provide simple and secure payment options.

Moreover, prompt growth in the expenditure on fashion accessories owing to the rising influence of social media is propelling the market. The latest changes in customer shopping trends and increasing inclination toward buying designer and high-end shoes are projected to trigger the growth. Demand for trendy, comfortable, and fancy footwear is driving the market growth. Furthermore, growing investments by market players in the latest technologies, coupled with a focus on easy-to-shop experience on their platforms, are further anticipated to boost the industry sales.

However, a notable disadvantage of e-commerce is uncertainty about product quality. If a shopper receives a product that doesn’t meet the expectancy, it entirely ruins their shopping experience and appears to be among the top disadvantages of e-commerce. This is an important factor challenging the growth of this market during the forecast period.

A recent trend observed in this target market is that the major footwear brands are presenting themselves on social media platforms to gain customer loyalty and offer more personalized products. In addition, the growing demand for superior quality products and product innovations are some major determinants driving the demand for footwear globally. For instance, Nike uses eco-friendly raw materials, including recycled car tires, recycled carpet padding, cotton, and plant-dyed leather to produce its footwear.

Type Insights

The leather footwear type segment accounted for the largest revenue share of around 70% in 2021. This growth is credited to the increasing demand for these items in developed nations such as the U.K., the U.S., and Germany. Leather footwears are durable and provide an elegant look, making them popular among several customers. The breathable features of real leather which can avoid unwanted odors and cool down the feet are also propelling the growth of this segment in the market.

The athletic footwear type segment is expected to show the fastest growth during the forecast period. The segment is projected to advance at 7.4% CAGR from 2022 to 2028, owing to the increasing demand from emerging economies such as China and India. Athletic footwear includes running shoes, sports shoes, aerobic shoes, and trekking shoes. Developing enthusiasm and awareness concerning the health benefits of fitness activities among consumers are anticipated to drive the growth of this segment during the forecast period.

Regional Insights

Europe led the global market with a revenue share of more than 31% in 2021. This growth is due to the rising demand for footwear products from developed nations such as France, Germany, and the U.K. Easy online purchases, more women at work, and a growing middle-class population are the prime factors that are anticipated to drive the growth of the market for e-commerce footwear in this region.

A high concentration of major manufacturers in the region such as in the U.K. and Germany prioritizing product innovation, research and development, and launches in the footwear category is the chief factor driving market demand.

Asia Pacific is expected to register a significant CAGR of 7.3% from 2022 to 2028, owing to the increasing demand for these products in developing countries such as China, India, and Japan. Factors such as the rising working-class population, the rapid expansion of international footwear chains, the growing number of low-middle class, and rising economies are anticipated to fuel the growth. A rapid rise in online sales and high internet penetration is anticipated to further fuel the regional market.

Key Companies & Market Share Insights

The global market is highly competitive, with major shares occupied by well-known players such as Walmart and Amazon, attributed to their high market penetration. This reflects their strong control over the industry through the products on offer, partnerships, and advertising. These brands adopted every possible strategy to meet the needs of the footwear market, including adopting aggressive digital marketing campaigns, offering a wide range of innovative and customizable products that meet the preferences of all age groups, including exclusively for children, and brand collaborations.

For instance, in July 2021, Nike launched the Nike App in Southeast Asian countries including Singapore, Philippines, Thailand, Malaysia, Taiwan, etc. The launch of the Nike App acts as an important expansion of Nike's digital ecosystem in Southeast Asian countries, as the company aims to build a strong online presence.

In October 2021, Puma SE opened its largest store in Gurgaon, a city in northern India. The approximately 7,000-square-foot store in Gurgaon’s CyberHub retail destination is a “digital experience store” with digital touchpoints to attract digitally savvy customers who are increasingly shopping online. Some of the major companies operating in the global e-commerce footwear market are:

-

Walmart, Inc.

-

Amazon, Inc.

-

JD.com

-

Alibaba

-

eBay.com

-

Flipkart

-

Shopify

E-Commerce Footwear Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 103.95 billion

Revenue forecast in 2028

USD 156.73 billion

Growth rate

CAGR of 6.8% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; Japan; South Africa; Brazil

Key companies profiled

Walmart, Inc.; Amazon, Inc.; JD.com; Alibaba; eBay.com; Flipkart; Shopify

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global e-commerce footwear market report on the basis of type and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Leather Footwear

-

Athletic Footwear

-

Athleisure Footwear

-

Other Town Footwear

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global e-commerce footwear market size was estimated at USD 99.1 billion in 2021 and is expected to reach USD 103.95 billion in 2022.

b. The global e-commerce footwear market is expected to grow at a compound annual growth rate of 6.8% from 2022 to 2028 to reach USD 156.73 billion by 2028.

b. Europe dominated the e-commerce footwear market with a share of 31.4% in 2021. This is attributable to growing demand for footwear on e-commerce portals from developed countries coupled with rising awareness and enthusiasm about the health benefits of fitness & sports activities among people.

b. Some key players operating in the e-commerce footwear market include Walmart, Inc.; Amazon, Inc.; JD.com; Alibaba; eBay.com; Flipkart; and Shopify.

b. Key factors that are driving the e-commerce footwear market growth include the latest changes in customer shopping trends, increasing inclination toward buying designer and high-end products, and technological innovation in communication technology across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.