- Home

- »

- Display Technologies

- »

-

Electronic Display Market Size, Industry Report, 2022GVR Report cover

![Electronic Display Market Report]()

Electronic Display Market Analysis By Technology (LCD, LED, OLED), By Application (Consumer Electronics, Digital Signage, Automotive Display), By End-Use (Retail, Entertainment, Corporate, Healthcare, Government)And Segment Forecasts To 2022

- Report ID: 978-1-68038-760-5

- Number of Report Pages: 111

- Format: PDF, Horizon Databook

- Historical Data: 2013-2015

- Forecast Period: 2016 - 2022

- Industry: Semiconductors & Electronics

Report Overview

The global electronic display market size was valued at USD 313.5 billion in 2014. Technological advancements, expansion of the consumer electronics industry, and increasing applications across different end-use segments are expected to drive the global market growth.

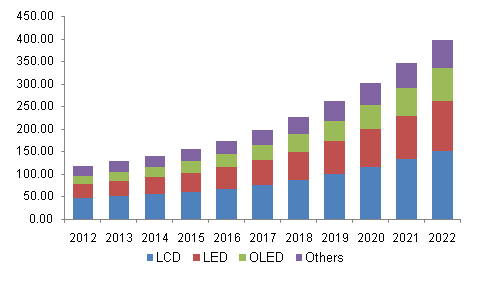

Asia Pacific Electronic Display Market Revenue by Technology, 2012 - 2022 (USD Billion)

The industry has evolved significantly over the last few years owing to several new technological developments. The emergence of advanced consumer electronics such as smartphones, tablets, smart wearables, and smart televisions is expected to drive the market over the next seven years. Moreover, increasing purchasing power across different sections of society has opened up greater avenues for industry growth.

Manufacturers are bound to follow regulations such as the Waste Electronics and Electrical Equipment (WEEE)and Restriction of Hazardous Substances (RoHS) standards. These standards intend to decrease the amount of harmful e-waste and handle critical issues such as reclamation & recycling of such devices.

The development of cutting-edge high-resolution display technologies such as OLED and AMOLED in consumer electronic devices has positively affected the industry. However, the adoption of such innovative technologies involves high initial costs resulting in an increase in the cost of the device and may hinder the market growth over the next few years.

Product Insights

LCD displays have dominated the market over the last few years. The segment accounted for over 35% of the total industry revenue share owing to the increasing applications in consumer electronics devices such as TVs, and personal computers. However, advanced LED and OLED display technologies are increasingly gaining popularity due to high operational reliability and suitability towards various applications.

These electronic technologies are widely used in digital signage applications and smart devices such as phones, tablets, and wearables. Manufacturers are increasingly shifting from rigid OLED displays to flexible AMOLED displays to differentiate their product offerings from rigid LCD and AMOLED displays used in various device applications.

Application Insights

Display forms an essential component in every other consumer electronic device and acts as an interface between the user and the device. The consumer electronics application segment accounted for over 50% of the overall revenue in 2014 and is projected to grow steadily over the forecast period.

Large scale adoption of digital signage across different end-use segments is expected favorably impact the market. Key developments such as advanced digital signage 2.0 that displays data by moving the infographics are widely used across the retailing industry thus resulting in the enrichment of the business strategy, brand using impressive aesthetics.

End-Use Insights

Advanced electronic displays are extensively used in a range of end-use segments including retail, entertainment, corporate, healthcare, and government. The entertainment end-use segment accounted for approximately 30% of the overall revenue in 2014. Significant expansion of console and mobile gaming industry has significantly contributed to the growth of the segment.

Additionally, increasing use of digital signage in the retailing industry coupled with surging adoption of modern the m-commerce retailing has made it the fastest-growing application segment in the industry.

Regional Insights

Asia Pacific regional market is estimated to dominate the global electronic displays industry amounting to over 140 billion in 2014. Lower manufacturing costs combined with less stringent government regulations in the region has led major technology giants to establish manufacturing bases in the region, thus driving the regional industry growth.

North America is expected to be the flourishing regional market and is expected to grow over the forecast period. High disposable incomes and improved lifestyle amongst the people is expected to generate a steady demand for such advanced display based applications.

Key Companies & Market Share Insights

Companies dominating electronic display market share include ActiveLight Inc., AU Optronics, Casio Computers Co. Ltd., LG Electronics, Toshiba Corporation, Sony Corporation, and Zenith Electronics Corporation. Vendors are adopting strategies such as innovation and product differentiation by stepping up R&D budgets in order to gain a competitive advantage over their competitors.

Consumer electronics and smartphone producers are establishing alliances with display technology manufacturers in order to outsource the manufacturing of electronic display related components. For instance, Apple Inc. is known to procure advanced OLED screens for its flagship iPhone models from LG Display Co Ltd and the panel-making unit of Samsung Electronics Co Ltd since these screens offer better picture quality and they are thinner than the mainstay liquid crystal display screens.

Electronic Display Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 586.9 billion

Revenue forecast in 2022

USD 733.7 billion

Growth Rate

CAGR of 11.5% from 2015 to 2022

Base year for estimation

2015

Historical data

2013 - 2015

Forecast period

2015 - 2022

Quantitative units

Revenue in USD million/billion and CAGR from 2015 to 2022

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Korea; Taiwan; Brazil; Mexico; Saudi Arabia; UAE

Key companies profiled

ActiveLight Inc.; AU Optronics; Casio Computers Co. Ltd.; LG Electronics; Toshiba Corporation; Sony Corporation; Zenith Electronics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global electronic display market size was estimated at USD 523.1 billion in 2019 and is expected to reach USD 586.9 billion in 2020.

b. The global electronic display market is expected to grow at a compound annual growth rate of 11.5% from 2015 to 2022 to reach USD 733.7 billion by 2022.

b. Asia Pacific dominated the electronic display market with a share of 50.0% in 2019. This is attributable to lower manufacturing costs combined with less stringent government regulations in the region leading to major technology giants establishing its manufacturing bases in the region.

b. Some key players operating in the electronic display market include ActiveLight Inc., AU Optronics, Casio Computers Co. Ltd., LG Electronics, Toshiba Corporation, Sony Corporation, and Zenith Electronics Corporation.

b. Key factors that are driving the market growth include Technological advancements, expansion of the consumer electronics industry, and increasing applications across the different end-use segments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."