- Home

- »

- Green Building Materials

- »

-

Environmental Testing Market Size, Industry Report, 2033GVR Report cover

![Environmental Testing Market Size, Share & Trends Report]()

Environmental Testing Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Rapid, Conventional), By Sample (Soil, Water, Air, Noise), By Target Tested (Chemical, Biological, Temperature), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-020-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Environmental Testing Market Summary

The global environmental testing market size was estimated at USD 13,612.7 million in 2025 and is projected to reach USD 25,977.3 million by 2033, growing at a CAGR of 7.3% from 2026 to 2033. Governments worldwide are imposing stricter environmental standards for air, water, soil, and waste to curb pollution and protect public health, prompting more frequent and comprehensive testing across industries.

Key Market Trends & Insights

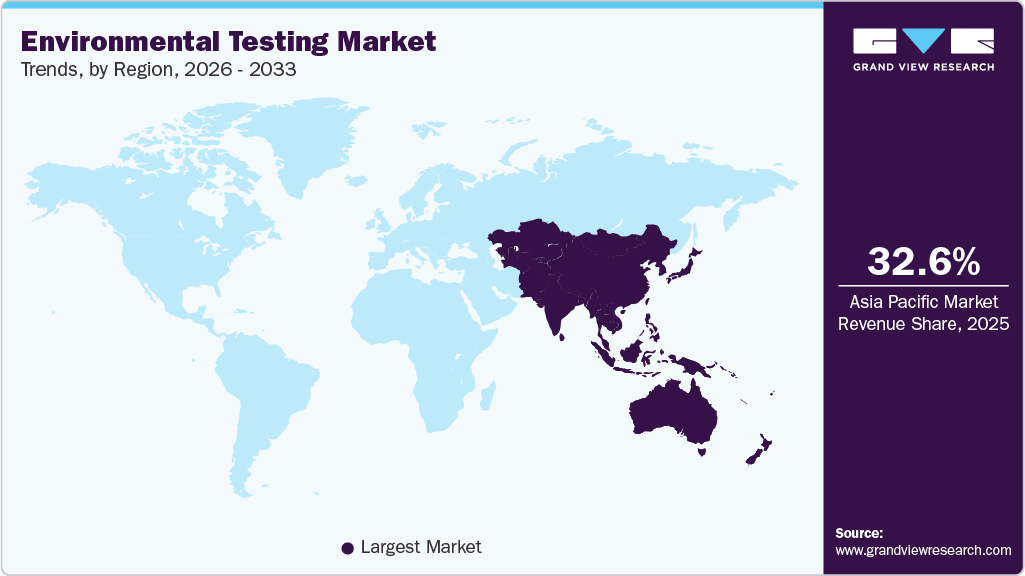

- Asia Pacific dominated the environmental testing market with the largest revenue share of 32.6% in 2025.

- By technology, conventional is expected to grow at a considerable CAGR of 6.7% from 2026 to 2033 in terms of revenue.

- By sample, the air segment is expected to grow at a considerable CAGR of 7.9% from 2026 to 2033 in terms of revenue.

- By target tested, biological is expected to grow at a considerable CAGR of 7.9% from 2026 to 2033 in terms of revenue.

- By end use, the environmental testing laboratories segment is expected to grow at a considerable CAGR of 7.9% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 13,612.7 Million

- 2033 Projected Market Size: USD 25,977.3 Million

- CAGR (2026-2033): 7.3%

- Asia Pacific: Largest market in 2025

This regulatory emphasis, coupled with increased public awareness of pollution and sustainability, is boosting demand for environmental testing services across industrial, municipal, and commercial sectors. Technological advancements, such as rapid testing methods, real‑time monitoring systems, AI‑enhanced analytics, and portable field diagnostics, are enhancing efficiency and broadening applications, further stimulating market expansion. Moreover, rapid industrialization, urbanization, and concerns over water and soil contamination are compelling companies to invest in environmental assessments to ensure compliance and support sustainability initiatives.

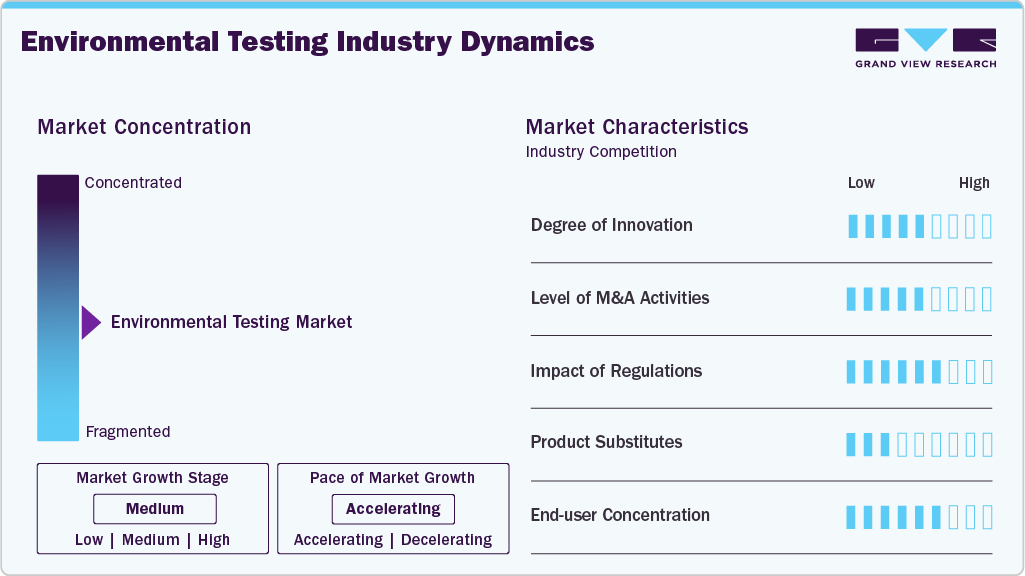

Market Concentration & Characteristics

The environmental testing industry is moderately fragmented due to the presence of a mix of large multinational testing companies and numerous small to mid-sized regional laboratories. While major players compete through advanced technologies, broad service portfolios, and global reach, regional firms remain competitive by offering cost-effective, localized, and specialized testing services. This combination prevents market consolidation while maintaining healthy competition across regions and application segments.

The environmental testing industry demonstrates a moderate to high degree of innovation driven by advancements in automation, digital monitoring, AI-based data analysis, and rapid testing technologies. These innovations improve accuracy, reduce turnaround time, and enable real-time environmental monitoring. The adoption of portable testing devices and advanced laboratory instrumentation allows service providers to meet complex regulatory requirements and deliver more efficient, data-driven environmental assessment solutions.

Merger and acquisition activity in the environmental testing industry is steadily increasing as large players seek to expand geographic reach, enhance service portfolios, and strengthen technical capabilities. Leading companies are acquiring regional and specialized laboratories to gain local expertise and scale operations. These strategic consolidations help firms improve operational efficiency, meet growing regulatory demand, and maintain competitive advantage in a moderately fragmented market.

Environmental regulations play a critical role in shaping the environmental testing industry by mandating strict monitoring of air, water, soil, and waste emissions. Governments worldwide continue to tighten environmental standards to protect public health and ecosystems. Compliance requirements force industries and municipalities to conduct frequent testing, driving sustained demand for environmental testing services and encouraging investment in advanced analytical technologies.

Drivers, Opportunities & Restraints

Stringent environmental regulations and growing awareness of pollution are key drivers of the environmental testing industry. Governments are enforcing stricter standards for air, water, soil, and waste quality, compelling industries and municipalities to conduct regular environmental testing. Rising concerns over public health, climate change, and environmental sustainability further increase demand for accurate and compliant testing services across industrial, commercial, and public sectors.

Growing industrialization and urbanization in emerging economies present significant opportunities for the market. Expanding manufacturing activities, infrastructure projects, and water treatment initiatives increase the need for environmental assessments and compliance testing. In addition, rising investment in smart cities, renewable energy, and sustainable development creates demand for advanced testing solutions, real-time monitoring, and specialized analytical services.

High operational and compliance costs pose a major challenge for the environmental testing industry. Advanced laboratory equipment, skilled personnel, accreditation requirements, and ongoing regulatory compliance increase service costs. Smaller laboratories often struggle to compete with larger players due to limited resources, while price sensitivity among clients can restrict profit margins and slow the adoption of advanced testing technologies.

Technology Insights

The rapid segment dominated the market with a revenue share of 67.4 % in 2025. Rapid methods minimize labor-intensive operations and cost per test. In addition, with rapid methods, one can achieve significant efficiency and possible cost savings. The benefits offered by rapid products are greater accuracy, increased sample throughput, automation, precision, and sensitivity. Over the forecast period, it is anticipated that the demand for mass spectroscopy in environmental testing will increase due to the growing global awareness of the presence of chemical substances in the environment.

The conventional segment by technology in the market is expected to grow significantly due to ongoing regulatory compliance requirements that rely on established laboratory methods. Traditional analytical techniques such as chromatography, spectrometry, and standardized bioassays remain essential for accurate measurement of pollutants in air, water, and soil. Many industries and regulatory bodies continue to mandate these proven methods for certification and reporting, ensuring stable demand. In addition, conventional testing serves as a benchmark for validating emerging technologies, sustaining its relevance.

Sample Insights

The wastewater/effluent segment accounted for a revenue share of 30.3% in 2025. Wastewater treatment is required to preserve public health and the environment, as well as to keep industrial processes running smoothly. Most regulatory authorities require regular analytical testing of wastewater effluents at various treatment stages. For instance, the requirements of the MCERT standard for wastewater effluents, treated sewage effluents, and untreated sewage effluents sampling and chemical testing.

The air segment in the market is expected to grow significantly due to increasing concerns over air pollution, stricter emissions regulations, and rising health awareness. Urbanization, industrial activities, and vehicle emissions are elevating airborne contaminants, driving demand for comprehensive air quality monitoring. Governments and businesses are investing in routine air sampling and analysis to ensure compliance, protect public health, and support sustainability goals, making air testing one of the fastest-growing sample categories.

Target Tested Insights

The chemical segment accounted for a revenue share of 24.8% in 2025 as regulatory agencies tightened limits on chemical pollutants in air, water, and soil. Industries must monitor an expanding list of contaminants, including VOCs, heavy metals, pesticides, and industrial chemicals, to ensure compliance and protect public health. Increasing awareness of chemical hazards and demand for advanced analytical capabilities further drive growth in chemical testing services.

Biological testing techniques are standardized trials that assess a substance’s or material’s toxicity on living things. In the upcoming years, it is projected that there will be an increase in demand for tests to determine the presence of biological agents and assess the contamination produced by them.

End Use Insights

The government segment accounted for a revenue share of 26.7% in 2025. The governments conduct environmental testing through their forestry departments, geology departments, and municipal authorities. The systems used by these departments are not only used to monitor the aforementioned environmental parameters but also help in educating and alerting users in the event of spikes in pollution levels.

The environmental testing laboratories segment is expected to grow significantly during the forecast period, as demand rises from industries, governments, and commercial clients for compliance and sustainability reporting. Stricter environmental regulations and increased monitoring requirements drive more testing services. In addition, expanding industrial activities and public awareness of pollution boost laboratory workloads. Laboratories offering specialized, accredited testing services will see increased utilization, making this segment one of the fastest-growing end-use categories in the market.

Regional Insights

The Asia Pacific region dominated the market and accounted for 32.6% of the global market share in 2025 due to booming industrialization, urbanization, and infrastructure development. Increasing environmental pollution, water scarcity issues, and air quality concerns are prompting stricter government regulations. Countries are investing in environmental monitoring and compliance testing to meet public health and sustainability goals. Rising foreign investments and the adoption of advanced analytical technologies further support market expansion across multiple sectors.

China Environmental Testing Market Trends

The environmental testing market in China is growing quickly as the government implements stricter pollution control policies and environmental protection initiatives. Industrial emissions, urban air quality, and water pollution challenges necessitate comprehensive testing. Strong enforcement measures require industries to conduct regular environmental assessments. Investments in advanced laboratory infrastructure and real-time monitoring technologies enhance testing capabilities, while public demand for cleaner environments drives continued market expansion.

India environmental testing market is expanding due to increasing industrial growth, rapid urbanization, and rising awareness of environmental health risks. Stricter enforcement of air and water quality standards is compelling businesses and municipalities to conduct frequent testing. Expansion of infrastructure projects and water treatment initiatives further drives demand for analytical services. The adoption of modern laboratory technologies and government efforts to improve environmental compliance are key contributors to market growth.

North America Environmental Testing Market Trends

The environmental testing market in North America is expanding due to stringent federal and state regulations that require the monitoring of air, water, and soil quality. Industrial compliance, aging infrastructure upgrades, and enforcement of environmental laws drive continuous testing needs. The region has well-established laboratory networks and strong investments in technology, such as real-time monitoring. Increased public awareness of environmental health issues, climate change impacts, and corporate sustainability commitments further elevates demand for environmental testing services.

The U.S. environmental testing market is expected to experience strong growth, with robust regulatory frameworks such as clean air, clean water, and hazardous waste laws that mandate frequent environmental testing. Industrial sectors must adhere to compliance reporting, leading to consistent demand for analytical services. Technology investments in advanced instrumentation and data analytics enhance testing capabilities, while public health and sustainability initiatives push companies and municipalities to monitor pollutants more frequently. Federal and state enforcement activities also contribute to market expansion.

The environmental testing market in Mexico is developing as environmental regulations strengthen and enforcement increases across industrial and urban areas. Rapid industrial growth, energy sector expansion, and infrastructure development elevate concerns about air and water pollution. Government initiatives targeting water quality improvement and contamination control create demand for analytical testing services. Public awareness of environmental health issues and international trade requirements also drives industries to adopt frequent environmental assessments, boosting the need for testing laboratories and compliance services.

Europe Environmental Testing Market Trends

The environmental testing market in Europe is expected to grow at a 7.5% CAGR during the forecast period, growing due to strict environmental directives and sustainability goals that necessitate regular monitoring of pollutants in air, water, and soil. The European Union’s regulatory frameworks, including emissions controls and waste management standards, compel industries to conduct frequent environmental assessments. Investments in advanced analytical technologies, strong enforcement mechanisms, and a high level of public environmental awareness further support market growth.

Germany environmental testing market is expanding under stringent national and EU environmental regulations that enforce rigorous pollution monitoring and reporting. The country’s large industrial base requires extensive air, water, and soil testing to ensure regulatory compliance and public safety. Investments in advanced technologies and analytical services strengthen testing capabilities. Germany’s focus on environmental sustainability, renewable energy, and emission reduction initiatives amplifies demand for environmental testing services across sectors.

The environmental testing market in the UK is growing due to continued enforcement of environmental protection standards after regulatory changes. Industrial emissions control, water resource management, and waste treatment regulations require frequent analytical testing. Increased public concern about air quality, contamination, and ecosystem health drives demand from both public and private sectors. Adoption of advanced testing technologies and integration of digital data solutions also enhance the capacity of laboratories to meet evolving monitoring needs.

Middle East & Africa Environmental Testing Market Trends

The environmental testing market in the Middle East and Africa is growing moderately, driven by rapid industrial development, oil and gas operations, and infrastructure expansion. Water scarcity and pollution concerns prompt environmental monitoring efforts. Governments are strengthening environmental regulations and investing in testing capabilities to comply with national sustainability goals. Growth is supported by increased environmental awareness, demand for clean water, and monitoring of industrial emissions.

Saudi Arabia environmental testing market is expanding as part of national sustainability and environmental protection strategies. Growth in the industrial and energy sectors requires regular environmental compliance testing. Government programs aimed at improving air quality and water resource management elevate demand for analytical services. Increased public focus on environmental health and regulatory enforcement further supports the adoption of advanced environmental monitoring solutions and testing services.

Latin America Environmental Testing Market Trends

The environmental testing market in Latin America is growing due to increasing industrialization, urban expansion, and environmental regulations. Mining, manufacturing, and agricultural activities drive the need for pollutant monitoring in air, water, and soil. Governments are strengthening environmental laws and compliance requirements, leading companies to invest in testing services. Public demand for environmental protection and sustainable development also supports market growth across the region.

Brazil environmental testing market is expanding with increased regulatory focus on environmental protection and pollution control, particularly in mining, agriculture, and industrial sectors. Monitoring of water quality, air emissions, and soil contamination is essential to address environmental challenges and ecosystem preservation. Government enforcement efforts and investments in analytical infrastructure strengthen testing capabilities. Rising public awareness of environmental issues and corporate sustainability initiatives also contributes to market growth.

Key Environmental Testing Company Insights

Some of the key players operating in the market include SGA SA, Eurofins Scientific, and Intertek Group plc, among others.

-

SGS SA is a Switzerland-based inspection, testing, and certification company providing environmental testing services across air, water, soil, and waste. The company supports regulatory compliance, quality assurance, and risk management for industrial and public-sector clients. Through a broad laboratory network and technical expertise, SGS delivers analytical testing and verification services to help organizations meet environmental and sustainability requirements.

-

Eurofins Scientific is a Luxembourg-based bioanalytical testing company offering environmental testing services for air, water, soil, and waste analysis. The company operates an extensive network of accredited laboratories worldwide and serves industrial, municipal, and commercial clients. Eurofins supports regulatory compliance, environmental monitoring, and research activities through advanced analytical methods and specialized scientific services.

Key Environmental Testing Companies:

The following are the leading companies in the environmental testing market. These companies collectively hold the largest market share and dictate industry trends.

- SGA SA

- Eurofins Scientific

- Intertek Group plc

- Bureau Veritas

- ALS Limited

- TUV SUD

- Asure Quality

- Merieux NutriSciences

- Microbac Laboratories, Inc

- R J Hill Laboratories Limited

- Symbio Laboratories

- Environmental Resources Management (ERM)

- RSK Group Limited

- TestAmerica Laboratories, Inc.

- UL Solutions

Recent Developments

-

In July 2025, SGS signed an agreement to acquire Applied Technical Services (ATS), a North American provider of specialized testing, inspection, calibration, and forensic services. This acquisition expands SGS’s technical capabilities and service portfolio in North America, enhancing its ability to deliver comprehensive testing, inspection, and certification solutions across multiple industries, strengthening its market presence and operational reach.

-

In January 2025, SGS SA expanded its sustainability and environmental testing capabilities by acquiring Aster Global Environmental Solutions, Inc. The acquisition enhances SGS’s expertise in validating and verifying greenhouse gas emissions, supporting clients’ sustainability goals and regulatory compliance. This move strengthens SGS’s service offerings in environmental assessment and verification.

Environmental Testing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 14,680.4 million

Revenue forecast in 2033

USD 25,977.3 million

Growth rate

CAGR of 7.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, sample, target-tested, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

SGA SA; Eurofins Scientific; Intertek Group plc; Bureau Veritas; ALS Limited; TUV SUD; Asure Quality; Merieux NutriSciences; Microbac Laboratories, Inc.; R J Hill Laboratories Limited; Symbio Laboratories; Environmental Resources Management (ERM); RSK Group Limited; TestAmerica Laboratories, Inc.; UL Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Environmental Testing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global environmental testing market based on technology, sample, target tested, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Rapid

-

Mass Spectrometer testing

-

Molecular Spectroscopy testing

-

Chromatography testing

-

Acidity/alkalinity testing

-

Turbidity testing

-

PCR testing

-

Immunoassay testing

-

Others

-

-

Conventional

-

Culture plate method

-

Biological & Chemical Oxygen Demand (BOD & COD)

-

Dissolved Oxygen determination (DOD)

-

-

-

Sample Outlook (Revenue, USD Million, 2021 - 2033)

-

Wastewater/effluent

-

Soil

-

Water

-

Air

-

Noise

-

Others

-

-

Target Tested Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemical

-

Biological

-

Temperature

-

Particulate Matter

-

Moisture

-

Noise

-

-

End-Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government

-

Industrial

-

Environment Testing Laboratories

-

Energy & Utilities

-

Agriculture

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global environmental testing market size was estimated at USD 13,612.7 million in 2025 and is expected to reach USD 14,680.4 million in 2026.

b. The chemical segment dominated the market with a revenue share of 24.8 % in 2025 as regulatory agencies tighten limits on chemical pollutants in air, water, and soil. Industries must monitor an expanding list of contaminants, including VOCs, heavy metals, pesticides, and industrial chemicals, to ensure compliance and protect public health. Increasing awareness of chemical hazards and demand for advanced analytical capabilities further drive growth in chemical testing services.

b. Some key players operating in the environmental testing market include SGA SA, Eurofins Scientific, Intertek Group plc, Bureau Veritas, ALS Limited, TUV SUD, Asure Quality, Merieux NutriSciences, and among others.

b. Key drivers driving the environmental testing market growth include growing industrial activity and pollution in developing economies have heightened public awareness of environmental deterioration, which adds to the expansion of the sector.

b. The global environmental testing market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.3% from 2026 to 2033 and reach USD 25,977.3 million by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.