- Home

- »

- Next Generation Technologies

- »

-

Education And Learning Analytics Market Size Report, 2030GVR Report cover

![Education And Learning Analytics Market Size, Share & Trends Report]()

Education And Learning Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Type, By Deployment, By End Use (Academics, Enterprises), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-521-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Education And Learning Analytics Market Summary

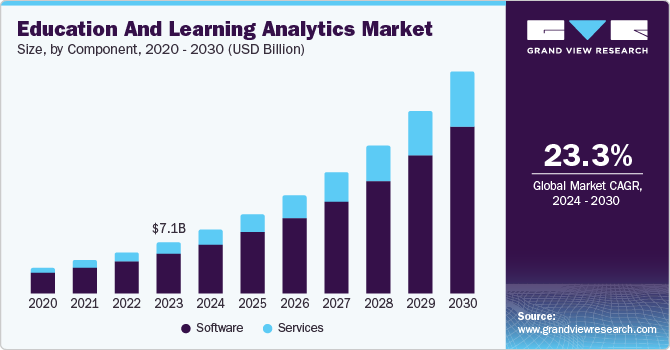

The global education and learning analytics market size was valued at USD 7.09 billion in 2023 and is projected to reach USD 30.96 billion by 2030, growing at a CAGR of 23.3% from 2024 to 2030. Increasing emphasis on data-driven decision-making, adoption of e-learning techniques in educational institutions and enterprises worldwide, and a focus on personalized learning are the key factors driving the market growth.

Key Market Trends & Insights

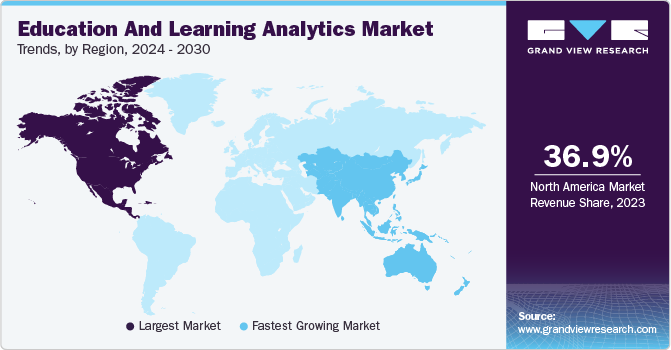

- North America led the market with a revenue share of 36.9% in 2023.

- Asia Pacific is expected to register the fastest CAGR of 25.9% during the forecast period.

- Based on component, software component accounted for the highest market share of 76.8% in 2023.

- In terms of deployment, on-premises deployment accounted for a larger revenue share in 2023.

- Based on end use, enterprises segment is expected to grow at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 7.09 Billion

- 2030 Projected Market Size: USD 30.96 Billion

- CAGR (2024-2030): 23.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Analytics provide actionable insights to optimize learning outcomes, resource allocation, and institutional performance. Further technological advancements in analytics software and the rapidly advancing education technology (Edtech) sector in developing economies worldwide are notable factors expected to propel steady demand for these solutions over the forecast period.

The growing recognition of benefits offered by personalized learning experiences has driven a substantial demand for analytics solutions globally. These tools enable the creation of customized educational pathways based on individual student needs and preferences. For instance, an institute can leverage analytics to develop innovative pedagogical strategies to provide enhanced learning experiences to students. Additionally, learners can use analytics solutions to understand their weak areas in terms of learning and use prescriptive tools to improve their performance. As a result, analytics empowers users with informed decision-making by presenting the precise data needed.

Integrating analytics tools with existing learning management systems and other educational platforms accelerates market penetration. The industry has witnessed accelerated growth in recent years owing to the increased use of Internet services in developing economies, a shift of traditional educational institutions to online platforms, and a heightened understanding of the value proposition of learning analytics among educators and administrators. Additionally, the adoption of analytics in the enterprise sector is increasing as a way of strategic goal setting and evaluating employee performance across organizations for better productivity.

Component Insights

Software component accounted for the highest market share of 76.8% in 2023. It is owing to the core functionality of software solutions, as they are the primary tools for collecting, storing, and processing educational data. Software solutions provide intuitive dashboards and reports, assisting management in understanding complex data patterns and deriving actionable insights. Furthermore, these solutions can be easily deployed across entire educational institutions, accommodating diverse user groups and vast data sets, irrespective of their size. These factors, along with the scalability and cost-effectiveness of software solutions, account for this segment’s market dominance.

The services segment is expected to grow at the fastest CAGR over the forecast period. Educational institutions utilize various systems for gathering student information, learning management, and performance tracking. Integrating these sources to derive meaningful insights requires specialized expertise. Moreover, effective utilization of analytics tools requires continuous training and support. Service providers offer on-site support and ensure end users can analyze data seamlessly. As the need to update and refine analytics tools remains pivotal in organizations, the segment is expected to maintain growth at a steady rate.

Type Insights

Descriptive analytics held the highest revenue share in the market in 2023. This type of analytics provides a comprehensive understanding of past performance and current status by collecting, organizing, and presenting data in a meaningful format. Descriptive tools have been in use for longer and have gained a wider market adoption compared to predictive and prescriptive tools. Furthermore, descriptive solutions are relatively convenient to implement and require less sophisticated data infrastructure as compared to other types. These factors have led to their widespread adoption across several educational institutions.

Prescriptive analytics is expected to witness the fastest CAGR from 2024 to 2030. It can be attributed to actionable insights and recommendations provided by prescriptive analytics solutions for optimized outcomes. The increasing emphasis on personalized learning requires prescriptive analytics to tailor educational content and strategies according to individual requirements. It enables institutions to intervene and assist students and learners with targeted support proactively. These factors have led to efficient resource allocation and optimized performance, accounting for this segment's high growth rate.

Deployment Insights

On-premises deployment accounted for a larger revenue share in 2023. Educational institutions handle a significant volume of sensitive student data, including personal information, academic records, and financial transaction details. On-premise solutions offer higher control over data security, thus allowing such institutes to implement robust security measures. Moreover, several countries in recent years have mandated stricter data localization norms, restricting cloud-based storage of sensitive data. On-premise deployment aligns with these mandates, ensuring compliance and mitigating the risks associated with cloud-based data storage.

Cloud-based deployment accounts for a notable revenue share in the market. These solutions offer an affordable alternative to on-premise deployment, as the need for investing in a data storage infrastructure is mitigated. Institutions can segregate the data based on its sensitivity and importance. The data already available in the public domain can be stored on the cloud, thereby saving on data storage infrastructure costs otherwise accrued by the institution. Additionally, the requirement for a continuous upgrade and maintenance of security software is eliminated. These factors have led to a steady adoption of cloud-based solutions by educational institutions and enterprises.

End Use Insights

The academics sector held a significant revenue share in 2023 in the education and learning analytics market. This is owing to the early adoption and technological integration of digital learning tools by academic institutions globally. Academic institutions constantly face substantial pressure to demonstrate student success and program effectiveness. Learning analytics provides valuable insights into student performance, enabling institutions to identify areas for improvement and optimize resource allocation accordingly. These factors have compelled several educational institutions to invest in a robust data storage and analytics infrastructure, accounting for segment dominance.

Enterprises segment is expected to grow at the fastest CAGR during the forecast period. Organizations have recognized the need for data-driven insights to identify the skill gaps in their workforce. Learning analytics provide valuable data to help optimize employee performance, enhance productivity, and drive the necessary business outcomes. By quantifying the impact of training programs, enterprises can better understand their return on investment. Additionally, the widespread use of learning management systems (LMS) and other digital learning platforms enables the generation of vast amounts of data regarding individual employee strengths and shortcomings, which further helps in optimizing long-term human resource management for the organization, leading to increased adoption of analytics solutions in this sector.

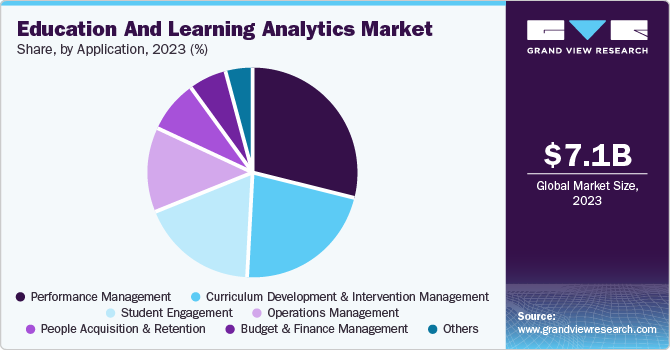

Application Insights

In terms of the application of education and learning analytics tools, performance management held a leading market share in 2023. It is attributed to an increased emphasis on quantifiable student performance data from different stakeholders such as governments, parents, and accrediting agencies. Performance analytics enable institutes to gain insights into individual student learning patterns, facilitating the delivery of tailored solutions for performance enhancement. Additionally, performance analytics enables efficient resource allocation, ensuring these resources are directed toward improving weak areas. These solutions ensure proactive measures are implemented across institutions, thereby mitigating issues such as regressive performance and outdated teaching mechanisms.

The student engagement segment is expected to register the fastest CAGR from 2024 to 2030. Educational institutions are increasingly focused on enhancing student success metrics such as retention and graduation rates and their employment after education. Student engagement analytics provide actionable insights to identify potential areas of risk and solutions that can be implemented for enhanced learning experiences. Moreover, advancements in data analytics technologies allow for the use of sophisticated modeling and predictive analytics solutions to identify early warning signs of student disengagement. As the competition in the education industry is increasing, innovative student engagement initiatives require competent analytics tools, accounting for segment growth.

Regional Insights

North America led the market with a revenue share of 36.9% in 2023. The presence of a well-developed technological infrastructure, such as high-speed internet connectivity and robust data centers, has created a conducive environment for the deployment and scaling of education and learning analytics solutions in the region. A strong emphasis on research and development activities to deploy solutions in the education sector has also led to significant advancements in learning analytics methodologies and tools. These factors, along with a high influx of international students, have compelled institutes to opt for advanced solutions such as analytics to optimize the management of the education system.

U.S. Education And Learning Analytics Market Trends

The U.S. accounted for a substantial share of the regional market in 2023. The country has a longstanding tradition of imparting quality higher education due to the presence of established institutions that have embraced innovative learning methodologies and tools. These institutions have been early adopters of learning analytics to enhance student outcomes and institutional efficiency. Furthermore, a culture of entrepreneurship and venture capital investment has encouraged the development of innovative Edtech startups. These companies have played a pivotal role in driving market growth and product development in the U.S., accounting for the country’s large market share.

Europe Education And Learning Analytics Market Trends

Europe held a notable market share in 2023. The region is known for its innovations in the education sector, with prominent economies such as the UK, Germany, and France developing and deploying advanced education models. Additionally, Europe has been at the forefront of technological advancements, particularly in data analytics and artificial intelligence. This early adoption and integration of analytics into the education sector has fostered a robust ecosystem of technology providers and innovators.

The UK accounted for a significant share of the European market in 2023. This is primarily attributed to the country’s historical eminence in education. Leveraging innovative technologies has enabled the deployment of advanced analytics solutions for an improved learning experience. It has created a heightened demand for learning management systems (LMS) and other such student data management solutions in the country. As the industry shifts to AI-based analytics solutions, the demand in the economy is further expected to increase during the forecast period.

Asia Pacific Education And Learning Analytics Market Trends

Asia Pacific is expected to register the fastest CAGR of 25.9% during the forecast period. The region has undergone a swift digital transformation across various sectors, including education. The increasing technology adoption in educational institutions has created a robust demand for analytics solutions to optimize learning outcomes and simplify administrative processes. Additionally, significant investments in educational infrastructure, coupled with rising student enrollment rates, have propelled the need for data-driven insights to enhance teaching methodologies, student performance, and resource allocation. As regional governments focus on global standards for the education sector, the demand for analytics solutions is expected to increase in the coming years.

India has significantly shifted towards the online education model since the COVID-19 outbreak. As new Edtech players enter the market, fierce competition has pushed them to opt for advanced data analytics solutions to retain their market share. Moreover, software providers offer competitively priced education and learning analytics tools, making them attractive to budget-conscious educational institutions. The country boasts a substantial proportion of the young population, which presents promising growth opportunities for institutional stakeholders during the forecast period.

Key Education And Learning Analytics Company Insights

Some key companies involved in the education and learning analytics market include Oracle, SAS Institute Inc., and Jenzabar, Inc., among others.

-

SAS Institute Inc. is a multinational software services and analytics solutions company. The company has gained prominence in the market for its data analytics software, SAS. SAS offers its services in over 56 countries in the education analytics sector. In the K-12 education segment, SAS offers Education Visualization and Analytics Solution (EVAAS), which has assisted student growth and improved attendance. In addition, SAS offers solutions for student success, educator workforce development, school performance management, P-20 data systems, and education financial management. SAS offers similar solutions in the higher education sector.

-

Oracle is a multinational software and cloud technology company. The company is well-known worldwide for its software solutions in enterprise resource planning (ERP), customer relationship management (CRM), and other similar products. The company offers several cloud-based solutions for the higher education sector, such as Oracle Cloud Student, a unified platform for various student activities; Oracle Cloud HCM for faculty and staff management; Oracle Cloud ERP for institutional growth; and various other solutions to provide holistic solutions to educational institutions.

Key Education and Learning Analytics Companies:

The following are the leading companies in the education and learning analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Anthology Inc.

- CIVITAS LEARNING, INC.

- Instructure, Inc.

- Jenzabar, Inc.

- Oracle

- PowerSchool

- QlikTech International AB

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

Recent Developments

-

In July 2024, Anthology Inc. announced the release of the company’s new version of the ‘Blackboard Learn’ Learning Management System (LMS), now known as Blackboard. The new iteration of this LMS will focus on improving AI literacy, supporting student achievements, and enhancing instructor workflows for better student engagement, as well as catering to the evolving requirements of academic institutions.

-

In July 2024, Instructure Holdings Inc. acquired Scribbles, a K-12 records and credentialing management solution provider. This strategic development is expected to aid Instructure in further expanding its credentialing network into K-12 while ensuring substantial support for student mobility and district transfer.

-

In March 2024, Jenzabar, Inc. announced its strategic partnership with Google Cloud to enhance its services in the student information systems (SIS) segment. By utilizing Google Cloud’s latest infrastructure and enhancements in security and AI offerings, Jenzabar will offer more secure, accessible, and personalized SIS to institutions in the higher education sector.

Education And Learning Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.83 billion

Revenue Forecast in 2030

USD 30.96 billion

Growth Rate

CAGR of 23.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, type, deployment, end use, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Anthology Inc.; CIVITAS LEARNING, INC.; Instructure, Inc.; Jenzabar, Inc.; Oracle; PowerSchool; QlikTech International AB; Salesforce, Inc.; SAP SE; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Education And Learning Analytics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global education and learning analytics market report based on component, type, deployment, end use, application, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Descriptive

-

Predictive

-

Prescriptive

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Academics

-

K-12

-

Higher Education

-

-

Enterprises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Curriculum Development & Intervention Management

-

Performance Management

-

Student Engagement

-

Operations Management

-

People Acquisition & Retention

-

Budget & Finance Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.