- Home

- »

- Homecare & Decor

- »

-

Edible Cutlery Market Size & Share, Industry Report, 2030GVR Report cover

![Edible Cutlery Market Size, Share & Trends Report]()

Edible Cutlery Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Material (Corn, Wheat Bran, Rice Bran), By Application (Household, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-518-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Edible Cutlery Market Summary

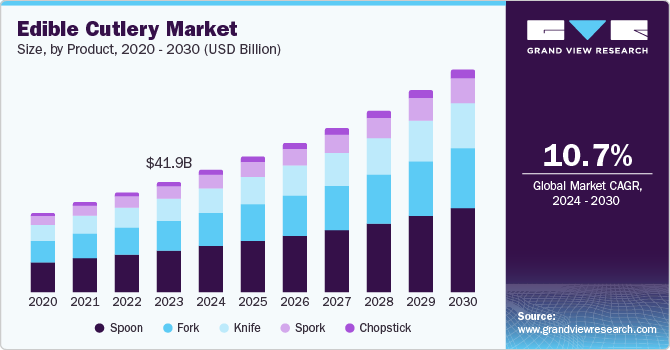

The global edible cutlery market size was estimated at USD 41.9 billion in 2023 and is projected to reach USD 85.1 billion by 2030, growing at a CAGR of 10.7% from 2024 to 2030. The growing demand for edible cutlery is attributed to several factors, including rising environmental awareness, which has led to a reduction in plastic usage.

Key Market Trends & Insights

- North America edible cutlery market dominated the global edible cutlery market with a revenue share of 37.5% in 2023.

- The edible cutlery market in U.S. held substantial market share in 2023.

- By product, spoons dominated the market with a revenue share of 38.6% in 2023.

- By material, corn-based material led the market with a revenue share of 44.0% in 2023.

- By application, commercial application of edible cutlery held the highest revenue share of 81.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 41.9 Billion

- 2030 Projected Market Size: USD 85.1 Billion

- CAGR (2024-2030): 10.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Consumers are also prioritizing health and wellness, driving demand for healthier alternatives. Innovation, favorable policies, and industry growth are also contributing to the trend’s development, as well as educational initiatives promoting sustainability.

The edible cutlery market has experienced significant growth due to the increasing awareness of environmental concerns and the need for sustainable solutions. The negative impact of plastic utensils on the environment has led consumers to seek alternative options that are eco-friendly and non-contributory to landfill waste. Edible cutlery, made from grains, seeds, and legumes, has emerged as a viable solution, offering both environmental and health benefits.

As consumers prioritize their health and wellness, the demand for edible cutlery has increased. The innovation in product development, including taste, texture, and appearance, has catered to diverse consumer preferences. The rise of the food service industry, particularly fast-casual restaurants and food delivery services, has created a new market for edible cutlery. The COVID-19 pandemic has accelerated the demand for takeaways, leading to a greater need for sustainable eating solutions.

As consumers become more aware of sustainability issues and available options, they are increasingly inclined to make purchasing decisions that align with their values. Manufacturers are responding to this demand by introducing new products that cater to the growing interest in sustainable living. The edible cutlery market is poised for continued growth as consumers seek healthier, environmentally friendly alternatives that meet their changing lifestyles and preferences.

Product Insights

Spoons dominated the market with a revenue share of 38.6% in 2023, owing to customer convenience, as spoons are versatile tools that can be used to serve and consume various types of food. As observed by a 2022 study in the Journal of Emerging Technologies and Innovations, manufacturers have developed diverse edible spoon types using ingredients such as wheat flour, rice flour, and lentils, appealing to a broad range of food industry segments.

Sporks are expected to register the fastest CAGR of 11.6% during the forecast period. The spork, a hybrid utensil combining the features of a spoon and fork, offers consumers the convenience of using a single tool for various food types. This portability advantage appeals to individuals who require flexible eating options, such as those in outdoor settings or quick-service restaurants. Moreover, spork production is often more cost-effective than spoon manufacturing.

Material Insights

Corn-based material led the market with a revenue share of 44.0% in 2023. The use of corn-based utensils offers a sustainable solution to the environmental concerns posed by plastic utensils, which contribute to pollution and take centuries to biodegrade. Aligning with global initiatives to reduce plastic waste and promote eco-friendly practices, corn-based utensils are biodegradable, compostable, and require less energy production than traditional plastics.

Wheat bran is projected to grow at the fastest CAGR of 11.1% over the forecast period, aided by them material’s high fiber and nutrient content make it a healthier option for consumers seeking low-calorie foods. This added value appeals to environmentally conscious consumers and those prioritizing practical attributes. In addition, sourcing wheat bran is relatively cost-effective due to its integration into the agricultural value chain.

Application Insights

Commercial application of edible cutlery held the highest revenue share of 81.4% in 2023. As restaurants and food service providers strive to reduce their environmental footprint, edible cutlery offers a sustainable solution. A Current Opinion in Toxicology Journal study reports that the growing trend of government regulations on disposable plastics necessitates the adoption of legal and environmentally-friendly substitutes. By adopting this alternative, establishments can minimize waste and project an eco-friendly brand image.

The household segment is projected to be the fastest-growing application with a CAGR of 11.4% over the forecast period. Customer awareness of health and wellness has led to increased demand for naturally derived products. Edible cutlery’s ease of disposal, biodegradability, and eco-friendly nature resonate with environmentally conscious households worldwide. This sentiment drives market growth as consumers prioritize products that align with their values of sustainability and responsible living.

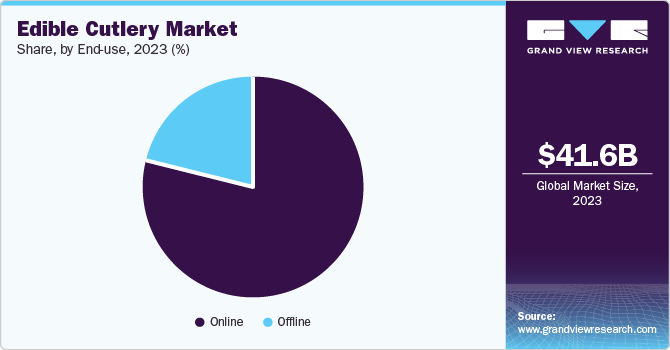

Distribution Channel Insights

Online distribution channels accounted for 79.4% of the total share, leading the market revenue generated in 2023. The digital age has significantly impacted consumer behavior, with online shopping becoming a preferred option for many. Internet marketplaces have enabled consumers to purchase edible cutlery from the comfort of their homes, eliminating geographical barriers. Online stores offer a vast range of products, allowing consumers to explore various brands, flavors, and materials, thereby expanding their purchasing options.

Offline distribution channels are expected to register significant growth over the forecast period. Many customers require a tactile experience before making a purchase, particularly with edible cutlery. Physical stores offer a tangible interaction with products, allowing consumers to verify safety and quality by inspecting labels, expiration dates, and tasting samples. This in-store experience fosters trust and confidence in the products, ultimately driving sales.

Regional Insights

North America edible cutlery market dominated the global edible cutlery market with a revenue share of 37.5% in 2023. The growing environmental awareness and the need to reduce plastic consumption have driven the demand for edible cutlery in North America, leading the market globally. Consumers are increasingly seeking biodegradable alternatives, and North American companies have been at the forefront of innovation, actively researching and developing edible cutlery products to meet this demand.

U.S. Edible Cutlery Market Trends

The edible cutlery market in U.S. held substantial market share in 2023. Steady innovations in food technology in the U.S. have enabled the production of high-quality and viable edible cutlery products. Furthermore, research indicates that customers in the U.S. are willing to pay a premium for eco-friendly products, supporting the growth of the edible cutlery market. Effective sustainability marketing campaigns have also resonated with consumers, transcending age groups, and influencing purchasing behavior.

Europe Edible Cutlery Market Trends

The European edible cutlery market is poised for significant growth over the forecast period, driven by the region’s emphasis on innovation and food technology. Many European organizations have introduced edible cutlery products made from ingredients such as rice, wheat, corn, and pulses. The European Union’s stringent measures to reduce plastic usage, as implemented in 2024, are also driving demand for sustainable alternatives, thereby fueling the market’s expansion.

The edible cutlery market in Germany held a significant market share in 2023. Germany’s rich culinary heritage provides a foundation for innovation in edible cutlery products. By combining traditional dishes with advanced technology, Germany can create unique and appealing edible cutlery offerings that captivate local and international markets. The country’s established manufacturing industries also enable the export of edible cutlery to global markets.

Asia Pacific Edible Cutlery Market Trends

Asia Pacific edible cutlery market is expected to register the fastest CAGR of 11.9% in the global edible cutlery market between 2024 and 2030. The region’s robust manufacturing infrastructure enables the production of edible cutlery at a low cost and large scale. China and India, with their well-established supply chain systems, are exemplary countries that can efficiently distribute products. This facilitates timely and cost-effective delivery of edible cutlery to customers, making it an attractive option for businesses.

The edible cutlery market in China is anticipated to experience significant growth over the forecast period. China’s advanced manufacturing sector enables large-scale production of edible cutlery, leveraging its investments in technology and facilities. The country’s inexpensive labor and materials also contribute to reduced costs, making edible cutlery a competitive option for businesses.

Key Edible Cutlery Company Insights

Some key companies in the edible cutlery market include incrEDIBLE eats inc.; Frenvi Private Limited; and EdiblePRO; among others. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

IncrEDIBLE Eats Inc offers innovative, eco-friendly products that contribute to a sustainable environment. The company’s product portfolio includes biodegradable spoons, forks, and knives made from grains, pulses, and other plant-based materials, providing a viable alternative to traditional plastic utensils.

-

Wisefood GmbH provides a range of products that can be made from grains, seeds, and legumes. Its edible cutlery solutions, including spoons, forks, and knives, are designed to be used and disposed of, thereby reducing the need for single-use plastic utensils and promoting a more environmentally responsible approach to dining.

Key Edible Cutlery Companies:

The following are the leading companies in the edible cutlery market. These companies collectively hold the largest market share and dictate industry trends.

- incrEDIBLE eats inc.

- Frenvi Private Limited

- EdiblePRO

- FlavorFulz, a DBA of Charlton Becker Catering

- Wisefood GmbH

- Mede Cutlery Company,

- KOOVEE

- Candy Cutlery

Recent Developments

-

In May 2024, Google tested innovative solutions from nine companies, including edible cutlery, clay cups, and smart snack dispensers, as part of its Single-Use Plastics Challenge to reduce plastic waste.

-

In April 2024, Frenvi Private Limited emerged as a 2nd runner-up in the Plastic-Free Orders Packathon, organized by Zomato, amidst competition from over 85 startups from 18 states across India.

-

In March 2024, KOOVEE temperature-resistant and edible cutlery, which can withstand hot meals, remaining intact for 5 minutes in 70°C water, rendering them versatile and suitable for various dishes, including soups.

-

In February 2024, Iberostar, a Mallorcan hotel chain, partnered with Gloop, a company producing edible cutlery, to acquire spoons, straws, and coffee stirrers for its 35 Spanish establishments, reducing waste and offering a unique gastronomic value.

Edible Cutlery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.3 billion

Revenue forecast in 2030

USD 85.1 billion

Growth Rate

CAGR of 10.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

incrEDIBLE eats inc.; Frenvi Private Limited; EdiblePRO; FlavorFulz, a DBA of Charlton Becker Catering; Wisefood GmbH; Mede Cutlery Company,; KOOVEE; Candy Cutlery

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edible Cutlery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edible cutlery market report based on product, material, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spoon

-

Fork

-

Knife

-

Spork

-

Chopstick

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Corn

-

Wheat Bran

-

Rice Barn

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.