- Home

- »

- Healthcare IT

- »

-

Electronic Health Records Market Size & Share Report, 2030GVR Report cover

![Electronic Health Records Market Size, Share & Trends Report]()

Electronic Health Records Market Size, Share & Trends Analysis Report By Product (Client-Server Based, Web-Based), By Type (Acute, Ambulatory, Post-Acute), By End Use, By Business Models, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-394-2

- Number of Report Pages: 154

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Electronic Health Records Market Trends

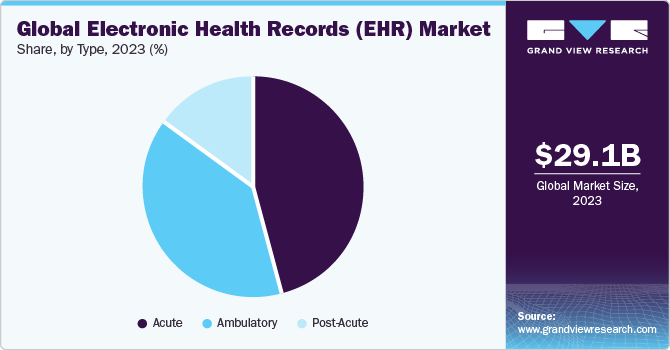

The global electronic health records market size was estimated at USD 29.06 billion in 2023 and it is anticipated to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030. Government initiatives to encourage healthcare IT usage is a key driver to this market. For instance, My Health Record is a national digital health record platform in Australia. Every Australian citizen has a “My Health Record” unless they have chosen that they don’t want it. The agency claims that by the end of 2022, all healthcare providers in the country will be able to contribute to and use healthcare information available on the platform. Moreover, the introduction of technologically advanced healthcare services is also expected to drive electronic health record (EHR) market growth.

The spread of COVID-19 has put a lot of pressure on healthcare organizations since the beginning of 2020. The pandemic has negatively impacted the revenue of major market players due to a decline in new business bookings as certain client purchasing decisions and projects were delayed to focus on treating patients, procuring necessary medical supplies, and managing their organizations through this crisis. Also, companies such as Allscripts experienced delays in deals with upfront software revenue and professional services implementations across their outpatient and inpatient bases.

New expansion activities, product approvals, product launches, partnerships, and acquisitions have positively impacted the EHR market in recent years. Furthermore, there has been a significant increase in the demand for electronic health records due to the growing digitalization which in turn is fueling the market growth.

Rising demand for centralization & streamlining of healthcare administration is also anticipated to drive the market growth. Centralization of health information management is driven by a value-based model which aims towards streamlining operations, standardizing processes, reduction of costs, and improving the quality of care that results in patient satisfaction.

Additionally, an increasing number of mergers & acquisitions by market players are also boosting the market growth. For instance, in January 2021, Allscripts Healthcare Solutions announced a strategic partnership with the U.S Orthopedic Alliance (USOA). This partnership is aimed at bringing efficient infrastructure designed to assist orthopedic practices scale with agility, improving EHR implementation timelines, providing evidence-based guidelines to support evolving clinical protocols, and creating community-wide connectivity with value-based care analytics.

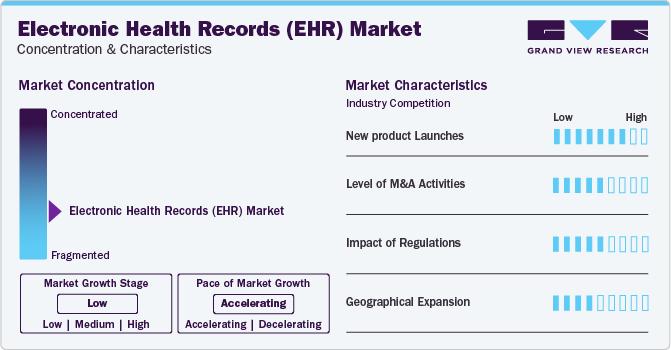

Market Concentration & Characteristics

New Product Launches: Market players in the electronic health records industry are launching new products to expand their reach and increase availability in different regions. For instance, in March 2022, GE Healthcare launched its Edison Digital Health Platform in to help healthcare providers accelerate their digital transformation and meet the growing demand for electronic health records. This shows how companies are investing in new technology to provide better healthcare services to their clients.

Level of M&A Activities: Mergers and acquisitions in the electronic health records (EHR) market are increasing, with several companies acquiring smaller players to strengthen their market position, expand product portfolios, and improve competencies. For instance, in September 2023, Thoma Bravo acquired NextGen Healthcare, Inc., a leading EHR systems manufacturer, to expand its capabilities in the market.

Impact of regulation: Regulations for EHR are evolving globally, with strong government support through regulatory reforms favoring market growth. In Europe, government bodies are driving the development and implementation of EHR in healthcare facilities. In the US, the HITECH Act established the Medicare and Medicaid EHR Incentive Programs to incentivize healthcare providers to adopt and use certified EHR technology.

Geographical Expansion:Several market players are involved in geographical expansion to enhance capabilities and have a direct presence in countries having high demand. For instance, in June 2021, Greenway Health, LLC expanded its geographical presence by opening its new office in Bengaluru, India. The company aims toward rapid product and software execution, revenue growth, and client success, through this expansion activity.

Product Insights

The web-based EHR segment led the market and accounted for more than 55% share of the global revenue in 2023. This market share is attributed to their popularity amongst the physicians and healthcare providers, which operate on a smaller scale. This is because web-based EHRs can be installed without the requirement of in-house servers and can also offer extensive customizations & improvements, as per need.

The client server-based EHR segment is anticipated to show significant growth over the forecast period. Client-server-based EHRs provides a safer alternative for users as it offers in-house data storage, hence preventing data theft. These can also be customized as per customer requirements and also are a favorable option in the case of multi-physician facilities. Furthermore, they do not require a stable internet connection as compared to web-based EHRs, which further drives the market growth.

Type Insights

Based on type, the market is classified into acute EHR, ambulatory EHR, and post-acute EHR. The acute EHR segment held the largest market share in 2023. The growth can be attributed to the government initiatives for the adoption of EHRs in small-scale facilities. For instance, acute care hospitals in the U.S. which are covered under the inpatient prospective payment system (IPPS) are eligible for the Medicare incentive payment system.

Ambulatory EHRs are meant for use in outpatient care facilities and small practices. Government support for the adoption of ambulatory EHRs, especially during the COVID-19 pandemic, is expected to boost market growth. Easy usage as compared to the inpatient EHRs is expected to drive the market growth. These EHRs deal with a single practice and its patient, instead of a complex web of hospital departments.

Post-acute EHRs are mainly used for providing rehabilitation services that patients receive after a stay in an acute care hospital. Post-acute care facilities consist of inpatient rehabilitation centers & hospitals, home health agencies, and long-term care hospitals. Rising spending on post-acute care facilities is anticipated to boost the market growth.

End Use Insights

Based on end-use, the market is classified into hospitals and ambulatory care. The hospitals' segment held the largest market share in 2023. The growth can be attributed to the large amount of medical data generated in hospitals. Furthermore, the cost of installation in EHRs is less in hospitals as compared to ambulatory care centers, which also boosts the market growth.

The market for Electronic Health Records (EHR) in ambulatory surgical centers is expanding, with an increasing number of facilities adopting this technology. A survey conducted by the Ambulatory Surgery Center Association in 2021 found that 54.6% of respondents reported using an EHR in ASCs. Additionally, the majority of physician-owned ASCs (62.2%) have implemented an EHR, with new facilities more likely to adopt this technology from the start.

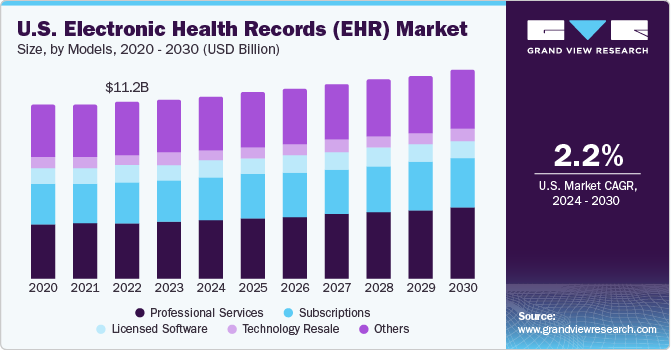

Business Model Insights

Based on the business model, the market is classified into licensed software, technology resale, subscriptions, professional services, and others. The professional services segment held the largest market share of in 2023. Professional services help healthcare systems in the implementation of information systems in their organizations. They are usually in the form of project management, technical & application expertise, clinical process optimization, regulatory consulting, and training of end-users for designing & implementing EHR systems.

Within the technology resale segment, licensed software is bundled with IPs of other companies in the form of sublicenses for creating complete technology solutions for healthcare systems. Licensed software includes application software, architecture, executable & referential knowledge, and data & algorithms. Other business models include managed services, support & maintenance, and other such services.

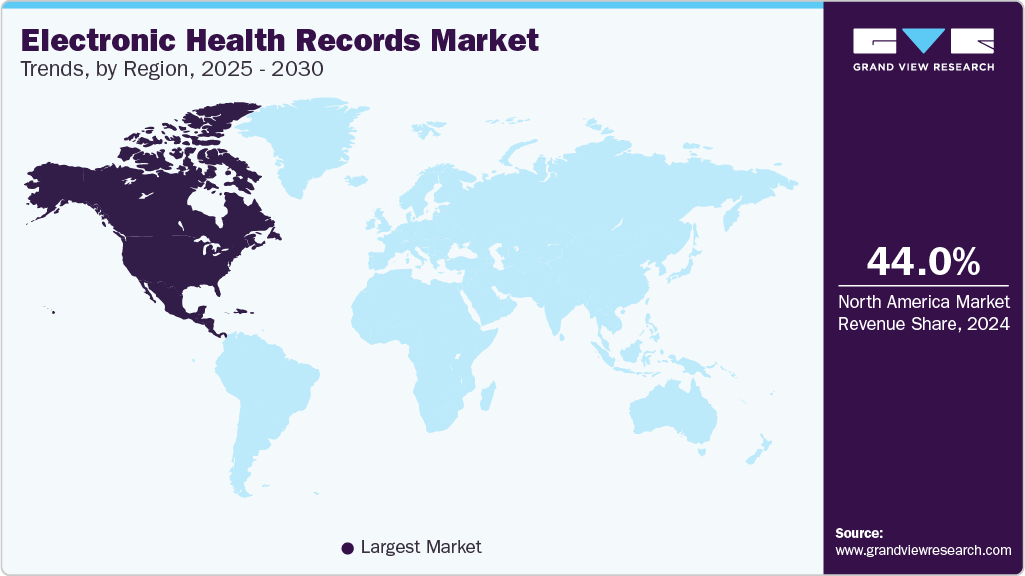

Regional Insights

North America dominated the market, accounting for about 43.76% share of global revenue in 2023. The major factor contributing to the growth of this region is the policies that support the adoption of electronic health records & the availability of infrastructure with high digital literacy. Furthermore, favorable government regulations and acts for monitoring the safety of healthcare IT solutions are expected to fuel the electronic health record market in U.S. For instance, in May 2020, the federal government proposed the Federal Health IT Strategic Plan 2020-2025, which mandates meaningful usage of EHR by healthcare providers.

U.S. Electronic health record market

Competition in the EHR market in the U.S. is driven by several factors, including growing demand for improved healthcare technology, regulatory requirements, and the rising need for interoperability between different EHR systems. Many companies offer EHR systems in the U.S., including large established companies such as Epic Systems, NextGen Healthcare, eClinicalWorks, Cerner Corporation, and Allscripts. These companies compete on factors such as system functionality, ease of use, cost, and customer support.

Asia Pacific is anticipated to demonstrate lucrative growth during the forecast period. This growth can be attributed to the ever-increasing demand for quality standards & services which is boosting the digitalization of healthcare in the region. The Ministry of Health in China has defined an action plan for the usage of services related to e-health across the country encompassing broad areas of medical services, insurance plans, and with a large focus on the adoption of electronic record, systems to allow data sharing across the national healthcare system.

Europe electronic health record accounted for second largest market share in 2023, owing to the presence of developed economies expected to fuel the EHR market in Europe during the forecast period. The Digital Single Market Strategy by the European Commission furnishes consumers and businesses with access to online services and goods across Europe, thus providing necessary conditions for the growth of the digital network and allied services, which is expected to maximize growth potential of the European economy.

Key Companies & Market Share Insights

The market leaders are involved in, expansions, product launches, partnerships & collaborations, and mergers & acquisitions to sustain the competition. Established organizations and small players are investing in mergers & acquisitions to gain a competitive edge. For instance, in August 2023, WellSky acquired Experience Care, a technology company offering EHR software solutions for long-term care and post-acute providers. Experience Care's electronic health record platform, NetSolutions, has served 150 long-term care clients with 850 facilities. The acquisition will help providers increase efficiencies, improve performance, and advance resident care by turning data into meaningful information.

Key Electronic Health Records Companies:

- Cerner Corporation (Oracle)

- GE Healthcare

- Veradigm LLC (Allscripts Healthcare, LLC)

- Epic Systems Corporation

- eClinicalWorks

- Greenway Health, LLC

- NextGen Healthcare, Inc.

- Medical Information Technology, Inc. (Meditech)

- Health Information Management Systems

- CPSI

- AdvancedMD, Inc.

- CureMD Healthcare

- McKesson Corporation

Recent Developments

-

In July 2023, NextGen Healthcare announced the expansion of its collaboration with the American Podiatric Medical Association (APMA). As per this collaboration, the ‘NextGen Office’ cloud-based small practice EHR and practice management solution is the sole platform to incorporate blueprints exclusively developed with APMA. These podiatry blueprints address several issues, including diabetes, dermatitis, infection, and injuries.

-

In June 2023, CPSI and the MidCoast Health System expanded their four-year partnership, through the implementation of CPSI’s EHR, accounts receivables services, and IT-managed services at the ‘Crockett Medical Center’ critical access hospital in Texas. Other MidCoast Health System hospitals to successfully implement CPSI healthcare solutions in recent years include the El Campo Memorial Hospital and the Palacios Community Medical Center, among others.

-

In May 2023, MEDITECH announced an agreement with Canada Health Infoway to connect with the latter’s e-prescribing service ‘PrescribeIT’. This agreement would allow prescribers in Canada to electronically transmit a prescription directly from MEDITECH’s Expanse EHR to the patient’s preferred choice of pharmacy. The functionality would allow ease of creation of new prescriptions, allow existing prescription renewal, and also cancel prescription requests.

-

In April 2023, Microsoft announced an expansion of its strategic partnership with Epic for the development and integration of generative AI into healthcare, through the combination of Epic’s advanced electronic health record software and the scale of Microsoft’s Azure OpenAI Service. The resulting generative AI solutions would help enhance patient care, increase productivity, and improve the financial integrity of health systems worldwide.

-

In February 2023, King’s College Hospital London - Dubai announced a strategic partnership with Oracle Cerner to accelerate innovation, through the utilization of Oracle Cloud Infrastructure (OCI) services via the Oracle Cloud Dubai Region for operating and managing the upgraded and enhanced electronic medical records system for KCH Dubai.

-

In February 2023, Oracle Cerner announced that the province of Nova Scotia, in partnership with Nova Scotia Health Authority (NSHA) and IWK Health (IWK), had signed a 10-year agreement for implementing an integrated electronic care record in the entire province. Known in Nova Scotia as “One Person One Record”, it is intended to provide clinicians easier access to real-time health information and allow healthcare workers to spend more time with their patients.

-

In January 2023, Veradigm (formerly Allscripts) announced that the Veradigm Network EHR Data would be available within the OMOP CDM format. Veradigm Network EHR is a complete statistically de-identified dataset with three integrated EHR sources. This transformation is expected to facilitate data sales for clients who require it to be delivered in OMOP format.

-

In January 2022, Health Information Management Systems, launched AxiaGram, a mobile communication care app, which can seamlessly work with an existing EHR platform. The company expanded its product portfolio with this.

-

In May 2022, CPSI entered into a partnership agreement with Medicomp Systems to launch Quippe Clinical Lens. The new technology aims to empower EHR users with proper access to clinical information at PoC.

Electronic Health Records Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 29.06 billion

Revenue forecast in 2030

USD 38.5 billion

Growth Rate

CAGR of 4.1% from 2024 To 2030

Actual estimates

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2024 To 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, type, end use, business models, application

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S., Canada, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Cerner Corporation (Oracle),GE Healthcare, Veradigm LLC (Allscripts Healthcare, LLC), Epic Systems Corporation, eClinicalWorks, Greenway Health, LLC, NextGen Healthcare, Inc., Medical Information Technology, Inc. (Meditech), Health Information Management Systems, CPSI, AdvancedMD, Inc., CureMD Healthcare, McKesson Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Health Records Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global electronic health records (EHR) market report on the basis of product, type, end use, business models, application and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Client Server-Based EHR

-

Web-Based EHR

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Acute

-

Ambulatory

-

Post-Acute

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospital Use

-

Ambulatory Use

-

Physician’s Clinic

-

Laboratories

-

Pharmacy

-

-

-

Business Models Outlook (Revenue, USD Million; 2018 - 2030)

-

Licensed Software

-

Technology Resale

-

Subscriptions

-

Professional Services

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Cardiology

-

Neurology

-

Radiology

-

Oncology

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electronic health records market size was estimated at USD 28.1 billion in 2022 and is expected to reach USD 29.0 billion in 2023.

b. The global electronic health records market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 38.5 billion by 2030.

b. The web-based electronic health records segment led the global market in 2022.

b. The acute type segment dominated the global electronic health records market with a share of over 45% in 2022.

b. The professional services segment dominated the global electronic health records market with over 31% share in 2022.

Table of Contents

Chapter 1 Electronic Health Records Market: Methodology and Scope

1.1 Market Segmentation and Scope

1.1.1 Segment scope

1.1.2 Regional scope

1.1.3 Estimates and forecast timeline

1.2 Research Methodology

1.3 Information procurement

1.3.1 Purchased database:

1.3.2 GVR’s internal database

1.3.3 Secondary sources

1.3.4 Primary research

1.3.5 Details of primary research

1.3.5.1 Data for primary interviews in North America

1.3.5.2 Data for primary interviews in Europe

1.3.5.3 Data for primary interviews in Asia Pacific

1.3.5.4 Data for primary interviews in Middle East and Africa

1.4 Information or Data Analysis

1.4.1 Data analysis models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.7 List of Secondary Sources

1.8 List of Primary Sources

1.9 Objectives

1.9.1 Objective 1

1.9.2 Objective 2

1.9.3 Objective 3

1.9.4 Objective 4

Chapter 2 Electronic Health Records Market: Executive Summary

2.1 Electronic Health Records (EHR) Market Summary

2.2 Segment Outlook

2.3 Market Lineage Outlook

2.3.1 Parent market outlook

2.3.2 Ancillary market outlook

2.4 Penetration & Growth Prospect Mapping

Chapter 3 Electronic Health Records (EHR) Market: Variables, Trends & Scope

3.1 Electronic Health Records (EHR) Market Dynamics

3.1.1 Market driver analysis

3.1.1.1 Government initiatives to encourage healthcare IT usage

3.1.1.2 Introduction to technologically advanced healthcare services

3.1.1.3 Rising demand for centralization and streamlining of healthcare administration

3.1.1.4 Increasing number of mergers & acquisitions by market players

3.1.2 Market restrains analysis

3.1.2.1 Reluctance to adopt ehrs among physicians and patients

3.1.2.2 High costs associated with ehr implementation

3.1.3 Market opportunity analysis

3.1.3.1 Government initiatives to ensure better health in developing economies

3.1.3.2 Increasing use of cloud-based EHRs

3.1.4 Market challenges analysis

3.1.4.1 Data security and privacy concerns for patient information

3.1.4.2 Issues related to interoperability of various systems related to ehr

3.2 Electronic Health Records (EHR) Market: Market Analysis Tools

3.2.1 Industry analysis - Porter’s

3.2.1.1 Bargaining Power of Suppliers

3.2.1.2 Bargaining Power of Buyers

3.2.1.3 Threat of Substitutes

3.2.1.4 Threat of New Entrants

3.2.1.5 Intensity of Rivalry

3.2.2 EHR - SWOT Analysis, by Factor (Political & Legal, Economic, and Technological)

3.2.2.1 Political & Legal

3.2.2.2 Economic

3.2.2.3 Technological

3.2.3 Major Deals and Strategic Alliances

3.2.4 Regulatory Framework for EHR Market

3.2.4.1 Regulatory Landscape

3.2.4.1.1 List of Regulations, by Country

3.2.4.2 Impact Analysis of Regulatory Framework

3.2.5 Electronic Health Records (EHR) - Unmet Need Analysis

3.2.6 Electronic Health Records (EHR) - Company Market Share, Global, 2022

Chapter 4 Electronic Health Records (EHR) Market: Competitive Analysis

4.1 Company market position analysis

4.2 Heat Map Analysis

4.3 List of market players

Chapter 5 Impact of COVID-19 on Electronic Health Records (EHR) Market

5.1 Current and Future Impact Analysis

5.1.1 Disease Prevalence Analysis

5.2 Opportunity Analysis

5.2.1 Market Entry Strategies

Chapter 6 Electronic Health Records (EHR) Market: Segment Analysis, By Product, 2017 - 2030 (USD Million)

6.1 Definition and Scope

6.2 Product Market Share Analysis, 2022 & 2030

6.3 Electronic Health Records (EHR) Market, by Product, 2017 - 2030

6.3.1 Client server-based EHR

6.3.1.1 Client server-based EHR market, 2017 - 2030 (USD Million)

6.3.2 Web-based EHR

6.3.2.1 Web-based EHR market, 2017 - 2030 (USD Million)

Chapter 7 Electronic Health Records (EHR) Market: Segment Analysis, By Type, 2017 - 2030 (USD Million)

7.1 Definition and Scope

7.2 Type Market Share Analysis, 2022 & 2030

7.3 Electronic Health Records (EHR) Market, by Type, 2017 - 2030

7.3.1 Acute EHR

7.3.1.1 Acute EHR market, 2017 - 2030 (USD Million)

7.3.2 Ambulatory EHR

7.3.2.1 Ambulatory EHR market, 2017 - 2030 (USD Million)

7.3.3 Post-acute EHR

7.3.3.1 Post-acute EHR market, 2017 - 2030 (USD Million)

Chapter 8 Electronic Health Records (EHR) Market: Segment Analysis, By End Use, 2017 - 2030 (USD Million)

8.1 Definition and Scope

8.2 End Use Market Share Analysis, 2022 & 2030

8.3 Global Electronic Health Records (EHR) Market, by End Use, 2017 - 2030

8.4 Market Size & Forecasts and Trend Analyses, 2017 - 2030

8.4.1 Hospital Use

8.4.1.1 Hospital Use market, 2017 - 2030 (USD Million)

8.4.2 Ambulatory Use

8.4.2.1 Ambulatory Use market, 2017 - 2030 (USD million)

Chapter 9 Electronic Health Records (EHR) Market: Segment Analysis, By Business Models, 2017 - 2030 (USD Million)

9.1 Definition and Scope

9.2 Business Models Market Share Analysis, 2022 & 2030

9.3 Global Electronic Health Records (EHR) Market, by Business Models, 2017 - 2030

9.4 Market Size & Forecasts and Trend Analyses, 2017 - 2030

9.4.1 Licensed Software

9.4.1.1 Licensed software market, 2017 - 2030 (USD Million)

9.4.2 Technology Resale

9.4.2.1 Technology resale market, 2017 - 2030 (USD Million)

9.4.3 Subscriptions

9.4.3.1 Subscriptions market, 2017 - 2030 (USD Million)

9.4.4 Professional Services

9.4.4.1 Professional services market, 2017 - 2030 (USD Million)

9.4.5 Others

9.4.5.1 Others market, 2017 - 2030 (USD Million)

Chapter 10 Electronic Health Records (EHR) Market: Regional Market Analysis, By Product, By Type, and By End Use 2017 - 2030 (USD Million)

10.1 Definition & Scope

10.2 Regional Market Share Analysis, 2022 & 2030

10.3 Regional Market Snapshot

10.4 Market Size, & Forecasts, and Trend Analysis, 2017 - 2030

10.5 North America

10.5.1 North America Market estimates and forecast, by country, 2017 - 2030 (USD Million)

10.5.2 U.S.

10.5.2.1 U.S. Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.5.3 Canada

10.5.3.1 Canada Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.6 Europe

10.6.1 Europe Electronic Health Records (EHR) Market, by country, 2017 - 2030 (USD Million)

10.6.2 U.K.

10.6.2.1 U.K. Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.6.3 Germany

10.6.3.1 Germany Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.6.4 France

10.6.4.1 France Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.6.5 Italy

10.6.5.1 Italy Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.6.6 Spain

10.6.6.1 Spain Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.6.7 Netherlands

10.6.7.1 Netherlands Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.6.8 Sweden

10.6.8.1 Sweden Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.6.9 Russia

10.6.9.1 Russia Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.7 Asia Pacific

10.7.1 Asia Pacific Electronic Health Records (EHR) Market, by country, 2017 - 2030 (USD million)

10.7.2 Japan

10.7.2.1 Japan Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.7.3 China

10.7.3.1 China Electronic Health Records (EHR) Market, 2017 - 2030 (USD million)

10.7.4 India

10.7.4.1 India Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.7.5 Australia

10.7.5.1 Australia Electronic Health Records (EHR) Market, 2017 - 2030 (USD million)

10.7.6 Singapore

10.7.6.1 Singapore Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.8 Latin America

10.8.1 Latin America Electronic Health Records (EHR) Market, by country, 2017 - 2030 (USD Million)

10.8.2 Brazil

10.8.2.1 Brazil Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.9 MEA

10.9.1 MEA Electronic Health Records (EHR) Market, by country 2017 - 2030 (USD Million)

10.9.2 South Africa

10.9.2.1 South Africa Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

10.9.3 Saudi Arabia

10.9.3.1 Saudi Arabia Electronic Health Records (EHR) Market, 2017 - 2030 (USD Million)

Chapter 11 Electronic Health Records (EHR) Market - Competitive Analysis

11.1 Company Profiles

11.2 Cerner Corporation (Oracle)

11.2.1 Company Overview

11.2.2 Service Benchmarking

11.2.3 Financial Performance

11.2.4 Strategic Initiatives

11.3 GE Healthcare

11.3.1 Company Overview

11.3.2 Service Benchmarking

11.3.3 Financial Performance

11.3.4 Strategic Initiatives

11.4 Allscripts Healthcare, LLC

11.4.1 Company Overview

11.4.2 Service Benchmarking

11.4.3 Financial Performance

11.4.4 Strategic Initiatives

11.5 McKesson Corporation

11.5.1 Company Overview

11.5.2 Service Benchmarking

11.5.3 Financial Performance

11.5.4 Strategic Initiatives

11.6 Epic Systems Corporation

11.6.1 Company Overview

11.6.2 Service Benchmarking

11.6.3 Financial Performance

11.6.4 Strategic Initiatives

11.7 NextGen Healthcare, Inc.

11.7.1 Company Overview

11.7.2 Service Benchmarking

11.7.3 Financial Performance

11.7.4 Strategic Initiatives

11.8 eClinicalWorks

11.8.1 Company Overview

11.8.2 Service Benchmarking

11.8.3 Financial Performance

11.8.4 Strategic Initiatives

11.9 Medical Information Technology, Inc.

11.9.1 Company Overview

11.9.2 Service Benchmarking

11.9.3 Financial Performance

11.9.4 Strategic Initiatives

11.10 Health Information Management Systems

11.10.1 Company Overview

11.10.2 Service Benchmarking

11.10.3 Financial Performance

11.10.4 Strategic Initiatives

11.11 CPSI

11.11.1 Company Overview

11.11.2 Service Benchmarking

11.11.3 Financial Performance

11.11.4 Strategic Initiatives

11.12 AdvancedMD, Inc.

11.12.1 Company Overview

11.12.2 Service Benchmarking

11.12.3 Financial Performance

11.12.4 Strategic Initiatives

11.13 CureMD Healthcare

11.13.1 Company Overview

11.13.2 Service Benchmarking

11.13.3 Financial Performance

11.13.4 Strategic Initiatives

11.14 Greenway Health, LLC

11.14.1 Company Overview

11.14.2 Service Benchmarking

11.14.3 Financial Performance

11.14.4 Strategic Initiatives

List of Tables

TABLE 1 List of secondary sources

TABLE 2 Primary interview details: North America

TABLE 3 Primary interview details: Europe

TABLE 4 Primary interview details: APAC

TABLE 5 Primary interview details: Latin America

TABLE 6 Primary interview details: MEA

TABLE 7 List of market players

TABLE 8 List of regulations, by Country

TABLE 9 Adoption Stages of EHR in Healthcare Facilities

TABLE 10 North America Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 11 North America Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 12 North America Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 13 North America Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 14 U.S. Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 15 U.S. Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 16 U.S. Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 17 U.S. Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 18 Canada Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 19 Canada Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 20 Canada Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 21 Canada Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 22 Europe Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 23 Europe Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 24 Canada Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 25 Canada Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 26 Canada Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 27 U.K. Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 28 U.K. Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 29 U.K. Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 30 U.K. Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 31 Germany Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 32 Germany Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 33 Germany Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 34 Germany Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 35 France Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 36 France Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 37 France Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 38 France Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 39 Italy Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 40 Italy Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 41 Italy Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 42 Italy Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 43 Spain Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 44 Spain Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 45 Spain Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 46 Spain Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 47 Netherlands Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 48 Netherlands Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 49 Netherlands Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 50 Netherlands Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 51 Sweden Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 52 Sweden Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 53 Sweden Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 54 Sweden Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 55 Russia Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 56 Russia Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 57 Russia Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 58 Russia Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 59 Asia Pacific Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 60 Asia Pacific Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 61 Asia Pacific Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 62 Asia Pacific Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 63 Japan Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 64 Japan Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 65 Japan Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 66 Japan Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 67 China Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 68 China Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 69 China Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 70 China Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 71 India Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 72 India Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 73 India Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 74 India Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million

TABLE 75 Australia Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 76 Australia Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 77 Australia Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 78 Australia Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 79 Singapore Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 80 Singapore Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 81 Singapore Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 82 Singapore Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 83 Latin America Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 84 Latin America Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 85 Latin America Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 86 Latin America Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 87 Brazil Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 88 Brazil Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 89 Brazil Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 90 Brazil Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 91 MEA Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 92 MEA Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 93 MEA Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 94 MEA Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 95 South Africa Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 96 South Africa Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 97 South Africa Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 98 South Africa Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 99 Saudi Arabia Electronic health records (EHR) market estimates and forecasts, by product, 2017 - 2030 (USD million)

TABLE 100 Saudi Arabia Electronic health records (EHR) market estimates and forecasts, by type, 2017 - 2030 (USD million)

TABLE 101 Saudi Arabia Electronic health records (EHR) market estimates and forecasts, by end use, 2017 - 2030 (USD million)

TABLE 102 Saudi Arabia Electronic health records (EHR) market estimates and forecasts, by business models, 2017 - 2030 (USD million)

TABLE 103 List of key market players

List of Figures

FIG. 1 Electronic Health Records (EHR) market segmentation

FIG. 2 Market research process

FIG. 3 Information procurement

FIG. 4 Primary research pattern

FIG. 5 Primary interviews in North America

FIG. 6 Primary interviews in Europe

FIG. 7 Primary interviews in Asia Pacific

FIG. 8 Primary interviews in Middle East and Africa

FIG. 9 Market research approaches

FIG. 10 Value-chain-based sizing & forecasting

FIG. 11 Market formulation & validation

FIG. 12 Commodity Flow Analysis

FIG. 13 Electronic Health Records (EHR) Market outlook (2022) (USD Million)

FIG. 14 Segment Outlook

FIG. 15 Parent market outlook

FIG. 16 Ancillary market outlook

FIG. 17 Penetration & growth prospect mapping by product, 2022

FIG. 18 Market participant categorization

FIG. 19 Market driver relevance analysis (Current & future impact)

FIG. 20 Market restraint relevance analysis (Current & future impact)

FIG. 21 Barriers to EHR Adoption in the U.S.

FIG. 22 Risk Levels at Various Levels of Data Storage

FIG. 23 Porter’s five forces analysis

FIG. 24 Percent of countries within regions having legislations for sharing EHRs between healthcare facilities

FIG. 25 Strategy mapping

FIG. 26 Company market position analysis

FIG. 27 Company Market Share, 2022 - Global

FIG. 28 Heat Map analysis

FIG. 29 COVID-19 new cases in major 35 countries around the world

FIG. 30 Electronic Health Records (EHR) market: Product movement analysis

FIG. 31 Electronic Health Records (EHR) market Product outlook: Key takeaways

FIG. 32 Client Server-based EHR market, 2017 - 2030 (USD Million)

FIG. 33 Web-based EHR market, 2017 - 2030 (USD Million)

FIG. 34 Electronic Health Records (EHR) market: Type movement analysis

FIG. 35 Electronic Health Records (EHR) market type outlook: Key takeaways

FIG. 36 Acute EHR market, 2017 - 2030 (USD Million)

FIG. 37 Ambulatory EHR market, 2017 - 2030 (USD Million)

FIG. 38 Post-acute EHR market, 2017 - 2030 (USD Million)

FIG. 39 Electronic Health Records (EHR) market: End-use movement analysis

FIG. 40 Electronic Health Records (EHR) market end-use outlook: Key takeaways

FIG. 41 Percentage of non-federal acute care hospitals, by type, possessing certified EHRs in the U.S., 2017

FIG. 42 Hospital use market, 2017 - 2030 (USD Million)

FIG. 43 Ambulatory use market, 2017 - 2030 (USD Million)

FIG. 44 Electronic Health Records (EHR) market: Business models movement analysis

FIG. 45 Electronic Health Records (EHR) market business models outlook: Key takeaways

FIG. 46 Licensed software market, 2017 - 2030 (USD Million)

FIG. 47 Technology resale market, 2017 - 2030 (USD Million)

FIG. 48 Subscriptions market, 2017 - 2030 (USD Million)

FIG. 49 Professional services market, 2017 - 2030 (USD Million)

FIG. 50 Others market, 2017 - 2030 (USD Million)

FIG. 51 Regional outlook, 2022 & 2030

FIG. 52 Regional marketplace: Key takeaways

FIG. 53 North America Electronic Health Records (EHR) market, by country, 2017 - 2030 (USD Million)

FIG. 54 U.S. Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 55 Canada Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 56 Europe Electronic Health Records (EHR) market, by country, 2017 - 2030 (USD Million)

FIG. 57 U.K. Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 58 Germany Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 59 France Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 60 Italy Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 61 Spain Electronic Health Records (EHR) market, 2017 - 2030 (USD million)

FIG. 62 Netherlands Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 63 Sweden Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 64 Russia Electronic Health Records (EHR) market, 2017 - 2030 (USD million)

FIG. 65 Asia Pacific Electronic Health Records (EHR) market, by country, 2017 - 2030 (USD Million)

FIG. 66 Japan Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 67 China Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 68 India Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 69 Australia Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 70 Singapore Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 71 Latin America Electronic Health Records (EHR) market, by country, 2017 - 2030 (USD Million)

FIG. 72 Brazil Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 73 MEA Electronic Health Records (EHR) market, by country, 2017 - 2030 (USD Million)

FIG. 74 South Africa Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)

FIG. 75 Saudi Arabia Electronic Health Records (EHR) market, 2017 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Global Electronic Health Records (EHR) Product Outlook (Revenue, USD Million, 2018 - 2030

- Client Server-Based EHR

- Web-Based EHR

- Global Electronic Health Records (EHR) Type Outlook (Revenue, USD Million, 2018 - 2030)

- Acute

- Ambulatory

- Post-Acute

- Global Electronic Health Records (EHR) End Use Outlook (Revenue, USD Million, 2018 - 2030

- Hospital Use

- Ambulatory Use

- Global Electronic Health Records (EHR) Business Models Outlook (Revenue, USD Million; 2018 - 2030)

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Global Electronic Health Records (EHR) Application Outlook (Revenue, USD Million; 2018 - 2030)

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Global Electronic Health Records (EHR) Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- North America Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- North America Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- North America Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- North America Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- U.S.

- U.S. Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- U.S. Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- U.S. Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- U.S. Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- U.S. Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- U.S. Electronic health records (EHR) market by product

- Canada

- Canada Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Canada Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Canada Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Canada Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Canada Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Canada Electronic health records (EHR) market by product

- North America Electronic health records (EHR) market by product

- Europe

- Europe Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Europe Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Europe Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Europe Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Europe Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- UK

- UK Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- UK Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- UK Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- UK Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- UK Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- UK Electronic health records (EHR) market by product

- Germany

- Germany Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Germany Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Germany Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Germany Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Germany Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Germany Electronic health records (EHR) market by product

- France

- France Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- France Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- France Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- France Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- France Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- France Electronic health records (EHR) market by product

- Italy

- Italy Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Italy Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Italy Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Italy Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Italy Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Italy Electronic health records (EHR) market by product

- Spain

- Spain Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Spain Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Spain Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Spain Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Spain Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Spain Electronic health records (EHR) market by product

- Sweden

- Sweden Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Sweden Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Sweden Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Sweden Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Sweden Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Sweden Electronic health records (EHR) market by product

- Denmark

- Denmark Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Denmark Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Denmark Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Denmark Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Denmark Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Denmark Electronic health records (EHR) market by product

- Norway

- Norway Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Norway Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Norway Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Norway Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Norway Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Norway Electronic health records (EHR) market by product

- Europe Electronic health records (EHR) market by product

- Asia Pacific

- Asia Pacific Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Asia Pacific Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Asia Pacific Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Asia Pacific Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Asia Pacific Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Japan

- Japan Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Japan Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Japan Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Japan Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Japan Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Japan Electronic health records (EHR) market by product

- China

- China Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- China Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- China Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- China Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- China Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- China Electronic health records (EHR) market by product

- India

- India Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- India Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- India Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- India Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- India Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- India Electronic health records (EHR) market by product

- Australia

- Australia Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Australia Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Australia Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Australia Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Australia Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Australia Electronic health records (EHR) market by product

- South Korea

- South Korea Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- South Korea Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- South Korea Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- South Korea Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- South Korea Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- South Korea Electronic health records (EHR) market by product

- Thailand

- Thailand Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Thailand Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Thailand Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Thailand Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Thailand Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Thailand Electronic health records (EHR) market by product

- Asia Pacific Electronic health records (EHR) market by product

- Latin America

- Latin America Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Latin America Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Latin America Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Latin America Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Latin America Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Brazil

- Brazil Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Brazil Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Brazil Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Brazil Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Brazil Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Brazil Electronic health records (EHR) market by product

- Mexico

- Mexico Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Mexico Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Mexico Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Mexico Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Mexico Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Mexico Electronic health records (EHR) market by product

- Argentina

- Argentina Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Argentina Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Argentina Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Argentina Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Argentina Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Argentina Electronic health records (EHR) market by product

- Latin America Electronic health records (EHR) market by product

- Middle East & Africa

- Middle East & Africa Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Middle East & Africa Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Middle East & Africa Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Middle East & Africa Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Middle East & Africa Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- South Africa

- South Africa Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- South Africa Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- South Africa Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- South Africa Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- South Africa Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- South Africa Electronic health records (EHR) market by product

- Saudi Arabia

- Saudi Arabia Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Saudi Arabia Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Saudi Arabia Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Saudi Arabia Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Saudi Arabia Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Saudi Arabia Electronic health records (EHR) market by product

- UAE

- UAE Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- UAE Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- UAE Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- UAE Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- UAE Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- UAE Electronic health records (EHR) market by product

- Kuwait

- Kuwait Electronic health records (EHR) market by product

- Client Server-Based EHR

- Web-Based EHR

- Kuwait Electronic health records (EHR) market by type

- Acute

- Ambulatory

- Post-Acute

- Kuwait Electronic health records (EHR) market by End Use

- Hospital Use

- Ambulatory Use

- Kuwait Electronic health records (EHR) market by business models

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

- Kuwait Electronic health records (EHR) market by application

- Cardiology

- Neurology

- Radiology

- Oncology

- Others

- Kuwait Electronic health records (EHR) market by product

- Middle East & Africa Electronic health records (EHR) market by product

- North America

Electronic Health Records Market Dynamics

Driver: Government Initiatives to Encourage HCIT Usage

The market is growing rapidly due to favorable government initiatives for increasing the adoption of HCIT-based solutions, such as EHRs. For instance, My Health Record is a national digital health record platform in Australia. It is managed by the Australian Digital Health Agency. Every Australian citizen has a My Health Record unless they have chosen otherwise. Countries, such as Estonia, New Zealand, Finland, Denmark, the UK, and the Netherlands, are capitalizing on electronic prescribing & shared medication records to improve medication management. Furthermore, the federal government offers substantial incentives to physicians who are willing to adopt EHRs in their practice. An average physician who has at least 30% of patients covered by Medicare is eligible for receiving USD 44,000 as a total incentive.

Driver: Introduction of Technologically Advanced Healthcare Services

EHRs provide invaluable data to clinical researchers. This can help them advance their medical knowledge and assist in developing novel treatments for common health issues. A standardized HCIT-based system can provide insights regarding the severity of an outbreak, enabling better preventative measures. These preventative measures can include increased production of vaccines or other medicinal shots. Medical coders and billers are among the most impacted affiliated healthcare workers. As per the Bureau of Labor Statistics, the demand for this sector is estimated to increase by 13% from 2016 to 2026. The introduction of EHRs for medical coding and billing has eased the process as data entering into computerized systems is more convenient than paper-based methods. EHRs can also help minimize the risk of errors in patient data and their financial details. As per the University of Michigan, the cost of outpatient care was reduced by 3% upon shifting to EHRs from paper-based records. This reduction resulted in USD 5.14 savings per patient per month.

Restraint: Reluctance to Adopt EHR Among Physicians and Patients

The implementation of EHRs poses a challenging process for vendors, institutions, and clinicians. Major barriers to the implementation of EHR systems include system costs, administrative, ethical & legal issues, and ineffective implementation due to alert fatigue, in which a person is exposed to a large number of frequent alarms, and hence, becomes desensitized to them. Lack of financial and operational resources also leads to non-adoption of EHRs among physicians & patients. The Healthcare Financial Management Association (HFMA), U.S., stated 9 reasons that are the top barriers to EHR adoption. The absence of computer skills can also lead to the reluctance of physicians to use EHRs. EHRs require a significant level of concentration, typing skills, and familiarity with the application’s user interface, which can appear as a complex process for physicians. Another major obstacle in the adoption of EHRs is the lack of technical training and support from vendors. Uncertainty over RoI is a major barrier to the product adoption. This is because physicians believe that their practices will suffer from substantial financial risks and it could take many years before they experience RoI.

What Does This Report Include?

This section will provide insights into the contents included in this electronic health records market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Electronic health records market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Electronic health records market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the electronic health records market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for electronic health records market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of electronic health records market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-