- Home

- »

- Organic Chemicals

- »

-

Electronic Materials And Chemicals Market Size Report, 2030GVR Report cover

![Electronic Materials And Chemicals Market Size, Share & Trends Report]()

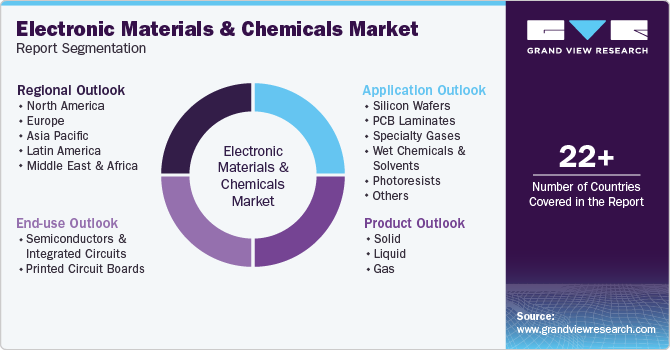

Electronic Materials And Chemicals Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Solid, Liquid), By Application (Silicon Wafers, Photoresists), By End-use (Semiconductors & Integrated Circuits, Printed Circuit Boards), By Region, And Segment Forecasts

- Report ID: 978-1-68038-920-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Materials And Chemicals Market Summary

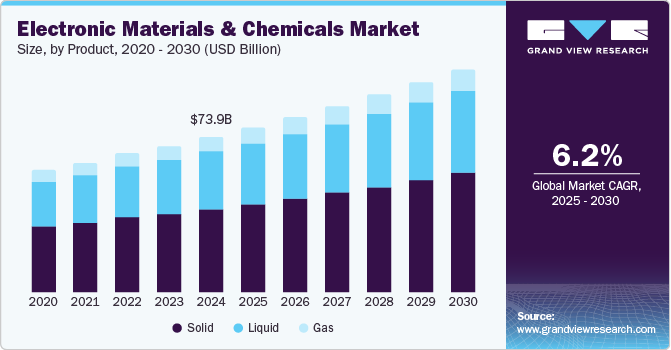

The global electronic materials and chemicals market size was valued at USD 73.94 billion in 2024 and is projected to reach USD 106.11 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. Increasing product demand for manufacturing semiconductors, flat panel displays, and photolithographic printing is expected to propel the growth.

Key Market Trends & Insights

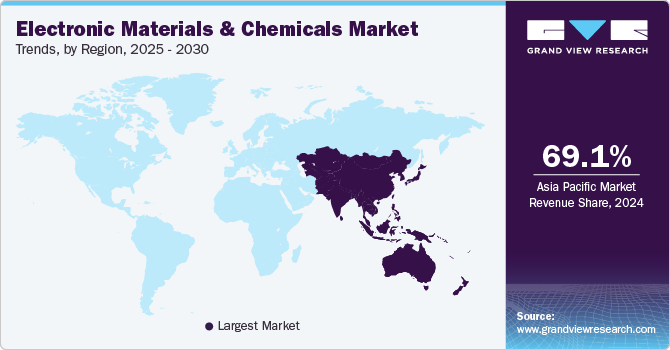

- Asia Pacific dominated the global market and accounted for the largest revenue share of 69.1% in 2024.

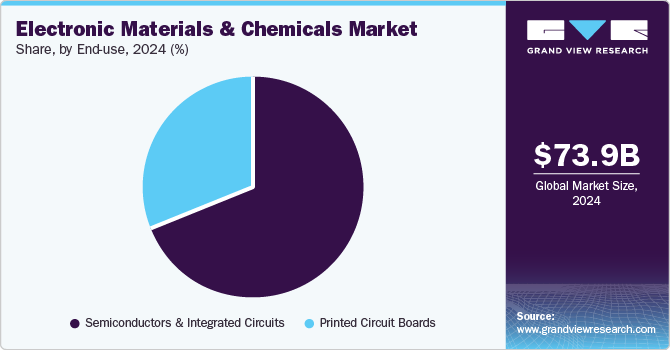

- By end-use, semiconductors and integrated circuits segment led the market and accounted for the largest revenue share of 68.7% in 2024.

- By product, the solid segment dominated the global market with the largest revenue share of 54.1% in 2024.

- By application, the silicon wafers dominated the global market and accounted for the largest revenue share of 43.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 73.94 Billion

- 2030 Projected Market Size: USD 106.11 Billion

- CAGR (2025-2030): 6.2%

- Asia Pacific: Largest market in 2024

Decreasing equipment prices and improved standards of living across various parts of the world is expected to be the key factor driving the consumer electronics industry’s growth, which in turn is likely to have a positive impact on this market. Growing demand for semiconductors for manufacturing mobile phones, electronic chips, and integrated circuits is expected to propel the growth.

Advancements in the assembly technologies and miniaturization in these electronic products are achieved through innovation in new materials and associated process techniques. Increasing technological advancements in electronic products owing to rising consumer demand for high-tech products is expected to spur the product demand. The electronics materials and chemicals is a technology driven industry and are primarily influenced by the adoption of new product designs and specifications in the product field. Electronic materials are an essential part of the electronic hardware and are used in the development and design of electronic equipment. Growing demand for modern handheld gadgets such as iPod, cell phone, laptops, and portables measuring and testing equipment has resulted in miniaturization of electronic gadgets.

The electronic materials & chemicals are an essential part of semiconductor manufacturing, as a result, as the need for semiconductor chips increases, demand for high purity chemicals and materials also increases. The market for electronic chemicals is directly influenced by the global demand for electronic products. The global consumer electronics market is anticipated to witness significant growth, especially in emerging economies such as China, Japan, Taiwan, and India. Increasing disposable income coupled with rising population in the region is expected to increase demand for electronic products, which in turn is likely to drive the industry growth over the forecast period.

Growing demand for electronic materials & chemicals for manufacturing consumer and industrial electronic products has been a major factor driving the growth. However, health and environmental hazards associated with the manufacturing and application of these products are expected to be key factors affecting the market negatively. Electronic equipment contains a wide range of toxic halogenated compounds, heavy metals, and radioactive substances. Initiatives taken by international organizations such as the U.S.EPA, the German Federal Ministry for the Environment, the National Institute of Environmental Health Sciences, and the World Health Organization (WHO) to address the global electronic waste trade and management concerns are likely to regulate various chemicals over the next eight years.

Product Insights

The solid segment dominated the global market with the largest revenue share of 54.1% in 2024. Increasing product demand for manufacturing various consumer goods such as computers, laptops, and smartphones is expected to drive demand for solid electronic materials over the forecast period. The expansion of renewable energy technologies, particularly solar panels and electric vehicles, also contributes to this growing demand, as they rely on sophisticated electronic components from these specialized materials. Consequently, manufacturers invest heavily in research and development to create more effective and sustainable solid chemicals and materials, further driving the market's growth.

The gas segment is expected to grow at the fastest CAGR of 6.9% over the forecast period, owing to their rising penetration in semiconductor and PCB manufacturing. Increasing demand for gas materials for manufacturing LEDs, solar photovoltaic, and flat panel displays is expected to drive growth over the forecast period. Specialty gases are crucial in chemical vapor deposition (CVD) and etching. They create thin films, patterns, and structures on semiconductor substrates. Ongoing advancements in semiconductor technology and innovative fabrication technologies fuel the segment's growth.

Application Insights

The silicon wafers dominated the global electronic materials and chemicals market and accounted for the largest revenue share of 43.5% in 2024. Increasing demand for PCB laminates in manufacturing various electronic products, including amplifiers and LEDs, is anticipated to positively impact the industry's growth over the projected period. Electronic device miniaturization and feature improvement require high-quality silicon wafers. These wafers play a crucial role in manufacturing semiconductors, which are utilized in manufacturing several electronic devices.

The photoresist is expected to be the fastest-growing application segment with the CAGR of 7.2% over the forecast period, owing to the growing demand for photoresists in microsystems and microelectronics. Photoresist involves the use of various chemicals for many imaging and non-imaging applications. In addition, ongoing advancements and enhanced manufacturing processes in the semiconductor industry drive the demand for high-performance photoresist materials to produce high-quality semiconductor gadgets.

End-use Insights

Semiconductors and integrated circuits led the market and accounted for the largest revenue share of 68.7% in 2024. The proliferation of advanced technologies such as artificial intelligence, the Internet of Things (IoT), and 5G communications requires increasingly sophisticated and miniaturized electronic components, driving the need for high-performance semiconductors and integrated circuits. Additionally, the automotive industry’s shift towards electric and autonomous vehicles demands robust electronic systems, further boosting this segment.

The printed circuit boards (PCBs) segment is expected to grow at a CAGR of 5.8% from 2025 to 2030. Increasing demand for printed circuit boards as vital components of integrated circuit chip technology that is used in consumer appliances, including smartphones, computers, and laptops is expected to boost the growth. Increasing demand for semiconductors & integrated circuits for manufacturing computers and other consumer appliances is expected to be a key factor for the industry growth. Changing consumer lifestyles coupled with increasing consumer disposable income is likely to boost demand for consumer appliances, thereby driving the market’s growth.

Regional Insights

The Asia Pacific electronic materials and chemicals market dominated the global market and accounted for the largest revenue share of 69.1% in 2024. The region is anticipated to continue its dominance over the forecast period. Rapid industrialization and the presence of numerous electronic device manufacturers in Asian countries, including China, Taiwan, Japan, and South Korea, are expected to positively impact the industry’s growth.

North America Electronic Materials And Chemicals Market Trends

The electronic materials and chemicals market in North America held a significant market revenue share in 2024, owing to the large number of electronic device manufacturers in the region including Micron, Intel, Fairchild, Texas Instruments, and Avago. These players are engaged in the manufacturing of digital and analog semiconductor technologies for the end-users, thereby propelling product demand over the forecast period. North America is a key player in specialty gases and is expected to grow in near future owing to the increasing demand for plasma display panels and photovoltaic products.

The U.S. electronic materials and chemicals market dominated the North American market and accounted for the largest revenue share in 2024. Rapid technological advancements within the country's electronics industry significantly drive the electronic chemicals and materials market. The U.S. government's initiatives to bolster domestic semiconductor production and the expansion of 5G technology, electric vehicles, and renewable energy sectors significantly contribute to this growing demand.

Latin America Electronic Materials And Chemicals Market Trends

Latin America electronic materials and chemicals market is projected to grow at a CAGR of 6.4% over the forecast period. Increased demand from end-user industries, integration with global markets, policy reforms, and technological advancements are the main factors fueling the expansion of the electronic chemicals and materials market in Latin America. The development of the region is supported by its thriving electronics industry, abundance of natural resources, and skilled labor force. It is anticipated that the electronic chemicals and materials market in Latin America will grow in the upcoming period.

Europe Electronic Materials And Chemicals Market Trends

The electronic materials and chemicals market in Europe is expected to witness substantial growth over the forecast period, owing to rising applications across end-use industries such as electrical and electronics and automotive. The burgeoning production of hand-held gadgets is anticipated to bring about a surge in the manufacturing of electronic components, thereby propelling industry growth. The constantly increasing applications of electronic and chemical materials are anticipated to take the concerned market to newer heights in Europe.

Key Electronic Materials And Chemicals Company Insights

Some of the key companies in the electronic materials and chemicals market include Sumika Electronic Materials; Drex-Chem Technologies; EMD Performance Materials Corp.; EKC Technology; Fujifilm Electronic Materials; and others.

-

Sumika Electronic Materials, a subsidiary of Sumitomo Chemical, provides electronic materials such as polarizing film and OLED optical films, photoresists and wet chemicals for semiconductor lithography, lithium battery membranes, high purity alumina (HPA), and more.

-

FUJIFILM Electronic Materials portfolio includes photoresist products, processing chemicals, CMP slurries, thin film-forming materials, and cleaner products. Recently, they completed the acquisition of the electronic chemicals business from Entegris, rebranding it as FUJIFILM Electronic Materials Process Chemicals.

Key Electronic Materials And Chemicals Companies:

The following are the leading companies in the electronic materials and chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Albemarle Corporation

- Ashland

- BASF SE

- Air Liquide Electronics

- Merck KGaA

- Honeywell International Inc.

- Cabot Corporation.

- Linde PLC

- Dow

- Hitachi, Ltd.

- Sumitomo Chemical Co., Ltd.

- Monsanto Electronic Materials Co.

- EKC Technology

- FUJIFILM Holdings America Corporation

- HD Microsystems. Ltd.

- High Purity Products

- JSR Micro

- KANTO KAGAKU.

- Moses Lake Industries, Inc.

Recent Developments

-

In August 2024, JSR Corporation announced the acquisition of all shares of Yamanaka Hutech Corporation, making YHC a wholly owned subsidiary. This strategic move aims to expand JSR's product portfolio in semiconductor materials, particularly in film-forming technologies. The acquisition aligns with JSR's growth strategy to enhance customer value and optimize the supply chain in the rapidly evolving semiconductor industry.

-

In May 2024, Air Liquide announced an expansion with its new diborane production facility at its advanced materials Center in Sejong, South Korea. This state-of-the-art plant, which utilizes advanced analytical and digital technologies, aims to provide high-quality diborane crucial for semiconductor manufacturing. The facility underscores Air Liquide's commitment to enhancing Korea's semiconductor ecosystem and aligns with its broader strategy to localize advanced material production.

Electronic Materials And Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 78.48 billion

Revenue forecast in 2030

USD 106.11 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region.

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; China; Japan; India; Brazil.

Key companies profiled

Bayer AG; Albemarle Corporation; Ashland; BASF SE; Air Liquide Electronics; Merck KGaA; Honeywell International Inc.; Cabot Corporation; Linde PLC; Dow; Hitachi, Ltd.; Sumitomo Chemical Co., Ltd.; Monsanto Electronic Materials Co.; EKC Technology; FUJIFILM Holdings America Corporation; HD Microsystems. Ltd.; High Purity Products; JSR Micro; KANTO KAGAKU.; Moses Lake Industries, Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Materials And Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global electronic materials and chemicals market report based on, product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

Gas

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicon Wafers

-

PCB Laminates

-

Specialty gases

-

Wet chemicals and solvents

-

Photoresists

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Semiconductors & Integrated Circuits

-

Printed Circuit Boards

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.