- Home

- »

- Plastics, Polymers & Resins

- »

-

Electrical And Electronic Adhesive Market Size Report, 2030GVR Report cover

![Electrical And Electronic Adhesive Market Size, Share & Trends Report]()

Electrical And Electronic Adhesive Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Thermal Conductive, Electrically Conductive), By Application (Surface-mount Devices), By Region, And Segment Forecasts

- Report ID: 978-1-68038-492-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Share

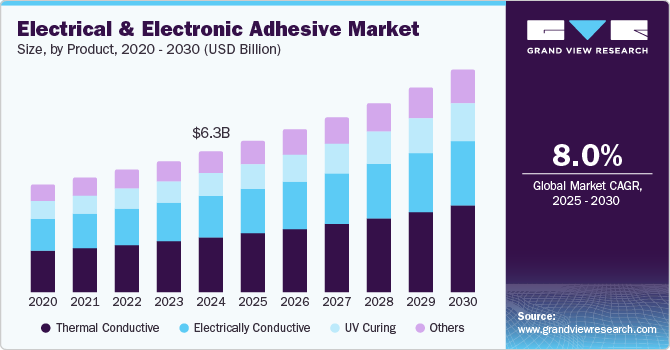

The global electrical and electronic adhesive market size was valued at USD 6.28 billion in 2024 and is expected to witness a CAGR of 8.0% from 2025 to 2030. This growth can be attributed to the increasing demand for smaller and more sophisticated electronic devices necessitating specialized adhesives for bonding components in compact designs. In addition, the rise of flexible and wearable electronics further boosts the market as these applications require adhesives with unique properties. Furthermore, the adoption of smart manufacturing and automated assembly processes in Industry 4.0 is driving the need for efficient and reliable adhesive solutions.

Electrical and electronics adhesives are essential for securing components in electronic devices such as semiconductors and printed circuit boards, guaranteeing structural integrity and functionality. The increasing miniaturization of electronics is one of the key drivers in the growth of the global electrical and electronics adhesives industry. As devices become smaller and more complex, specialized adhesives are needed to provide reliable bonding, thermal management, and electrical conductivity in compact spaces.

In addition, the automotive sector, particularly with the growth of electric vehicles and advanced driver-assistance systems, increasingly relies on these adhesives for thermal management and electrical insulation. Similarly, the medical field uses them in wearable health monitors and diagnostic equipment, while the aerospace industry needs them in avionics and satellite systems where performance under extreme conditions is critical. The market is shifting toward eco-friendly adhesives in response to stricter regulations and sustainability goals. Water-based and bio-based options are becoming more popular as alternatives to traditional solvent-based adhesives, aligning with the preferences of environmentally conscious consumers. The use of epoxy adhesives is expected to see continued growth due to their widespread use in protecting electronic components through encapsulation and conformal coatings.

Furthermore, the broader adoption of smart manufacturing techniques and Industry 4.0 principles is increasing the need for adhesives that can facilitate efficient and automated assembly processes. Moreover, increasing industrialization and electronics production in regions such as Latin America create further opportunities for growth. In India, the expanding automotive and telecommunications sectors drive demand, while ongoing investments in aerospace and defense provide additional market momentum.

Product Insights

Electrically conductive adhesives dominated the global electrical & electronics adhesives industry with the highest revenue share of 38.6% in 2024. This growth can be attributed to the expansion of renewable energy sources and the continuous growth of the electronics sector. They play a vital role in assembling solar PV modules, ensuring effective current flow. Furthermore, the increasing integration of electronics in the automotive industry, particularly in electric vehicles, fuels their demand. These adhesives offer robust bonding and efficient electrical conductivity, essential for battery management and power electronics in EVs. Moreover, advancements in material science and the ongoing trend toward miniaturization further contribute to the growing adoption of electrically conductive adhesives.

UV curing adhesives are expected to grow at the fastest CAGR of 8.7% over the forecast period, primarily due to their rapid curing times, which enhance production efficiency in electronics manufacturing. In addition, their ability to cure on demand with minimal heat makes them ideal for delicate electronic components. The growing demand for high-precision assembly in sectors such as medical devices and aerospace also contributes to their popularity. Furthermore, UV Curing adhesives often offer superior bond strength and resistance to environmental factors, making them suitable for demanding applications.

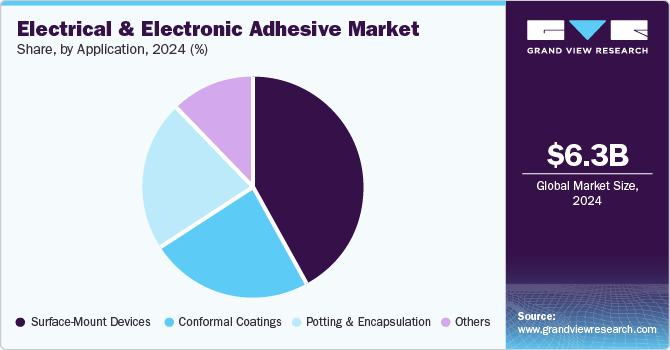

Application Insights

The surface-mount devices led the market and accounted for the largest revenue share of 42.2% in 2024. This growth can be attributed to rising trend of miniaturization in electronics drives, which require proper adhesion in compact designs. Surface mount technology offers advantages such as low cost, high efficiency, and shorter setup times. In addition, it enhances joint stability, enabling devices to withstand harsh conditions. Furthermore, the demand for compact devices in consumer electronics, automotive, and telecommunications sectors is propelling the growth of surface mount technology, making it a popular choice for electronic adhesives.

Potting and encapsulation is expected to grow at a CAGR of 8.2% from 2025 to 2030, owing to the need to protect electronic assemblies from harsh environments and mechanical shocks, ensuring they function accurately for longer periods. This process offers advantages such as low-cost shells, reusable molds, better electric insulation, and efficient performance in extreme conditions. In addition, increased demand for potting compounds stems from the consumer electronics sector, where they ensure safety by providing corrosion, electrical, and thermal resistance for integrated circuits and printed circuit boards. The trend toward miniaturization in electronics further boosts this market.

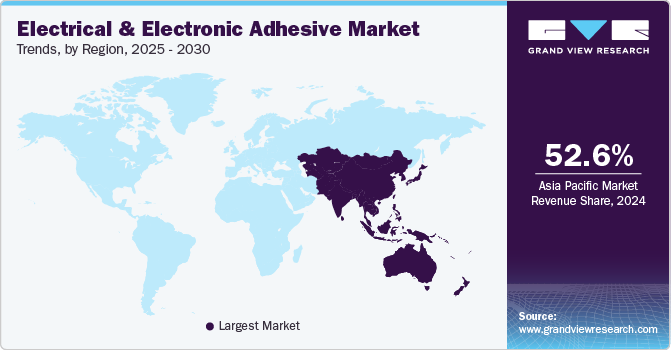

Regional Insights

The Asia-Pacific electrical and electronics adhesives market dominated the global market and accounted of the largest revenue share of 52.6% in 2024, primarily driven by its extensive electronics production, particularly in China, South Korea, and Taiwan. These countries not only produce components for international companies but also lead in domestic and foreign electronic product sales. In addition, rising consumer spending, technological advancements, and the increasing need for eco-friendly adhesives also contribute to market expansion. Furthermore, the shift of manufacturing plants to this region due to low production costs further fuels the demand for electronic adhesives.

China Electrical And Electronic Adhesive Market Trends

The electrical & electronics adhesives market in China led the Asia Pacific market with the highest revenue share in 2024, driven by The country's role as a major production hub for various electronic components and products drives substantial demand for these adhesives. Furthermore, government initiatives supporting the electronics industry, coupled with increasing domestic consumption of electronic devices, further accelerate market growth. Moreover, the focus on developing advanced technologies, such as 5G and AI, also necessitates the use of high-performance electronic adhesives.

Middle East & Africa Electrical And Electronic Adhesive Market Trends

The Middle East & Africa region electrical & electronics adhesives market is expected to grow at a CAGR of 8.4% over the forecast period, owing to increasing investments in infrastructure development, including telecommunications and smart city projects, drive demand for electronic components and adhesives. In addition, the rising adoption of consumer electronics, along with growing industrialization in some countries, contributes to market expansion.

North America Electrical And Electronic Adhesive Market Trends

The electrical & electronics adhesives market in North America is expected to witness a significant growth over the forecast period, due to a strong electronics and semiconductor industry. In addition, the presence of major electronics manufacturers, semiconductor companies, and research institutions drives innovation and demand for advanced adhesive solutions. Furthermore, the increasing popularity of medical devices and wearables, requiring specialized adhesives, also fuels market growth. Furthermore, the region's focus on technological advancements and R&D activities contributes to the market's expansion.

The U.S. electrical and electronic adhesive market dominated the North American market and held the largest revenue share in 2024, primarily driven by the country's well-established electronics and semiconductor industries. Furthermore, high demand from sectors such as aerospace, defense, and automotive, which require high-performance electronic components, fuels market growth. Moreover, the increasing adoption of advanced technologies, along with a strong focus on R&D, contributes to the development and use of innovative adhesive solutions.

Europe Electrical And Electronic Adhesive Market Trends

The growth of the electrical & electronics adhesives market in Europe is expected to be driven by the region's established automotive, industrial, and healthcare sectors. In addition, the increasing adoption of electric vehicles and advanced driver-assistance systems in the automotive industry boosts demand for electronic adhesives. Furthermore, stringent environmental regulations promote the use of eco-friendly adhesives in electronics manufacturing. Moreover, the region's focus on innovation and sustainable technologies further contributes to the growth of the electronic adhesives market.

Key Electrical And Electronic Adhesive Company Insights

Key companies in the electrical & electronics adhesives industry include Ashland, Covestro AG, Dow, and others. These players are focusing on strategies such as adopting new technologies, product innovations, mergers and acquisitions, joint ventures, alliances, and partnerships to enhance their market position. Furthermore, they are increasing production capacities and pushing for geographical expansion to reduce dependency on imports.

-

Ashland provides adhesives and additives for diverse sectors, including electronics. Their materials act as binders, thickeners, and adhesion promoters in both water-based and solvent-based adhesives. The company’s solutions are used in heat-activated, pressure-sensitive, and energy-curable adhesives. Ashland operates in segments such as adhesives, coatings, automotive, construction, energy, and electronics.

-

Covestro AG produces raw materials such as polyurethane and polycarbonate, which are utilized in coatings and adhesives. Their product range encompasses specialty chemicals and polycarbonates. The company operates through two segments: Solutions and Specialties, and Performance Materials. Covestro maintains production sites worldwide, some of which manufacture materials specifically for the electrical and electronics industries.

Key Electrical And Electronic Adhesive Companies:

The following are the leading companies in the electrical and electronic adhesive market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema

- 3M

- Ashland

- AVERY DENNISON CORPORATION

- BASF SE

- Covestro AG

- Dow

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc. (ITW)

- MAPEI S.P.A.

- Permabond LLC

- Pidilite Industries Ltd.

- Sika AG

Recent Developments

-

In July 2024, Henkel has completed Phase III of its manufacturing facility in Kurkumbh, India, reinforcing its commitment to the Indian market. The new Loctite plant aims to address the rising demand for high-performance adhesive solutions, including Electrical & Electronics Adhesives, in the manufacturing, automotive, and MRO sectors. This expansion aims to localize the product portfolio, reducing reliance on imports and supporting the 'Make in India' initiative. The Kurkumbh site is LEED Gold certified and strives for carbon neutrality by 2030, utilizing green energy solutions.

-

In May 2024, H.B. Fuller Company has acquired ND Industries Inc., a move that expands its service and product offerings in high-growth segments such as Electrical & Electronics Adhesives. ND Industries specializes in adhesives and fastener solutions for the automotive, electronics, and aerospace industries. This acquisition enhances H.B. Fuller's capabilities by adding ND Industries' Vibra-Tite brand to its existing range of epoxy, cyanoacrylate, UV curable, and anaerobic products. ND Industries' expertise in pre-applied fastener technology and custom equipment strengthens H.B. Fuller's position in the adhesives market, providing a powerful advantage for customers needing Electrical & Electronics Adhesives.

-

In January 2024, Intertronics has released a Structural Adhesives Selector Guide to aid manufacturers in choosing the right adhesive for their applications. The guide offers an overview of five structural adhesive chemistries, including epoxies and UV curing, covering 28 materials, their properties, and compatibility. Tailored for industries such as automotive, aerospace, and electronics, the guide helps establish robust bonds with materials such as metals, plastics, and composites. This is particularly relevant to Electrical & Electronics Adhesives as it aids in selecting materials for reliable electronic device assembly.

-

In May 2023, Arkema acquired Polytec PT, enhancing its position in adhesives and thermal management for electronics. The deal boosts Bostik's capabilities in battery and electronics applications with specialized thermal interface materials. Polytec PT's technology, essential for efficient heat dissipation in batteries and electronics, complements Bostik's existing adhesive solutions. Arkema aims to leverage this acquisition to achieve significant revenue growth in high-performance materials, strengthening its portfolio in Electrical & Electronics Adhesives for advanced electronic devices.

Electrical And Electronic Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.74 billion

Revenue forecast in 2030

USD 9.93 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East & Africa

Country scope

U.S., Germany, Italy, France, China, India, Japan

Key companies profiled

Arkema; 3M; Ashland; AVERY DENNISON CORPORATION; BASF SE; Covestro AG; Dow; H.B. Fuller Company; Henkel AG & Co. KGaA; Huntsman International LLC; Illinois Tool Works Inc. (ITW); MAPEI S.P.A.; Permabond LLC; Pidilite Industries Ltd.; Sika AG.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrical And Electronic Adhesive Market Report Segmentation

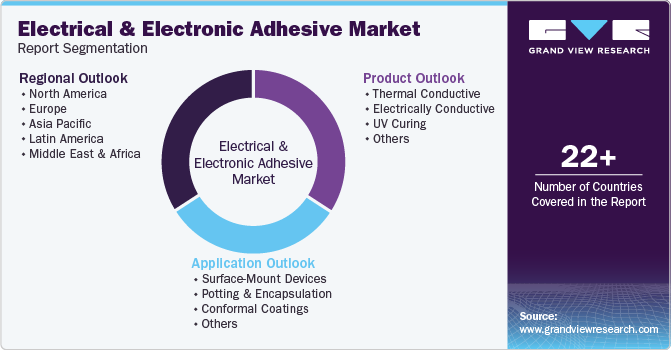

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global electrical and electronic adhesive market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thermal Conductive

-

Electrically Conductive

-

UV Curing

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Surface-Mount Devices

-

Potting & Encapsulation

-

Conformal Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.