- Home

- »

- Medical Devices

- »

-

Enteral Feeding Devices Market Size, Industry Report, 2030GVR Report cover

![Enteral Feeding Devices Market Size, Share & Trends Report]()

Enteral Feeding Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Giving Set, Enteral Feeding Pump), By Age Group (Adults, Pediatrics), By Indication, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-009-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enteral Feeding Devices Market Summary

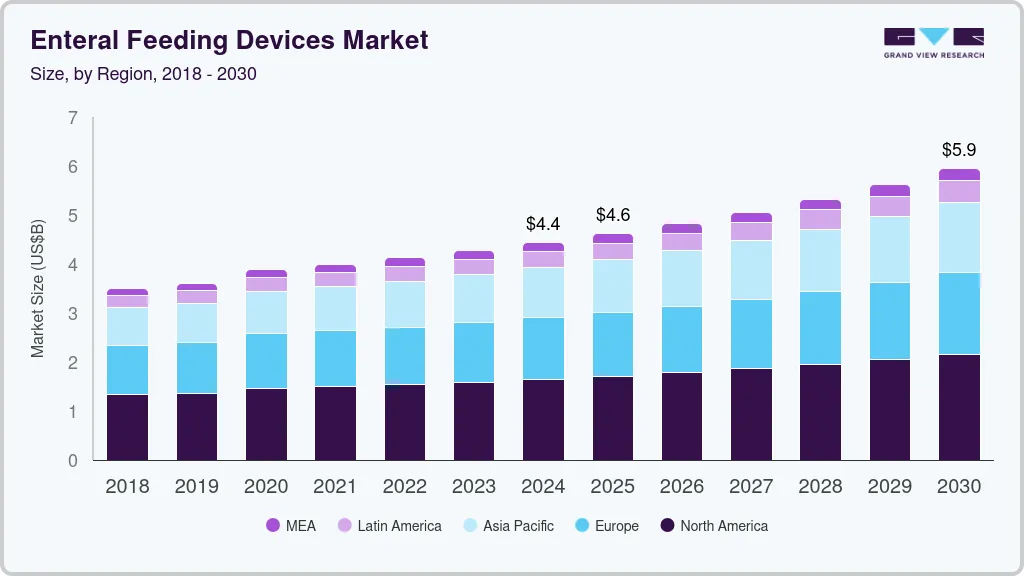

The global enteral feeding devices market size was estimated at USD 4.43 billion in 2024 and is projected to reach USD 5.94 billion by 2030, growing at a CAGR of 5.18% from 2025 to 2030. The growing geriatric population has resulted in increased incidences of diabetes, severe pancreatitis, and other gastrointestinal diseases, which fuel the market growth.

Key Market Trends & Insights

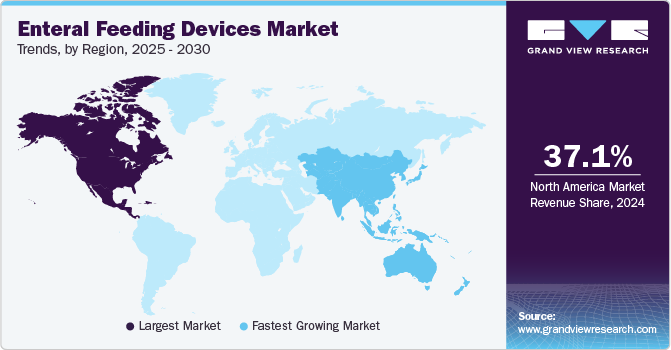

- North America enteral feeding market held the largest share of 37.12% in 2024.

- Based on product, the enteral feeding pump segment held the largest revenue share of 50.60% in 2024.

- Based on age group, the adult age group segment dominated the market with the largest revenue share in 2024.

- Based on indication, the cancer care segment dominated the market with the largest revenue share in 2024.

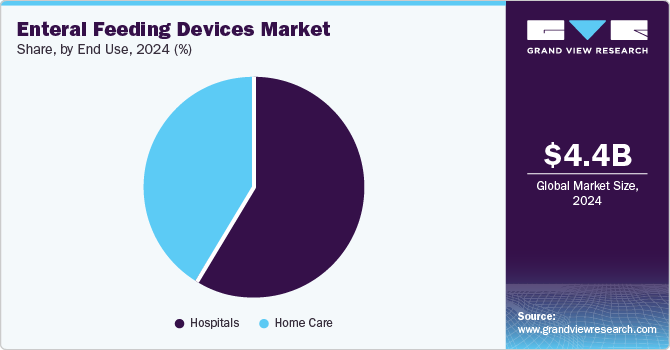

- Based on end-use, hospitals segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.43 Billion

- 2030 Projected Market Size: USD 5.94 Billion

- CAGR (2025-2030): 5.18%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Adoption of the “Feed Early Enteral Diet Adequately for Maximum Effect” (FEED ME) protocol in surgical trauma ICUs in the U.S. enables subsidies on these devices. Technological advancements such as the introduction of tri-funnel replacement G-tubes and J-tubes with reverse balloon designs are also expected to drive the market growth during the forecast period.

According to several NCBI studies, individuals aged over 65 years are at a greater risk of developing chronic illnesses such as Parkinson’s and nervous system disorders. The global population aged 60 years and above increased significantly from around 1 billion in 2020 to about 1.4 billion in 2030 and is expected to double by 2050 to reach around 2.1 billion. The number of elderly patients with critical illnesses has increased significantly over the past few years. The risk of malnutrition and frailty among the geriatric population with comorbidities, such as stroke, depression, and dementia, is much higher, mainly owing to various age-related changes in body composition and muscle mass. This results in a reduced ability to perform Activities of Daily Living (ADLs), thereby increasing the risk of falls or injuries.

The rising prevalence of chronic disease is one of the major factors driving the demand for enteral feeding devices. There has been a constant increase in the prevalence of chronic diseases, such as Alzheimer’s disease, Attention Deficit Hyperactivity Disorder (ADHD), osteoporosis, osteoarthritis, central nervous system disorders, and other diseases, which require clinical dietary management. These devices are highly adopted by the geriatric population who are dealing with chronic conditions for proper intake of nourishment and, thus, fueling the market growth.

According to a May 2024 CDC estimate, about 6 in 10 adults are suffering from at least one chronic condition. Thus, a growing number of surgeries throughout the world also boosts market growth as these devices are commonly used for providing nutrition to critical care patients. According to an article by NCBI, on average, 310 million surgeries are performed every year globally, providing growth opportunities for the market. Increasing healthcare expenditure, growing healthcare infrastructure, and advancements in medical devices can further fuel the market over the forecast period.

The general lack of awareness and understanding regarding enteral nutrition in the medical community is projected to limit its adoption. It requires a prescription and supervision by medical professionals. Although these products are gaining acceptance, they remain poorly understood by patients, physicians, and pharmacists. This factor prevents doctors from adopting or prescribing enteral nutrition, which may restrain market growth. Not all medical experts are convinced that enteral formula would be successful in the treatment of chronic conditions and their symptoms, which may negatively impact the adoption of enteral feeding products along with treatment.

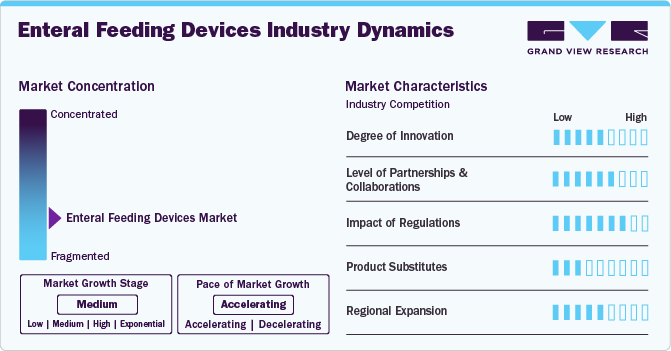

Market Concentration & Characteristics

The industry has witnessed a medium to high degree of innovation, driven by the development of advanced technologies that improve patient safety, ease of use, and treatment outcomes. Innovations include smart enteral feeding pumps with real-time monitoring, automatic flow adjustments, and compatibility with thickened or blended formulas. These technological advancements are key growth drivers and reflect a strong innovation focus in the market.

M&A activity is medium in the industry. Key players are focusing on mergers or acquisitions to expand their market reach and portfolio. For instance, in May 2024, Danone acquired Functional Formularies to strengthen its medical nutrition portfolio in the U.S. M&A is mainly focused on expanding specialized product ranges and patient-centric nutrition offerings rather than consolidating large device manufacturers, keeping activity steady.

The impact of regulations is high, especially in regions such as the U.S. and Europe. Regulatory frameworks such as the FDA’s medical device classification and the European MDR (Medical Device Regulation) influence product design, approval timelines, and market entry. Companies ensure rigorous quality control, biocompatibility testing, and labeling compliance, significantly affecting innovation speed and product rollouts.

The product substitutes in the enteral feeding devices industry are low. Enteral feeding remains the standard care pathway for patients who cannot safely eat or swallow. Alternatives such as parenteral nutrition (feeding through veins) are riskier, costlier, and used only in severe cases where the gastrointestinal tract cannot function.

Regional expansion is medium, with companies actively entering emerging markets but facing infrastructural and regulatory challenges. For instance, in February 2025, Cardinal Health’s plan to expand Kangaroo OMNI pumps into Europe, Australia, and New Zealand by 2025 shows regional diversification efforts.

Product Insights

The enteral feeding pump segment held the largest revenue share of 50.60% in 2024 due to its precision in delivering controlled nutrition and fluids to patients who cannot eat naturally. Key drivers include the rising prevalence of chronic conditions, including cancer, neurological disorders, and gastrointestinal diseases, along with an aging global population requiring long-term nutritional support. Technological advancements such as portable and programmable pumps enhance patient convenience and care quality. For instance, Nutricia's Flocare Infinity III pump is lightweight, allowing users to be mobile and independent.

The enteral feeding bags are anticipated to expand at a significant pace with a CAGR of 5.87% for the forecast period, due to their affordability, ease of use, and rising demand for home-based enteral nutrition. These bags are essential for gravity feeding or pump-assisted feeding, offering a simple and hygienic method for delivering nutrition directly to patients. Key drivers include the increasing prevalence of chronic diseases, a growing elderly population requiring long-term nutritional care, and expanding outpatient and homecare settings.

Age Group Insights

The adult age group segment dominated the market with the largest revenue share in 2024, driven by the rising prevalence of chronic diseases such as cancer, stroke, gastrointestinal disorders, and neurological conditions that impair swallowing in adults. An increased aging population, lifestyle-related health issues, and greater awareness of home-based enteral nutrition options are accelerating demand. Adults often require long-term nutritional support post-surgery or during prolonged illness, boosting device adoption.

Enteral feeding involves the administration of liquid nutrients through a tube directly into the gastrointestinal tract. In addition, according to the WHO, approximately 45% of deaths in children aged 5 years are associated with undernutrition. According to a report published by the UNICEF, approximately 3 million young individuals die every year due to malnutrition. Some types of enteral feeding formulas used for infants are nasojejunal, nasoduodenal, gastrostomy, and jejunostomy tubes.

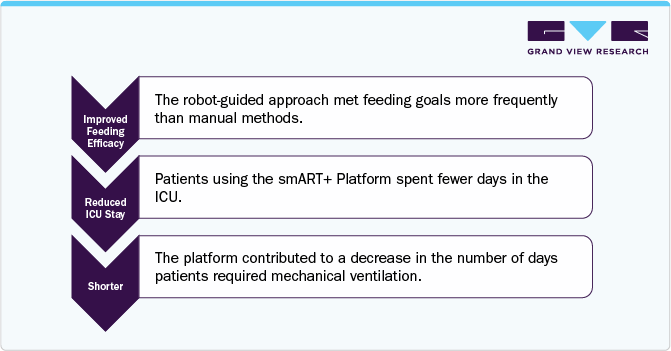

Case Study: “Robot-guided nutrition management platform improves feeding efficacy in ICU patients”

Background:

Enteral nutrition is vital for critically ill patients in intensive care units (ICUs). Traditionally, feeding has been managed manually, leading to challenges in meeting nutritional goals. In August 2023, the smART+ Platform, developed by ART MEDICAL, introduces a robot-guided approach to enhance feeding efficacy. This platform aims to address the limitations of manual feeding methods by providing precise control over feeding parameters.

Challenges:

Manual enteral feeding in ICUs faces several challenges:

-

Inconsistent Feeding: Manual methods may lead to variability in feeding volumes and timing.

-

Tube Misplacement: Incorrect positioning can result in feeding complications.

-

Reflux and Gastric Pressure: Difficulties in monitoring and managing these issues can affect feeding outcomes.

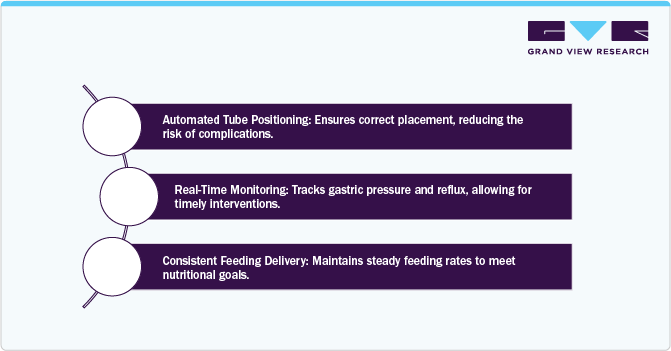

Solutions:

Key Takeaways:

Indication Insights

The cancer care segment dominated the market with the largest revenue share in 2024. Cancer patients, especially those with oral cancer, encounter difficulties with regular food consumption because of side effects from chemotherapy and radiation therapy. The growing use of enteral feeding devices in cancer care, particularly for patients suffering from cancer cachexia and complications related to treatment, played a significant role in driving the dominance of this segment. According to WHO, Oral cancer, which includes cancers of the lip, mouth, and oropharynx, ranks as the 13th most common cancer globally, with an estimated 389,846 new cases and 188,438 deaths reported worldwide in 2022. In addition, the growing global cancer burden and rising adoption of home-based enteral nutrition drive this segment’s growth.

Orphan diseases are expected to grow at the fastest CAGR over the forecast period. According to the Ministry of Health and Family Welfare (MoHFW), Government of India, approximately 300 million individuals globally are living with rare diseases, and around 72% of these diseases are genetic, and approximately 70% of these rare genetic diseases begin in childhood. Thus, due to an increase in awareness about enteral nutrition and a rise in the number of diseases categorized as orphan diseases, the market is expected to grow at the fastest rate over the forecast period.

End Use Insights

Hospitals dominated the market in 2024. Growing awareness among healthcare professionals and others regarding hospital-associated malnutrition is one of the significant factors expected to boost the use and demand for enteral feeding devices in hospitals. Moreover, an increasing number of ICU admissions & re-admissions, increasing demand for enteral foods & formulations among critically or severely ill patients, and rising prevalence of several chronic disorders such as diabetes, cancer, & others are some of the major factors that drive the market growth.

The home care segment is projected to increase at the fastest CAGR over the forthcoming years. According to the Oley Foundation, it is estimated that more than 344,000 individuals of all ages in the U.S. are taking home enteral nutrition. Moreover, according to the British Artificial Nutrition Survey (BANS), more than 59% require support for home enteral tube feeding in the UK. Therefore, due to an increase in the number of alternative care options and rapid technological advancements, the market is anticipated to grow at a significant rate during the forecast period.

Regional Insights

North America enteral feeding market held the largest share of 37.12% in 2024. The growing number of premature infants in critical care is a major factor driving the regional market growth. For instance, according to the CDC, about 1 in 10 babies were born prematurely in the U.S. in 2022. The market is significantly driven by an increase in the geriatric population, which is more susceptible to chronic diseases that result in various disorders such as gastrointestinal disorders, metabolic disorders, and neurological disorders.

U.S. Enteral Feeding Devices Market Trends

The enteral feeding devices market in the U.S. is driven by continuous innovation, regulatory support, and the rising prevalence of chronic diseases. Advanced technologies, including portable enteral feeding pumps and wireless monitoring, are gaining traction to improve patient comfort and mobility. For instance, the Infinity Orange enteral feeding pump is a Bluetooth-enabled option for mobile app connectivity and real-time monitoring (mainly for pediatric and adult mobility care).

Asia Pacific Enteral Feeding Devices Market Trends

The enteral feeding devices market in Asia Pacific is anticipated to grow at the fastest rate over the forecast period. The region has a large patient pool and geriatric population. Lifestyle changes are leading to an increase in the prevalence of various diseases such as cancer, diabetes, gastrointestinal disorders, and autoimmune diseases. This is ultimately expected to increase the demand for enteral feeding devices for the dietary management of chronic diseases. Japan and China have a large elderly population, which is at a high risk of chronic conditions. Nutritional deficiencies are more common in the geriatric population, and it is expected to boost the demand for enteral feeding devices in the Asia Pacific. According to the World Hunger Education Service, around 70% of all malnourished children live in Asia.

Europe Enteral Feeding Devices Market Trends

The enteral feeding devices market in Europe is driven by strong regulatory frameworks, particularly stringent safety and quality standards set by the European Medicines Agency (EMA) and MDR (Medical Device Regulation) guidelines. Innovation in portable, patient-friendly feeding pumps drives growth, especially in home care settings. According to Eurostat, the rising elderly population, projected to reach 30% of the European population by 2050, drives demand for long-term nutritional support devices.

Latin America Enteral Feeding Devices Market Trends

The enteral feeding devices market in Latin America is driven by increasing healthcare investments, improving hospital infrastructure, and rising awareness about malnutrition management, particularly among cancer and gastrointestinal patients. The region faces limited access to specialized healthcare professionals, but ongoing healthcare improvements and increasing chronic disease prevalence present significant expansion opportunities. European regulatory frameworks emphasize safety and standardization, encouraging manufacturers to invest in R&D and compliance initiatives.

Middle East & Africa Enteral Feeding Devices Market Trends

The enteral feeding devices market in the Middle East and Africa is experiencing significant growth, driven by the expansion of advanced healthcare infrastructure in the Gulf Cooperation Council (GCC) countries. Regulatory improvements, such as centralized health authority approvals in countries including Saudi Arabia and the UAE, are streamlining device registrations.

Key Enteral Feeding Devices Company Insights

Key players operating in the enteral feeding devices market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Enteral Feeding Devices Companies:

The following are the leading companies in the enteral feeding devices market. These companies collectively hold the largest market share and dictate industry trends.

- Conmed Corporation

- C.R.Bard

- Gravitas Medical

- Cook Medical

- Boston Scientific Corporation

- Moog Inc.

- Fresenius Kabi AG

- Danone Medical Nutrition

- Kimberly-Clark

- Abbott Nutrition

- B Braun Melsungen AG

- Avanos Medical, Inc.

- Cardinal Health

- Applied Medical Technology, Inc.

- Vygon India

- Fidmi Medical

- ALCOR Scientific

- Amsino International, Inc.

Recent Developments

-

In March 2023, Gravitas Medical recently received FDA 510(k) clearance for its Enteric feeding tube system. It features a "smart" nasogastric tube equipped with sensors to track the tube's position and monitor during feeding.

“Our mission is to use technology to replace the current nutrition delivery solutions with an enteral nutrition intelligence platform that helps caregivers make timely decisions for their patients, and this marks the beginning of that transformation.”

- CEO Sahel Sutaria

-

In September 2023, Cardinal Health launched the Kangaroo OMNI enteral feeding pump, intended to give patients undergoing enteral feeding more options to suit their individual needs over the course of their enteral feeding journey.

"Product innovation plays an essential role in our portfolio lifecycle process. Kangaroo OMNI™ was designed to help improve the lifestyle of enteral feeding patients and caregivers through ease of use, intelligence, versatility, and portability. Kangaroo OMNI™ provides patients and caregivers with the lightest, smallest, and quietest Kangaroo™ feed and flush enteral feeding pump, while delivering a wider variety of commercially available enteral formulas to the patient."

- Kelley Moffett, senior vice president, Global Medical Products, Medical Segment, Cardinal Health

-

In August 2023, Cardinal Health launched its next-generation NTrainerTM System 2.0, a medical device intended to shorten the length of stay in the neonatal intensive care unit (NICU) for premature and newborn infants by assisting them in developing the oral coordination skills necessary for the transition to independent feeding more quickly. The NTrainerTM System gives parents confidence in their newborns' progress and potential for success after discharge by giving clinicians the objective data they need to monitor an infant's development of pre-feeding skills through real-time assessment technology.

"The NTrainer System demonstrates Cardinal Health's investment in innovation to help improve patient outcomes and increase caregiver confidence while providing objective data important for delivering consistent patient care. The NTrainer System will help some of our most vulnerable patients at the beginning of life through the first and only biofeedback device to improve NNS patterns in newborns and infants born prematurely."

- Steve Mason, CEO of Cardinal Health's Medical Segment

Enteral Feeding Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.62 billion

Revenue forecast in 2030

USD 5.94 billion

Growth rate

CAGR of 5.18% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, age group, indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Conmed Corporation; Gravitas Medical; C.R. Bard; Cook Medical; Boston Scientific Corporation; Moog Inc.; Fresenius Kabi AG; Danone Medical Nutrition; Kimberly-Clark; Abbott Nutrition; B Braun Melsungen AG; Avanos Medical, Inc.; Cardinal Health; Applied Medical Technology, Inc.; Vygon India; Fidmi Medical; ALCOR Scientific; Amsino International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enteral Feeding Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, & country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global enteral feeding devices market report based on product, age group, indication, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Giving Sets

-

Enteral Feeding Pumps

-

Enteral Feeding tubes

-

Nasogastric Tube

-

Gastrostomy Tube

-

Others

-

-

Enteral Feeding Bags

-

Percutaneous Endoscopic Gastrostomy Device

-

Low Profile Gastrostomy Device

-

Other Accessories

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Pediatrics

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer’s

-

Nutrition Deficiency

-

Cancer Care

-

Diabetes

-

Chronic Kidney Diseases

-

Orphan Diseases

-

Dysphagia

-

Pain Management

-

Malabsorption/GI Disorder/Diarrhea

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Care

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global enteral feeding devices market size was estimated at USD 4.43 billion in 2024 and is expected to reach USD 4.62 billion in 2025.

b. The global enteral feeding devices market is expected to grow at a compound annual growth rate of 5.18% from 2025 to 2030 to reach USD 5.94 billion by 2030.

b. North America dominated the enteral feeding devices market with a share of 37.12% in 2024. Growing number of premature infants in critical care is a major factor driving the regional market growth.

b. Some key players operating in the enteral feeding devices market include Gravitas Medical, Conmed Corporation, C.R.Bard, Cook Medical, Boston Scientific Corporation, Moog Inc., Fresenius Kabi AG, Danone Medical Nutrition, Kimberly-Clark, Abbott Nutrition, B Braun Melsungen AG, Avanos Medical, Inc., Cardinal Health, Applied Medical Technology, Inc., Vygon India, Fidmi Medical, ALCOR Scientific, Amsino International, Inc.

b. Key factors that are driving the enteral feeding devices market growth include growing demand from the home care sector, the prevalence of chronic diseases, the incidence of preterm birth, and the growing geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.