- Home

- »

- Processed & Frozen Foods

- »

-

Edible Offal Market Size, Share And Growth Report, 2030GVR Report cover

![Edible Offal Market Size, Share & Trends Report]()

Edible Offal Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Processed, Fresh), By Distribution Channel (Food Service, Retail), By Source (Cattle, Goat), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-103-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Edible Offal Market Summary

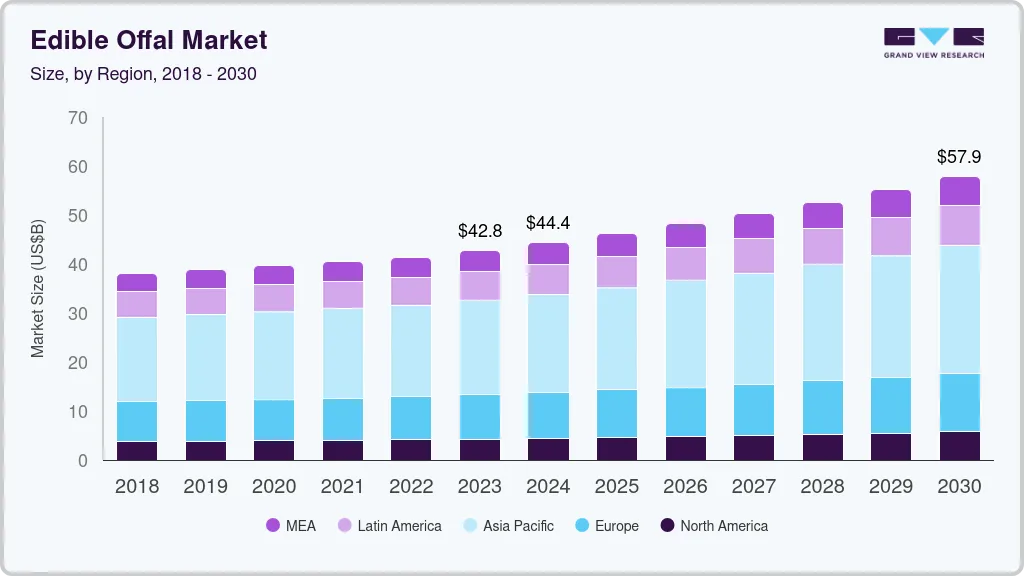

The global edible offal market size was valued at USD 42.79 billion in 2023 and is projected to reach USD 57.9 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. The growth of the market for edible offal is driven by its high nutritional value coupled with the economic cost of offal compared to other meat cuts.

Key Market Trends & Insights

- The Asia Pacific market held a dominant revenue share of 45.1% in 2022.

- The Europe Offal market is expected to grow at the fastest CAGR of 4.0% from 2023 to 2030.

- In terms of source, the pig offal segment held the largest share of 43.06% in terms of revenue in 2022.

- In terms of application, the processed segment held the largest revenue share of 68.01% in 2022.

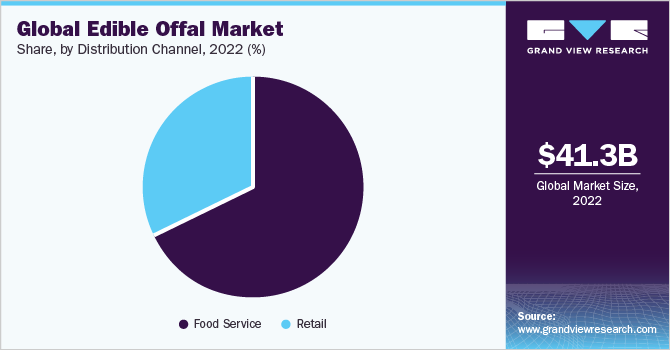

- In terms of distribution channels, the food service segment held the largest revenue share of 68.07% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 42.79 Billion

- 2030 Projected Market Size: USD 57.9 Billion

- CAGR (2024-2030): 4.4%

- Asia Pacific: Largest market in 2022

- Europe: Fastest growing market

Edible offal is more affordable compared to prime cuts of meat. This affordability makes it an attractive option for consumers, who seek cost-effective protein sources. As meat prices fluctuate and economic conditions vary, edible offal provides an economical alternative without compromising on nutritional value. Edible offals offer higher nutrient density and contain higher amounts of vitamin B12 and iron compared to the other forms of lean muscle meat.

Several governments globally are promoting the use of offals as it reduces food wastage and possesses higher nutritional value than meats. The rise in greenhouse gases is contributing to the demand for animal by-products as it will help in mitigating GHG emissions by reducing the need for additional livestock production. Edible offal provides a valuable source of protein and nutrients. By satisfying the demand for high-protein food through the consumption of animal by-products, the industry can help meet nutritional needs while optimizing resource utilization and reducing the environmental burden associated with increased meat production.

In addition, the food industry continually explores innovative ways to incorporate edible offal into processed food products. Offal can be used as an ingredient in sausages, pâtés, meatballs, and other processed meat products. This diversification allows offal to be presented in more approachable and convenient forms, catering to consumers' preferences for ready-to-eat or easy-to-cook options. Furthermore,ready-to-eat or easy-to-cook offal-based products cater to the busy lifestyles of modern consumers who seek convenient and quick meal solutions. By incorporating offal into these products, the food industry helps overcome potential barriers to offal consumption, such as the perceived difficulty in preparation or the association with lower social status.

Source Insights

In terms of source, the pig offal segment held the largest share of 43.06% in terms of revenue in 2022. The utilization of pig offal helps in reducing food waste and maximizing the utilization of the entire pig carcass. This aligns with the growing consumer awareness of food waste and the desire to minimize environmental impact, contributing to the demand for pig offal. For instance, in the UK, the shipments of offal increased by 3% to 35,300 tonnes. This trend has fueled the demand for offal as it adds value to the pig carcass and helps reduce waste.

On the other hand, the horse offal is projected to have a significant CAGR of 6.2% during the forecast period. The horse offal is nutrient-dense and provides essential vitamins, minerals, and proteins. For example, horse liver is known for its high iron content and can be valued for its nutritional benefits. Consumers who prioritize nutrient-rich foods and seek variety in their diet may be drawn to horse offal for its nutritional profile.

Application Insights

In terms of application, the processed segment held the largest revenue share of 68.01% in 2022 over the forecast period. Processing offal into various forms and incorporating it into processed meat products can enhance its flavor profile. The addition of offal adds a distinct taste and richness to products, making them more appealing to consumers seeking unique and savory flavors. In addition, processed offal enables the food industry to diversify its product offerings, providing consumers with a wider range of options. By incorporating offal into processed meat products, manufacturers can target different consumer preferences, dietary needs, and culinary traditions.

This diversification helps meet the demands of a diverse and evolving consumer base. The fresh offal showcased a CAGR of 4.0% during the forecast period. The rise in gastronomic trends focused on utilizing unique and lesser-known ingredients. Fresh offal, with its distinct taste and texture, appeals to adventurous eaters, food enthusiasts, and culinary professionals who seek to explore and create innovative dishes using these ingredients. Several companies are offering a mix of offal in a single pack that contains a heart, tongue, and tail. For example, U.S.-based Heritage Foods offers a goat offal pack that includes kidney, liver, tail, heart, and tongue.

Distribution Channel Insights

On the basis of distribution channels, the market has been bifurcated into the food service and retail segments. The food service segment held the largest revenue share of 68.07% in 2022. The rising demand for fine dining restaurants coupled with the rising consumption of organ meats is anticipated to drive the demand for offal in the food service sector. Several restaurants are utilizing entire carcasses of animals including offal to maximize flavors and reduce wastage. In addition, the rising trend of nose-to-tail dining in several Western countries is driving the demand for offal in the food service sector. For instance, London-based Manteca utilizes the nose-to-tail cooking trend and offers unique items, such as pig-skin ragu pasta and stuffed pig snout.

The retail segment is anticipated to grow at a CAGR of 3.9% during the forecast period. Consumers are becoming increasingly conscious of sustainability and ethics in their food choices, leading to a growing interest in utilizing the entire animal and reducing food waste. Several retailers are offering offal as an environment-friendly option, appealing to consumers who prioritize sustainable and ethical food practices. For instance, a U.S.-based supermarket, Coop offers a wide variety of chicken and beef offal, such as tongue, heart, and liver.

Regional Insights

The Asia Pacific market held a dominant revenue share of 45.1% in 2022. The Asia Pacific region has a significant portion of the global population. The growing population, coupled with rising incomes and urbanization, has led to an increased demand for a diverse range of food products, including offal. This expanding market presents opportunities for retailers and suppliers to cater to the demand for offal in the region. Furthermore, Australia & New Zealand’s market for edible offal showcased the fastest CAGR of 5.30% over the forecast period. Favorable initiatives by the government coupled with rising consumer demand for sustainably sourced animal by-products are favoring the demand for edible offal in the country.

The Europe Offal market is expected to grow at the fastest CAGR of 4.0% from 2023 to 2030. The demand for edible offal in the region is being bolstered by the increasing consumer interest in sustainably sourced meat and the rising trend of organuary in the region. For instance, the Association of Meat Suppliers (AIMS) in the UK is actively encouraging consumers to eat organ meats such as kidneys, liver, and offal to help their health and the environment. Middle East & Africa is expected to witness a steady CAGR of 5.0% owing to the increasing demand for fast food products. There is a growing demand for offal in the region as it is an affordable source of protein compared to other meat types.

Key Companies & Market Share Insights

Competition among companies is expected to be intense in the global market, primarily due to the presence of several players in the industry. In response to changing consumer trends, several companies are expanding their product portfolios to gain a competitive advantage. In May 2023: Organic Meat Company announced the acquisition of Pakistan-based Mohammad Saeed Mohammad Hussain Ltd, an offal processor. Prominent players in the global edible offal market include:

-

Offal Good

-

Offal Delight

-

Offal Cuisine

-

JBS Food

-

Alpha Field Products Co

-

Yoma International

-

Cenfood International Inc.

-

Organic Meat Company

-

Sure Good Foods Ltd.

Edible Offal Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 44.43 billion

Revenue forecast in 2030

USD 57.9 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilo tons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Offal Good; Offal Delight; Offal Cuisine; JBS Food Canada; Alpha Field Products Co; Yoma International; Cenfood International Inc.; Sure Good Foods Ltd.; Organic Meat Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edible Offal Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edible offal market report based on source, application, distribution channel, and region:

-

Source Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Cattle

-

Goat

-

Pig

-

Sheep

-

Poultry

-

Horse

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Fresh

-

Human Food

-

Animal/Pet Feed

-

Others

-

-

Processed

-

Canned/Brine

-

Frozen

-

Sausage/Bagged

-

Others

-

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Retail

-

Online Sales

-

Hypermarkets/Supermarkets

-

Wholesale Stores

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global edible offal market size was estimated at USD 41.28 billion in 2022 and is expected to reach USD 42.79 billion in 2023.

b. The global edible offal market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 57.9 billion by 2030

b. The Asia Pacific market held a dominant revenue share of 45.1% in 2022 owing to the rising consumption of alternative protein

b. Some of the major players in the edible offal market include Offal Good, Offal Delight, Offal Cuisine, Jbs Food Canada, Alpha Field Products Co, Yoma International, Cenfood International Inc., and Sure Good Foods Ltd.

b. The rising popularity of alternative protein coupled with the popularity of organic meat is driving the demand for the edible offal market.

b. Australia & New Zealand edible offal market is expected to grow at the fastest CAGR of 4.3% from 2022 to 2030, driven by the presence of key players in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.