- Home

- »

- Advanced Interior Materials

- »

-

E-waste Management Market Size And Share Report, 2030GVR Report cover

![E-waste Management Market Size, Share & Trends Report]()

E-waste Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Processed Material (Metal, Plastic), By Source (Industrial Electronics, Consumer Electronics), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-397-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-waste Management Market Size & Trends

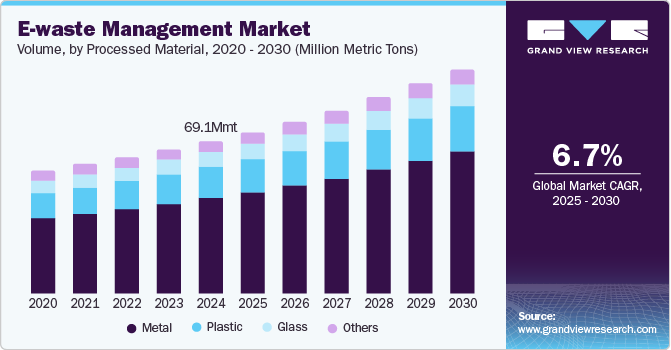

The global e-waste management market volume was estimated at 69.1 million metric tons in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The rapid pace of technological advancements significantly drives the growth of the market. As new technologies emerge and consumer electronics become more sophisticated, the lifecycle of electronic devices shortens, leading to increased turnover rates and higher volumes of discarded electronics. The scenario creates a substantial demand for effective and sustainable e-waste management solutions to handle the growing surge of electronic waste responsibly.

Regulatory policies and initiatives focused on e-waste collection and treatment present significant market growth opportunities. Increased awareness of the environmental and health impacts of e-waste is compelling governments and international organizations to implement stringent regulations and policies designed to ensure the safe handling, recycling, and disposal of e-waste. These regulatory frameworks address the challenges posed by e-waste and facilitate the market's growth by promoting an environment of compliance and innovation.

Regulatory initiatives promoting public awareness and education about e-waste management are also favoring the expansion of the market. Governments and Non-Governmental Organizations (NGOs) are increasingly launching campaigns to inform consumers and businesses about the importance of proper e-waste disposal and the availability of recycling programs. For instance, in October 2023, the Indian state of Himachal Pradesh launched a campaign to collect e-waste across the state. The initiative, led by the state's Department of Environment, Science and Technology, seeks to mitigate the environmental hazards of improperly disposed electronic waste. The campaign facilitates the collection of discarded electronic items such as old laptops, mobile phones, and other electronic gadgets from various locations throughout the state. Such initiatives help increase the volume of e-waste collected, thereby increasing the demand for e-waste management services.

Moreover, organizations are also introducing e-waste recycling campaigns to promote responsible e-waste disposal habits. For instance, in June 2024, Maxis Bhd., a telecommunication company, expanded its e-waste recycling campaign to include a free postal drop-off service, enhancing customer accessibility. The initiative allows individuals to mail their old electronic devices directly to recycling centers at no cost. By offering this convenient postal option, the company aims to encourage more people to participate in e-waste recycling, thereby reducing electronic waste and promoting environmental sustainability. The e-waste management market environment is evolving, and companies are launching new technologies to cater to the increasing demand. For instance, in February 2022, Umicore introduced a new generation Li-ion battery recycling technologies. Technology recovers 95% of cobalt, nickel, and copper from batteries as well as most of the lithium. This initiative is a significant step in recycling performance, with increased extraction efficiency and automated material flow to minimize manual handling.

As the global economy continues to evolve, there is an increasing demand for e-waste management solutions. Industry players are collaborating to introduce innovative technologies and expand their presence in the market. For instance, in May 2023, Adams County Solid Waste & Recycling partnered with ERI to offer free e-waste recycling services as part of the 2023 Clean Sweep event. The electronic waste recycling event was part of a community recycling initiative sponsored by Adams County. This partnership empowered ERI to responsibly recycle unwanted electronics dropped off by residents. The event aimed to promote sustainability and proper disposal of electronic waste, which often contains hazardous materials that should not end up in landfills.

Moreover, regulatory trends in the market focus on proper and efficient management of electronic waste. These include the Electrical and Electronic Equipment Act (ElektroG) in Germany that outlines the obligations that companies must meet when introducing electrical and electronic equipment to the market, including their take-back responsibilities and ensuring the environmentally friendly disposal of these products.

In the market, the threat of substitutes can be termed low. There are few alternatives to recycling and proper disposal of electronic waste. While some electronic devices can be refurbished and resold, this does not eliminate the need for end-of-life e-waste management. Although possible, incineration or landfilling are not sustainable or environmentally friendly options and are heavily regulated or banned in many regions.

Processed Material Insights

The metals segment accounted for a dominant share of 62.2% in 2024 and is expected to maintain its leading position during the forecast period. Electrical and electronic products extensively utilize components that require metal solders, metal tracks, and conductive metals. Commonly known metals such as copper, tin, zinc, lead, and cobalt are used in products such as microcontroller and printed circuit boards (PCBs), which form a core part of devices such as smartphones and laptops. Thus, the growing disposal rates of such products create a significant health and environmental risk, necessitating their proper management to avoid exposure to harmful chemicals. Metal recycling is beneficial as it can reduce the environmental impact of mining due to the reusability of various components in other areas, thus helping in the conservation of natural resources. Additionally, recycling metals from e-waste provides a sustainable source of metals that are essential to producing new electronic devices. In October 2024, MTM Critical Metals Limited announced that it had successfully extracted tin and palladium from e-waste such as PCBs using its proprietary Flash Joule Heating (FJH) technology. This was achieved without using any chemicals in the process, with the recovery rates standing at 86% for tin and 82% for palladium.

The plastic segment is anticipated to expand at a significant CAGR over the forecast period. The growing incorporation of plastic components in electronic products such as vacuum cleaners, microwaves, electric shavers, radios, calculators, and cameras has led to an increase in plastic waste generation. Improper disposal of such products can lead to various environmental issues, necessitating their proper processing. Plastic is known for not being biodegradable and accumulating in the environment, taking hundreds of years to break down. As a result, governments and e-waste management companies are deploying solutions to ensure faster and more efficient recovery and processing of these compounds.

Source Insights

The consumer electronics segment accounted for the largest share in 2024. Several factors, including the increasing adoption of devices such as smartphones and smartwatches, drive the contribution of this segment to the e-waste management industry. According to a report by IDC, there was a 6.5% year-on-year increase in global smartphone shipments in the second quarter of 2024, highlighting a steady growth in demand for these products. In addition, the growing popularity of high-definition displays and streaming devices has led to a noticeable increase in sales of TVs and other display equipment. Improper disposal of such devices can lead to environmental pollution and health risks. Moreover, in the cases of smartphones and laptops, the risk of security breaches is also present.

On the other hand, the industrial electronics segment is anticipated to grow at a significant CAGR from 2025 to 2030. The increasing demand for electronic devices in manufacturing, healthcare, and logistics industries has resulted in an increased e-waste generation. As a result, leading enterprises and establishments frequently avail themselves of the services of e-waste management organizations that can collect waste products from the source and effectively process them. In the healthcare sector, the extensive use of devices such as medical monitors and MRI machines and frequent upgrades to such systems to ensure optimal patient outcomes have driven the disposal rates of these products, which is another major factor for segment growth.

Application Insights

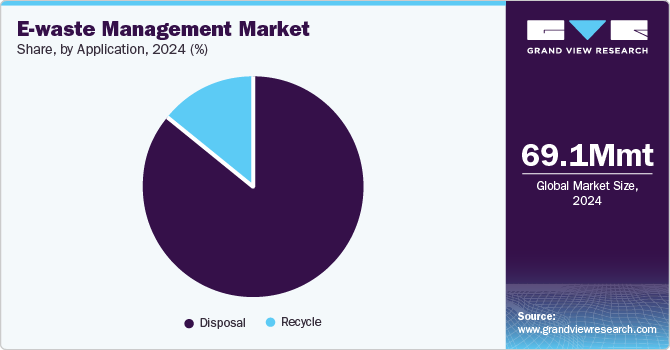

The disposal segment accounted for a dominant volume share in 2024. The growing pace of urbanization and the rapidly expanding middle-income population in emerging economies is a primary factor driving segment growth. With the rapid increase of population in cities due to mass migration, there has been an increase in the generation of e-waste, which requires responsible disposal and processing. Governments and private companies invest in e-waste management infrastructure to cater to this growing demand. Furthermore, the development of planned cities is anticipated to boost the implementation of advanced technologies in waste disposal practices.

The recycle segment is anticipated to grow at a faster CAGR over the forecast period. This can be attributed to consumers' rising awareness about environmental sustainability and the need to reduce electronic waste. Governments are implementing regulations and policies in collaboration with NGOs and private organizations that promote e-waste recycling practices and reduce the generation of electronic waste. Technological advancements in e-waste recycling are also crucial in driving growth in this segment. The development of smart cities is expected to substantially boost this segment, as innovative recycling initiatives are being developed to improve the convenience for consumers looking to dispose of their electronic products.

Regional Insights

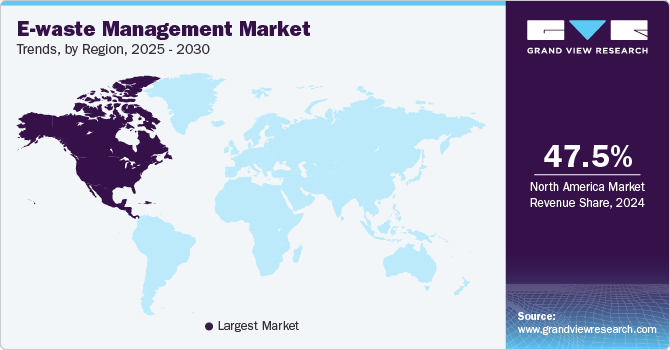

Asia Pacific led the market with 47.5% of the share in 2024. Rapid technological advances, coupled with the steadily increasing consumption of electronic devices among regional consumers, have significantly driven the demand for electronic waste management services. The region has seen substantial economic growth in recent years, leading to increased sales of electronic products such as smartphones, computers, and household appliances. The region still holds significant potential to expand this market, as Asian economies account for a substantial proportion of electronic waste disposed globally but only contribute 25% to e-waste recycling. With improvements in living standards and rising awareness and exposure to proper waste disposal and recycling practices, the Asia Pacific region is expected to grow at a healthy pace in this industry.

China E-waste Management Market Trends

The e-waste management market in China accounts for a substantial volume share in the region and is further expected to advance at a promising CAGR during the forecast period. The country's ambitious sustainable future goals have helped shape policies and regulations concerning electronic waste disposal and processing, as well as responsible industry practices. As one of the world's largest producers and consumers of electronic devices, China faces significant challenges concerning e-waste management. The country is the leading global mobile phone consumer market and is expected to have approximately 6 billion used mobile phones by 2025. Consequently, the Chinese government has launched an ambitious policy outlining its aim to properly recycle 50% of the nation’s e-waste by 2025 while including 20% of recycled content in new products.

Europe E-waste Management Market Trends

Europe accounted for a notable share of the global market in 2024. The growing collection of Waste Electrical and Electronic Equipment (WEEE) in Europe is a crucial factor driving the growth of the market across the region. The trend reflects a broader commitment to environmental sustainability, resource efficiency, and regulatory compliance, collectively promoting a dynamic and expanding e-waste management sector.

The e-waste management market is expected to witness a significant CAGR from 2024 to 2030. The substantial volume of e-waste requiring disposal in the UK is significantly driving the growth of the country's market. The rapid pace of technological innovation and the resulting obsolescence of electronic devices contribute to the high volumes of e-waste in the UK. This trend results in significant amounts of discarded electronics that require proper disposal and recycling.

The e-waste management market in Germany is projected grow from 2024 to 2030. Strong environmental awareness among consumers and businesses in Germany significantly contributes to the regional market's growth. There is a widespread understanding of the environmental and health risks associated with improper e-waste disposal. Public awareness campaigns and educational initiatives emphasize the importance of recycling electronic devices, leading to increased participation in e-waste collection programs.

North America E-waste Management Market Trends

North America is anticipated to emerge as the fastest-growing market during the forecast period. The increasing pace of urbanization and rising adoption of smartphones and other electronic devices among regional consumers has led to the increased generation of electronic waste, driving substantial demand for efficient recycling and e-waste disposal services. In Canada, e-waste recycling policies are mainly established at the provincial level, with the federal government supporting their standardization. Most provinces have implemented extended producer responsibility (EPR) programs that require manufacturers and retailers to collect and recycle certain electronic components at the end of their lifecycle. Additionally, each province has its own environmental regulations that may prohibit irresponsible disposal of e-waste. For instance, Ontario's EEE regulation requires producers to establish free collection systems for consumers.

U.S. E-waste Management Market Trends

The U.S. accounted for a dominant volume share in the North American market for e-waste management in 2024. The growing pace of disposal of smartphones, tablets, and laptops due to the frequent launch of more advanced products has created the issue of extensive e-waste generation, driving the need for government and non-government organizations to increase awareness regarding proper waste recycling practices. Twenty-five states in the country have laws in place regarding electronic recycling, although there are no federal laws that mandate waste recycling. States such as Colorado have banned the disposal of electronic devices in landfills. Organizations such as ERI (Electronic Recyclers International) and WM have helped drive awareness regarding the proper collection and processing of electronic waste in the economy among individuals and businesses. For instance, in April 2024, ERI partnered with Staples to expand its nationwide store-based recycling services by including consumer batteries. This development aims to enhance the company’s existing Recycling Services program by adding both single-use and rechargeable alkaline batteries to the list of accepted materials for recycling.

Middle East & Africa E-waste Management Market Trends

The e market in the Middle East & Africa is anticipated to witness considerable growth from 2025 to 2030. The partnerships and collaborations between governments, private sector entities, and organizations are driving the growth of the market in the Middle East and Africa region. For instance, in May 2024, Tadweer Group and Dubal Holding completed the acquisition of Enviroserve, an e-waste management firm. The acquisition enhances Tadweer Group and Dubai Holding's capabilities in managing electronic waste, aligning with global efforts toward sustainable environmental practices.

Key E-waste Management Company Insights

Some key companies involved in the e-waste management market include Umicore, WM Intellectual Property Holdings, and Sims Limited, among others.

-

Umicore is a circular materials technology company with expertise in chemistry, material science, and metallurgy. The company's operations are divided into three business units - Energy and Surface Technologies, Catalysis, and Recycling. The Recycling division accounts for the treatment of waste streams that contain precious metals as well as other specialty metals, obtained from various end-of-life materials and industrial residues.

-

Sims Limited provides metal recycling and circular technology solutions and is engaged in the buying, processing, and sales of non-ferrous and ferrous recycled metals in several global economies, including the U.S., China, India, Australia, and Bangladesh. The company operates under three segments: Sims Lifecycle Services, Sims Metal, and Sims Resource Renewal. The Sims Lifecycle Services division offers decommissioning services, IT asset disposition, data center services, and data destruction. The Sims Metal business unit offers a range of solutions such as dismantling & demolition, collection, and transportation & logistics. Meanwhile, Sims Resource Renewal is involved in the utilization of materials left after the recycling of cars and end-of-life consumer goods to produce valuable products from them.

Key E-waste Management Companies:

The following are the leading companies in the e-waste management market. These companies collectively hold the largest market share and dictate industry trends.

- Aurubis AG

- Boliden Group

- Desco Electronic Recyclers

- EcoCentric

- ENVIRO-HUB HOLDINGS LTD.

- ERI

- Greentec

- Kuusakoski

- MRITECHNOLOGIES

- Namo eWaste Management Ltd.

- Sims Limited

- Stena Metall AB

- Tetronics Environmental Technology Company

- Umicore

- WM Intellectual Property Holdings, L.L.C.

Recent Developments

-

In September 2024, Aurubis AG, the Germany-based non-ferrous metal provider and a major copper recycler, inaugurated its new recycling facility in Georgia, the U.S. The new plant, which is the first secondary smelter in the country for multi-metal recycling, has been stated to have a capacity to process more than 180,000 tons of complex recycling materials per year, including copper cables and circuit boards.

-

In August 2024, ERI announced the launch of its first recycling plant for alkaline batteries, located within the company’s existing e-waste recycling and ITAD facility in Plainfield, Indiana. The new center has the capability to recycle a substantial volume of alkaline batteries annually using ERI’s propriety clean technology.

-

In April 2024, ERI partnered with Staples to expand its nationwide store-based recycling services to include consumer batteries. This collaboration aims to enhance the existing Recycling Services program by adding single-use batteries and rechargeable to the list of accepted materials for recycling. Moreover, the initiative aims to increase the recycling of consumer batteries and promote environmental sustainability.

-

In September 2023, ERI, a cybersecurity-focused hardware destruction and integrated ITAD provider, recalibrated its geographic footprint to accommodate continued growth in ITAD and e-waste recycling services. As part of this recalibration, the company envisioned opening three larger e-waste recycling and ITAD centers in 2024 and closing its smallest facility in Aurora, Colorado. The facilities will be strategically positioned to improve ERI's national logistics and operations, ensuring greater balance and efficiency in serving customers across the U.S.

-

In June 2022, Sims Lifecycle Services (SLS), an IT Asset Disposition (ITAD) company, opened its Circular Center in Atlanta, Georgia. With this initiative, the company aimed to provide Atlanta-based companies with sustainable and secure local redeployment, recycling, and reuse for IT equipment and data center materials. The Atlanta circular center is part of SLS's global network of facilities, which now includes nine locations across North America and additional centers in Australia, Europe, Asia, and the Indian subcontinent.

E-waste Management Market Report Scope

Report Attribute

Details

Market volume in 2025

73.1 million metric tons

Volume Forecast in 2030

101.3 million metric tons

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in thousand metric tons and CAGR from 2025 to 2030

Report Coverage

Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Processed material, source, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Sweden, Switzerland, Austria, Belgium, Netherlands, Ireland, China, India, Japan, Taiwan, South Korea, Brazil

Key companies profiled

Aurubis AG; Boliden Group; Desco Electronic Recyclers; EcoCentric; ENVIRO-HUB HOLDINGS LTD.; ERI; Greentec; Kuusakoski; MRITECHNOLOGIES; Namo eWaste Management Ltd.; Sims Limited; Stena Metall AB; Tetronics Environmental Technology Company; Umicore; WM Intellectual Property Holdings, L.L.C.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

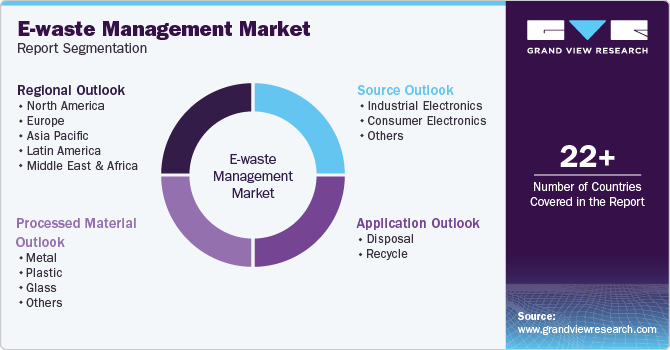

Global E-waste Management Market Report Segmentation

This report forecasts volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global e-waste management market report based on processed material, source, application, and region:

-

Processed Material Outlook (Volume, Thousand Metric Tons, 2018 - 2030)

-

Metal

-

Copper

-

Steel

-

Others

-

-

Plastic

-

Glass

-

Others

-

-

Source Outlook (Volume, Thousand Metric Tons, 2018 - 2030)

-

Industrial Electronics

-

IT & Telecom Equipment

-

Datacenters

-

Networking Cards/Equipment

-

Digital Boards

-

Others

-

-

Medical Equipment

-

Monitoring And Control Equipment

-

Others

-

-

-

Consumer Electronics

-

Household Appliances

-

Refrigerator

-

Television

-

Others

-

-

Handheld Electronics

-

Smartphones

-

Tablets

-

Wearables

-

Others

-

-

IT Accessories

-

Keyboards

-

Mice

-

Laptop Cases

-

USB Memory Sticks

-

Others

-

-

IT Equipment

-

Desktops

-

Laptops

-

Netbooks

-

Others

-

-

PCBs

-

High-grade

-

Medium-grade

-

Low-grade

-

-

-

Others

-

-

Application Outlook (Volume, Thousand Metric Tons, 2018 - 2030)

-

Disposal

-

Reuse

-

Landfill

-

Incineration

-

-

Recycle

-

-

Regional Outlook (Volume, Thousand Metric Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Switzerland

-

Austria

-

Belgium

-

Netherlands

-

Ireland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.