Electric Water Heater Market Size & Trends

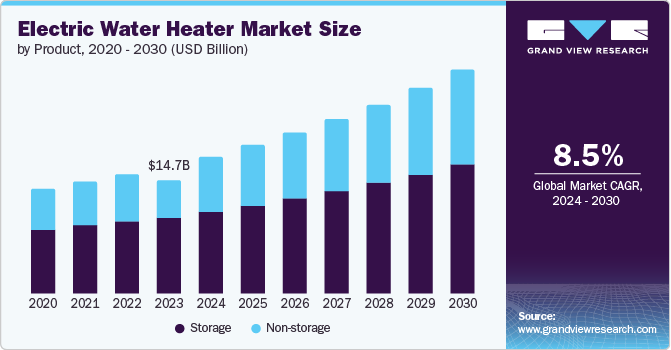

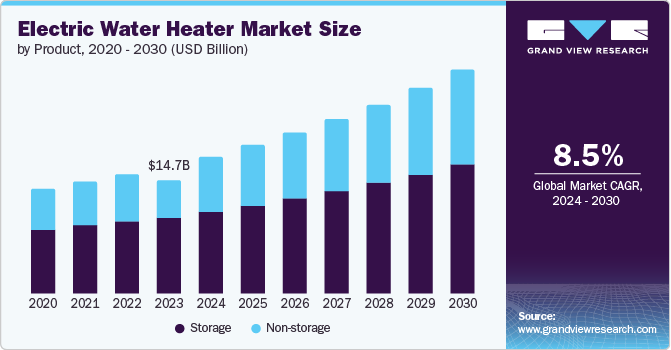

The global electric water heater market size was valued at USD 14.67 billion in 2023 and is expected to expand at a CAGR of 8.5% from 2024 to 2030.The global electric water heater market is expected to witness significant growth due to urbanization and rising living standards, which are increasing the demand for hot water in modern residential and commercial buildings. In addition, the growing demand for energy efficiency and sustainability is leading consumers to choose electric water heaters as a cleaner and more convenient alternative to traditional options.

Demand for hot water is increasing rapidly due to population growth, urbanization and lifestyle changes. Consumers are increasingly aware of the environmental impact of traditional water heaters and are choosing more efficient and sustainable options. Technological advancements and innovative product offerings are also contributing to the growth of the market.

Product Insights

Storage segment dominated the market and accounted for a share of 60.3% in 2023. This is attributable to constant supply of hot water in storage heaters, which is very important for homes and businesses that need hot water at all times. Additionally, the low initial cost compared to tankless models makes it a good choice for many buyers.

The non-storage segment is expected to register the fastest CAGR during the forecast period.The segment growth is owing to space-saving designs, improved energy efficiency through on-demand heating, and lower standby power loss in storage models.

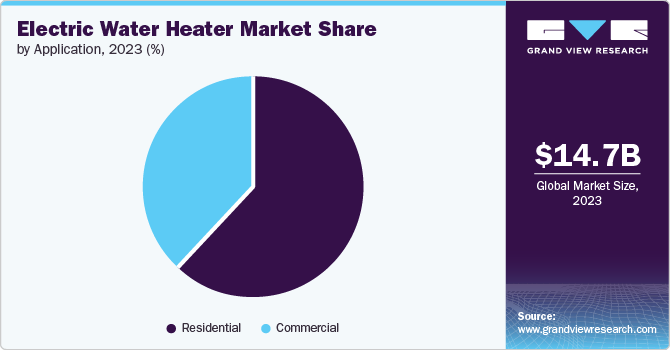

Application Insights

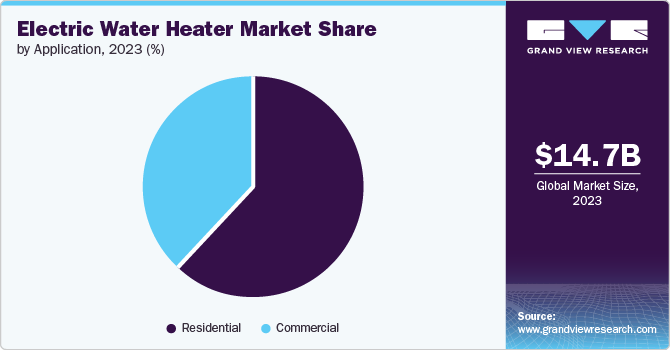

The residential segment accounted for the largest market revenue share in 2023.This is pertaining to urbanization and increasing number of individual households, each of which requires its own hot water system. The households need hot water for activities such as bathing, laundry, and dishwashing. In addition, increased income allows homeowners to invest in upgrading their appliances, including electric water heaters.

The commercial segment is anticipated to witness a significant CAGR over the forecast period.This increase is driven by the factors such as the global business sector and expanding industries that need to maintain hot water. Moreover, the stricter environmental regulations and incentives to adopt energy efficient technologies are increasing the demand for electric water heaters in commercial areas. Furthermore, the market for electric water heaters is growing due to the growing popularity of hotels, restaurants, and healthcare facilities with the requirements for large amounts of hot water.

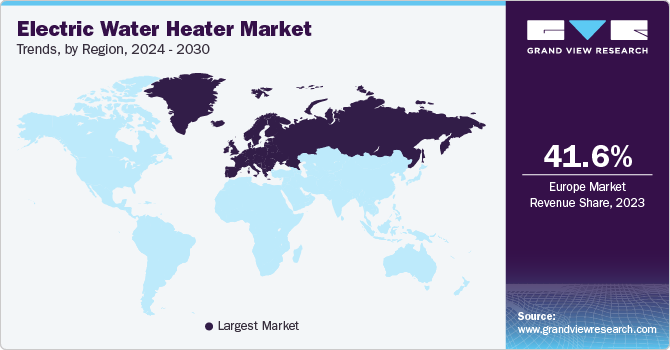

Regional Insights

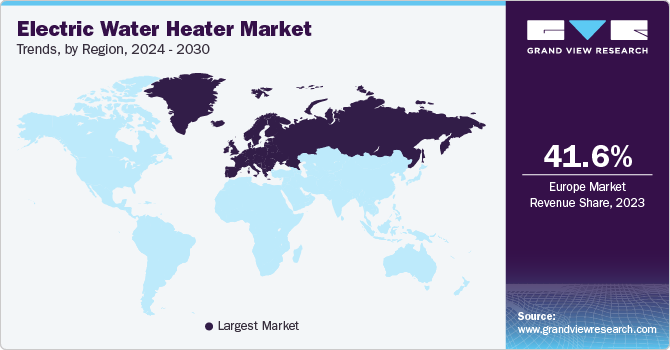

Europe Electric Water Heater Market Trends

Europe electric water heater market dominated the market in 2023. This is owing to government regulations encouraging energy efficiency have led consumers to choose electric heaters. Electric heaters are simpler and more efficient than gas or oil models. Additionally, increased energy production from new energy sources such as wind and solar power has made electric water heaters more suitable for environmentally conscious Europeans.

The electric water heater market in UK is expected to grow rapidly in the coming years due togovernment pressure on energy and efficiency. In addition, consumer concerns about cost and sustainability is making electric heaters more attractive. Smart features such as remote controls are another factor driving the growth of modern British homes.

Asia Pacific Electric Water Heater Market Trends

Asia Pacific electric water heater market is anticipated to witness significant growth in the electric water heater. The demand for products in the Asia-Pacific region is driven by the increase in wind and power generation in rural areas and the increase in investment in infrastructure, manufacturing capacity and industrial development in the south and southeast. Asian economies. In addition, increasing focus on carbon neutrality and energy efficiency standards is expected to drive market growth.

The electric water heater market in China held a substantial market share in 2023 owing to the growing industrial sector.China has pledged to be carbon-free by 2060, so the government is committed to encouraging investment and innovation in the manufacturing sector by supporting research and development and implementing CO2 reduction techniques.

Key Electric Water Heater Company Insights

The market is extremely fragmented with various global and regional product manufacturers releasing innovative systems and technologies. Various industry participants' strategies typically involve new product development, product upgrades, and expansions to boost market penetration and respond to the changing technical needs of the application industries. The major players form technical partnerships to innovate and develop novel product lines, therefore expanding their consumer base.

-

A.O. Smith provides water heater solutions and treatment solutions to residential and commercial customers. They offer a variety of water heaters, including energy efficient models and water purification systems to ensure clean and safe drinking water.

-

Havells India Limited is a major player in the electronics and home appliances market with a strong presence in India and globally. The product portfolio is extensive, covering both residential and commercial needs, including fans, water heaters, lighting and cables.

Key Electric Water Heater Companies:

The following are the leading companies in the electric water heater market. These companies collectively hold the largest market share and dictate industry trends.

- AquaMAX

- Ariston

- Atwood

- Bosch

- Bradford White Corporation

- Eemax

- General Electric (GE)

- Haier Electronics

- Hubbell

- Kenmore

- Marey Heater Corp

Recent Developments

-

In March 2024, Bosch Home Comfort has launched a new hybrid electric water heater called the GreenTronic 7000 T. This water heater uses heat pump technology to efficiently heat water, potentially reducing energy costs. The GreenTronic 7000 T is available in 50 and 80-gallon models and qualifies for a federal tax credit, making it an attractive option for homeowners looking for a more sustainable hot water solution.

-

In March 2023, A.O. Smith Corporation announced the acquisition of Reliance Water Heaters, a leading manufacturer of electric water heaters in the Gulf Cooperation Council region.

-

In January 2023, Haier Electronics announced a partnership with Emaar Properties to provide energy-efficient electric water heaters to its customers in the UAE.

Electric Water Heater Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 15.85 billion

|

|

Revenue forecast in 2030

|

USD 25.86 billion

|

|

Growth rate

|

CAGR of 8.5% from 2024 to 2030

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

August 2024

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; China; India; Japan; Brazil

|

|

Key companies profiled

|

A.O. Smith, AquaMAX, Ariston, Atwood, Bosch, Bradford White Corporation, Eemax, General Electric (GE), Haier Electronics, Havells, Hubbell, Kenmore, Marey Heater Corp

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options |

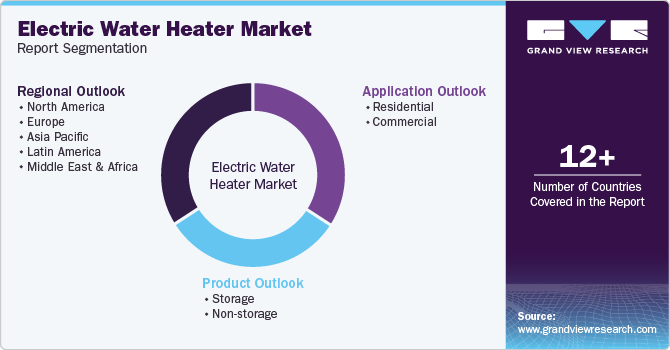

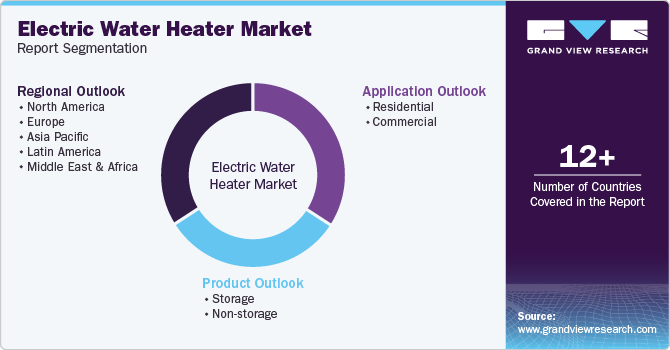

Global Electric Water Heater Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric water heater market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

Asia Pacific

-

Latin America