- Home

- »

- Personal Care & Cosmetics

- »

-

Emollients & Oils for Personal Care and Cosmetics Market Report, 2025GVR Report cover

![Emollients & Oils for Personal Care and Cosmetics Market Size, Share & Trends Report]()

Emollients & Oils for Personal Care and Cosmetics Market Size, Share & Trends Analysis Report By Application (Sun Care, Deodorants, Skin Care, Hair Care), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-794-0

- Number of Report Pages: 79

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Bulk Chemicals

Report Overview

The global emollients & oils for personal care and cosmetics market size was valued at USD 960.3 million in 2017. It is anticipated to register a CAGR of 6.1% during the forecast period. Rising awareness regarding health coupled with the popularity of multifunctional products is anticipated to drive the growth. Favorable regulations pertaining to the use of various ingredients coupled with the compatibility of emollients and oils with other ingredients are further anticipated to drive expansion.

Changing lifestyles, widespread consciousness regarding the enhancement of the overall personality among consumers along with rising GDP and utilization of natural ingredients for manufacturing cosmetics are expected to drive the global market. Developed countries, such as U.S., France, and U.K. are focusing on capturing business share across emerging regions. As per the International Trade Administration (ITA), the Asian countries offer a potential customer base of over three billion and acts as a fastest growing region for cosmetics and personal care products.

Growing middle-class population in developing countries along with increasing disposable income are some of the key factors positively influencing the emollients and oils for personal care and cosmetics market. Increasing penetration of e-commerce platforms across emerging regions is also supporting the market. Companies are focusing on strengthening their regional base and tapping into the potential industry.

However, the recent emergence of various beauty treatments and increasing awareness regarding the potential side effects of cosmetics are the key factors restraining growth of the cosmetics industry, thereby limiting the product demand.

Application Insights

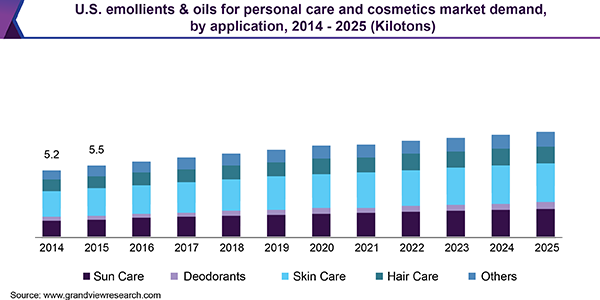

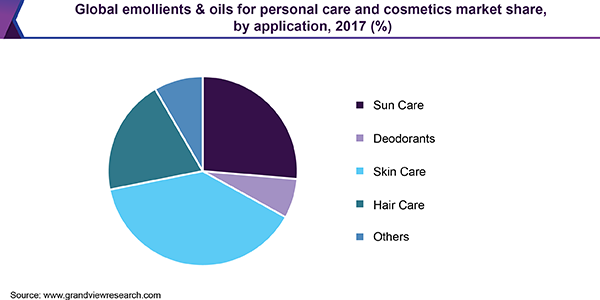

Skincare application accounted for over 40% market share in 2017, owing to rising adoption of these products in daily grooming routines of consumers. Rising consciousness pertaining to beauty is a prominent factor propelling the demand for skin care products, thereby contributing to the consumption of emollients and oils. Additionally, increasing consumer concerns regarding the harmful effects of pollution on the skin will positively influence the demand for skin care products across the globe.

The deodorant segment is likely to witness rapid growth from 2018 to 2025. Rising standard of living in emerging economies and inclination towards beauty are anticipated to further fuel the market over the forecast period. Moreover, consumption of natural oil-based skin care products is expected to ascend in the coming years on account of rising demand to minimize side effects of harmful chemicals on skin.

The demand for deodorants has witnessed a rise, with the introduction of newer and advanced products, such as moisturizing deodorants and antiperspirants, gas-less deodorants, and alcohol-free deodorants. Large-scale utilization of such products in the U.S. and the European countries, such as Germany, the U.K., Italy, France, and Spain is positively influencing demand for emollients and oils.

The galenic formulation of sun care cosmetics is based on the composition that includes oil phase optimized by a selection of emollient esters. These esters enhance the spreadability and sensory properties of products, thereby resulting in a uniform distribution of the product on the skin. Furthermore, they are also known to enhance the solubilization of sun care products, which, in turn, improves the absorption of UV radiation, thereby sufficing the regulatory requirements of these products. Ascending demand for sun care cosmetics offering easy applicability along with enhanced protection is projected to boost the consumption of emollients and oils over the foreseeable future.

Regional Insights

North America is expected to generate revenue of over USD 400 million by 2025. The establishment of the North American Free Trade Agreement (NAFTA) in 1994, allowing free trade agreement across U.S., Mexico, and Canada has increased consumer access to multinational brands, particularly in the mass product category, and has also intensified the competition across personal care and cosmetics industry. High competition necessitates improvement in manufacturing efficiencies, better economies of scale, and enhanced distribution channels.

Europe is projected to witness a CAGR of 5.5% from 2018 to 2025. The robust manufacturing base of personal care products in France, the U.K., and Germany are expected to emerge as a promising factor for business growth. In 2013, the European Commission (EC) introduced Horizon 2020 Strategy with the prime intention to promote the use and production of natural-based ingredients in chemicals, personal care, cosmetics, and many other sectors, thereby supporting the emollients and oils for personal care and cosmetics industry demand.

In 2017, Asia Pacific held a market share of over 25% in terms of revenue. Rising preference for natural-based products over their synthetic counterparts is expected to have a favorable impact on the regional growth over the forecast timeframe. The growth in India can be attributed to rising awareness pertaining to beauty and wellness coupled with rapidly changing lifestyle of consumers.

Emollients & Oils for Personal Care and Cosmetics Market Share Insights

Manufacturers are investing in R&D to develop products offering multiple advantages, such as flexibility while manufacturing along with enhanced cleansing capabilities. A healthy distribution cycle is among the critical factors for capturing the market share. The producers are forming long-term tie-ups with product distributors to enhance their regional presence. For instance, in July 2017, Lubrizol Corporation collaborated with Essential Ingredients for distributing its products across the U.S., thereby strengthening its regional presence.

Mergers and acquisitions are among the critical strategies implemented by the market players for enhancing their product portfolio and improving the regional presence. Increasing the product line across the personal care industry will boost competition for the emollients and oils used as an ingredient in cosmetic products. Innospec, Inc. acquired European Differentiated Surfactants, a subsidiary of Huntsman Investments B.V., to further enhance its product base for performance chemicals.

Increasing customer awareness regarding the use of bio-based and organic products has prompted manufacturers to procure organic raw materials. Furthermore, market participants are acquiring organic farms to enhance their farming capabilities. For instance, Vantage Specialties, Inc. acquired organic jojoba farm from Cocopah Nurseries for manufacturing emollients and oils for personal care and cosmetics products.

Emollients & Oils for Personal Care and Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 1078.8 million

Revenue forecast in 2025

USD 1543.9 million

Growth Rate

CAGR of 6.1% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, UK, France, China, India, Japan, Brazil, Saudi Arabia

Key companies profiled

The Lubrizol Corporation, Stephenson Group Limited, Evonik Industries AG, Sonneborn, LLC Innospec, Inc., Hallstar, Vantage Specialty Ingredients, Inc., BASF SE, Berg + Schmidt GmbH & Co. KG, Cargill, Incorporated, Yasham

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at a global, regional, and country level, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global emollients and oils for personal care and cosmetics market report on the basis of application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2014 - 2025)

-

Sun Care

-

Deodorants

-

Skin Care

-

Hair Care

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global emollients and oils for personal care and cosmetics market size was estimated at USD 1,078.7 million in 2019 and is expected to reach USD 1,146 million in 2020

b. The global emollients and oils for personal care and cosmetics market is expected to grow at a compound annual growth rate of 6.1% from 2019 to 2025 to reach USD 1,543.9 million by 2025.

b. Europe dominated the emollients and oils for personal care and cosmetics market with a share of 28.7% in 2019. This is attributable to high consumer awareness regarding their health benefits positive perception towards cosmetic products usage

b. Some key players operating in the emollients and oils for personal care and cosmetics market include The Lubrizol Corporation, Stephenson Group Limited, Evonik Industries AG, Sonneborn, LLC Innospec, Inc., Hallstar, Vantage Specialty Ingredients, Inc., BASF SE, Berg + Schmidt GmbH & Co. KG, Cargill, Incorporated, Yasham

b. Key factors that are driving the market growth include ascending preference for natural and bio-based products coupled with favorable regulatory norms for their usage across countries

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."