- Home

- »

- Communications Infrastructure

- »

-

E-commerce Logistics Market Size & Share Report, 2030GVR Report cover

![E-commerce Logistics Market Size, Share & Trends Report]()

E-commerce Logistics Market Size, Share & Trends Analysis Report By Service Type (Transportation, Warehousing), By Type (Forward, Reverse), By Model (3PL, 4PL), By Operation, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-968-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global e-commerce logistics market was valued at USD 315.82 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 22.3% from 2023 to 2030. E-commerce logistics involves the provision of services such as warehousing, transportation, value-added services, and packaging services. The demand for e-commerce logistics has increased across a wide range of applications due to the growth of digital technologies. Increasing cross-border e-commerce and the rising number of internet users, particularly in developing countries, are the major drivers of online business.

Instead of visiting a physical store, individuals are increasingly using e-commerce websites to buy products ranging from groceries to gadgets, personal care products, furniture, and clothing. The market is anticipated to expand significantly over the forecast period as a result of rising smartphone penetration, drone delivery, digitization, and digital payments. The increasing adoption of hardware technologies such as the Internet of Things (IoT), barcode technologies, portable data terminal, GIS, and GPS further drives the industry’s growth.

The E-commerce logistics market has a huge scope for expansion. To realize this potential, venture capitalists (VC) across the globe are funding e-commerce logistics startups on a large scale. The Asian startup Lalamove received USD 1.5 billion in January 2021, and the Indonesian company J&T Express received USD 2.5 billion in venture capitalists (VC) funding. On-demand (rapid) delivery sector has seen significant inflows of funds as compared to other categories owing to the growing consumer demand for the quickest delivery.

COVID - 19 Impact Analysis

Consumers’ desire to purchase goods online has been fueled by the ability to compare pricing and product availability online. This has increased the demand for e-commerce logistics services. Market players now have speedier delivery methods, given the rapid growth of technology. The outbreak of the COVID-19 pandemic led to increased online shopping compared to physical shopping.

However, as e-commerce expands quickly, logistics businesses are required to deal with the complicated supply chains, rising fuel prices, and heightened competition. It may be possible for 3PLs to deal with these constraints and maintain their competitiveness, but that is becoming more difficult by implementing a multi-client fulfillment model. Compared to dedicated fulfillment models, the multi-client fulfillment model is cost-efficient.

The outbreak of the COVID-19 pandemic had a positive effect on the target market as opposed to other industries. The closure of physical shopping outlets forced the consumers to shift to e-commerce for the most basic daily needs ranging from groceries, furnishing, gadgets, and clothing. According to a survey conducted by DHL, last-mile delivery for e-commerce was the most sort after logistic service even after the pandemic.

Since no one could foresee the sudden drop in demand, the stock for those non-essential items was left unsold in warehouses and fulfillment centers and clogged up space that could be used for essential goods which are in high demand. Since there was a considerable shift in consumer demand, companies could not expand their storage and transportation capacities overnight, leading to a substantial backlog of orders. In response to the pandemic, all the major players are either focusing on M&A activities or are going public to raise more funds to expand their operations.

Service Type Insights

Based on service type, the target market is segmented into transportation, warehousing, and others. The transportation segment is further bifurcated into airways, railways, roadways, and waterways. Warehousing is further bifurcated into mega centers, hubs/delivery centers, and returns processing centers. Mega centers are large fulfillment centers that have a large storage capacity for goods.

Goods are transferred from these mega centers to smaller units called hubs/delivery centers. Hubs and delivery centers are increasing significantly to facilitate quick commerce. In warehousing, mega centers accounted for the largest market share of over 42% in the global market in 2022. The hubs/ delivery centers are expected to be the fastest growing segment with a CAGR of 21.8% during the forecast period.

Transportation accounted for the largest share in the service type segment of over 70% in 2022. Further in the transportation segment, the roadways segment accounted for the highest market share of over 52% in 2022. The high market share for roadways is due to the fact all the last mile deliveries are carried out through roadways. The airways segment is expected to grow at the highest rate at a CAGR of 24.8% during the forecast period. The high growth rate is owing to the increasing trend of same-day and next-day delivery, wherein airways are the optimal choice of transport.

Operation Insights

Based on operation, the e-commerce logistics market is segmented into domestic and international. The domestic segment held the largest revenue share of about 74.39% in 2022. However, international operations are expected to grow at the fastest CAGR of 24.9% during the forecast period.

International online commerce is on the rise due to the significant increase in the volume of cross-border shipments. The easy availability of foreign brands through big e-commerce providers such as Amazon and Alibaba have been a substantial driver for the international e-commerce logistics market. According to a report by DHL, cross-border shipments account for almost 15% of the total e-commerce retail shipments across the globe.

International brands are partnering with third-party logistics providers to expand their regional presence in developing nations. Countries in Asia-Pacific, such as India, Indonesia, and Thailand, are witnessing a huge demand for foreign brands. The market share of cross-border shipments is expected to rise further in the near future.

Due to the consumer preference for same-day delivery instead of next-day deliveries or standard deliveries, the market for domestic e-commerce logistics is expanding rapidly. The increase in demand for quick commerce for food delivery, grocery delivery, and medicine delivery is also significantly contributing to the demand for logistics services. Due to the rise in 10-minute deliveries, the need for local hubs and delivery centers is also increasing rapidly.

Model Insights

Based on the model, the target market is segmented into 3PL, 4PL, and others. Third-party logistics companies offer outsourced services. 3PL held the largest revenue share of about 75.57% in the year 2022. These companies provide warehousing, transportation, and packaging, among other services.

The services of a 3PL provider allow the business to focus on its core activities such as R&D, manufacturing, and strategic planning, thereby relieving it of the day-to-day burden of operations. Outsourcing product fulfillment operations to a 3PL provider provide all the benefits of an entire logistics set-up, including warehousing, order processing equipment, and computer and software systems – without fixed overheads. Firms with limited in-house resources can economically manage high order volumes by outsourcing their logistics.

Fourth-party logistics (4PL) is the step ahead that can manage resources, infrastructure, technology, and even external 3PL to provide a holistic supply chain solution. The 4PL companies offer comprehensive consulting services in addition to logistics operations.

The services include logistics strategy, inbound and outbound logistics, inventory planning and management, business planning, and analytics. BDP International and DB Schenker Logistics are some of the companies that are offering 4PL services. 4PL is a relatively new concept, but it is expected to gain momentum in the coming years from medium and large businesses seeking a complete logistics solution.

Vertical Insights

The apparel vertical held the largest revenue share of about 38.13% in the year 2022. The easy viewing of options, returnable policies, and good discounts are contributing to the rise in demand for the online fashion market. Electronic gadgets such as mobile phones, speakers, headphones, etc., are in huge demand on e-commerce platforms such as Amazon and Flipkart.

Consumer electronics is one of the fastest-growing verticals of e-commerce. The food and beverage segment is expected to grow at the fastest CAGR of 25.1% during the forecast period. The food and beverages sector is witnessing a massive surge in demand due to the increasing trend of online delivery, which includes groceries, restaurant food, and packaged food, among others.

Healthcare is also among the emerging verticals in the e-commerce industry. The share of online sales channels in pharmaceutical delivery is significantly increasing. The transportation of pharmaceuticals involves several strict regulations, and the regulations differ in each country.

Type Insights

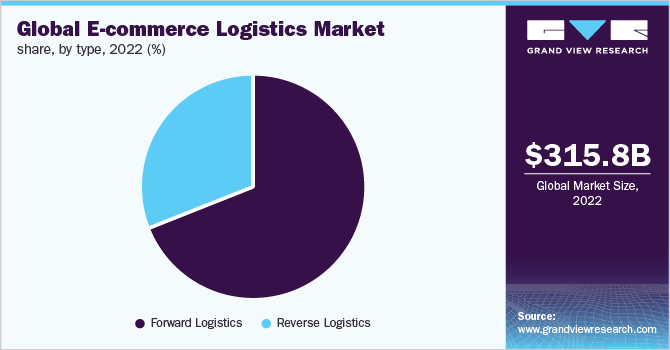

Based on the type, the industry is segmented into forward logistics and reverse logistics. Forward logistics held the largest revenue share of about 68.9% in 2022 and is also expected to grow at the fastest CAGR of 22.3% during the forecast period. Forward logistics oversees the movement of commodities, services, and products from suppliers to customers at the downstream end of the e-commerce supply chain.

Reverse logistics was designed to control the movement of things upstream or from customers to suppliers in the e-commerce supply chain. These items are added back to the inventory and replenished or given back to the vendors. According to industry experts, merchants spend 8% of total sales on returns, and inbound shipments account for 4% of worldwide retail revenues.

Unless appropriately managed, handled, and converted to sellable inventory or repurposed, they accumulate and result in losses. Accurate demand forecasting is an integral part of e-commerce logistics. Accurate demand forecasting can be used for both forward and reverse e-commerce logistics. Inventory management software can be used for better inventory planning and to avoid overstocking in warehouses and fulfillment centers.

Regional Insights

Asia Pacific has emerged as the top region compared to other regions in the overall industry. The high proliferation of smartphones and the internet in the region has boosted the demand for e-commerce and, inadvertently, for logistics services. The rise of new e-commerce players in the region has positively impacted the growth of the e-commerce logistics industry.

Numerous Chinese investments in improving infrastructure, including ports, railways, and highways, are hugely supporting the growth of logistics services in China. Japan's e-commerce logistic sector is expanding rapidly due to the increasing demand for home delivery as Japanese consumers prefer home delivery over in-store purchasing.

Additionally, substantial improvement toward digital transformation, adoption of advanced technologies by small and medium-sized businesses, and ongoing modernization of Asia Pacific countries is significantly contributing to the market growth.

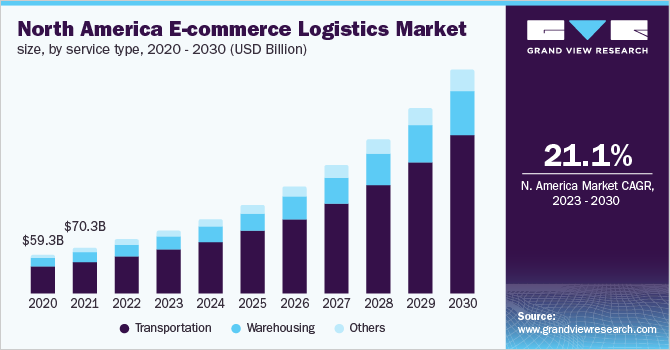

North America held the second largest revenue share of around 25.86% in 2022. The high revenue share is due to the presence of e-commerce giants such as Amazon, Walmart, and eBay. Amazon surpassed USD 1.5 trillion market cap and continues to be the leading e-commerce retailer in the U.S., capturing almost 38% of all e-commerce providers.

The company’s strategic investments to address the booming demand has led them to entail over 100 fulfillment centers and 300 delivery centers to tackle last-mile dispatches in 2020. As the demand for e-commerce increases, the subsequent demand for e-commerce logistics will arise in the region.

Key Companies & Market Share Insights

The market is highly competitive owing to the presence of several companies, which include big players such as FedEx Corporation, DHL International GmbH, and Aramex International, among others. The players are engaging in several strategic initiatives such as expansion, mergers, and acquisitions to gain a competitive edge over other players. The e-commerce logistics companies are establishing warehouses in various countries across the globe to speed up the process of delivering goods.

For instance, in February 2021, CEVA Logistics expanded its presence in Southeast Asia by opening a new warehouse in Bien Hoa City, Vietnam. The expansion aims to support distribution and customers’ storage needs across several industries. In February 2021, CEVA Logistics announced to expand its presence in Thailand. The company opened its new head office in Bangkok to support customers across Thailand.

In another instance, in November 2020, Naqel Express announced the opening of its new pharma and cold chain warehouse facilities in Jeddah. The facility maintains the standard requirements in the cold chain business with a range of solutions tailored to the needs of the healthcare, pharmaceutical, FMCG, and other related industries. Some prominent players in the global e-commerce logistics market include:

-

FedEx Corporation

-

DHL International GmbH

-

Aramex International

-

XPO Logistics Plc.

-

United Parcel Service, Inc.

-

Gati Limited

-

Kenco Group, Inc.

-

Clipper Logistics Plc.

-

Agility Public Warehousing Company K.S.C.P.

-

CEVA Logistics

Recent Developments

-

In Nov 2022, CEVA Logistics announced a multi-year contract extension with ASOS to handle e-commerce fulfillment, warehousing, and inbound and outbound services for ASOS.

-

In October 2022, Aramex PJSC announced the acquisition of USA Shipping, LLC (MyUS), a global technology-driven platform involved in cross-border e-commerce. The acquisition aimed to strengthen Aramex’s cross-border express business, providing strong revenue growth.

-

In September 2022, DHL acquired a major stake in Monta, a Dutch e-commerce specialist aiming to serve mid-sized and small webshops in e-fulfillment and online sales. The partnership focussed to strengthen DHL’s core logistics business.

-

In July 2022, DHL, a global leader in the logistics industry announced to invest EUR 560 million in DHL Parcel UK, its e-commerce operation. The investment aimed to deliver better infrastructure and facilitate digital logistics.

-

In January 2022, FedEx Corp. collaborated with Microsoft Corp. to develop a cross-platform for e-commerce called “logistics as a service” for brands, merchants, and retailers to improve their competitiveness in the e-commerce space.

-

In June 2021, XPO Logistics secured a multi-year contract with Electrolux Logistics SAS to manage its logistics operations in France. They further aimed to work on Electrolux’s direct-to-consumer e-commerce website.

E-commerce Logistics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 373.37 billion

Revenue forecast in 2030

USD 1,526.42 billion

Growth rate

CAGR of 22.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service type, type, model, operation, vertical, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Japan; China; India; Australia; Brazil.

Key companies profiled

FedEx Corporation; DHL International GmbH; Aramex International; XPO Logistics Plc.; United Parcel Service, Inc.; Gati Limited; Kenco Group, Inc.; Clipper Logistics Plc.; Agility Public Warehousing Company K.S.C.P.; CEVA Logistics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-commerce Logistics Market Segmentaion

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global e-commerce logistics market report based on service type, type, model, operation, vertical, and region:

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation

-

Airways

-

Railways

-

Roadways

-

Waterways

-

-

Warehousing

-

Mega Centers

-

Hubs/Delivery Centers

-

Returns Processing Centers

-

- Others

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Forward Logistics

-

Reverse Logistics

-

-

Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

3PL

-

4PL

-

Others

-

-

Operation Outlook (Revenue, USD Billion, 2017 - 2030)

-

Domestic

-

International

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Apparels

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Food and Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global E-commerce logistics market size was estimated at USD 315.82 billion in 2022 and is expected to reach USD 373.37 billion in 2023.

b. The global E-commerce logistics market is expected to grow at a compound annual growth rate of 22.3% from 2023 to 2030 to reach USD 1,526.42 billion by 2030.

b. The Asia Pacific dominated the E-commerce logistics market with a share of 41.49% in 2022. This is attributable to the increased adoption of e-commerce for purchasing needs in the majority of the countries, as well as the high adoption of digital payment methods in Asia Pacific countries.

b. Some key players operating in the E-commerce logistics market include FedEx Corporation, DHL International GmbH, Aramex International, XPO Logistics Plc., and United Parcel Service, Inc.

b. Key factors that are driving E-commerce logistics market growth include increasing penetration of smartphones and increasing usage of the internet leading to higher use of e-commerce, and increasing reliability on logistics services owing to real-time tracking.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."