- Home

- »

- Distribution & Utilities

- »

-

Electrical Conduit Market Size, Share, Industry Report, 2033GVR Report cover

![Electrical Conduit Market Size, Share & Trends Report]()

Electrical Conduit Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Metallic, Non-Metallic), By Type (Rigid, Flexible), By Application (Energy, Rail Infrastructure, Manufacturing Facilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-410-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrical Conduit Market Summary

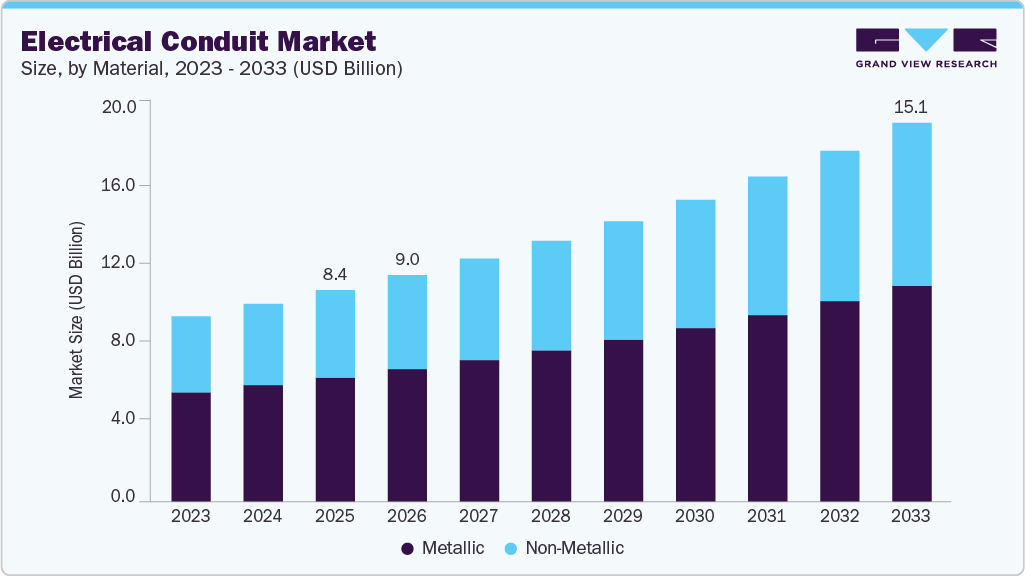

The global electrical conduit market size was estimated at USD 8.45 billion in 2025 and is projected to reach USD 15.14 billion by 2033, growing at a CAGR of 7.6% from 2026 to 2033. Electrical conduit is a protective tubing system that routes and safeguards electrical wiring in buildings, infrastructure, and industrial installations.

Key Market Trends & Insights

- The North America electrical conduit market held the largest share of 31.6% of the global market in 2025.

- The U.S. electrical conduit industry is expected to grow significantly from 2026 to 2033.

- By material, the metallic segment held the highest market share in 2025.

- By type, the rigid segment held the highest market share in 2025.

- By application, the flexible segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 8.45 Billion

- 2033 Projected Market Size: USD 15.14 Billion

- CAGR (2026-2033): 7.6%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

These systems are crucial for ensuring electrical safety, minimizing wire damage, and promoting long-term reliability across various applications. The growing demand for secure and organized wiring systems, alongside stringent building codes and safety standards, continues to drive the adoption of electrical conduits in the residential, commercial, and industrial construction sectors.

The market is poised to experience steady growth during the forecast period, driven by increasing investments in infrastructure development and the modernization of aging electrical grids worldwide. Metal and non-metallic conduits, such as PVC, EMT, and HDPE, are gaining traction due to their durability and flexibility in harsh environments. Additionally, the transition toward smart buildings and energy-efficient solutions encourages the deployment of advanced conduit systems compatible with IoT-enabled infrastructure. Countries such as the U.S., Germany, India, and China are experiencing increased demand due to rapid urbanization, the expansion of renewable energy, and supportive regulatory frameworks. These factors, combined with technological innovation in materials and installation methods, are expected to reinforce the long-term outlook of this market.

Drivers, Opportunities & Restraints

The global electrical conduit market is driven by the rising emphasis on electrical safety, regulatory compliance, and organized wiring systems across construction and industrial sectors. As urbanization accelerates, particularly in the Asia Pacific and the Middle East, the demand for robust infrastructure, smart buildings, and energy-efficient electrical networks continues to surge. Building codes and fire safety standards are increasingly mandating protective conduits, thereby supporting market penetration. Furthermore, the growth in industrial automation and the expansion of data centers and manufacturing units worldwide have amplified the need for secure, flexible, and corrosion-resistant cable management systems.

Emerging opportunities lie in developing halogen-free, UV-resistant, and flame-retardant conduit materials tailored to withstand extreme environmental conditions. The shift toward green construction and net-zero energy buildings also spurs demand for conduits that integrate easily with smart energy systems. Technological advancements such as prefabricated conduit systems, bendable non-metallic variants, and modular installation solutions create value through labour and time savings. However, the market is constrained by the fluctuating prices of raw materials, such as PVC, steel, and aluminum, which impact production costs. Additionally, the availability of low-cost counterfeit products in unregulated markets and labour-intensive installation processes in large-scale infrastructure projects pose challenges to market scalability.

Material Insights

The metallic segment emerged as a dominant material category in the global electrical conduit market, accounting for a revenue share of over 58.6% in 2025. It is expected to maintain its lead throughout the forecast period, driven by robust demand from the commercial, industrial, and infrastructure sectors, where mechanical strength, fire resistance, and long-term durability are essential. The increasing global investment in transportation networks, manufacturing facilities, and large-scale utility buildings continues to drive the use of metallic conduits such as EMT (Electrical Metallic Tubing), RMC (Rigid Metal Conduit), and IMC (Intermediate Metal Conduit). These conduits are particularly valued for their superior protection against physical damage and compatibility with grounding systems, making them ideal for high-risk or code-intensive environments.

The growing use of metal conduits in mission-critical applications such as data centers, airports, and hospitals reflects the segment’s reliability and compliance with stringent safety regulations. Moreover, the ability to withstand extreme environmental and mechanical conditions makes them a preferred choice in oil & gas, mining, and heavy industrial settings. As industries increasingly focus on electrical resilience and structured cabling, metallic conduits continue to see strong adoption. However, weight and installation cost considerations remain, especially in retrofit or space-constrained projects. Nevertheless, advancements in corrosion-resistant coatings and lightweight alloy-based conduits are expected to enhance the segment’s long-term growth potential.

Application Insights

The energy segment accounted for the largest revenue share of over 29.0% in the global electrical conduit industry in 2025 and is expected to maintain its dominance over the forecast period. This application segment is also anticipated to grow steadily, supported by rising investments in power generation, transmission, and distribution infrastructure across developed and emerging economies. As energy projects often require highly durable, flame-retardant, and corrosion-resistant wiring protection systems, the demand for metallic and advanced non-metallic conduits has surged. Electrical conduits play a critical role in safeguarding power cables in harsh operating environments, such as substations, renewable energy farms, and conventional power plants.

The increasing deployment of renewable energy sources, such as solar and wind, especially in large-scale utility and grid integration projects, creates a further need for high-performance conduit systems that ensure safe and efficient cable routing. Moreover, the global transition toward decarbonization is accelerating the construction of new natural gas, hydrogen, and hybrid power facilities, each requiring reliable electrical infrastructure. Governments’ push toward electrification and grid modernization drives the installation of conduits in energy storage systems and smart grid frameworks. As energy systems grow more complex and distributed, robust, code-compliant conduit solutions will remain essential for ensuring operational safety and long-term infrastructure resilience.

Type Insights

The rigid segment accounted for the largest revenue share of approximately 62.0% in 2025. This dominance is attributed to the widespread use of rigid conduits in high-performance applications requiring superior protection, mechanical strength, and fire resistance. Rigid conduit systems, commonly made from steel, aluminum, or heavy-duty PVC, are essential in commercial buildings, industrial plants, and utility infrastructure where compliance with strict building codes is critical. The demand for rigid conduits is expected to grow steadily over the forecast period, driven by rapid urbanization, increased infrastructure investments, and expanding utility and energy projects worldwide.

The rigid segment continues to lead; concerns regarding installation complexity and higher material costs persist among contractors and builders, especially in cost-sensitive markets. On the other hand, the flexible segment, which is used in retrofitting tight spaces and light-duty applications, is gaining traction due to ease of installation and labor savings. Applications across telecom, residential, and light industrial sectors support its growth. Still, rigid conduits remain preferred in environments with high safety and durability requirements. Technological innovations in lighter alloys and prefabricated conduit assemblies are expected to mitigate some limitations, ensuring the rigid type maintains its stronghold in the global electrical conduit landscape.

Regional Insights

North America led the global electrical conduit market in 2025, holding the largest regional share of 31.6%. Extensive infrastructure modernization, smart city rollouts, and increased adoption of energy-efficient electrical systems support this dominance. In particular, high levels of construction activity across the U.S. commercial, industrial, and residential sectors are driving steady demand for code-compliant and durable conduit systems.

The region also benefits from stringent wiring and fire safety regulations enforced by bodies such as the National Electrical Code (NEC), which support the use of advanced conduit technologies. Grid modernization efforts and the rise of renewable energy installations, including wind and solar farms, further amplify conduit consumption, especially in utility-scale and distributed energy projects.

U.S. Electrical Conduit Market Trends

The U.S. remains the primary contributor to North America's electrical conduit industry, driven by robust investment in infrastructure, clean energy, and residential development. In 2024, the demand for metallic and non-metallic conduits surged in commercial buildings, transit systems, and industrial facilities. Landmark federal initiatives such as the Infrastructure Investment and Jobs Act (IIJA) and clean energy funding have significantly accelerated the deployment of advanced and secure electrical systems.

The U.S. market is also experiencing a notable shift toward smart grids, electric vehicle charging infrastructure, and renewable energy installations, requiring conduit systems that accommodate complex wiring needs. Furthermore, there is growing adoption of halogen-free, flexible, and prefabricated conduit systems to reduce installation time and enhance compliance with evolving safety codes. As electrification deepens across critical sectors such as manufacturing, healthcare, and data centers, the market is poised for sustained growth.

Asia Pacific Electrical Conduit Market Trends

Asia Pacific has emerged as a key regional player in the global electrical conduit industry, driven by rapid urbanization, industrial growth, and large-scale infrastructure investments across countries such as China, India, and the economies of Southeast Asia. The expansion of transportation networks, smart cities, and power transmission systems continues to drive strong demand for metallic and non-metallic conduit systems. Government-led electrification initiatives and increasing direct foreign investment in manufacturing and construction reinforce regional market expansion.

Also, cost-effective manufacturing hubs and adherence to international wiring and safety standards position the Asia Pacific as a long-term growth engine. The region's evolving energy landscape, rising construction activities, and adoption of smart building practices support a robust outlook for conduit system installations across residential, commercial, and industrial projects.

Europe Electrical Conduit Market Trends

A strong regulatory focus on fire safety, energy efficiency, and sustainable construction shapes Europe's electrical conduit industry. Countries like Germany, the UK, and France are channeling investments into infrastructure upgrades, underground cable installations, and the promotion of green buildings. These developments boost demand for structured conduit systems that align with modern construction techniques and safety standards.

The rise of modular and prefabricated construction practices is further driving the adoption of pre-engineered conduit solutions. At the same time, Europe's commitment to environmental sustainability encourages manufacturers to develop recyclable and halogen-free conduit materials. These trends collectively support a forward-looking and environmentally conscious market trajectory.

Latin America Electrical Conduit Market Trends

As regional infrastructure improves, Latin America is gradually strengthening its presence in the global electrical conduit landscape. Countries such as Brazil, Mexico, and Colombia are scaling up investments in commercial, residential, and industrial development projects, creating steady demand for conduit systems.

The region's growth outlook is enhanced by efforts to formalize the construction industry, improve power grid resilience, and enforce safer wiring regulations. Although cost sensitivity remains challenging, the preference for corrosion-resistant and easy-to-install conduit types is increasing in urban areas and large-scale energy projects.

Middle East & Africa Electrical Conduit Market Trends

The Middle East and Africa (MEA) region shows emerging potential in the electrical conduit industry, fueled by the expansion of megacity projects, energy diversification, and electrification initiatives. Countries like Saudi Arabia, the UAE, and South Africa are investing in smart infrastructure, solar farms, and national utility upgrades, all of which require robust conduit installations.

Challenging environmental conditions, such as extreme heat and exposure to UV radiation, drive the need for durable, flame-retardant, and weather-resistant conduit materials. Although slower development in rural zones presents short-term constraints, long-term growth is supported by government-backed industrialization and infrastructure enhancement plans across the region.

Key Electrical Conduit Company Insights

Some of the key players operating in the global electrical conduit industry are actively expanding their market footprint through product innovation, strategic acquisitions, and collaborations aimed at enhancing their global distribution networks and technological capabilities.

Key Electrical Conduit Companies:

The following are the leading companies in the electrical conduit market. These companies collectively hold the largest market share and dictate industry trends.

- Atkore International

- Thomas & Betts

- Schneider Electric

- General Electric (GE)

- Eaton Corporation

- Southwire Company

- Cooper Industries

- Hubbell

- Robroy Industries

- Sekisui Chemical Co., Ltd.

- Aliaxis SA

- Dura-Line Corporation

- Anamet Electrical, Inc.

Recent Developments

-

In January 2025, Atkore International unveiled plans to expand its product portfolio by launching a new line of halogen-free and flame-retardant flexible conduit systems. Designed for commercial buildings, data centers, and transportation networks, the new products aim to meet stricter safety codes and growing sustainability requirements. This product innovation reinforces Atkore’s leadership in providing advanced electrical raceway solutions while supporting safer and more efficient installations across multiple end-use sectors.

Electrical Conduit Market Report Scope

Report Attribute

Details

Market Definition

The Electrical Conduit market size represents the global revenue generated from the production and sale of metallic and non-metallic conduit systems and fittings used to protect and route electrical wiring across residential, commercial, industrial, and infrastructure applications.

Market size value in 2026

USD 9.05 billion

Revenue forecast in 2033

USD 15.14 billion

Growth rate

CAGR of 7.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Atkore International; Thomas & Betts; Schneider Electric; Legrand; Siemens; General Electric; Eaton Corporation; Southwire Company; Cooper Industries; Hubbell; Robroy Industries; Sekisui Chemical Co., Ltd.; Aliaxis SA; Dura-Line Corporation; Anamet Electrical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrical Conduit Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electrical conduit market report based on material, type, application, and region:

-

Material Outlook (Revenue, USD Million; 2021 - 2033)

-

Metallic

-

Non-Metallic

-

-

Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Rigid

-

Flexible

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Energy

-

Rail Infrastructure

-

Shipbuilding & Offshore Facilities

-

Manufacturing Facilities

-

Process Plants

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electrical conduit market size was estimated at USD 8.45 billion in 2025 and is expected to reach USD 9.05 billion in 2026.

b. The global electrical conduit market is expected to grow at a compound annual growth rate of 7.6% from 2026 to 2033 to reach USD 15.14 billion by 2033.

b. Based on the application segment, Energy held the largest revenue share of over 29% in the electrical conduit market in 2025, driven by the sector's increasing focus on grid modernization, renewable integration, and safety compliance. As energy infrastructure expands to accommodate solar, wind, and smart grid technologies, the demand for reliable conduit systems to protect electrical wiring has grown significantly.

b. Some of the key vendors of the global electrical conduit market include Robroy Industries, Legrand, General Electric, Schneider Electric, and Eaton Corporation, among others.

b. The key factors driving the electrical conduit market include the rapid expansion of renewable energy sources such as solar and wind, which demand safe and durable electrical infrastructure. Electrical conduits play a crucial role in protecting power cables used in solar farms, wind turbines, and energy storage systems, ensuring system reliability and compliance with safety standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.