- Home

- »

- Network Security

- »

-

Embedded Security Market Size And Share Report, 2030GVR Report cover

![Embedded Security Market Size, Share & Trends Report]()

Embedded Security Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Security Type (Authentication And Access Management, Payment), By End Use, By Region And Segment Forecasts

- Report ID: GVR-4-68040-397-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Embedded Security Market Summary

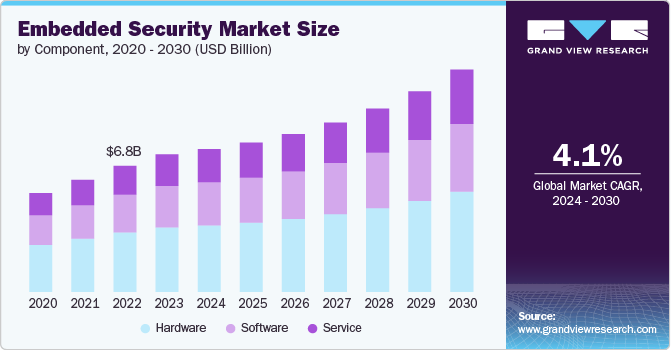

The global embedded security market size was valued at USD 7.40 billion in 2023 and is projected to reach USD 11.93 billion by 2030, growing at a CAGR of 7.6% from 2024 to 2030. The market is focused on providing security solutions for embedded systems, which are specialized computing systems designed to perform dedicated functions within larger devices.

Key Market Trends & Insights

- North America held the largest market share of 37% in the embedded security market in 2023.

- The embedded security market in Asia Pacific is expected to grow significantly at a CAGR of 9.2% from 2024 to 2030.

- Based on component, the hardware segment accounted for the largest market share of over 46% in 2023.

- Based on security type, the payment segment held a market share of 45% in 2023 and is expected to dominate the market by 2030.

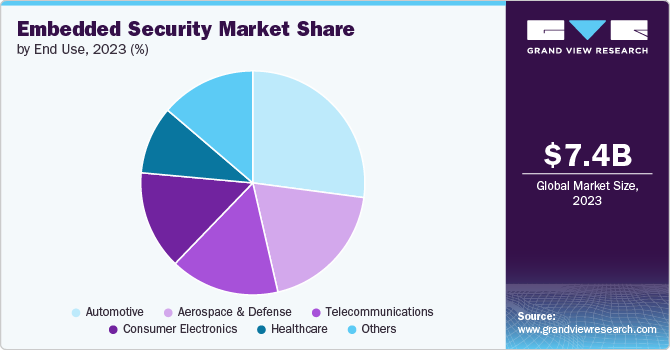

- Based on end use, the automotive segment held a market share of over 27% in 2023 and is expected to dominate the market by 2030.

Market Size & Forecast

- 2023 Market Size: USD 7.40 Billion

- 2030 Projected Market Size: USD 11.93 Billion

- CAGR (2024-2030): 7.6%

- North America: Largest market in 2023

With the proliferation of IoT devices, connected cars, industrial control systems, and smart medical devices, the demand for robust embedded security solutions has surged. Key drivers include the rising threat of cyber-attacks, stringent regulatory requirements, and advancements in technology such as AI and machine learning, which are enhancing security capabilities. As technology evolves and the number of connected devices grows, the market is expected to expand significantly, emphasizing the need for continuous innovation and robust security measures.

The rise in cyber-attacks targeting embedded systems, particularly IoT devices, has significantly heightened the need for embedded security solutions. Embedded systems, often integral components in critical infrastructure, consumer electronics, medical devices, and industrial control systems, are increasingly becoming targets for cybercriminals due to their widespread deployment and often insufficient security measures. IoT devices, which connect and communicate over networks, present numerous entry points for attackers to exploit. These vulnerabilities can lead to unauthorized access, data breaches, device manipulation, and even large-scale attacks like distributed denial-of-service (DDoS) attacks.

The market is increasingly leveraging advanced technologies to enhance protection. AI and machine learning are being utilized to predict and mitigate potential threats in real-time by analyzing patterns and identifying anomalies. Blockchain technology enhances security, particularly in IoT applications, by providing decentralized, tamper-proof data integrity and secure transactions. Similarly, zero trust architecture is being implemented to ensure that no entity, whether inside or outside the network, is trusted by default. This principle enforces strict verification for every device and user attempting to access network resources, significantly reducing the risk of unauthorized access and enhancing overall security. These innovations are critical in addressing the evolving cyber threat landscape and ensuring robust embedded security.

Component Insights

The hardware segment accounted for the largest market share of over 46% in 2023. The increasing frequency and sophistication of cyber-attacks targeting embedded systems have significantly heightened the need for advanced hardware security measures. Embedded systems, which are integral to critical infrastructure, industrial control systems, automotive technology, and IoT devices, are particularly vulnerable to cyber threats. These attacks can lead to unauthorized access, data breaches, and system disruptions, posing severe risks to safety and operational continuity. To counter these threats, secure elements (SEs) and trusted platform modules (TPMs) are employed. SEs provide a tamper-resistant environment for storing sensitive data and performing secure transactions, while TPMs ensure hardware-based encryption and secure boot processes. These hardware security components offer robust protection by safeguarding cryptographic keys and enabling secure authentication, thereby mitigating the risk of attacks. As cyber threats evolve, the adoption of SEs and TPMs in embedded systems is critical to ensuring comprehensive security and maintaining the integrity and trustworthiness of these systems.

The services segment is expected to grow at a CAGR of 8.6% during the forecast period. The emergence of managed security services (MSS) has significantly impacted the embedded security market by offering continuous monitoring, management, and support of security operations. MSS providers deliver cost-effective and scalable solutions that help organizations protect their embedded systems from evolving cyber threats. By outsourcing security operations to specialized MSS providers, organizations can leverage advanced technologies and expertise that might otherwise be unavailable or too costly to develop in-house. This includes real-time threat detection, vulnerability management, incident response, and compliance support. Additionally, the scalability of MSS allows organizations to adapt their security measures in response to changing needs and emerging threats, ensuring comprehensive protection without the need for significant upfront investment in security infrastructure. This approach enhances overall security posture, reduces operational risks, and ensures business continuity.

Security Type Insights

The payment segment held a market share of 45% in 2023 and is expected to dominate the market by 2030. The rising incidents of payment fraud and cyber-attacks targeting financial transactions have significantly increased the demand for advanced security measures in payment systems. As cybercriminals employ more sophisticated techniques to exploit vulnerabilities in financial transactions, the need for robust security solutions has intensified. Secure elements (SEs) and trusted execution environments (TEEs) are critical technologies embedded in payment devices to safeguard sensitive information. SEs provide a tamper-resistant environment for securely storing and processing payment data, ensuring that cryptographic keys and personal information remain protected from unauthorized access. TEEs create isolated environments within the main processor, allowing secure execution of sensitive operations without interference from potentially compromised parts of the system. These advanced security measures enhance the overall security of payment transactions, protecting against fraud and instilling confidence in digital payment methods. As payment fraud continues to escalate, the integration of SEs and TEEs in payment devices becomes increasingly essential for maintaining the integrity and trustworthiness of financial transactions.

The authentication and access management segment is expected to grow at a CAGR of 8.5% over the forecast period. The rise of remote work and bring-your-own-device (BYOD) policies has significantly increased the need for robust authentication and access management (AAM) solutions to secure corporate networks and sensitive data. With employees accessing company resources from various locations and personal devices, the risk of unauthorized access and data breaches has escalated. AAM solutions address these challenges by implementing multi-factor authentication (MFA), single sign-on (SSO), and adaptive authentication to verify user identities and ensure secure access to critical systems. These measures help prevent unauthorized access and protect against cyber threats, regardless of where employees are working or what devices they are using. Additionally, AAM solutions enable IT departments to monitor and manage access in real-time, providing greater visibility and control over who is accessing corporate resources. This is essential for maintaining data integrity, compliance with regulatory requirements, and overall organizational security in a distributed work environment.

End Use Insights

The automotive segment held a market share of over 27% in 2023 and is expected to dominate the market by 2030. The increasing electronic content in modern vehicles, including systems such as infotainment, advanced driver-assistance systems (ADAS), and telematics, necessitates robust security measures to prevent unauthorized access and tampering. These electronic components enhance vehicle functionality, safety, and user experience but also introduce potential vulnerabilities to cyber threats. Infotainment systems, for instance, connect to various external networks, making them potential entry points for hackers. ADAS, which controls critical functions like braking and steering, must be protected to ensure passenger safety. Telematics systems, used for vehicle tracking and data transmission, also require secure communication channels to protect sensitive information. As vehicles become more connected and reliant on electronic systems, the need for embedded security solutions, such as secure boot processes, encryption, and intrusion detection systems, becomes essential. These measures help safeguard vehicle systems from cyber-attacks, ensuring the integrity, reliability, and safety of modern automotive technology.

The aerospace & defense segment is expected to grow at a CAGR of 8.7% over the forecast period. The integration of Internet of Things (IoT) and Industrial Internet of Things (IIoT) devices in aerospace and defense applications significantly enhances operational capabilities but also introduces new security challenges. These devices facilitate real-time monitoring, data collection, and automation, improving efficiency and decision-making. However, their connectivity to broader networks exposes them to potential cyber threats. Ensuring secure connectivity and data protection is paramount to prevent unauthorized access, data breaches, and malicious attacks that could compromise mission-critical operations. Robust embedded security solutions, such as encryption, secure boot, and intrusion detection systems, are essential to safeguard these devices. This secure integration of IoT and IIoT devices is crucial for maintaining operational resilience and achieving mission success in the highly sensitive aerospace and defense sector.

Regional Insights

North America embedded security market held the largest market share of 37% in the embedded security market in 2023. The surge in sophisticated cyber-attacks in North America, targeting critical infrastructure, financial institutions, and government agencies underscores the urgent need for advanced embedded security measures. Embedded security solutions, such as secure elements and encryption technologies, are crucial for safeguarding sensitive data and ensuring system integrity. These measures help prevent unauthorized access, data breaches, and operational disruptions, providing robust protection against evolving cyber threats. Implementing advanced embedded security is essential for maintaining the security and reliability of vital systems in an increasingly digital and interconnected world.

U.S. Embedded Security Market Trends

The embedded security market in the U.S. is expected to grow significantly at a CAGR of 7.0% from 2024 to 2030. The growing healthcare sector in the U.S., driven by the rise of connected medical devices and telehealth services, necessitates robust embedded security solutions. As healthcare providers increasingly rely on digital technologies for patient monitoring and remote consultations, the protection of sensitive patient data and the functionality of medical devices become critical. Embedded security solutions, such as encryption and secure authentication, are essential to guard against unauthorized access, data breaches, and cyber threats. Ensuring robust security not only protects patient information but also maintains the safety and reliability of medical devices, crucial for delivering effective and secure healthcare services in a digital age.

Asia Pacific Embedded Security Trends

The embedded security market in Asia Pacific is expected to grow significantly at a CAGR of 9.2% from 2024 to 2030. The rise of smart cities in the Asia Pacific region characterized by interconnected infrastructure and services, will help in the embedded security market growth. As cities integrate technologies like smart grids, traffic management, and public safety systems, they become vulnerable to cyber threats that could disrupt essential services. Robust embedded security solutions are crucial for safeguarding these systems against unauthorized access, data breaches, and cyber-attacks. By ensuring the security and reliability of interconnected services, embedded security helps maintain the smooth operation of critical urban functions, enhances public safety, and protects sensitive data, which is vital for the success and resilience of smart city initiatives.

Europe Embedded Security Market Trends

The embedded security market in Europe is expected to grow significantly at a CAGR of 6.5% from 2024 to 2030. The growing adoption of cloud-based services and infrastructure in Europe has increased the need for secure embedded solutions to protect cloud-connected devices and data. As organizations move critical operations and data to the cloud, ensuring the security of these cloud environments becomes crucial. Secure embedded systems, such as encryption modules and secure access controls, help safeguard data during transmission and storage, preventing unauthorized access and breaches. By integrating robust security measures, organizations can enhance the overall security of their digital ecosystem, maintain data integrity, and build trust in cloud services, which is essential for leveraging the full potential of cloud-based technologies.

Key Embedded Security Company Insights

Key players operating in the market include Idemia Group, Infineon Technologies AG, Intellias Ltd., Karamba Security Ltd., McAfee, LLC , Microchip Technology Inc., NXP Semiconductors, Qualcomm Technologies, Rambus Incorporated, Renesas Electronics, RVL, Samsung Electronics Co., Sirin Software, STMicroelectronics N.V., and Texas Instruments Inc.

Key Embedded Security Companies:

The following are the leading companies in the embedded security market. These companies collectively hold the largest market share and dictate industry trends.

- Idemia Group

- Infineon Technologies AG

- Intellias Ltd.

- Karamba Security Ltd.

- McAfee, LLC

- Microchip Technology Inc.

- NXP Semiconductors

- Qualcomm Technologies

- Rambus Incorporated

- Renesas Electronics

- RVL

- Samsung Electronics Co.,

- Sirin Software

- STMicroelectronics N.V.

- Texas Instruments Inc.

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In July 2024, NXP accelerated the adoption of digital car keys with certification from the Car Connectivity Consortium (CCC). This certification validates NXP’s secure digital car key solutions, enhancing interoperability and security in vehicle access. By meeting CCC standards, NXP’s technology supports seamless and secure digital key experiences, enabling consumers to unlock and start their vehicles using smartphones, enhancing convenience and safety in automotive access.

-

In March 2024, IDEMIA Secure Transactions partnered with Qualcomm to enhance secure offline Central Bank Digital Currency (CBDC) payments. This collaboration aims to boost the adoption of CBDCs by integrating IDEMIA's secure transaction technologies with Qualcomm's advanced hardware. The initiative focuses on improving the security and efficiency of offline CBDC transactions, ensuring reliable and secure digital payments even in the absence of internet connectivity.

-

In September 2023, STMicroelectronics introduced a new secure microcontroller that enhances IoT device security. This microcontroller, featuring advanced encryption and authentication capabilities, is designed to protect sensitive data and ensure secure communication for connected devices. By integrating robust security features directly into the hardware, STMicroelectronics aims to address growing concerns about IoT security, offering a reliable solution for safeguarding against cyber threats and unauthorized access.

Embedded Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.67 billion

Revenue forecast in 2030

USD 11.93 billion

Growth Rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018- 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, security type, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa.

Key companies profiled

Idemia Group; Infineon Technologies AG ; Intellias Ltd.; Karamba Security Ltd.; McAfee, LLC; Microchip Technology Inc.; NXP Semiconductors; Qualcomm Technologies; Rambus Incorporated; Renesas Electronics; RVL; Samsung Electronics Co.,; Sirin Software; STMicroelectronics N.V. ; Texas Instruments Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Embedded Security Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global embedded security market report based on component, security type, end use and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Secure Element

-

Embedded SIM

-

Trusted Platform Modules

-

Hardware Security Modules

-

Hardware Token

-

-

Software

-

Service

-

-

Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Authentication And Access Management

-

Payment

-

Content Protection

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Healthcare

-

Consumer Electronics

-

Telecommunications

-

Aerospace & defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global embedded security market was valued at USD 7.40 billion in 2023 and is expected to reach USD 7.67 billion in 2024.

b. The global embedded security market is expected to grow at a compound annual growth rate of 7.65% from 2024 to 2030 to reach USD 11.93 billion by 2030.

b. The hardware segment held the largest revenue share of more than 46% in 2023 in the global web performance market. The increasing frequency and sophistication of cyber-attacks targeting embedded systems have significantly heightened the need for advanced hardware security measures. Embedded systems, which are integral to critical infrastructure, industrial control systems, automotive technology, and IoT devices, are particularly vulnerable to cyber threats.

b. Key players operating in the embedded security market include Idemia Group, Infineon Technologies AG, Intellias Ltd., Karamba Security Ltd., McAfee, LLC , Microchip Technology Inc., NXP Semiconductors, Qualcomm Technologies, Rambus Incorporated, Renesas Electronics, RVL, Samsung Electronics Co., Sirin Software, STMicroelectronics N.V., and Texas Instruments Inc.

b. The embedded security market is focused on providing security solutions for embedded systems, which are specialized computing systems designed to perform dedicated functions within larger devices. With the proliferation of IoT devices, connected cars, industrial control systems, and smart medical devices, the demand for robust embedded security solutions has surged. Key drivers include the rising threat of cyber-attacks, stringent regulatory requirements, and advancements in technology such as AI and machine learning, which are enhancing security capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.