- Home

- »

- Catalysts & Enzymes

- »

-

Emission Control Catalyst Market Size, Industry Report, 2030GVR Report cover

![Emission Control Catalyst Market Size, Share & Trends Report]()

Emission Control Catalyst Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Palladium, Platinum, Rhodium), By Application (Automotive, Industrial), By Catalytic Converter, By Region, And Segment Forecasts

- Report ID: 978-1-68038-885-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Emission Control Catalyst Market Summary

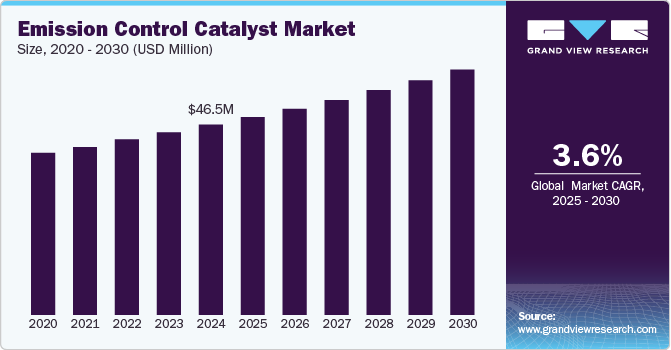

The global emission control catalyst market size was estimated at USD 46.5 million in 2024 and is projected to reach USD 60.0 million by 2030, growing at a CAGR of 3.6% from 2025 to 2030. Governments globally are intensifying their focus on environmental compliance, implementing stringent regulations aimed at curbing pollutants from vehicles and industrial operations.

Key Market Trends & Insights

- Asia Pacific emission control catalyst market dominated the global market in 2024.

- The emission control catalyst market in China held a substantial share in the Asia Pacific emission control catalyst market in 2024.

- By product, rhodium is expected to register significant growth over the forecast period.

- By application, stationary sources are projected to grow at the fastest rate over the forecast period.

- By catalytic converter, three-way catalytic converter (TWC) led the market with the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 46.5 Million

- 2030 Projected Market Size: USD 60.0 Million

- CAGR (2025-2030): 3.6%

- Asia Pacific: Largest market in 2024

This regulatory pressure compels manufacturers to adopt advanced emission control technologies and encourages a corporate commitment to sustainability. As regulatory bodies enforce increasingly rigorous air quality standards, demand for effective solutions in this space continues to grow, prioritizing the urgency for innovation in emission control systems.

In addition to regulatory frameworks, technological advancements play a pivotal role in shaping the market. Continuous research and development initiatives are fostering innovations in catalyst materials, notably through the emergence of nanoparticle technology and highly efficient metal oxides. These advancements enhance the performance and durability of catalytic converters, thus making them more effective in reducing various pollutants. Moreover, as the automotive sector shifts its focus towards electric and hybrid vehicles, there remains a substantial market need for tailored emission control solutions that align with these evolving technologies, presenting an opportunity for manufacturers to pioneer innovative products.

Consumer preferences are also driving the market, reflecting a growing awareness of environmental issues. Modern vehicle manufacturers are increasingly inclined towards incorporating advanced emission control systems in their designs, prompted by heightened environmental consciousness among consumers and supported by governmental incentives aimed at promoting cleaner transportation methods. This consumer-driven demand is fostering a robust ecosystem where the integration of emissions control technology is not merely regulatory compliance but a competitive advantage in the marketplace.

Economic factors, particularly fluctuations in raw material costs, further impact the dynamics of the emission control catalyst market. The prices of metals such as platinum, palladium, and rhodium-essential components in catalyst formulations-can exhibit significant volatility, which poses challenges for manufacturers striving to balance cost-effective production with compliance to stringent environmental regulations. This fluctuation necessitates strategic sourcing and operational adaptability to ensure continued growth and sustainability in the emissions control sector, underpinning the intricate relationship between economic viability and regulatory compliance in driving market evolution.

Product Insights

Palladium dominated the market in 2024, driven by its cost-effectiveness and high-temperature performance capabilities, making it a preferred choice for manufacturers seeking to optimize costs while meeting stringent emissions regulations. Palladium-based catalysts are particularly effective in gasoline engines, underscoring their popularity among automotive manufacturers.

Rhodium is expected to register significant growth over the forecast period. Rhodium holds exceptional effectiveness in reducing nitrogen oxides (NOx) emissions, particularly in three-way catalytic converters used in automotive applications. Rhodium’s high corrosion resistance and thermal stability enhance its appeal, ensuring compliance with stringent environmental standards.

Application Insights

Mobile sources (off road and on road) dominated the market in 2024 due to heightened regulatory pressures and increased vehicle production. Stringent emissions regulations in the automotive sector necessitated the adoption of advanced catalytic technologies. This shift towards cleaner vehicle solutions led to a surge in demand for mobile emission control technologies, making this application segment the market leader.

Stationary sources are projected to grow at the fastest rate over the forecast period, driven by industrialization and stringent environmental regulations. As industries expand, the necessity for effective emissions control technologies intensifies, particularly in power generation and manufacturing. The increased focus on reducing air pollution and adhering to strict emission standards will catalyze investment in stationary emission control catalysts.

Catalytic Converter Insights

Three-way catalytic converter (TWC) led the market with the largest share in 2024. TWCs are effective in simultaneously reducing carbon monoxide, hydrocarbons, and nitrogen oxides, making them crucial for meeting emissions regulations. Their established technology and efficiency in converting harmful pollutants into less harmful substances solidify their dominance in the automotive catalyst sector.

Selective catalytic reduction (SCR) systems are projected to grow at the fastest rate over the forecast period. SCR technology is notably effective in reducing nitrogen oxides (NOx) emissions from diesel engines, in line with stringent regulations aimed at enhancing air quality. The increasing adoption of SCR systems across automotive and industrial sectors underscores their importance in meeting rigorous emissions standards.

Regional Insights

Asia Pacific emission control catalyst market dominated the global market in 2024, aided by rapid industrialization, urbanization, and increasing vehicle production across key economies such as China and India. Stricter environmental regulations aimed at controlling pollution are pushing industries and automakers to adopt advanced emission control technologies. Moreover, rising consumer awareness regarding air quality and health impacts is further driving demand for efficient catalysts that meet regulatory requirements while supporting sustainable development.

The emission control catalyst market in China held a substantial share in the Asia Pacific emission control catalyst market in 2024. China aims to combat severe air pollution, it has implemented strict standards that require advanced emission control technologies in vehicles and industrial processes. The rising demand for automobiles combined with government incentives for cleaner technologies is driving substantial investment in emission control catalysts.

Europe Emission Control Catalyst Market Trends

Europe emission control catalyst market held substantial market share in 2024. The European Union’s commitment to sustainability has led to significant investments in cleaner technologies, driving demand for advanced catalysts in automotive applications. Moreover, the growing awareness of air quality issues among consumers is prompting automakers to adopt more efficient emission control systems, further boosting market growth.

The emission control catalyst market in Germany is expected to grow lucratively in the forecast period. As one of the largest automotive producers globally, Germany is at the forefront of adopting advanced emission control technologies to comply with EU standards. The country’s commitment to sustainability and innovation in vehicle manufacturing drives significant demand for effective catalysts, enhancing air quality while supporting the transition towards greener transportation solutions.

North America Emission Control Catalyst Market Trends

North America emission control catalyst market is expected to register significant growth over the forecast period, owing to stringent environmental regulations and a robust automotive industry. The U.S. has implemented rigorous emission standards, such as the Tier 3 Vehicle Emission and Fuel Standards Program, which mandates significant reductions in harmful emissions. Moreover, the growth of electric vehicles (EVs) and advancements in catalyst technology are further propelling demand, as manufacturers seek to comply with regulations while enhancing vehicle performance and sustainability.

U.S. Emission Control Catalyst Market Trends

The emission control catalyst market in the U.S. dominated the North America emission control catalyst market in 2024. The implementation of programs such as the Tier 3 standards has driven manufacturers to adopt advanced catalytic technologies. Furthermore, the rapid growth of the electric vehicle market in the U.S. is fostering innovation in emission control solutions, ensuring compliance with evolving environmental standards.

Key Emission Control Catalyst Company Insights

Some key companies operating in the market include Johnson Matthey; Solvay; Umicore SA; Corning Incorporated; and Aerinox Inc.; among others. Companies are actively investing in R&D to improve catalyst efficiency and lower costs, while engaging in mergers and acquisitions to enhance market presence and diversify product offerings. For instance, in October 2024, Johnson Matthey and Noya formed a partnership to manufacture sorbents for Noya’s direct air capture system, aiming to enhance carbon removal and support ambitious sustainability goals.

-

Solvay develops advanced emission control catalyst solutions, such as Actalys and Optalys, enhancing catalytic converter performance and achieving up to 99.9% reduction in particulate emissions, bolstering its position as a sustainability leader in the automotive sector.

-

Aerinox Inc. specializes in innovative emission control technologies, focusing on high-performance catalytic converter systems. Their commitment to research and development allows for customized solutions that meet evolving regulatory standards, promoting cleaner air and environmental sustainability in emissions control.

Key Emission Control Catalyst Companies:

The following are the leading companies in the emission control catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Matthey

- Solvay

- Umicore SA

- Corning Incorporated

- Aerinox Inc.

- Cormetech Inc.

- BASF

- DCL International Inc.

- Shell Global

- CLARIANT

- CATALER CORPORATION

Recent Developments

-

In December 2024, Clariant announced the successful startup of its EnviCat N2O-S catalyst at Sichuan Lutianhua’s nitric acid plant, projected to reduce emissions by 275 kilotons of CO2 equivalent annually.

-

In November 2024, Solvay launched climate and water projects at its Paulínia site, targeting a 40% reduction in greenhouse gas emissions and a 10% decrease in water intake by 2025.

-

In November 2024, Honeywell UOP and Johnson Matthey established a partnership to produce sustainable fuels from diverse feedstocks, aiming to reduce costs and enhance project deployment through integrated technologies.

-

In August 2024, DCL International Inc. transferred its longstanding sponsorship of the Mining Vehicle Powertrain Conference to Roadwarrior Inc., refocusing on expanding its clean energy solutions and environmental technologies.

-

In August 2024, BASF inaugurated a new RD&A lab in Chennai to develop emissions control catalysts, enhancing its support for India’s fuel diversification and stricter emissions regulations in the automotive sector.

Emission Control Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 48.4 million

Revenue forecast in 2030

USD 60.0 million

Growth rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, catalytic converter, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Russia, China, Japan, India, South Korea, Brazil

Key companies profiled

Johnson Matthey; Solvay; Umicore SA; Corning Incorporated; Aerinox Inc.; Cormetech Inc.; BASF; DCL International Inc.; Shell Global; CLARIANT; CATALER CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Emission Control Catalyst Market Report Segmentation

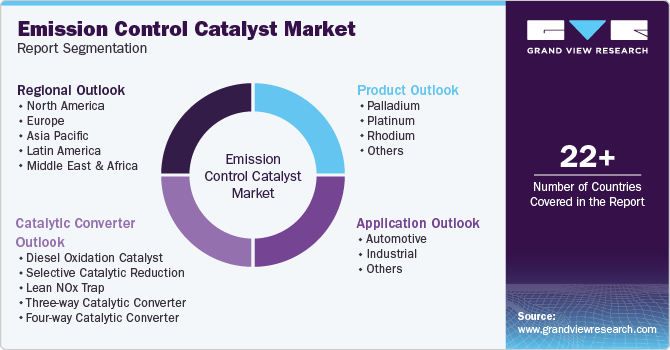

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global emission control catalyst market report based on product, application, catalytic converter, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Palladium

-

Platinum

-

Rhodium

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Industrial

-

Others

-

-

Catalytic Converter Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Diesel Oxidation Catalyst

-

Selective Catalytic Reduction

-

Lean NOx Trap

-

Three-way Catalytic Converter

-

Four-way Catalytic Converter

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.