- Home

- »

- Consumer F&B

- »

-

Edible Oil And Fats Market Size & Share Analysis Report, 2030GVR Report cover

![Edible Oil And Fats Market Size, Share & Trends Report]()

Edible Oil And Fats Market Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Source (Natural, Synthetic), By Product (Edible Oil, Edible Fats), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-830-5

- Number of Report Pages: 161

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

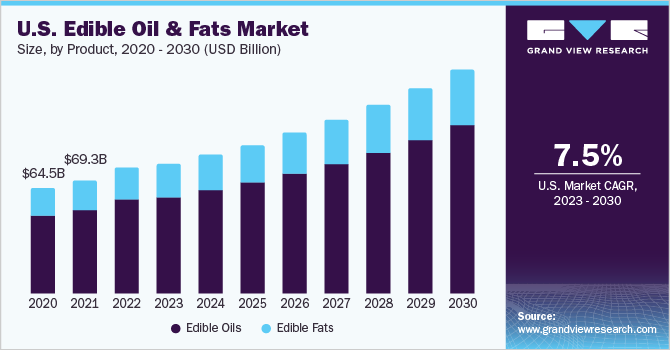

The global edible oil and fats market size was valued at USD 464.48 billion in 2022 and is expected to expand at a revenue-based compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. The rising importance of vegetable oils as key functional ingredients which reduce the risk of cardiovascular disorders along with lowering the possibility of breast cancer is projected to remain a favorable growth driver. Furthermore, the rising popularity of omega-3 fatty acid as a nutritional constituent in the food industry on account of its exceptional anti-inflammatory properties is projected to prompt the adoption of oil produced from soybean, canola, and flax seeds. Over the past few years, cooking oil manufacturers including Unilever PLC and Cargill, Inc., have been increasing their spending toward the development of products with the low cholesterol content.

Furthermore, fluctuating diet patterns along with hectic lifestyle among working-class professionals are projected to change consumer preference and drive demand for sunflower and coconut oil for cooking. Coconut oil is a rich source of fatty acid, which provides immunity against bacteria and other pathogens. On the other hand, olive oil is capable of balancing HDL to LDL ratio of cholesterol which ensures proper blood circulation.

The pandemic led to disruptions in the supply chain, causing delays in the transportation of goods and the closure of production facilities. This, in turn, has led to price fluctuations in the market, with certain products experiencing an increase in demand and others a decrease. The pandemic also brought about a shift in consumer behavior, with more people working and cooking at home, resulting in an increased demand for packaged and convenience foods. On the other hand, the pandemic resulted in a slowdown in the foodservice sector, affecting the demand for edible oils & fats used in commercial cooking and food preparation. Despite these challenges, the industry has been able to adapt and continue to meet the needs of consumers.

Increasing awareness of the negative health effects of consuming trans fats, such as an increased risk of heart disease, diabetes, and stroke, is expected to drive demand for vegetable oils as a healthier alternative for cooking. Additionally, vegetable oils are also popular as a flavoring agent, as they can add unique aroma and taste to dishes, for instance, the aroma of peanut or groundnut oil. As a result, the market for vegetable oils is expected to grow in the coming years.

The growth of the hotel and restaurant industry in countries such as China and India, due to favorable government policies supporting city infrastructure development, is expected to drive the demand for edible oils. Additionally, the rising middle-income population in countries like Saudi Arabia and the UAE, who prefer dining out during weekends, is expected to open new opportunities in the food service sector. As a result, the market for edible oils is expected to grow over the next eight years.

Product Insights

Edible oils generated a revenue of more than USD 350.12 billion and a volume of 210,308.26 kilotons in 2022. The edible oil category is further segmented into soyabean oil,sunflower oil, olive oil, coconut oil, palm oil, and others. The Palm Oil segmentation has the highest revenue share in 2022. The rising importance of the product as a key source of numerous nutritional constituents including vitamin E, selenium, phytosterols, and magnesium in the food and beverage industry is expected to remain a favorable factor over the coming years.

Edible fats generated a revenue of USD 114.36 billion and a volume of 81,157.60 kilotons in 2022. The edible fats category is further segmented into cocoa butter replacers,cocoa butter substitutes, filling fats, milk-fat replacers, spread fat, frying fats, margarine, shortenings, butter, and others. The butter segmentation held the highest revenue share of USD 60.11 billion and a volume of 22,987.96 kilotons in 2022.

The emergence of veg-derived margarine as a key substitute for butter in developed markets including, Germany and the U.K. is expected to open new markets. Furthermore, growing concerns over lactose intolerance and glutamic disorders in the abovementioned countries are projected to encourage consumers to use margarine as a veg-based fat alternative for direct consumption in the near future.

Nature Insights

The conventional segment held the largest revenue of USD 350.12 billion and a volume of 210,308.26 kilotons in 2022. Unlike organic oils, conventional oils may be exposed to a lot of pesticides, fertilizers, and other growing aids. Oils produced conventionally are refined, altered, and processed.

Conventional oils are largely produced from seeds that have undergone genetic modification. Conventional seed oils are typically solvent expelled. Organic oils cost more to produce and are more expensive to buy compared to conventional oils. Typically, conventional oils cost about 20-70% less than organic oils. Therefore, consumers prefer to buy conventional edible oils and fats over organic due to the affordability factor.

On the other hand, the organic segment is expected to register a significant revenue-based CAGR of 8.0% during the forecast period.Organic edible oils are only minimally processed with no preservatives, artificial ingredients, or irradiation. Organic edible oil is produced using environmentally friendly methods, by implementing farming practices that take into account both the qualities of the finished product as well as the production process. Genetically modified seeds cannot be used to produce organic oils.

One of the key factors driving the expansion of the organic edible oil market is the rising demand for oils free of trans fats. The demand for clean-labeled and organic edible oils with lower fat content than conventional edible oils has increased due to the rising prevalence of health issues like obesity, diabetes, and digestive diseases.

Source Insights

The natural segment held the largest revenue of USD 265.17 billion and a volume of 112,123.92 kilotons in 2022. Vegetable, animal, and marine sources are used to make edible fats and oils. Vegetable fats are found in foods such as cocoa butter and oils like corn, sunflower, peanut, olive, soybean, cottonseed, canola, argan, palm, pumpkin seed, sunflower, grape seed, sesame seed bran, linseed, and coconut.

The low-saturated fats include sunflower, safflower, mustard, olive, rice bran, and sesame, while butter fat, tallow, palm oil, coconut oil, and palm kernel oil are all high in saturated fats. Lard, tallow, and butter fat are examples of animal fats, whereas whale oil, cod liver oil, and salmon oil are examples of fish oils.

The synthetic segment is expected to register a CAGR of 7.0% during the forecast period. Synthetic sources of edible oil are oils that are produced through chemical or industrial processes rather than being extracted from natural plant or animal sources. They are often used in processed foods and baked goods. Synthetic sources of edible oil are generally not considered as healthy as natural plant-based oils. The consumption of hydrogenated oils and trans fats has been associated with an increased risk of heart disease.

End-use Insights

The food & beverage segment held the largest revenue of USD 292.52 billion and a volume of 204,641.00 kilotons in 2022. The food & beverage industry is the largest consumer of edible oils and fats. Oilseeds from plants are used to make vegetable oils, which are mostly used in the food business for preparing nutritional food and healthy snacks. The increasing income levels have led to higher disposable incomes.

More families are dining out and experimenting with diverse cuisines due to changing lifestyles. Convenience food purchases by working couples are rising. Furthermore, customers' purchasing habits are dramatically impacted by growing health concerns. Consumers are becoming more particular about the quality of edible oils and fats used in food items, and those who live in metropolitan areas trust branded items since they guarantee quality.

On the other hand, the biofuel & energy segment is expected to register the fastest revenue-based CAGR of 8.0% during the forecast period.A renewable fuel called biodiesel is produced from leftover cooking oil, animal fats, and vegetable oils, which include triglycerides. Triglycerides are converted into biodiesel, a natural biodegradable diesel fuel, through transesterification with ethanol and methanol. The utilization of leftover cooking oil, by-products from the synthesis of Omega-3 fatty acids from fish oil as well as tallow, lard, chicken fat, yellow grease, and other materials as biodiesel fuel feedstocks are rising.

Edible oils & fats are used in the pharmaceutical industry owing to their refinement and extraction techniques. Numerous studies on their qualities have opened new avenues for the treatment of various diseases. Vegetable and essential oils are known to contain a wide variety of potent chemicals. Edible oils and fats will continue to be in high demand for the manufacturing of numerous pharmaceutical products over the forecast period due to their beneficial characteristics.

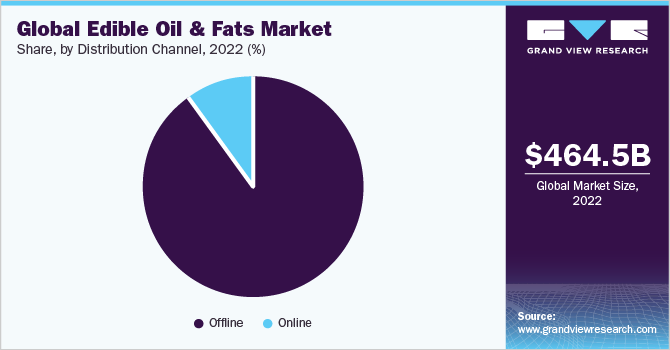

Distribution Channel Insights

The offline segment dominated the market and held a revenue of 416.66 billion and a volume of 255,614.80 kilotons in 2022. Edible oils are majorly sold through supermarkets and convenience stores. Walmart, Reliance Mart, SPAR, and Carrefour, are among some of the major retail chains. At a macro level, several consumers prefer purchasing grocery products such as edible oils from convenience stores to support local businesses.

These stores are usually family-owned or operated by a single proprietor. Thus, purchasing products at convenience stores would mean contributing to or supporting the local economy directly. Consumers also prefer shopping for edible oils and fats products at convenience stores because they are widespread/prevalent. For instance, currently, there are roughly 155,000 convenience stores across the U.S.

The market revenue from online channels is expected to witness a CAGR of 6.0% from 2023 to 2030, attributed to the increasing importance of e-commerce portals as the key selling medium among buyers on account of exceptional value-added services including Cash-on-Delivery (COD) and coupon benefits.

Key firms in the edible oils and fats market are progressively building their e-commerce websites in lucrative markets as a result of the growing popularity of online shopping amongst millennials and youths. Various firms are launching their products online to attract more customers. For instance, in April 2020, Calyxt, Inc., a plant-based technology business, launched Calyno cooking oil, its first commercial product,, and a premium, high-performing oil, through its e-commerce website calyno.com. Calyno combines the functional efficiency of a premium cooking oil with all the advantages of a heart-healthy oil.

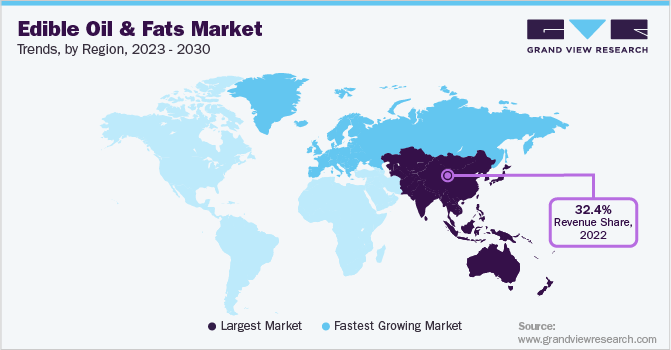

Regional Insights

Asia Pacific led the market in 2022 and accounted for 32.4% global revenue share and volume sales of 109,179.86 kilotons due to population growth, rising disposable income coupled with urbanization in emerging economies such as China, India, and Bangladesh. One of the key factors propelling the growth of the edible oil market is the rise in consumer inclination for nutritional enhancements.

The transition to a healthy and innovative approach brought about by the rising trend of living a healthy lifestyle has a positive impact on the market. In addition, the rising popularity of low-calorie content oil among middle-income age groups of the abovementioned economies is projected to have a positive impact on the market.

Europe is expected to register a significant CAGR during the forecast period. The predominant consumption of the Mediterranean diet among consumers from Spain, Italy, and France is projected to upscale the requirements of specialty oils including olive oil. The rising consumption of premium cooking and edible oils among health-conscious consumers is a major factor driving the market. The growth is also propelled by the increasing application of edible oils and fats in numerous industries, including food, biofuel, animal feed, and cosmetics.

Key Companies & Market Share Insights

Leading manufacturers are Wilmar Internationals, Cargill, Archer Daniels Midland Company, and International Foodstuff Company Holdings Limited. Market leaders are expanding their geographical existence to gain a concentrated market share. The formation of strategies and collaborations with buyers to build new products is projected to remain a critical success factor. The strong foothold of oilseeds farmers in developing countries including China, India, and Indonesia is projected to force the edible products manufacturers to establish their strategic business units in the vicinity over the next eight years. Some prominent players in the global edible oil and fats market include:

-

ADM

-

Cargill, Incorporated

-

Bunge Limited

-

Adani Wilmar Ltd

-

Aceites Borges Pont S.A.

-

Apetit Kasviöljy Oy.

-

The Nisshin Oillio Group, Ltd.

-

Kaneka Corporation

-

ACH Food Companies, Inc

-

GrainCorp

Edible Oil And Fats Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 481.08 billion

Revenue forecast in 2030

USD 831.10 billion

Growth rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, volume in kiloton, and CAGR (revenue & volume) from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, source, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Colombia; South Africa; Saudi Arabia

Key companies profiled

ADM; Cargill; Incorporated; Bunge Limited; Adani Wilmar Ltd.; Aceites Borges Pont S.A.; Apetit Kasviöljy Oy.; The Nisshin Oillio Group, Ltd.; Kaneka Corporation; ACH Food Companies, Inc.; GrainCorp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edible Oil And Fats Market Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global edible oil & fats market report based on product, nature, source, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Edible Oil

-

Soyabean Oil

-

Sunflower Oil

-

Olive Oil

-

Coconut Oil

-

Palm Oil

-

CPO

-

RBD Palm Oil

-

Palm Kernel Oil

-

Fractionated Palm Oil

-

-

Others

-

-

Edible Fats

-

Cocoa Butter Replacer

-

Cocoa Butter Substitute

-

Filling Fats

-

Milk-Fat Replacers

-

Spread Fat

-

Frying Fats

-

Margarine

-

Shortenings

-

Butter

-

Others

-

-

-

Nature Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2030)

-

Organic

-

Edible Oil

-

Soyabean Oil

-

Sunflower Oil

-

Olive Oil

-

Coconut Oil

-

Palm Oil

-

CPO

-

RBD Palm Oil

-

Palm Kernel Oil

-

Fractionated Palm Oil

-

Edible Fats

-

-

Others

-

-

Edible Fats

-

Cocoa Butter Replacer

-

Cocoa Butter Substitute

-

Filling Fats

-

Milk-Fat Replacers

-

Spread Fat

-

Frying Fats

-

Margari

-

Shortenings

-

Butter

-

Others

-

-

Conventional

-

Edible Oil

-

Soyabean Oil

-

Sunflower Oil

-

Olive Oil

-

Coconut Oil

-

Palm Oil

-

CPO

-

RBD Palm Oil

-

Palm Kernel Oil

-

Fractionated Palm Oil

-

Edible Oil

-

-

Others

-

-

Edible Fats

-

Cocoa Butter Replacer

-

Cocoa Butter Substitute

-

Filling Fats

-

Milk-Fat Replacers

-

Spread Fat

-

Frying Fats

-

Margarine

-

Shortenings

-

Butter

-

Others

-

-

-

-

Source Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2030)

-

Natural

-

Synthetic

-

-

End-use Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2030)

-

Food & Beverage

-

Personal Care & Cosmetics

-

Biofuel & Energy

-

Pharmaceuticals

-

Others

-

-

Distribution Channel Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global edible oil and fats market size was estimated at USD 464.48 billion in 2022 and is expected to reach USD 481.08 billion in 2023.

b. The global edible oil and fats market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 831.10 billion by 2030.

b. Asia Pacific dominated the edible oil and fats market with a share of 32.4% in 2022. This is attributed to population growth, rising disposable income coupled with urbanization in emerging economies such as China, India, and Bangladesh.

b. Some key players operating in the edible oil and fats market include Wilmar Internationals, Cargill, Archer Daniels Midland Company, and International Foodstuff Company Holdings Limited.

b. Key factors that are driving the market growth include rising importance of vegetable oils as key functional ingredients which reduce the risk of cardiovascular disorders and lowering the possibility of breast cancer.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."