- Home

- »

- Pharmaceuticals

- »

-

Endometriosis Treatment Market Size & Trends Report, 2030GVR Report cover

![Endometriosis Treatment Market Size, Share & Trends Report]()

Endometriosis Treatment Market Size, Share & Trends Analysis Report By Treatment Type, By Drug Class (NSAIDs), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-005-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global endometriosis treatment market size was valued at USD 1,222.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 13.5% from 2023 to 2030. The rising disease burden, increasing disease awareness, and robust product pipeline are among the major factors driving the market growth. In addition, this space faced high competition from generic and off-label products, which could slow down the space growth. According to the March 2021 World Health Organization report, around 190 million reproductive-age females have endometriosis, accounting for about 10% of the female population globally. In addition to rising prevalence, healthcare workers report a delay in diagnosis due to variable and broad symptoms of endometriosis. The delay in diagnosis aggravates symptoms, thereby increasing the dependence on treatment. This also leads to individuals suffering from limited awareness of the condition. All such factors are increasing demand for treatment and fueling the endometriosis treatment market.

Globally, in March, endometriosis awareness programs across several countries occur every year to raise awareness about the disease. For instance, on 12th March, Austria hosts the free, full-day, online congress to cater knowledge from experts on endometriosis. On 19th and 20th March 2022, Endometriosis and Reproductive Health Foundation in Bulgaria organized a virtual conference called Myths and truths about the disease. On such platforms, experts in the field shutter on myths about the disease. Similarly, Canada, Bangladesh, Finland, France, Hungary, India, and many more countries worldwide have raised a series of activities to encourage open discussion about endometriosis. Thus, such initiatives are driving the endometriosis treatment market.

At national and international levels, government and key market players actively invest in research and development and increase funds, further catering to market growth. For instance, in March 2022, the U.S. federal government announced USD 92 million funds to NICHD for endometriosis research. Similarly, in February 2021, DBT Wellcome India Alliance announced a grant of USD 0.47 million for the Endometriosis Clinical and Genetic Research in India (ECGRI) project. This ECGRI project is an endometriosis clinical study on genetic risks and phenotypes associated with the disease.

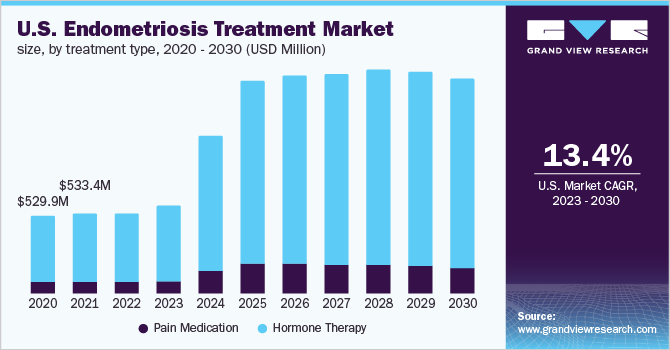

Treatment Type Insights

The pain medication segment held a revenue share of 15.16% in 2022. During endometriosis, patients experience painful symptoms such as dysmenorrhea and dyspareunia, chronic pelvic pain, infertility, and psychological suffering, among others. Thus, medications suppressing painful symptoms of disease eventually reduce their impact on mental health and quality of life. This medication has fewer side effects, good tolerance, reasonable costs, and high safety profile, driving the market. The most common class of drugs includes NSAIDs (nonsteroidal anti-inflammatory drugs), such as ibuprofen (Advil, Motrin IB, others), paracetamol, and naproxen (Aleve).

Hormone therapy segment is expected to witness a CAGR of 13.99% during the forecast period. Hormone therapy have prominent therapeutic products such as Myovant / Pfizer’s Relugolix combination tablet, ObsEva’s Yselty (linzagolix) which is expected to propel the segment growth. Moreover, a strategic collaboration by key players is expected to drive market growth. For example, in February 2022, ObsEva SA and Theramex’s entered into a strategic licensing agreement to expand linzagolix outside of the U.S., Canada and Asia. Linzagolix is indicated as a potential treatment for endometriosis-associated pain.

Drug Class Insights

The NSAIDs segment held a share of 19.50% in 2022, owing to immediate relief of pain, the first line of treatment, ranging from over-the-counter drugs to prescription drugs, and available at a reasonable cost. The nonsteroidal anti-inflammatory drugs include paracetamol, ibuprofen and naproxen, which reduce mild to moderate pain by blocking the production of prostaglandins.

Gonadotropin-releasing hormone (GnRH) medicines are anticipated to be the dominating segment over the forecast period. They come as a pill, shot, injection, or nasal spray. The first pill approved by the FDA is AbbVie Inc.’s Orilissa (elagolix) to treat pain associated with the disease. GnRH agonists and antagonists (Zoladex, Lupron, Orilissa and Synarel) are indicated as alternative for patients’ resistance to first line of treatment. The major advantage of the treatment is that after therapy completion, the patient returns to a normal menstrual cycle, and the ability to get pregnant is not affected.

Route of Administration Insights

The oral segment dominated the market in 2022 and accounted for revenue share of 19.7%. The segment is anticipated to maintain its share over the forecast period, owing to common and convenient route of administration for pain killers, good bioavailability, and effective for hormone therapy. The oral route of administration includes NSAIDs, oral contraceptives, oral progestins such as Aygestin and Provera, and oral GnRH agonists driving the segment growth. Moreover, novel treatment such as AbbVie’s Orilissa (elagolix), is the first orally administered GnRH antagonist for the management of endometriosis, fueling the segment.

However, the other route of administration is expected to witness a CAGR of 5.35% during the forecast period. This can be attributed due to presence of topical formulations as novel transdermal drug delivery technologies. They demonstrate increased efficacy by surpassing first pass metabolism. The segment includes contraceptive patches such as Twirla and Xulane. Furthermore, key players are showing interest in developing such a transdermal system, boosting the segment growth. For instance, Noven Pharmaceutical developed CombiPatch, which is a combination patch (estradiol/norethindrone acetate) for endometriosis treatment.

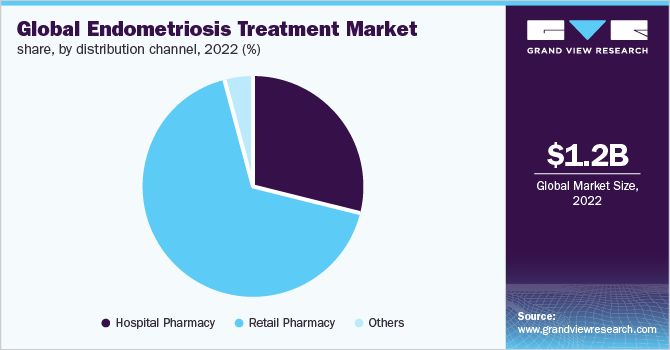

Distribution Channel Insights

The retail pharmacy segment dominated the market and accounted for revenue share of 67.4% in 2022. This can be attributed the fact that most endometriosis patients are treated in outpatient settings and there is high presence of over the counter drugs. Other factors boosting market growth are rising volume of prescriptions for endometriosis drugs, growing awareness of the disease, and increasing healthcare expenditure.

The hospital pharmacy segment is expected moderate growth over the forecast period. The rising option to surgery that needs endometriosis treatment in a hospital setting acts as a major driver for the Hospital pharmacy segment. In addition, hospital pharmacists, as medication experts, can assist patients with endometriosis and their caretakers with appropriate medication selection. All such factors support segment growth.

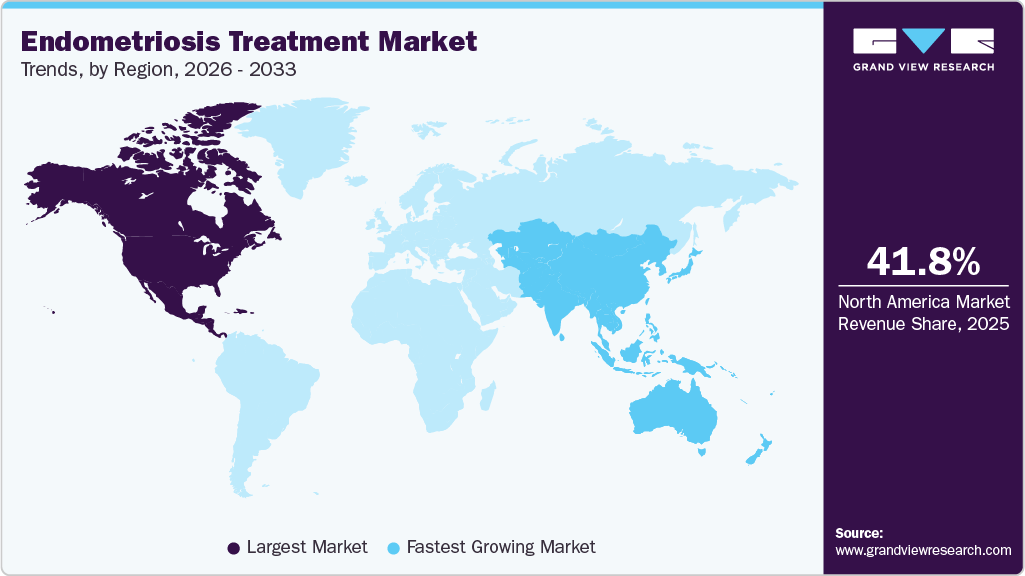

Regional Insights

North America dominated the market and accounted for revenue share of 48.7% in 2022. This can be attributed due to the rising prevalence of endometriosis, increasing awareness about disease in this region, and easy availability of technologically advanced products. For instance, in 2021, in the U.S., around 6.5 million women are affected with the disease, and the condition impacts 1 in 10 women of the age group 15 to 44.

Furthermore, novel product approval and subsequent launches are among the prominent factors driving the growth of the endometriosis treatment market. For instance, in August 2022, the FDA approved Myovant Sciences and Pfizer’s Myfembree (relugolix 40 mg, estradiol 1 mg, and norethindrone acetate 0.5 mg), used as pain management medication in pre-menopause women with the disease.

Asia Pacific is expected to witness a growth rate of 14.83% over the forecast period. The region's growth is attributed to the upsurge in number of disease cases and strategic initiatives undertaken by market players for regional expansion in such regions. Furthermore, rising research and development and increasing investments to develop and commercialize such novel delivery systems is anticipated to boost the market growth in the region.

Key Companies & Market Share Insights

Some of the key players in the endometriosis treatment market are undertaking strategic initiatives such as new launches, collaborations, mergers and acquisitions, further driving market growth. In February 2022, Theramex and ObsEva SA announced the strategic licensing `agreement to back the commercialization and expansion of Linzagolix across the global market. Some of the prominent players in the endometriosis treatment market include:

-

Bayer AG

-

Pfizer, Inc.

-

AbbVie, Inc

-

AstraZeneca

-

ObsEva SA

-

Teva Pharmaceutical Industries

-

Zydus Healthcare Limited

-

Eli Lilly and Company

-

Astellas Pharma Inc.

Endometriosis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,328.9 million

Revenue forecast in 2030

USD 3.2 billion

Growth Rate

CAGR of 13.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 - 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment type, drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bayer AG; Pfizer, Inc.; AbbVie, Inc; AstraZeneca; ObsEva SA; Teva Pharmaceutical Industries; Zydus Healthcare Limited; Eli Lilly and Company; Astellas Pharma Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endometriosis Treatment Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global endometriosis treatment market report on the basis of treatment type, drug class, route of administration, distribution channel, and region:

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain Medication

-

Hormone Therapy

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

NSAIDs

-

Oral Contraceptive

-

Gonadotropin Releasing Hormone

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATA

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global endometriosis treatment market is expected to grow at a compound annual growth rate of 13.52% from 2022 to 2030 to reach USD 3.2 billion by 2030.

b. North America dominated the market for endometriosis treatment and accounted for the largest revenue share in 2022.

b. Some key players operating in the endometriosis treatment market include Bayer AG; Pfizer, Inc.; AbbVie, Inc.; AstraZeneca; ObsEva SA; Teva Pharmaceutical Industries; Zydus Healthcare Limited; Eli Lilly and Company; and Astellas Pharma Inc.

b. Key factors that are driving the endometriosis treatment market growth include a robust late stage product pipeline, rising prevalence of endometriosis, and increasing awareness about women’s health

b. The global endometriosis treatment market size was estimated at USD 1,222.16 million in 2022 and is expected to reach USD 1,328.89 million in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."