- Home

- »

- Medical Devices

- »

-

Endoscopic Vessel Harvesting System Market Report, 2030GVR Report cover

![Endoscopic Vessel Harvesting System Market Size, Share & Trends Report]()

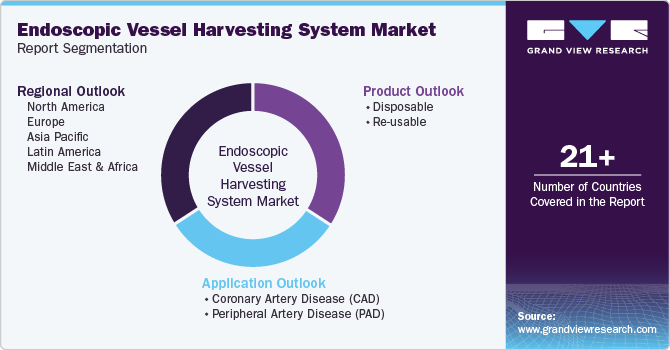

Endoscopic Vessel Harvesting System Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Disposable, Re-usable), By Application (Coronary Artery Disease (CAD)), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-447-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

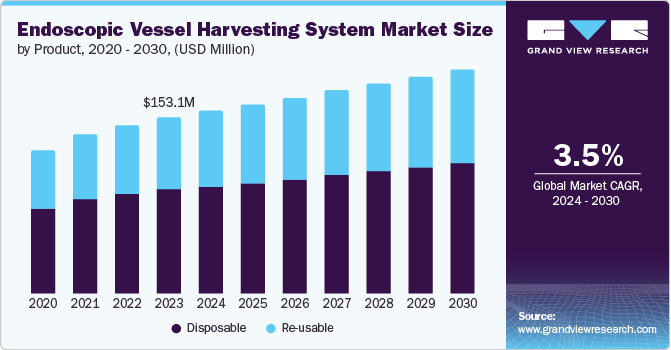

The global endoscopic vessel harvesting system market size was estimated at USD 153.1 million in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. The increasing prevalence of cardiovascular diseases globally, such as peripheral artery disease & coronary artery disease, and growing preference for minimally invasive harvesting attributed to its benefits over conventional methods, coupled with the rising burden of the global geriatric population. For instance , according to the PCR online, CVD continues to be the primary cause of death for both men and women worldwide. As of 2023, the global population is 8 billion, with approximately 620 million individuals living with heart and circulatory diseases. Each year, approximately 60 million people worldwide develop heart or circulatory diseases.

Moreover, the growing incidents of heart disorders including atrial fibrillation are driving the demand for innovative solutions including endoscopic vessel harvesting(EVH) systems to prevent and manage atherosclerosis. As per the Journal of the American Heart Association’ Journal published in January 2023, approximately 6.1 million Americans currently live with Atrial Fibrillation (AFib), a condition characterized by irregular heart rhythm. Additionally, this number is projected to increase to approximately 12.1 million by 2030. This growth is attributed to an aging population and increasing prevalence of risk factors such as hypertension, obesity, and diabetes.

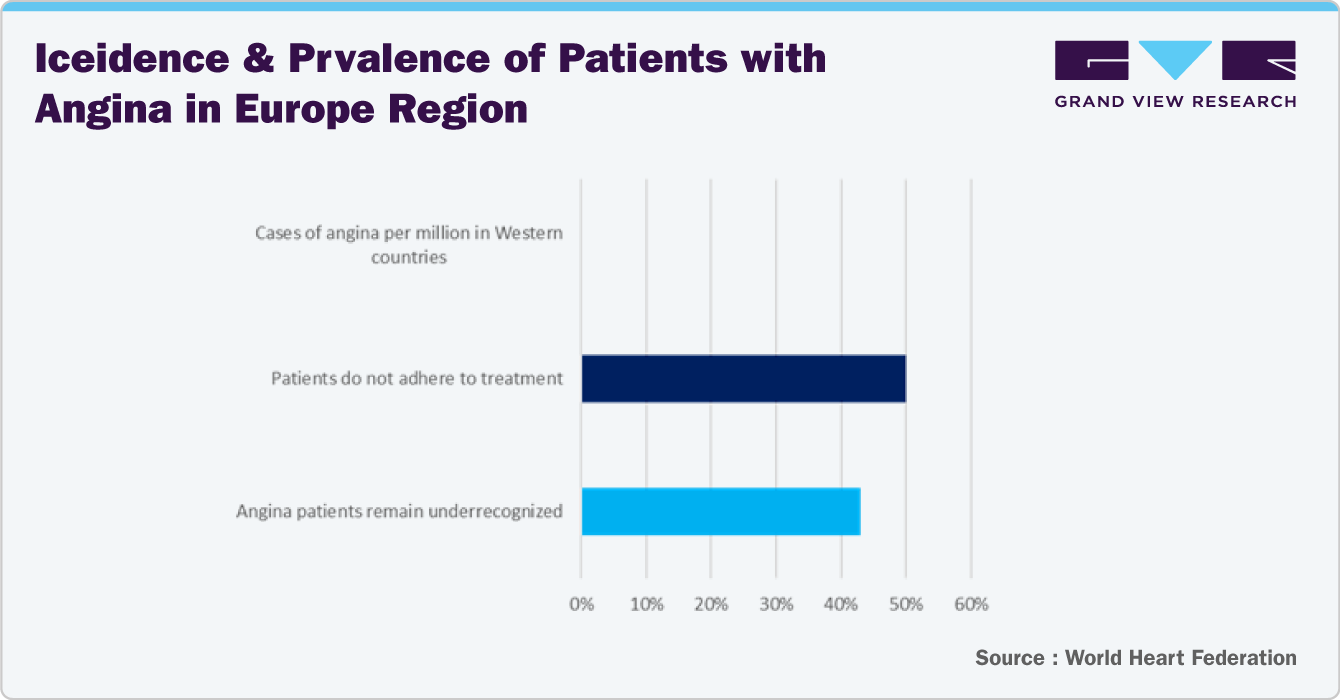

Moreover, angina pectoris, a leading cause of morbidity and mortality globally, affects a significant number of individuals who could benefit from continuous cardiac monitoring. For instance,according to the National Library of Medicine, the prevalence of angina pectoris worldwide ranged from approximately 2% to 7% in 2024. Additionally, in 2023, there were over 2,806,000 reported cases of angina pectoris in China. Developing an accurate diagnosis of angina can be difficult, particularly if the symptoms are unusual. With the reduced risk offered by EVH systems, angina episodes-related transient ischemia alterations or arrhythmias can be treated effectively and enhance the overall success of coronary artery bypass graft CABG surgery by ensuring high-quality grafts with fewer complications.

There is evidence that angina doubles the risk of serious cardiovascular events. Currently, coronary artery disease (CAD) accounts for 4.1 million deaths in Europe annually, with individuals over 65 accounting for 82% of these deaths.

Moreover, the advanced medical imaging technology in the EVH devices enabled the surgeons with improved visualization capabilities. For instance, the integration of near-infrared fluorescence imaging in EVH devices allows for real-time visualization of blood vessels during the harvesting process, enhancing precision and reducing the risk of damage to the vessels. These advancements in the EVH devices ensure better outcomes in coronary artery bypass grafting (CABG) procedures, thus supporting the market growth.

The advances in percutaneous intervention have led to reducing the number of CABG performed each year. However, the growing adoption of EVH systems in CABG surgeries and an increasing preference for minimally invasive surgeries are some of the key contributing factors that exhibit the surge in growth over the forecast period. Furthermore, the growing government regulations for efficacy and product safety are driving the market.

As per the American College of Cardiology, Journal published in May 2024, AHA/ ACC/AAC/ /APMA /SCAI/ABC/VPR /SVM/SVS/SVN/SIR/VESS Guideline, 2024 for the Management of lower extremity peripheral artery disease is a comprehensive document that provides evidence-based recommendations to assist clinicians in managing patients with lower extremity peripheral artery disease (PAD) across various clinical presentations. This guideline covers different subsets of PAD, including chronic symptomatic PAD, acute limb ischemia. asymptomatic PAD, and chronic limb-threatening ischemia

The increasing demand for coronary artery bypass graft (CABG) surgeries significantly drives the market for EVH systems. CABG is a common procedure used to treat coronary artery disease (CAD). As the prevalence of CAD rises due to factors such as aging populations, sedentary lifestyles, and increasing rates of diabetes and obesity, the number of CABG procedures correspondingly increases. This surge in CABG surgeries propels the need for effective, minimally invasive harvesting techniques such as EVH. For instance, as per the Vitality Life Insurance, approximately 20,000 coronary artery bypass grafts are performed annually in England, with most of these procedures being conducted on male patients.

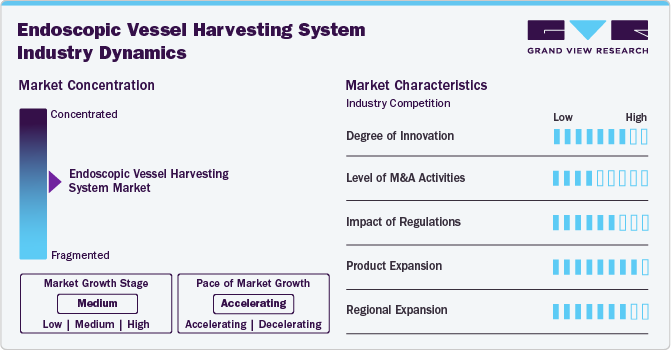

Market Concentration & Characteristics

The endoscopic vessel harvesting (EVH) system industry is characterized by a relatively high level of concentration, with a few key players dominating the market. This concentration is driven by several factors, including the significant investment required in research and development, stringent regulatory requirements, and the need for specialized technology and expertise. Additionally, their ability to navigate complex regulatory landscapes and secure necessary approvals allows them to maintain a competitive edge.This concentration can lead to high barriers to entry for new companies, thus perpetuating the dominance of established firms and shaping the competitive dynamics of the EVH system market.

The endoscopic vessel harvesting system industry is characterized by a high degree of innovation, with technological advancements and companies consistently developing products that enhance efficiency and safety. The advancements in Endovascular Hybrid (EVH) technology are focused on optimizing the quality of conduits, reducing complications, increasing patient satisfaction, and enhancing clinical outcomes in cardiovascular procedures. For instance, the Endoscopic Vessel Harvesting System known as Vasoview Hemopro 2 developed by Getinge is the latest advancement in simultaneous cut-and-seal technology for Endoscopic Vessel Harvesting (EVH). These devices effectively eliminate thermal spread and ensure the acquisition of high-quality conduits for coronary artery bypass graft (CABG) procedures.

Regulations significantly impact the endoscopic vessel harvesting system industry by ensuring patient safety, product quality, and efficacy.Regulatory bodies such as the guidelines and regulations for endoscopic vessel harvesting system are primarily governed by regulatory bodies such as the Food and Drug Administration (FDA) in the United States. These devices must meet stringent requirements to obtain approval for commercial distribution. In March 2024, Getinge received the FDA’s 510(k) clearance for the Vasoview Hemopro 3, the newest addition to its endoscopic vessel harvesting (EVH) solutions. This clearance signifies a significant achievement for Getinge, highlighting its dedication to meeting the highest safety and efficacy standards in the medical technology industry and showcasing its commitment to advancing healthcare technology.

Mergers and acquisitions in the endoscopic vessel harvesting system industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals.

Companies have been developing advanced devices that offer improved ergonomics, visualization capabilities, and precision during surgery. Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance,in January 2023, Terumo and Siemens Healthineers India have joined forces to enhance cardiac care in India by collaborating on initiatives related to physician training, access to advanced medical technologies, and expanding reach into Tier 2 and 3 cities. The partnership is likely to commence with a tailored training program for Cathlab professionals, developed in conjunction with a prestigious academic institution in India.

The endoscopic vessel harvesting system industry is experiencing robust global expansion due to increasing healthcare expenditure, technological advancements, and growing awareness about cardiovascular disorders. Additionally, the growing adoption of endoscopic vessel harvesting system by healthcare facilities due to their benefits such as reduced post-operative complications, shorter recovery times, and improved patient outcomes is fueling market growth.

Product Insights

The disposable segment accounted for the largest market share in 2023. The growth is attributed to reducing the risk of cross-contamination and infection, addressing heightened awareness and regulatory requirements regarding hospital-acquired infections. To improve patient safety and adherence to healthcare regulations, these single-use solutions guarantee sterility for every surgery. Further simplifying hospital operations and lessening the workload for medical personnel, they do away with the requirement for elaborate and expensive sterilization procedures related to reusable equipment. The durability and lack of wear and degradation associated with reusable equipment contribute to the market attraction of disposable systems.

The re-usable segment is anticipated to grow at the fastest CAGR of 4.0% over the forecast period. The growth is attributed to the minimally invasive approach, improved patient outcomes, and efficiency & cost-effectiveness. This innovative system represents a significant advancement in modern surgical techniques, benefiting both patients and healthcare providers similarly.

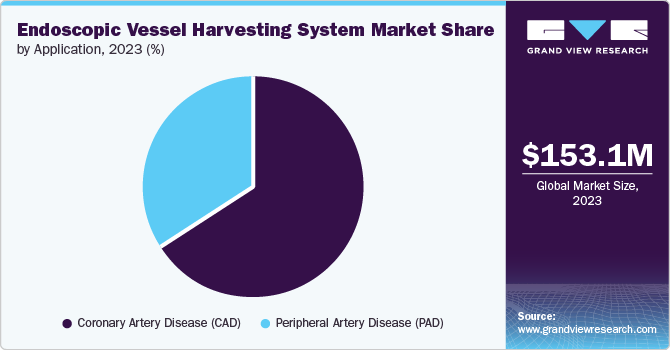

Application Insights

The coronary artery disease (CAD) segment dominated the market with the largest share in 2023. The growth is owed to the rising need to diagnose and monitor patients with CAD efficiently and accurately. These devices are designed to help healthcare providers assess heart function, diagnose CAD, and determine the best treatment plan for individuals with this condition. By utilizing technologies such as electrocardiograms (ECG), echocardiograms, stress tests, chest X-rays, and coronary angiography, CAD devices enable healthcare professionals to evaluate the electrical activity of the heart, visualize its structure and function, measure heart rate under stress conditions, and directly observe blockages in the coronary arteries.

As per Mayo Clinic updates, October 2023 , in a recent study published in eClinicalMedicine, it was found that artificial intelligence (AI) analyzing patient electrocardiograms (ECGs) can detect signs of coronary artery disease, such as calcification, blockages, and evidence of prior heart attacks, years earlier than traditional risk assessment methods. This innovative approach using ECG-AI has the potential to improve heart disease risk assessment by identifying risks at an earlier stage.

The peripheral artery disease (PAD) segment is anticipated to grow at the fastest CAGR of 3.7% over the forecast period. The growth is driven by its ability to cater to patients with compromised vascular health, making it ideal for harvesting vessels in such individuals. These devices are equipped with features that allow for precise and efficient vessel harvesting even in challenging anatomical conditions often present in patients with PAD. Additionally, the rise in the prevalence of PAD globally has led to an increased demand for specialized devices that can effectively address the unique needs of these patients during vessel harvesting procedures. For instance, as per the American College of Cardiology study published in July 2023, 200 million individuals are suffering with PAD globally. Furthermore, advancements in technology have enabled PAD devices to offer improved outcomes, reduced complications, and enhanced patient safety compared to traditional methods, further driving their popularity in the market.

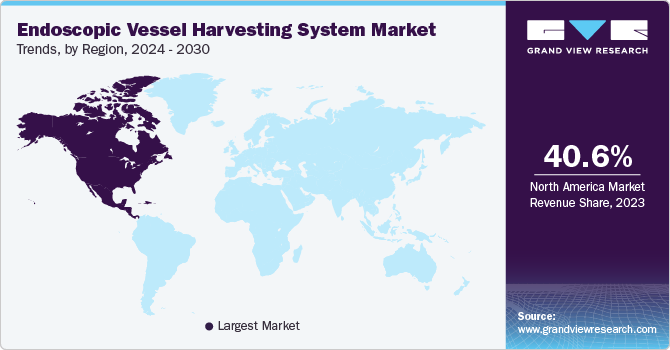

Regional Insights

North America endoscopic vessel harvesting system market dominated the overall global market and accounted for the 40.6% revenue share in 2023. This is due to its large market size and significant growth in the healthcare sector. Expansion of the endoscopic vessel harvesting system industry in this region is driven by rising prevalence of chronic diseases, quick acceptance of technological device improvements, and rising elderly population. For instance, the CDC reports that each year in the U.S., over 795,000 people experience a stroke, with ischemic stroke accounting for 87% of cases.

U.S. Endoscopic Vessel Harvesting System Market Trends

The endoscopic vessel harvesting system market in the U.S. held the largest share in 2023, in the North American region, owing to aging population of older individuals. According to a Population Reference Bureau article published in January 2024, the projected growth indicates that the number of Americans aged 65 and older is anticipated to rise from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. Simultaneously, the share of the total population represented by the 65-and-older age group is expected to rise from 17% to 23%. Moreover, the growing cases of atrial fibrillation (AFib) in the country is also contributing to market growth. For instance, as per the Heart Rhythm Society approximately 6 million individuals in the U.S. are suffering from AFib disorders.

Europe Endoscopic Vessel Harvesting System Market Trends

Europe endoscopic vessel harvesting system market is expected to witness lucrative growth over the forecast period. The growth is driven by the increasing emphasis on personalized and preventive healthcare. Furthermore, government initiatives to improve healthcare infrastructure and accessibility are also boosting the market for endoscopic vessel harvesting system in Europe. For instance, MedTech Europe actively collaborates with patients, European governments, and payers to advance cardiovascular health and instigate coordinated actions at the European level. Under the Healthier Together – EU Non-Communicable Diseases Initiative, MedTech Europe advocated for the following key areas:

Emphasizing the need for a comprehensive EU policy plan aimed at improving cardiovascular health. This plan should focus on prevention, early detection, and effective treatment of cardiovascular diseases (CVDs).

Highlighting the importance of secondary prevention in reducing morbidity and mortality from CVDs. They are advocated for policies that promote early detection and intervention to prevent complications and improve patient outcomes.

To effectively address CVDs at the European level, MedTech Europe called for improved data gathering and exchange between member states. This would enable better understanding of disease trends, resource allocation, and policy development in this area.

The endoscopic vessel harvesting system market in the UK is one of the major markets in the region. The growth is attributed to the favorable reimbursement policies and government initiatives aimed at improving cardiovascular care also play a crucial role in driving market expansion by facilitating patients’ access to advanced treatment options. For instance[AM15] , as per the article published by Gov.UK in February 2023, the Medicines and Healthcare products Regulatory Agency (MHRA) revised its previous guidance (DSI/2022/003) concerning the utilization of paclitaxel coated devices (PCD) for treating peripheral arterial disease (PAD). This update follows an extensive review of recent literature, consultation with the Interim Devices Working Group (IDWG), and input from experts. As a result of this evaluation, the MHRA has lifted restrictions on indications, dosages, and repeated exposure related to PCD.

Germany's endoscopic vessel harvesting system market is projected to expand over the forecast period owing to a rapidly aging population, growing prevalence of cardiovascular issues, a sophisticated healthcare system, a highly qualified workforce, and high healthcare spending. Moreover, the increasing technological advancements in monitoring devices, supportive reimbursement policies, and strategic collaborations within the healthcare industry is further boosting the market growth in the country.

Asia Pacific Endoscopic Vessel Harvesting System Market Trends

Asia Pacific endoscopic vessel harvesting system market is expected to grow at the fastest CAGR from 2024 to 2030. Factors such as unhealthy dietary habits and the rising adoption of a sedentary lifestyle leading to physical inactivity are contributing to the increased cardiovascular morbidities in the region. According to the Ministry of Health Labor and Welfare, around 170,000 deaths were attributed to cardiovascular diseases each year in Japan. Moreover, several multinational companies are setting up their manufacturing business in the region due to low manufacturing costs and skilled labor. The aforementioned factors are further fueling the demand for mobile cardiac telemetry devices.

The endoscopic vessel harvesting system market in Japan is expected to grow at the fastest rate. The market is expected to expand steadily in the foreseeable future due to the ongoing advanced medical technologies, and strategic initiatives undertaken by the key players in Japan. For instance, in November 2023, Kaneka Corporation announced the acquisition of Japan Medical Device Technology Co., Ltd.The market for the treatment of coronary artery diseases, including atherosclerosis, in Japan is positively growing, and Kaneka Corporation, a leading Japanese specialty chemical company, has identified this area as a significant growth opportunity and is actively expanding its business in this sector.

Latin America Endoscopic Vessel Harvesting System Trends

Latin America endoscopic vessel harvesting system marketis experiencing significant growth attributed to the rising awareness towards cardiovascular issues and treatments. For instance, the Cardiovascular Surgery Conference in Latin America, scheduled for December 2024 as per the Society of Thoracic Surgeons, aims to present the latest advancements and best practices in treating congenital heart disease, thoracic aortic disease, coronary artery disease, surgical interventions atrial fibrillation and for heart failure.

The endoscopic vessel harvesting system market in Brazil is expected to grow over the forecast period due to the increasing number of minimally invasive surgeries and growing awareness of minimally invasive procedures among healthcare professionals and patients. Minimally invasive surgeries (MIS) have become increasingly common in Brazil due to several factors. MIS offers numerous benefits over traditional open surgeries, including smaller incisions, reduced blood loss, shorter hospital stays, and faster recovery times. These advantages not only lead to improved patient satisfaction but also result in cost savings for healthcare providers.

MEA Endoscopic Vessel Harvesting System Market Trends

MEA endoscopic vessel harvesting system marketis experiencing significant growth. The rising awareness campaigns regarding the endoscopic vessel harvesting system is further fueling the market growth in the region. For instance, in February 2024, the MEA Harvesters Summit, held at the Address Dubai Mall event brought together around 130 attendees from more than 25 countries. The summit served as a platform for sharing knowledge and promoting professional development, particularly on endoscopic vessel harvesting. The attendees included distinguished doctors, valued partners from the MEA region, and Getinge employees from various global locations.

The endoscopic vessel harvesting system market in Saudi Arabia is anticipated to expand in the forecast period due to increasing number of cardiovascular procedures and the growing focus on minimally invasive surgical techniques. Saudi Arabia has witnessed a significant rise in the number of cardiovascular diseases due to lifestyle factors such as obesity, diabetes, and sedentary lifestyles. According to the Saudi Heart Association, an estimated 3.5 million Saudis are affected by cardiovascular diseases, making it a major health concern in the country.

Key Endoscopic Vessel Harvesting System Company Insights

The competitive scenario in the market is highly competitive, with key players such as Medtronic; Johnson & Johnson; Stryker; NuVasive; and Zimmer Biomet holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Endoscopic Vessel Harvesting System Companies:

The following are the leading companies in the endoscopic vessel harvesting system market. These companies collectively hold the largest market share and dictate industry trends.

- MAQUET Holding B.V. & Co. KG

- CARDIO MEDICAL GmbH

- Terumo Cardiovascular Group

- Med Europe S.r.l. (Elite Life Care)

- LivaNova plc. (Sorin and Cyberonics)

- Saphena Medical, Inc.

- Getinge AB

- Olympus Corporation

- Saphena Medical

- KARL STORZ

- Medical Instruments S.p.a

Recent Developments

-

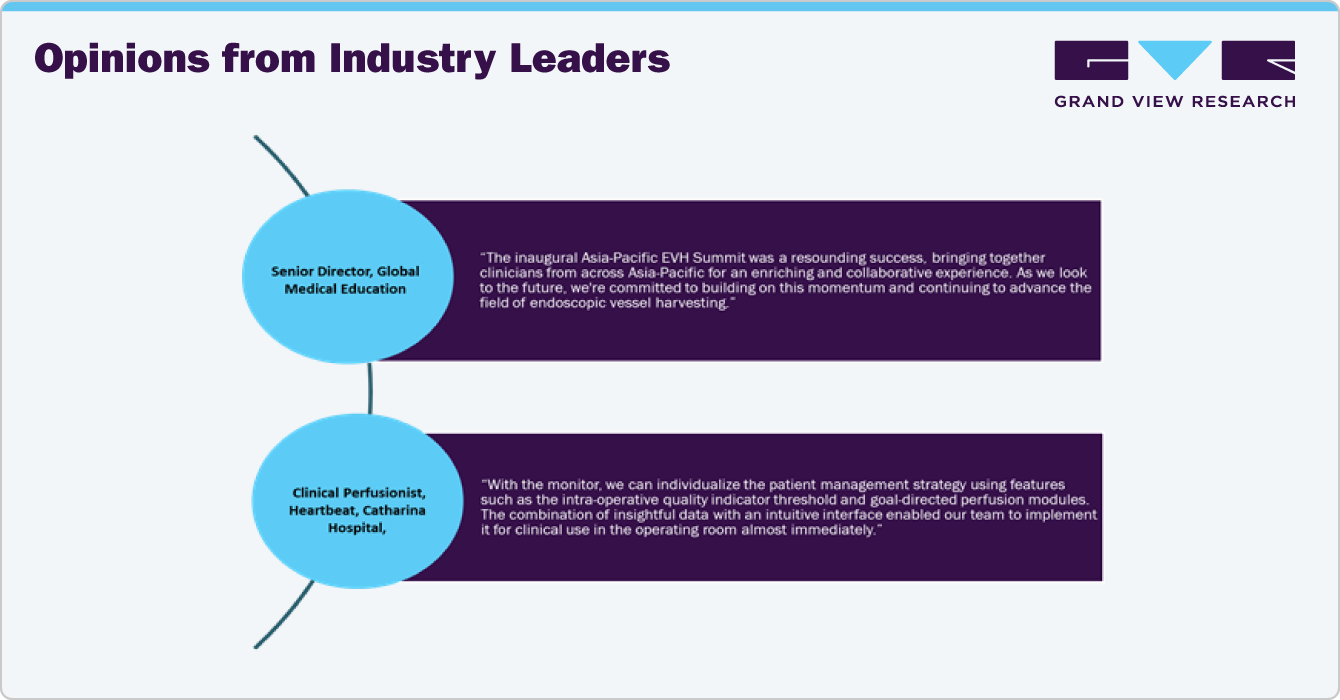

In May 2024, Getinge AB organized the Vessel Harvesting (EVH) Summit in Singapore. The panel discussions featured four clinicians sharing their perspectives on Endoscopic Vessel Harvesting (EVH), covering topics such as surgical ergonomics, patient considerations, emergency scenarios, technical aspects, and concluded with insights and general advice from the panelists.

-

In December 2023, COMBINE-CT, a public-private partnership, has been granted USD 7.28 million (Euro 6.5 million) fund from the Innovative Health Initiative to enhance the diagnosis and treatment of patients suffering from coronary artery disease.This grant is expected to enable COMBINE-CT to develop innovative solutions that aim to improve the accuracy and efficiency of diagnosing coronary artery disease, as well as enhancing the treatment options available for affected patients.

-

In April 2022,LivaNova PLC announced LivaNova introduced the Essenz Patient Monitor in the U.S. and Europe after obtaining clearance from the U.S. Food and Drug Administration 510(k) and receiving the CE Mark. This transformative monitoring system employs a patient-tailored approach during cardiopulmonary bypass (CPB) procedures to enhance clinical efficiency and improve patient care.

Endoscopic Vessel Harvesting System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 159.2 million

Revenue forecast in 2030

USD 195.1 million

Growth rate

CAGR of 3.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast Data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Singapore; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

MAQUET Holding B.V. & Co. KG; CARDIO MEDICAL GmbH; Terumo Cardiovascular Group; Med Europe S.r.l. (Elite Life Care); LivaNova plc. (Sorin and Cyberonics); Saphena Medical, Inc.; Getinge AB; Olympus Corporation; .Saphena Medical; KARL STORZ; Medical Instruments S.p.a

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopic Vessel Harvesting System Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endoscopic vessel harvesting system market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Re-usable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Coronary Artery Disease (CAD)

-

Peripheral Artery Disease (PAD)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopic vessel harvesting system market size was estimated at USD 153.1 million in 2023 and is expected to reach USD 159.2 million in 2024.

b. The global endoscopic vessel harvesting system market is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 195.1 million by 2030.

b. North America dominated the endoscopic vessel harvesting system market with a share of 40.6% in 2023. This is attributable to increasing population and rising cardiovascular disorders which have spurred the demand for Coronary Artery Bypass Grafting surgeries in the region.

b. Some key players operating in the endoscopic vessel harvesting system market include MAQUET Holding B.V. & Co. KG; CARDIO MEDICAL GmbH; Terumo Cardiovascular Group; Med Europe S.r.l. (Elite Life Care); LivaNova plc. (Sorin and Cyberonics); and Saphena Medical, Inc.

b. Key factors that are driving the market growth include growing inclination of the patient population toward minimally invasive cardiac surgeries, technological advancements and innovation pertaining to the cardiovascular medical devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.