- Home

- »

- Communication Services

- »

-

Enterprise Governance, Risk And Compliance Market Report, 2030GVR Report cover

![Enterprise Governance, Risk And Compliance Market Size, Share & Trends Report]()

Enterprise Governance, Risk And Compliance Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Application (ESG, EHS), By Organization Size (SMEs, Large Enterprises), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-670-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Governance, Risk And Compliance Market Summary

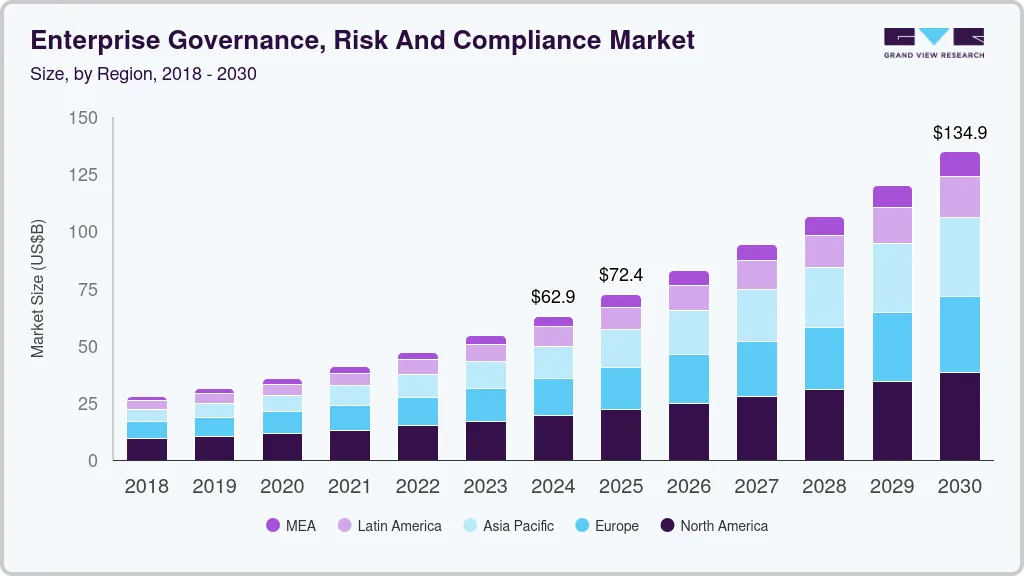

The global enterprise governance, risk and compliance market size was estimated at USD 62.92 billion in 2024 and is projected to reach USD 134.96 billion by 2030, growing at a CAGR of 13.2% from 2025 to 2030. The growth of this market can be attributed to the benefits of implementing enterprise governance, risk and compliance (eGRC), which include stability, optimization, transparency, reduced costs, and consistency, among others.

Key Market Trends & Insights

- In 2024, North America dominated the market with a revenue share of 34.0%.

- Europe is expected to witness fastest growth over the forecast period.

- Based on component, the software segment dominated the market and accounted for a revenue share of nearly 65.0% in 2024.

- Based on software, the risk management segment accounted for the largest revenue share of nearly 25.0% in 2024.

- Based on services, the consulting segment accounted for the largest revenue share of over 38.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 62.92 Billion

- 2030 Projected Market Size: USD 134.96 Billion

- CAGR (2025-2030): 13.2%

- North America: Largest market in 2024

Additionally, the presence of companies such as Oracle, Microsoft, SAP SE, and Software AG, which offer unique solutions, has resulted in a wide range of products available in the market, driving its growth.

The integration of AI and ML technologies within eGRC platforms has revolutionized how companies manage risk and compliance. AI-powered tools can detect emerging risks by analyzing large datasets, identifying patterns, and providing predictive insights. For example, AI can be used to automatically assess credit risks, identify fraud, or highlight potential regulatory violations. Machine learning algorithms can also be used to improve compliance monitoring, continuously adapting to new regulations and evolving threats.

These technologies enhance the efficiency and accuracy of eGRC tools, helping businesses stay proactive in managing risks. For instance, in April 2024, LogicGate, a U.D.-based risk management platform, unveiled its AI Governance Solution, designed to help organizations effectively manage and govern AI technology across all levels. This solution enables enterprises to adopt AI while ensuring compliance, agility, and competitive edge swiftly. The offering aims to help businesses maximize AI benefits while maintaining security and governance.

As regulations become more stringent across industries globally, companies are investing heavily in eGRC solutions to ensure they meet the growing compliance demands. Laws such as the GDPR, Sarbanes-Oxley, and others require organizations to track, manage, and report on compliance metrics, prompting the adoption of eGRC tools to streamline processes and minimize the risk of non-compliance.

With the increasing frequency and sophistication of cyberattacks, businesses are prioritizing cybersecurity and data protection. eGRC solutions help organizations manage their security risks more effectively by identifying vulnerabilities, automating risk assessments, and ensuring policies and controls are in place to prevent breaches. This trend is particularly pronounced in industries such as finance, healthcare, and manufacturing, which handle sensitive data.

Component Insights

The software segment dominated the market and accounted for a revenue share of nearly 65.0% in 2024. Cloud adoption is a significant factor accelerating the growth of the eGRC software market. As organizations increasingly move to cloud-based infrastructure, they need scalable and flexible eGRC solutions that can integrate seamlessly with cloud environments. Cloud-based eGRC software offers cost-effective deployment, real-time collaboration, and continuous updates, making it an attractive choice for businesses seeking efficiency and scalability.

The services segment is expected to grow at a significant CAGR of 13.8% over the forecast period. Many businesses are outsourcing eGRC operations to managed service providers (MSPs) to reduce internal resource burdens and ensure that governance and compliance tasks are handled by experts. Managed services offer ongoing risk assessments, real-time compliance monitoring, and response strategies, which help organizations stay agile and compliant in a fast-changing regulatory landscape.

Software Insights

The risk management segment accounted for the largest revenue share of nearly 25.0% in 2024. Organizations are more aware of the need to address operational risks, such as fraud, supply chain disruptions, and internal process inefficiencies. Risk management software helps enterprises assess risks across various operational domains, providing them with insights into potential vulnerabilities and enabling them to adopt proactive measures.

The compliance management segment is expected to grow at a significant CAGR of 15.6% over the forecast period. Compliance management systems are evolving to integrate with other applications such as risk management, auditing, and finance, providing a holistic approach to compliance. By offering a unified platform, these solutions allow companies to monitor compliance across multiple departments, ensuring greater alignment with corporate objectives and regulatory expectations.

Services Insights

The consulting segment accounted for the largest revenue share of over 38.0% in 2024. As companies increasingly turn to automation to streamline their eGRC operations, consulting services are in demand to advise on the integration of automated compliance and risk management tools. Consultants provide expertise on how to effectively leverage technology to enhance reporting, auditing, monitoring, and documentation, improving efficiency and reducing the likelihood of human error. This shift towards automation is particularly valuable for organizations looking to scale their operations while maintaining compliance and minimizing risk.

The integration segment is expected to grow at a significant CAGR over the forecast period. As businesses accumulate vast amounts of data from multiple sources, the need for a centralized platform to manage governance, risk, and compliance has become more critical. Integration services play a vital role in consolidating data from disparate systems into a unified view, allowing organizations to have a comprehensive understanding of their risk landscape. This centralized data hub enables better decision-making, more accurate reporting, and improved risk mitigation strategies.

Application Insights

The ESG segment accounted for a largest revenue share of over 30.0% in 2024. As stakeholders, including investors, customers, and employees, place greater emphasis on sustainability, businesses are increasingly expected to adopt environmentally responsible practices. Companies are integrating ESG factors into their governance frameworks to ensure they meet sustainability goals, reduce their environmental footprint, and promote social responsibility. This shift is driving demand for eGRC solutions that support ESG reporting, risk management, and compliance.

The EHS segment is expected to grow at a significant CAGR over the forecast period. Ensuring the health and safety of employees is a significant priority for organizations, particularly in high-risk industries such as manufacturing, construction, and chemicals. EHS software helps companies proactively identify and mitigate health and safety risks, reducing the likelihood of workplace accidents, injuries, and illnesses. These platforms support the tracking of safety incidents, near misses, and hazardous exposures, helping businesses take corrective actions and implement preventive measures to protect employees.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share of nearly 68.0% in 2024. As large enterprises expand into new global markets, they encounter a more diverse and complex set of regulatory and compliance requirements. Operating across various jurisdictions with different laws, labor standards, and tax regulations increases the risk of non-compliance. eGRC solutions enable large organizations to manage compliance and risk in multiple regions simultaneously, ensuring consistent adherence to local laws, industry standards, and corporate policies.

The SMEs segment is expected to grow at a significant CAGR over the forecast period. As SMEs embrace digital transformation, they face new risks related to cybersecurity, data privacy, and digital business models. eGRC platforms help SMEs manage these risks by providing tools to assess digital vulnerabilities, implement security protocols, and ensure compliance with digital-related regulations. These solutions facilitate the smooth adoption of digital tools while safeguarding SMEs from potential risks associated with digital transformation.

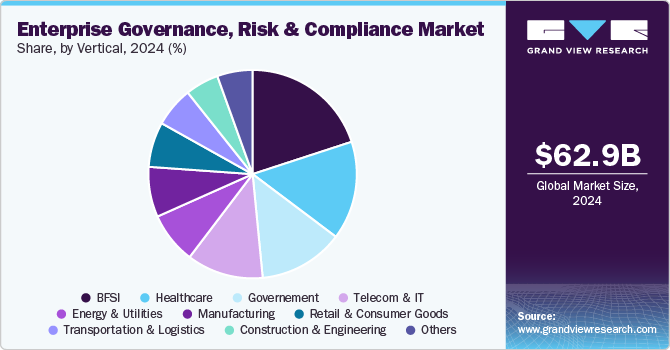

Vertical Insights

The BFSI segment accounted for a largest revenue share of over 20.0% in 2024. Financial institutions face various types of risks, including credit risk, market risk, operational risk, liquidity risk, and cybersecurity threats. As financial products and services become more complex, the potential for exposure to risks increases. eGRC solutions allow BFSI institutions to identify, assess, and mitigate these risks in real time, ensuring they comply with risk management frameworks and maintain operational stability. Moreover, fraud risks, including money laundering, insider trading, and fraudulent transactions, are a significant concern for the BFSI sector. eGRC solutions help in automating fraud detection, monitoring transactions for suspicious activities, and ensuring that all necessary compliance procedures are followed to mitigate the risk of financial crimes.

The telecom & IT segment is expected to grow at a significant CAGR over the forecast period. Telecom and IT companies manage vast amounts of sensitive data, including personal, financial, and corporate information. As cyberattacks and data breaches become more frequent and sophisticated, maintaining strong cybersecurity practices has become critical. Moreover, telecom and IT companies rely heavily on third-party vendors and service providers for various functions, such as software development, cloud services, network infrastructure, and customer support. This creates a risk of exposure to third-party breaches, non-compliance, and operational inefficiencies.

Regional Insights

The enterprise governance, risk and compliance market in North America held the largest revenue share of over 34.0% in 2024. The integration of artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and big data analytics in eGRC solutions is becoming more prominent. These technologies enable real-time risk monitoring, predictive analytics, and the automation of routine compliance tasks, improving efficiency and reducing human errors. AI and ML capabilities help organizations identify emerging risks, automate risk assessments, and enhance decision-making processes.

U.S. Enterprise Governance, Risk And Compliance Market Trends

The U.S. eGRC industry is expected to grow significantly at a CAGR of 10.7% from 2025 to 2030. Key regulations like Sarbanes-Oxley (SOX), Health Insurance Portability and Accountability Act (HIPAA), Gramm-Leach-Bliley Act (GLBA), Dodd-Frank Act, and industry-specific rules continue to increase pressure on organizations to maintain compliance. With businesses facing fines, reputational damage, and even legal actions for non-compliance, there is a growing demand for eGRC solutions that automate compliance processes, simplify reporting, and ensure continuous adherence to regulatory requirements.

Europe Enterprise Governance, Risk And Compliance Market Trends

The eGRC market in Europe is anticipated to register a considerable growth from 2025 to 2030. As sustainability and corporate responsibility become more important to stakeholders, European businesses are under increasing pressure to meet ESG standards. Regulations such as the EU Taxonomy for sustainable activities and the Non-Financial Reporting Directive (NFRD) require organizations to disclose ESG-related metrics, and failure to comply can result in reputational damage and financial consequences. eGRC solutions are increasingly incorporating ESG capabilities, allowing companies to track, report, and ensure compliance with ESG standards, thus driving demand for these solutions in Europe.

The UK enterprise governance, risk and compliance market is expected to grow rapidly in the coming years. The U.K. has stringent regulations aimed at preventing financial crime, including anti-money laundering (AML) and know your customer (KYC) laws. As financial crime risks become more sophisticated, financial institutions and other sectors are leveraging eGRC solutions to manage these challenges. These platforms provide tools to monitor transactions, assess potential risks, and ensure compliance with AML regulations.

The enterprise governance, risk and compliancemarket in Germany held a substantial market share in 2024 owing to the country’s strong manufacturing and industrial base, particularly in sectors such as automotive, engineering, and chemicals. The country adopts Industry 4.0 principles, which involve the integration of digital technologies into manufacturing processes.

Asia Pacific Enterprise Governance, Risk And Compliance Market Trends

The Asia Pacific eGRC market is growing significantly at a CAGR of 15.8% from 2025 to 2030. The financial services sector in APAC is highly regulated, and institutions must comply with a wide range of local and international financial regulations, such as Basel III, Anti-Money Laundering (AML), and Know Your Customer (KYC) requirements. Regulatory technology (RegTech) has emerged as a critical enabler of compliance, leveraging eGRC solutions to streamline reporting, audit trails, and risk management processes. The rapid growth of RegTech in countries like Singapore, Hong Kong, and Australia is influencing the demand for eGRC solutions that can provide real-time compliance monitoring and reporting in line with global regulatory requirements.

The enterprise governance, risk and compliancemarket in Japan is expected to grow rapidly in the coming years. Japan’s supply chains, particularly in industries such as automotive, electronics, and manufacturing, are highly complex and interconnected, often spanning multiple countries. Thus, Japanese businesses are increasingly adopting eGRC solutions to manage third-party and supply chain risks, assess vendor compliance, and track supplier performance.

The China enterprise governance, risk and compliance market held a substantial market share in 2024. China’s "Digital China" strategy aims to accelerate the adoption of AI, big data, blockchain, and cloud computing. With this digital transformation comes a higher complexity in governance, risk, and compliance requirements. Organizations adopting digital technologies face increased risks related to data security, third-party compliance, and automation governance.

Key Enterprise Governance, Risk And Compliance Company Insights

Key players operating in the eGRC industry are Oracle, Genpact, MetricStream, NAVEX Global, Inc., and Maclear Global. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, IBM partnered with e&, a UAE-based technology group, to implement a comprehensive AI and Generative AI governance solution to strengthen compliance, oversight, and ethical standards within its AI ecosystem. Leveraging IBM's watsonx.governance platform and IBM Consulting's expertise, the initiative is designed to enhance AI governance, risk management, and regulatory compliance across e&'s operations.

-

In October 2024, Thomson Reuters acquired Materia, a U.S.-based startup specializing in AI-driven assistants for tax, audit, and accounting professionals. The acquisition aims to strengthen Thomson Reuters' AI capabilities by enhancing automation in research and workflows, improving compliance with financial regulations. By integrating Materia’s technology, the company seeks to help professionals better manage risks related to financial reporting and regulatory compliance, reinforcing its commitment to innovation in the financial sector.

-

In September 2024, Oracle introduced the Oracle Financial Crime and Compliance (FCCM) Management Monitor Cloud Service, designed to give banks, fintechs, and financial institutions a centralized view of their compliance efforts. The solution enhances risk management by enabling faster detection of potential issues and helping organizations proactively combat financial crime while reducing compliance costs. Advanced reporting features allow institutions to generate customized, visually rich reports that are aligned with AML and regulatory requirements.

Key Enterprise Governance, Risk And Compliance Companies:

The following are the leading companies in the enterprise governance, risk and compliance market. These companies collectively hold the largest market share and dictate industry trends.

- FIS

- Genpact

- IBM

- Maclear Global

- MetricStream

- Microsoft

- NAVEX Global, Inc.

- Oracle

- RSA Security LLC

- SAI360 Inc.

- SAP SE

- SAS Institute Inc.

- Software GmbH

- Thomson Reuters

- Wolters Kluwer N.V.

Enterprise Governance, Risk And Compliance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 72.42 billion

Revenue forecast in 2030

USD 134.86 billion

Growth rate

CAGR of 13.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, software, services, application, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

FIS; Genpact; IBM; Maclear Global; MetricStream; Microsoft; NAVEX Global, Inc.; Oracle; RSA Security LLC; SAI360 Inc.; SAP SE; SAS Institute Inc.; Software GmbH; Thomson Reuters; Wolters Kluwer N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Governance, Risk And Compliance (eGRC) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Enterprise Governance, Risk and Compliance (eGRC)market report based on component, software, services, application, organization size, vertical, and region.:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Software Outlook (Revenue, USD Billion, 2018 - 2030)

-

Audit Management

-

Compliance Management

-

Risk Management

-

Policy Management

-

Incident Management

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integration

-

Consulting

-

Support

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Director Board

-

EHS

-

ESG

-

Legal Services

-

Others

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Construction & Engineering

-

Energy & Utilities

-

Government

-

Healthcare

-

Manufacturing

-

Retail & consumer goods

-

Telecom & IT

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise governance, risk and compliance market size was estimated at USD 62.92 billion in 2024 and is expected to reach USD 72.42 billion in 2025.

b. The global enterprise governance, risk and compliance market is expected to grow at a compound annual growth rate of 13.2% from 2025 to 2030 to reach USD 134.86 billion by 2030.

b. The risk management software segment dominated the EGRC market, with a share of nearly 25.0% in 2024. Organizations are more aware of the need to address operational risks, such as fraud, supply chain disruptions, and internal process inefficiencies. Risk management software helps enterprises assess risks across various operational domains, providing insights into potential vulnerabilities and enabling them to adopt proactive measures.

b. The software segment dominated the global EGRC market and accounted for the largest revenue share, nearly 65.0%, in 2024 due to increasing cloud adoption. As organizations move to cloud-based infrastructure, they need scalable and flexible eGRC solutions that can integrate seamlessly with cloud environments.

b. Consulting services led the global enterprise governance, risk, and compliance market and accounted for a maximum revenue share of more than 38.0% in 2024; owing to companies increasingly turn to automation to streamline their eGRC operations, consulting services are in demand to advise on the integration of automated compliance and risk management tools.

b. The large enterprise segment led the global enterprise governance, risk & compliance market with a revenue share of nearly 68.0% of the overall revenue share in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.