- Home

- »

- Electronic & Electrical

- »

-

Electronic Soap Dispenser Market Size & Share Report, 2030GVR Report cover

![Electronic Soap Dispenser Market Size, Share & Trends Report]()

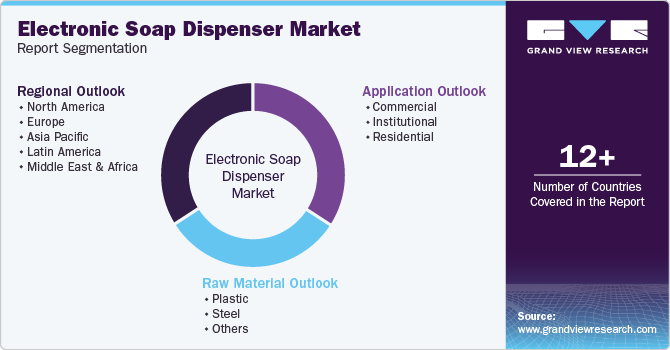

Electronic Soap Dispenser Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (Plastic, Steel, Others), By Application (Commercial, Institutional, Residential), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-107-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Soap Dispenser Market Summary

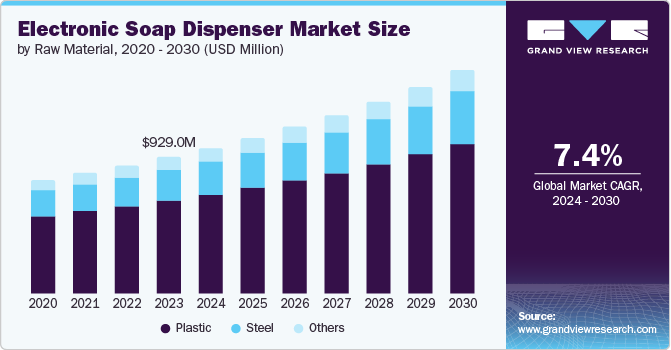

The global electronic soap dispenser market size was valued at USD 929.0 million in 2023 and is projected to reach USD 1,518.5 million by 2030, growing at a CAGR of 7.4% from 2024 to 2030. The growing adoption of smart restroom technology in commercial spaces, increasing demand by residential users, increase in disposable income levels, and changing lifestyles are fueling growth for the electronic soap dispenser market.

Key Market Trends & Insights

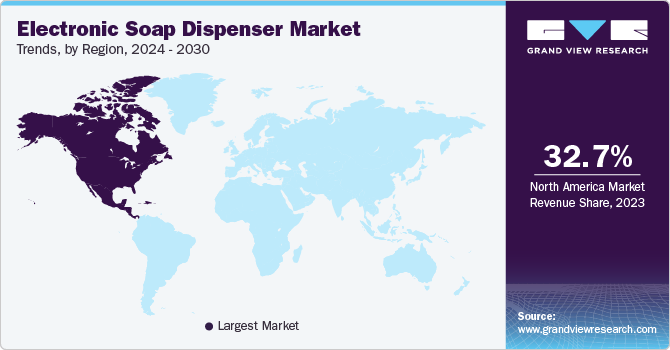

- North America electronic soap dispenser market dominated the global market with a revenue share of 32.7% in 2023.

- Asia Pacific electronic soap dispensermarket is anticipated to witness significant growth during the forecast period.

- Electronic soap dispenser market in Europe is expected to experience significant growth during the forecast period.

- Based on raw material, plastic-based electronic soap dispensers segment dominated the market and accounted for a share of 68.1% in 2023.

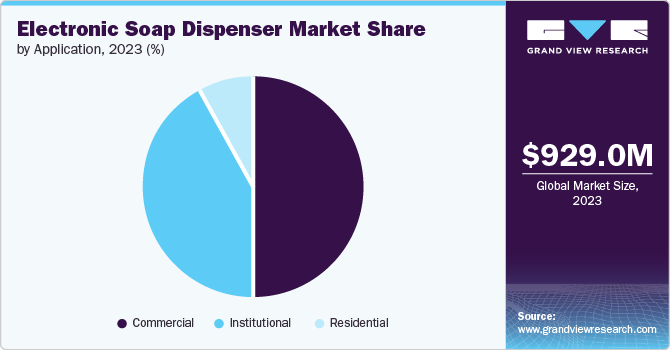

- In terms of application, commercial applications segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 929.0 Million

- 2030 Projected Market Size: USD 1,518.5 Million

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The expanding hospitality and real estate industries worldwide are also expected to drive market expansion. Major market participants operating in the electronic soap dispenser market are adopting strategies such as adding extra technology features, launching novel designs, and delivering customized product ranges to generate greater demand for the product.

This product form, which utilizes dispensing technology, aims to offer optimal hygiene and dispense a precise quantity of liquid soap. As a result, it enhances the dispenser's effectiveness and minimizes wastage. Increasing recognition of the durability of this technology is expected to drive the growth of this industry in the approaching years.

The sensor device in the product automatically releases liquid and foam soap when it detects an external object. The touchless, skin-safe, and germ-free properties of the product are leading to increased adoption in commercial and institutional applications. Growing awareness regarding personal care, hygiene and the significance of touch-free functions of multiple devices offered in restrooms of commercial spaces are expected to develop an upsurge in demand for electronic soap dispensers.

Raw Material Insights & Trends

Plastic-based electronic soap dispensers segment dominated the market and accounted for a share of 68.1% in 2023. The plastic is preferred as a material due to features such as lightweight structure, easy-to-clean surfaces and capacity to be wall mounted, unlike ceramic and glass-based dispensers. The plastic-based electronic soap dispensers are increasingly used in high usage settings such as corporate offices, multi-specialty hospitals, public restrooms, cinema halls, toll plazas, shopping malls and others.

Steel-based electronic soap dispensers segment is expected to experience a significant growth during the forecast period 2024 to 2030. Stainless steel offers numerous benefits over other materials such as increased durability, sustainability, and greater aesthetic value. Additionally, increased motor strength results in a consistent volume of liquid produced and is equipped with technology that is both leak-proof and waterproof to avoid damage to circuit boards from soap or water. These aspects are anticipated to generate greater demand for steel-based electronic soap dispensers.

Application Insights &Trends

Commercial applications segment accounted for the largest revenue share in 2023. Overwhelming response experienced by the hospitality industry and the resumed rate of tourist inflow in multiple countries around the world are driving the growth of electronic soap dispensers in commercial settings. The continuous expansion of the travel and tourism industry indicates a notable increase in demand for the electronic soap dispenser market. Most luxurious hotels and restaurants have transitioned from conventional to smart bathrooms. Businesses within the rising competitive hospitality industry are making investments in advanced technology appliances and infrastructure to enhance customer satisfaction.

Institutional applications segment is expected to register the fastest CAGR during the forecast period. According to UNESCO, approximately 254 million students have been enrolled in different universities around the world, a figure that has increased in the past two decades and is projected to continue growing. The rising adoption of electronic devices in restrooms of universities and research institutes is expected to drive growth for this industry in the approaching years.

Regional Insights & Trends

North America electronic soap dispenser market dominated the global market with a revenue share of 32.7% in 2023. This region claims one of the largest travel and tourism markets globally, which directly has an impact on the usage of electronic soap dispensers in the hospitality industry of the region. In addition, the growing embracement of advanced technologies such as smart homes, smart restrooms, easy availability through online platforms and a rise in disposable income levels are most likely to result in rising demand for this market.

U.S. Electronic Soap Dispenser Market

The electronic soap dispenser market in the U.S. held the largest revenue share of the regional industry. According to the International Trade Administration, U.S. Department of Commerce, in April 2023, the U.S. recorded 5,580,778 international visitor arrivals, which has increased by 30.2% from 2022. The largest number of visitors were from countries such as Canada, Mexico, the United Kingdom, France, and Germany. This has a great influence on the travel and tourism industry, which in turn, develops an impact on the electronic soap dispensers market. Growth experienced by the travel & tourism industry, a rise in commercial users such as hotels and airports, and effective distribution strategies embraced by the key companies are driving demand for this market.

Europe Electronic Soap Dispenser Market

Electronic soap dispenser market in Europe is expected to experience significant growth during the forecast period. This is attributed to the presence of multiple global tourist hotspots, growing use of electronic soap dispensers in public spaces such as metro station restrooms, bus stations, public restrooms, and shopping plazas, and the rising availability of durable products offered by key industry participants in the region.

Germany electronic soap dispenser market is projected to grow at a rapid rate from 2024 to 2030. Aspects such as growing awareness regarding personal hygiene, the presence of multiple businesses offering a diverse product range, and effective distribution strategies embraced by the key market participants primarily drive growth for this market.

Asia Pacific Electronic Soap Dispenser Market Trends

Asia Pacific electronic soap dispensermarket is anticipated to witness significant growth during the forecast period. This regional industry is mainly driven by factors such as the increasing use of products in developing economies, enhanced market penetration attained by key companies through tie-ups and collaborations, growing availability and rising disposable income levels. the regional market is expected to be driven in the upcoming years by a rising number of commercial spaces in developing countries such as India, recovering inflow of tourists in China and rising use of electronic soap in settings such as restaurants, hospitals, hotels, shopping malls, and offices.

China electronic soap dispenser market held the largest revenue share of this regional industry. This market is primarily driven by continuous growth in awareness regarding personal hygiene, presence of multiple global as well as domestic companies operating in the industry, large population, growing use in public restrooms, and increase in spending on hygiene and wellness in the country.

Key Electronic Soap Dispenser Company Insights

Some of the key companies operating in the electronic soap dispenser market are TOTO LTD., American Specialties, Inc., Umbra, simplehuman, ORCHIDS INTERNATIONAL, Toshi Automatic Systems Pvt. Ltd, and others. Many companies have chosen product development as a key competitive strategy, and have embraced research & development and innovation to develop a competitive edge over others.

-

TOTO Ltd., a Japanese company specializing in the production of sanitary ware, toilet seats, fittings, bathtubs, advanced ceramics and other related products. The company offers multiple alternatives electronic soap dispensers range, including power plug-in and battery-operated versions.

-

ORCHIDS INTERNATIONAL, one of the prominent companies in soap dispensers market, offers an electronic soap dispenser made with ABS plastic in a powder-coated finish. The product is powered by electricity.

Key Electronic Soap Dispenser Companies:

The following are the leading companies in the electronic soap dispenser market. These companies collectively hold the largest market share and dictate industry trends.

- TOTO LTD.

- American Specialties, Inc.

- Umbra

- simplehuman

- ORCHIDS INTERNATIONAL

- Toshi Automatic Systems Pvt. Ltd

- The Splash Lab

- Bobrick Washroom Equipment, Inc.

- ZAF ENTERPRISES

- Shenzhen SVAVO Intelligent Technology Co.,Ltd

Recent Developments

-

In June 2024, Bobrick introduced new top-fill soap dispensers in their Fino Collection, which have won a Best of NeoCon 2024 Silver Award in the Interior Products and Solutions/Architectural Products category.

Electronic Soap Dispenser Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 991.4 million

Revenue forecast in 2030

USD 1,518.5 million

Growth Rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, and South Africa

Key companies profiled

TOTO LTD.; American Specialties, Inc.; Umbra; simplehuman; ORCHIDS INTERNATIONAL; Toshi Automatic Systems Pvt. Ltd; The Splash Lab; Bobrick Washroom Equipment, Inc.; ZAF ENTERPRISES; Shenzhen SVAVO Intelligent Technology Co.,Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Soap Dispenser Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic soap dispenser market report based on raw material, application, and region.

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Steel

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Institutional

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.