- Home

- »

- Medical Devices

- »

-

Endotracheal Tube Market Size & Share Analysis Report, 2030GVR Report cover

![Endotracheal Tube Market Size, Share & Trends Report]()

Endotracheal Tube Market Size, Share & Trends Analysis Report By Product Type (Regular, Reinforced), By Route Type (Orotracheal, Nasotracheal), By Application, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-727-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global endotracheal tube market size was valued at USD 1,821.61 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.20% from 2023 to 2030. The demand for endotracheal tubes is increasing due to technological advancements such as anti-fouling coating products, a significant increase in surgeries, strategic initiatives by key companies, and increasing incidences of chronic diseases. There has been a rise in the prevalence of chronic diseases like urological disorders, cancer, stroke, cardiovascular disorders, and neurovascular diseases, among other chronic problems.

According to the WHO, in September 2022, non-communicable diseases were responsible for the death of approximately 40 million people worldwide. Factors such as high blood pressure, diabetes, obesity, and other unhealthy lifestyle-related disorders result in a higher percentage of the population developing non-communicable diseases. Additionally, according to the same source, over 17 million individuals died as a result of cardiovascular disorders, accounting for 32% of all deaths worldwide. Moreover, stroke and heart attack were responsible for 85% of these deaths.

Moreover, according to the NCBI, lung cancer, which affects both men and women equally, is the second-most prevalent cancer in Americans and the main cause of cancer-related deaths in the country. In 2021, around 235,760 new cases of lung cancer were expected in the U.S. Out of these cases, the local disease was expected to be diagnosed in 17.8% of new patients, regional disease in 22%, and distant stage in 56%. Most patients receive surgical therapy, including 76.7% of those with stage I disease and 83.8% of those with stage II disease. Thus, the above factors will increase market growth in the near future.

The increasing number of investment programs to continue product development and commercialization will drive the endotracheal tube industry in the future. For instance, in November 2022, the third batch of firms to participate in AlphaLab Health, a partnership program of Innovation Works and Allegheny Health Network to accelerate the growth of life sciences and healthcare entrepreneurs, was announced.

The AlphaLab Health startups were chosen through a competitive process to participate in a 6-months program that will assist them in navigating major risk points in the clinical and commercial development of early-stage companies.This cohort includes a diverse set of companies involved in diagnostics, medicines, medical equipment, and healthcare information technology which is expected to boost the market growth.

Technological advancements in anesthesia, surgeries, and endotracheal products are anticipated to drive the market. Advancements in the field enabled healthcare professionals to isolate a lung, minimize aspiration, and prevent Ventilator-associated Pneumonia (VAP). For instance, in November 2021, GE Healthcare announced that it gained FDA 510(k) clearance for an Artificial Intelligence (AI) algorithm that will assist doctors in assessing placements of Endotracheal Tube (ETT).

The need for endotracheal tubes in various healthcare settings is likely to increase with a growing aging population, a demographic that is more susceptible to chronic illnesses such as diabetes and other lifestyle-related disorders. In addition, according to the CDC, adults aged 65 years and above are more likely to suffer from heart disease, Chronic Obstructive Pulmonary Disease (COPD), diabetes, cancer, neurological problems, and other chronic illnesses. Patients with such illnesses require emergency and nonemergency hospital services.

According to the WHO, the global population of individuals aged 60 years or more is likely to reach 2 billion by 2050. Furthermore, by 2050, 80% of the world's elderly population will reside in middle- and low-income countries. As a result, one of the high-impact drivers for the endotracheal tube industry is expected to be the growing elderly population.

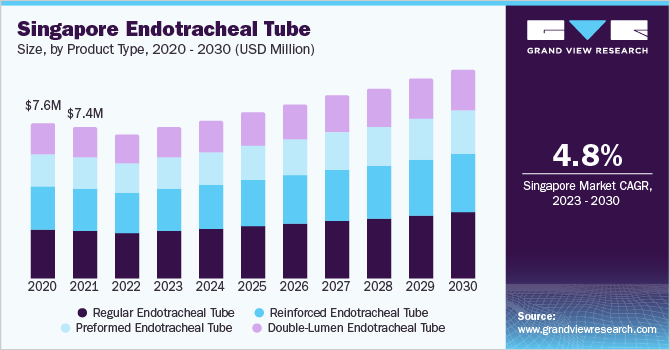

Product Type Insights

The regular endotracheal tube segment held the largest market share of around 32.10% in 2022. Regular endotracheal tubes are widely used to support breathing during surgeries and/or postsurgical care and when the patient is unable to breathe due to pneumothorax (collapse of a lung), pneumonia, respiratory failure or impending respiratory failure, and unconsciousness due to an overdose, stroke, brain injury, or heart failure. Some medical conditions, such as neurological, can result in partial or full paralysis of the diaphragm. These may also require respiratory support. The high prevalence of the above-mentioned medical conditions, coupled with the wide application scope of these tubes, is anticipated to fuel segment growth.

The reinforced endotracheal tube segment is expected to exhibit the fastest growth during the forecast period.Reinforced endotracheal tubes are used during neurosurgeries and facial surgeries. According to an article published by the Journal of Neurosurgery in October 2021, globally, nearly 22.6 million individuals suffer from neurological disorders or injuries, out of which, around 13.8 million require surgery each year. The requirement for neurosurgical procedures is anticipated to fuel the market. In addition, the article states that each year, more than 5 million patients with treatable neurosurgical conditions may never undergo therapeutic surgical intervention. This unmet need is anticipated to further increase the demand for neurosurgical procedures, thereby driving the segment.

Route Type Insights

The orotracheal segment held the largest market share of around 65.17% in 2022. Orotracheal intubation is most widely used in case of emergency indications like respiratory or cardiac arrest, to protect the airway from aspiration, ventilation, inadequate oxygenation, and existing or anticipated airway obstruction. As the prevalence of respiratory and cardiac disorders continues to increase, the demand for orotracheal tubes is expected to grow over the forecast period. The high success rate associated with the procedure is one of the major reasons for the increasing demand for orotracheal intubation over recent years.

The nasotracheal segment held the second-largest market share in 2022. Nasotracheal intubation is a commonly used airway management technique in patients undergoing oral, dental, or throat surgical procedures. It is primarily used to deliver anesthesia in oral surgery patients as it provides easy accessibility to the surgical site during these procedures. For instance, according to the American Cancer Society, there are approximately 54,540 new instances of oral cavity or oropharyngeal cancer per year, and 11,580 fatalities from the oral cavity or oropharyngeal cancer.

Application Insights

The emergency treatment segment held the largest market share of around 55.78% in 2022. The emergency treatment department is equipped to treat injuries, infections, heart attacks, stroke, asthma attacks, and acute pregnancy complications. Increasing incidence of trauma & road accidents, growing demand for emergency care, and rising healthcare expenditure across the globe are major factors expected to drive the demand for emergency treatment. According to WHO, each year, nearly 1.35 million individuals die due to road traffic injuries, while around 20 to 50 million individuals suffer from nonfatal injuries and lifelong disabilities. In addition, as per CDC, in 2018, around 35 million visits to the emergency department were injury-related, while 2.3 million emergency department visits resulted in admission to critical care units.

The therapy treatment segment held the second-largest market share in 2022. The therapy segment mainly includes the use of Endotracheal Tube (ETT) due to inadequate ventilation or oxygenation, as well as airway obstruction, cardiac arrest, and other respiratory diseases. According to a WHO report in 2018, around 83% of people worldwide suffer from lung infections. In addition, the global cancer burden is expected to increase from nearly 19.3 million in 2020, with lung cancer being the second-most common cancer in 2020, to around 28.4 million in 2040. The high prevalence of lung diseases is anticipated to facilitate segment growth. Moreover, the increasing prevalence of road accidents and trauma injuries can further boost the market.

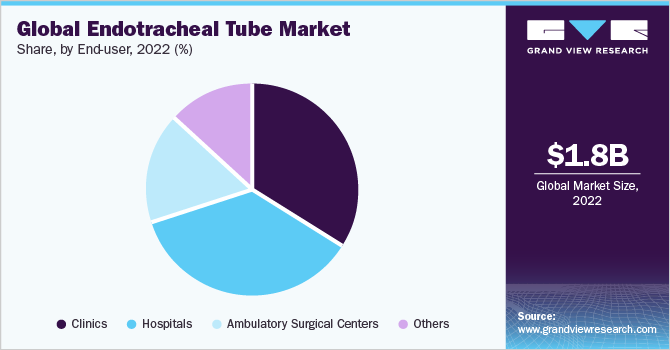

End-User Insights

The hospital segment held the largest market share of around 36.00% in 2022. Hospitals offer various treatments for chronic disorders through skilled staff and certified professionals who can help lower the risk of complications. Therefore, people prefer hospitals to perform related treatments. Furthermore, the availability of various endotracheal tubes to treat oral or respiratory disorders is expected to drive the segment over the forecast period. The number of surgeries undertaken at hospitals is higher than in any other healthcare setting owing to favorable reimbursement structure and availability of hospitals for primary care in developing economies. These factors are likely to be collectively accountable for segment growth over the forecast period.

Clinics are expected to exhibit the fastest growth during the forecast period.The increasing prevalence of respiratory disorders and the growing geriatric population with a high prevalence of chronic diseases are estimated to fuel this segment. Shorter waiting times at clinics, convenient access to care, and affordability are among the key factors due to which patients prefer to undergo surgeries at clinics over other medical settings. In addition, clinics can help reduce the need to visit emergency departments. However, an increase in the preference for ASCs is likely to limit the demand for surgeries at clinics.

Furthermore, the closure of nonessential clinics due to lockdowns issued by several countries amid the COVID-19 pandemic is anticipated to complicate financial issues related to equipment maintenance, as well as facility rents, potentially increasing the financial burden on clinics

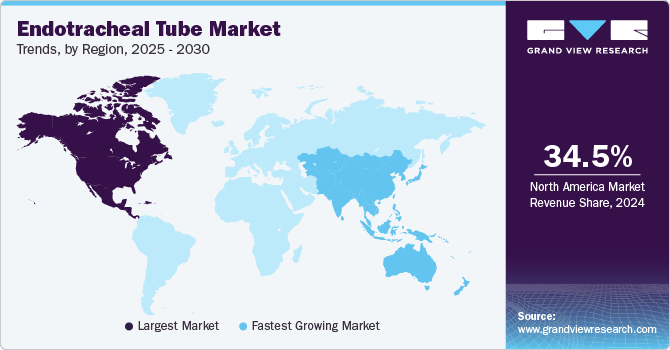

Regional Insights

North America held the largest market share of around 37.72% in 2022. An increase in the number of surgical procedures/hospital visits, the presence of well-established healthcare infrastructure, and favorable reimbursement & regulatory policies in the healthcare industry are among the factors expected to create significant growth opportunities in the market. For instance, according to the Centers for Medicare & Medicaid Services (CMS), health spending in the U.S is predicted to expand at a 5.5% annual pace from 2018 to 2027, reaching USD 6 trillion by 2027. In addition, high disposable income in developed economies and the availability of skilled professionals are some of the factors responsible for the large share of the North America endotracheal tube industry.

Asia Pacific is expected to exhibit the fastest growth during the forecast period. A large patient pool and the growing need for technologically improved and cost-effective healthcare solutions are predicted to create considerable regional growth potential in the market. As a result of low-cost services and an increase in clinical trials, multinational businesses are making significant R&D investments to tap into untapped markets in the Asia Pacific. These factors will have a significant impact on the market.

A few other factors promoting market expansion in the region are a rise in hospital admissions and improvements in clinical development framework in developing nations. In addition, it is anticipated that in the coming years, the burden of chronic diseases and the growing older population in the Asia Pacific would drive demand for endotracheal tubes. The three most prevalent diseases in the area, according to WHO, were cancer, diabetes, and cardiovascular disorders. However, the region's market expansion could be hampered by a lack of advanced healthcare facilities, a shortage of experienced professionals, and a poor reimbursement environment

Key Companies & Market Share Insights

As the demand for endotracheal tubes increases, global manufacturers are accelerating their production processes and modernizing them with cost-effective solutions. To support the growing demand for various endotracheal tube applications, leading companies in the global endotracheal tube industry are pushing for higher product quality. For instance, in January 2022, ICU Medical, Inc. acquired Smith’s Medical, a medical device company. This helped the company gain a strong position on a global level in the medical industry & technology sector. In addition, in January 2022, Medtronic agreed to acquire Affera, Inc, a privately held medical technology company. The acquisition was expected to expand Medtronic’s portfolio of advanced cardiac ablation products. Some prominent players in the global endotracheal tube market include:

-

Angiplast Pvt Ltd

-

Advin Health Care

-

Sterimed Group

-

ICU Medical, Inc.

-

Medtronic (Covidien)

-

Van Oostveen Medical B.V.

-

Teleflex Incorporated

-

Convatec Inc.

-

Fuji Systems Corp

-

SEWOON MEDICAL Co., Ltd.

-

Mercury Medical

-

Hollister Incorporated

-

Well Lead Medical Co., Ltd

-

Viggo Medical Devices

-

ARMSTRONG MEDICAL

-

Medline

-

BD (BESDATA)

-

BRIO DEVICE, LLC.

-

pfm medical ag

Endotracheal Tube Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,919.98 million

Revenue forecast in 2030

USD 2,925.14 million

Growth rate (Value)

CAGR of 6.20% from 2023 to 2030

Volume in 2023

252.64 million units

Volume forecast in 2030

389 million units

Growth Rate (Volume)

CAGR of 6.38% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume unit, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type, route type, application, end- user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; Spain; France; Netherlands; Belgium; Switzerland; Russia; Sweden; China; India; Japan; Australia; South Korea; Malaysia; New Zealand; Singapore; Philippines; Thailand; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Angiplast Pvt Ltd; Advin Health Care; Sterimed Group; ICU Medical, Inc.; Medtronic (Covidien); Van Oostveen Medical B.V.; Teleflex Incorporated; Convatec Inc.; Fuji Systems Corp; SEWOON MEDICAL Co., Ltd.; Mercury Medical; Hollister Incorporated; Well Lead Medical Co.,Ltd; Viggo Medical Devices; ARMSTRONG MEDICAL; Medline; BD; BRIO DEVICE, LLC.; pfm medical ag

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endotracheal Tube Market Report Segmentation

This report forecasts volume & revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global endotracheal tube market report based on product type, route type, application, end-user, and region:

-

Product Type Outlook (Volume, Per Unit; Revenue, USD Million, 2018 - 2030)

-

Regular Endotracheal Tube

-

Reinforced Endotracheal Tube

-

Preformed Endotracheal Tube

-

Double-Lumen Endotracheal Tube

-

-

Route Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Orotracheal

-

Nasotracheal

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Treatment

-

Therapy

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

Spain

-

France

-

Netherlands

-

Belgium

-

Switzerland

-

Russia

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Malaysia

-

New Zealand

-

Singapore

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global endotracheal tube market size was estimated at USD 1,821.61 million in 2022 and is expected to reach USD 1,919.98 million in 2023.

b. The global endotracheal tube market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 2,925.14 million by 2030.

b. North America dominated the endotracheal tubes market with a share of 37.72% in 2022. This is attributable to technological development in endotracheal tubes, the rising prevalence of chronic disease, and the increasing number of surgical procedures.

b. Some key players operating in the endotracheal tube market include TAngiplast Pvt Ltd, Advin Health Care, Sterimed Group, ICU Medical, Inc., Medtronic (Covidien), Van Oostveen Medical B.V., Teleflex Incorporated, Convatec Inc., Fuji Systems Corp, SEWOON MEDICAL Co., Ltd., Mercury Medical, Hollister Incorporated, Well Lead Medical Co., Ltd, Viggo Medical Devices, ARMSTRONG MEDICAL, Medline, BD (BESDATA), BRIO DEVICE, LLC., pfm medical ag, and others.

b. Key drivers expected to contribute to market growth include increase in disease burden, constant increase in the number of surgeries being performed worldwide, technological advancements, and increase in private & public healthcare expenditure

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."