- Home

- »

- Medical Devices

- »

-

ENT Devices Market Size & Share, Industry Report, 2030GVR Report cover

![ENT Devices Market Size, Share & Trends Report]()

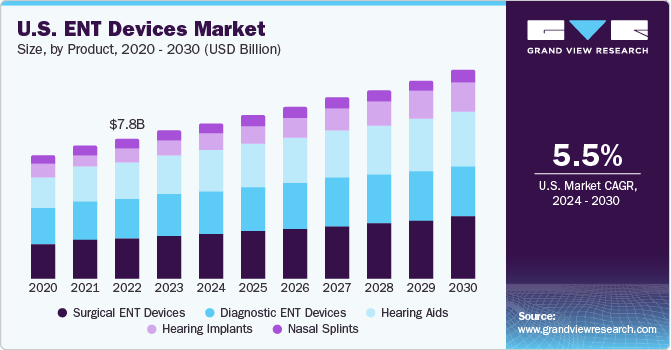

ENT Devices Market Size, Share & Trends Analysis Report By Product (Hearing Aids, Hearing Implants, Diagnostic ENT Devices, Surgical ENT Devices, Nasal Splints), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-477-2

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

ENT Devices Market Size & Trends

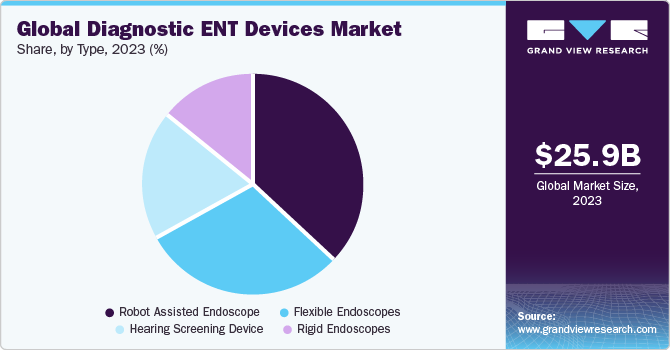

The global ENT devices market size was estimated at USD 25.93 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.54% from 2024 to 2030. This growth can be attributed to several factors, such as high prevalence of ENT-related disorders, an increase in the usage of minimally invasive ENT procedures, and rising geriatric population. Technological advancements also play a crucial role in driving the market growth.

The demand for advanced ENT devices, like robot-assisted endoscopes, is more in developed countries such as the U.S. while it is less in developing countries due to their high cost. The ENT devices market penetration is anticipated to grow significantly due to increasing healthcare spending by other governments and a rise in per capita income. Sales are expected to increase rapidly in developing economies due to high occurrences of ENT diseases such as hearing loss and sinusitis. Additionally, there is an increase in efforts to provide better access to healthcare facilities in these regions.

Hearing loss or impairment is a common condition among patients, particularly in industrialized countries. The World Health Organization reported, more than 430 million people worldwide, approximately 5% of the world's population, have a disabling hearing loss. This number is projected to rise to over 700 million, or one in every ten people, by 2050. The main reasons for this increase are growing life expectancy and noise pollution, leading to more age-related hearing loss cases. In low-income countries, infections such as middle ear infections, measles, or meningitis are the common causes of hearing loss. Moreover, vascular disorders, noise exposure, chronic inflammation, genetic susceptibility, physiological aging of the ear contributing to hearing impairment.

Rising technological advancements such as the adoption of AI and ML and innovations in auditory products are propelling industry growth. For instance, in September 2023, ELEHEAR Inc., an AI-powered hearing aids and audio solutions provider, introduced ELEHEAR Alpha Pro and ELEHEAR Alpha hearing aid devices. It is incorporated with AI noise reduction and extraction, which predicts daily users and their actions to minimize the effect of noise in typical audio environments such as public transit, offices, restaurants, homes, and busy streets. In March 2023, Oticon Medical A/S introduced new features in the processing chip Polaris R, which uses an onboard Deep Neural Network (DNN) for an entirely new method of sound processing. The updated processing chip features include sudden sound stabilizer and Wind & Handling Stabilizer.

Market Concentration & Characteristics

Technological advancements have significantly contributed to the market growth. Development of minimally invasive procedures, innovative diagnostic and surgical devices, and the adoption of AI and machine learning have improved the accuracy and precision of ENT procedures and led to better patient outcomes. The growth is influenced by the pace of technological advancements and the introduction of innovative products.

Several market players, such as Olympus Corporation, Cochlear Ltd., Stryker, Demant A/S, and KARL STORZ are constantly involved in partnership & collaboration and M&A activities to expand their geographic presence and service offerings.

This market is experiencing an increase in regulatory inspections due to government initiatives to raise awareness about ENT related disorders. As a result, key players are investing in research and development (R&D) to launch compliant and innovative devices, leading to improved quality and safety.

The ENT device market’s growth has been significantly influenced by regional expansion. Many companies concentrate their operations regionally to better cater to diverse healthcare needs. This approach helps them expand their market presence, introduce new products, and customize their strategies to specific regional needs. Some major players operate globally and have a diverse product portfolio. They leverage their experience in multiple markets to maintain a competitive edge.

Product Insights

The hearing aids segment held the largest revenue share of over 30% in 2023 and it is estimated to grow at the fastest CAGR from 2024 to 2030. Growing awareness regarding technologically advanced devices for hearing impairment and deafness, and the increasing prevalence of hearing loss due to the growing geriatric population are anticipated to drive the segment growth. The growth is expected to be fueled by an increase in product launches by major players. For instance, in February 2022, Oticon, Inc. broadened its hearing aid portfolio to make its advanced BrainHearing technology accessible to a broader audience with hearing loss.

The hearing implants segment is anticipated to grow at the second-fastest CAGR from 2024 to 2030. This can be attributed to the increasing adoption of hearing implants, rising awareness about cochlear implants as non-invasive procedures, and the launch of new products by key companies. For instance, in January 2022, Acclarent Inc., a subsidiary of Johnson & Johnson Medical Devices Companies, launched TruSeg and TruPath, an AI-powered ENT navigation systems to provide real-time feedback, efficient image guides navigation, and preoperative planning for ENT trials, like endoscopic sinus surgery.

Regional Insights

North America dominated the market with 35% share in 2023. The region's dominance can be attributed to various factors, such as the high prevalence of ENT-related disorders, the presence of large hospital chains and advanced ambulatory facilities, increased demand for hearing care products, and a significant target population. Factors such as the local presence of key players, supportive government regulations for portable medical devices, and high adoption of advanced technology also drive the market growth.

The U.S. dominates the market and is expected to account for the largest revenue share during the forecast period. In 2022, the American Cancer Society predicted that approximately 12,470 new cases of laryngeal cancer will be recorded in the U.S. The high burden of ENT disorders, favorable reimbursement policies, and better healthcare infrastructure are the key factors contributing to the high market share of the U.S.

Asia Pacific is anticipated to grow the fastest from 2024 to 2030, due to increased awareness about early diagnosis of diseases, and rising healthcare expenditure, and growing investment by market players. For instance, in June 2022, Demant A/S acquired ShengWang, a network of hearing aid clinics in China, for USD 245.8 million (RMB 1,750 million). Moreover, technological advancements such as real-time monitoring, wireless, and other innovations, are anticipated to promote market growth further. The support of regulatory bodies and an increase in healthcare spending are expected to contribute to the regional market growth.

Key ENT Devices Company Insights

Some of the key market players include, Cochlear Ltd., Demant A/S, Stryker, and KARL STORZ.

-

Cochlear Ltd. (Cochlear) engages in developing and commercializing cochlear implants, bone conduction implants, & acoustic implants to treat hearing-impaired individuals. Cochlear Ltd. is a global company with major manufacturing facilities in Sweden and Australia.It has a global presence in more than 180 countries.

-

Demant A/S (Demant) is a global company that develops, manufactures, and commercializes hearing implants, traditional hearing instruments, personal communication devices, & diagnostic instruments. The group operates in over 30 countries and sells its products in over 130 countries.

Nemera., Nico Corporation, and Rion Co., Ltd. are the emerging market participants.

-

Nemera, founded in 2003, is a medical equipment manufacturer specializing in a diverse product portfolio, including Ear, Nose, Throat, Nasal spray pumps, drug delivery devices, ophthalmic, and others. In 2021, Nemera established an operational base in Brazil and expanded its product and service offerings throughout Latin America.

-

NICO Corporation is a medical technology company that specializes in developing minimally invasive surgical solutions, particularly in the fields of neurosurgery and otolaryngology (ear, nose, and throat or ENT).

Key ENT Devices Companies:

The following are the leading companies in the ENT devices market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these ENT devices companies are analyzed to map the supply network.

- Ambu A/S

- Cochlear Ltd.

- Demant A/S

- GN Store Nord A/S

- Karl Storz SE & Co.

- Olympus Corporation

- Pentax of America, Inc.

- Richard Wolf GmbH

- Rion Co., Ltd.

- Smith & Nephew plc

- Sonova

- Starkey Laboratories, Inc.

- Stryker

- Nico Corporation

- Nemera

Recent Developments

-

In April 2023, Unitron, a brand of Sonova launched Vivante, a platform aimed to enhance listener’s experience through personalized hearing control. This platform offers improved sound performance and new designs to enhance the hearing experience, integrating experience innovations and the remote plus app to offer a customized hearing experience.

-

In February 2023, Cochlear Ltd. announced a partnership with Amazon.com, Inc. to expand audio streaming for hearing aids for people with Cochlear's hearing implants to provide comfortable entertainment.

-

In November 2022, Cochlear Ltd. announced the expansion of its manufacturing facility plant in Kuala Lumpur, Malaysia. The expansion involved an asset of more than USD 6.28 million (RM 30 million) to help the growing demand for acoustic and cochlear hearing implants.

ENT Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.30 billion

Revenue forecast in 2030

USD 37.72 billion

Growth rate

CAGR of 5.54% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Demant A/S; Sonova; GN Store Nord A/S; Ambu A/S; Pentax Medical (HOYA Corporation); Karl Storz; Olympus Corporation; Richard Wolf GmbH; Cochlear Ltd.; Starkey Laboratories, Inc.; Rion Co., Ltd.; Stryker; and Smith & Nephew plc; Nico Corporation, Nemera

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ENT Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ENT devices market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic ENT Devices

-

Rigid Endoscopes

-

Sinuscopes

-

Otoscopes

-

Laryngoscopes

-

-

Flexible Endoscopes

-

Bronchoscopes

-

Laryngoscopes

-

Nasopharyngoscopes

-

-

Robot Assisted Endoscope

-

Hearing Screening Device

-

-

Surgical ENT Devices

-

Radiofrequency handpieces

-

Otological Drill Burrs

-

ENT Hand Instruments

-

Sinus Dilation Devices

-

Nasal Packing Devices

-

-

Hearing Aids

-

Hearing Implants

-

Nasal Splints

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ENT devices market size was estimated at USD 25.93 billion in 2023 and is expected to reach USD 27.30 billion in 2024.

b. The global ENT devices market is expected to grow at a compound annual growth rate of 5.54% from 2024 to 2030 to reach USD 37.72 billion by 2030.

b. North America dominated the ENT devices market with a share of 35.18% in 2023. This is attributable to increased demand for hearing care devices, the presence of large hospital chains & highly equipped ambulatory facilities, and a significant target population.

b. Some key players operating in the ENT devices market are Demant A/S, Sonova, GN Store Nord A/S, Ambu A/S, Pentax Medical (HOYA Corporation), Karl Storz, Olympus Corporation, Richard Wolf GmbH, Cochlear Ltd., Starkey Laboratories, Inc., Rion Co., Ltd., Stryker, and Smith & Nephew plc, Nico Corporation.

b. Key factors that are driving the ENT devices market growth include the increasing prevalence of hearing loss, the growing geriatric population, increasing penetration of minimally invasive ENT procedures, and technological advancements in this field.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."