- Home

- »

- Pharmaceuticals

- »

-

Erythropoietin Drugs Market Size & Share Report, 2030GVR Report cover

![Erythropoietin Drugs Market Size, Share & Trends Report]()

Erythropoietin Drugs Market Size, Share & Trends Analysis Report By Type (Biologics, Biosimilars) By Product (Erythropoietin, Darbepoetin-alfa), By Application (Cancer, Renal Disease, Neurology), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-861-9

- Number of Report Pages: 126

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global erythropoietin drugs market size was valued at USD 6.87 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 1.5% from 2023 to 2030. The introduction of biosimilar EPO in the U.S. market in 2018, the impending patent expiry of Aranesp in 2024 in the U.S., declining prices, and the development and approval of alternative products such as HIF prolyl-hydroxylase inhibitors are some of the key factors responsible for the slow market growth.

The growth can be attributed to the rising incidence of chronic diseases such as cancer, end-stage renal diseases, HIV, and neurological diseases. As per CDC, more than 37 million people in the U.S. suffered from chronic kidney disease (CKD) in 2021. In CKD, the RBC production decreases significantly, resulting in anemia. The rising number of CKD cases is thus expected to boost demand for erythropoietin drugs over the forecast period.

However, the market will face fierce competition from the launch of alternative drugs, which is expected to slow down the market growth in Japan. For instance, in August 2020, Kyowa Kirin Co., Ltd., in partnership with GlaxoSmithKline plc, launched Duvroq in Japan to treat patients with renal anemia due to chronic kidney disease. This partnership opened new avenues for this product in the Japanese market, negatively impacting the erythropoietin drugs market

The product pipeline for EPO drugs only includes biosimilar products, innovator products are not currently, being developed. Due to the increasing biosimilar competition the prices of both patented and biosimilar products have been declining and are expected to decline further during the forecast period. This is one of the factors for the slow growth of the erythropoietin drugs market.

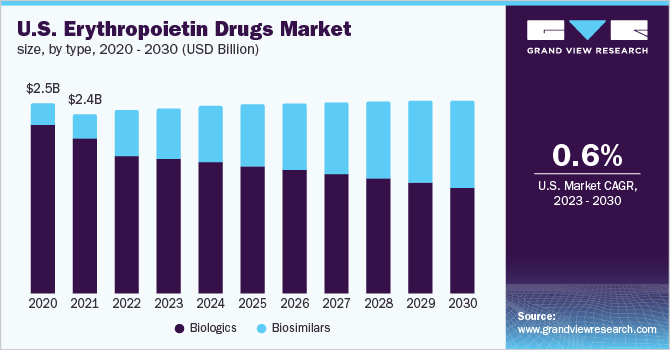

Type Insights

The biologics segment dominated the drugs market with a revenue share of 55.14% in 2022. This can be attributed to their high usage rate in the U.S. due to the lesser penetration of biosimilars. Erythropoietin biologics include Procrit (Johnson & Johnson), NeoRecormon, Epogin, Mircera (F. Hoffmann La-Roche Ltd.), and Aranesp and Epogen from Amgen. However, this segment is losing its market share and is expected to exhibit a decline over the forecast period.

The biosimilars segment is expected to witness lucrative growth over the forecast period owing to the expiry of major patented drugs in the U.S. The European and APAC markets already have a higher penetration of biosimilars. Some of the major erythropoietin drugs whose patents will expire during the forecast include Aranesp (darbepoetin) and Mircera (PEG-EPO). The company may lose patent rights for this drug by May 2024 (U.S.). Thus, the patent expiration of this drug opens new opportunities for biosimilar manufacturers to develop and commercialize their products.

Product Insights

The erythropoietin segment dominated the erythropoietin drugs market with a revenue share of 77.78% in 2022. According to NCBI, a study was carried out to compare the therapeutic efficacy of Epoetin alfa and Epoetin -beta in hemodialysis patients. It was reported that Epoetin -beta was more effective in maintaining the hemoglobin concentration and that a higher dose of Epoetin -alfa was required to maintain the same hemoglobin concentration. Owing to this improved efficacy, the market for Epoetin -beta is expected to exhibit positive growth.

The Darbepoetin-alfa segment is expected to grow at a high growth rate over the forecast period. The growth of the segment can be attributed to initiatives undertaken by the company to provide financial assistance to patients for purchasing ARANESP (darbepoetin alfa). In the U.S., Amgen, Inc. offers financial assistance to uninsured patients through its Amgen Safety Net Foundation. It is up to public and private reimbursement providers whether they mandate to engage in schemes or not. This foundation also guides insured patients to avail and buy discount benefits associated with Aranesp.

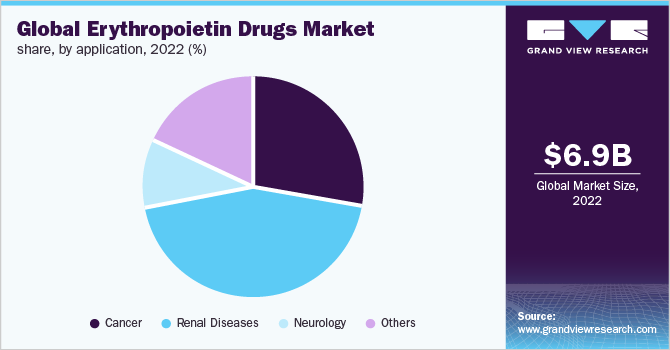

Application Segment Insights

The renal diseases segment dominated the erythropoietin drugs market with a revenue share of 43.86% in 2022. This dominance can be attributed to the fact that the wide availability of erythropoietin drugs for the treatment of patients suffering from different renal disease conditions. Some of the erythropoietin drugs used are Epogen, Aranesp, Venofer, and Ferrlecit. These drugs represent approximately 25% of the total payments of drugs that are used for the management of anemia patients with CKD as per the Medicare and Beneficiary report. Thus, the presence of well-developed reimbursement policies for renal transplants and related diseases is also expected to drive the erythropoietin drugs market.

The cancer segment is expected to witness the fastest growth over the forecast period owing to the disease burden. According to Globocan, the number of new cancer cases is anticipated to reach 28.4 million within the next two decades, with a rise of 47% from 2020, owing to the adoption of a western lifestyle, high consumption of alcohol, smoking, poor diet choices, and physical inactivity. Erythropoietin drugs majorly epoetin-alfa have been in use to increase the hemoglobin levels in cancer patients who have developed chemotherapy-associated anemia. Thus, a growing number of cancer cases is projected to propel the demand for erythropoietin drugs.

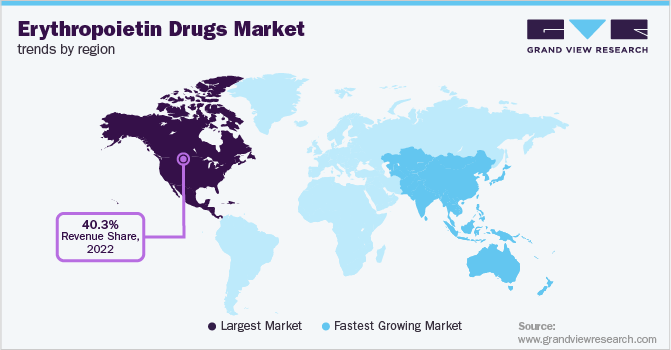

Regional Insights

North America dominated the overall erythropoietin drugs market in terms of the revenue share of 40.35% in 2022. The regional market is anticipated to significantly benefit from local organizations that are actively engaged in advancing the development and use of erythropoietin drugs. Currently, there are five erythropoietin drugs available-NeoRecormon (epoetin beta), Dynepo (epoetin delta), Eprex (epoetin alfa), Aranesp (darbepoetin alfa), and Mircera (methoxy polyethylene glycol-epoetin beta). Biosimilars have been recently introduced in the U.S. market, which is expected to negatively impact market growth.

Asia Pacific is expected to witness a growth rate of 3.0% over the forecast period. The growth of the region is attributed to the presence of key players in the market and strategic initiatives undertaken by them to develop and commercialize new erythropoietin drug products to treat anemia patients. For instance, in September 2021, Wanbang Biopharma received approval for Yi Bao (Human Erythropoietin Injection) from NMPA (National Medical Products Administration). It is indicated to treat chemotherapy-associated anemia in patients with non-myeloid malignancies. All such strategic initiatives are expected to propel market growth in the Asia Pacific region.

Key Companies & Market Share Insights

Key players are collaborating to fulfill the global demand for therapeutic products, thereby accelerating market growth. For instance, in November 2022, Dong-A ST entered into a strategic agreement with Polifarma for the DA-3880 NESP biosimilar. Under this agreement, Polifarma attained the right to commercialize and develop DA-3880 in Brazil, Mexico, and Turkey. Some of the key players in the global erythropoietin drugs market include:

-

Johnson & Johnson Services, Inc.

-

Novartis AG

-

Teva Pharmaceutical Industries Ltd.

-

Amgen, Inc.

-

F. Hoffmann-La Roche Ltd.

-

LG Chem

-

Biocon

-

Intas Pharmaceuticals Ltd.

-

Sun Pharmaceutical Industries Ltd

-

Dr. Reddy’s Laboratories Ltd

Erythropoietin Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.0 billion

Revenue forecast in 2030

USD 7.8 billion

Growth Rate

CAGR of 1.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

Type, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait,

Key companies profiled

Johnson & Johnson Services, Inc.; Novartis AG; Teva Pharmaceutical Industries Ltd.; Amgen, Inc.; F. Hoffmann-La Roche Ltd.; LG Chem; Biocon; Intas Pharmaceuticals Ltd.; Sun Pharmaceutical Industries Ltd; Dr. Reddy’s Laboratories Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Erythropoietin Drugs Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global erythropoietin drugs market report based on type, product, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Biosimilars

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Erythropoietin

-

Darbepoetin-alfa

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Renal Diseases

-

Neurology

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global erythropoietin drugs market is expected to grow at a compound annual growth rate of 1.5% from 2023 to 2030 to reach USD 7.8 billion by 2030.

b. North America dominated the erythropoietin drugs market with a share of 40.4% in 2022. This is attributable to increasing awareness about chronic diseases and its treatment, favorable reimbursement policies, and the high presence of major players.

b. Some key players operating in the erythropoietin drugs market include Johnson & Johnson; Celltrion, Inc.; Teva Pharmaceutical Industries Ltd.; Amgen, Inc.; F. Hoffmann-La Roche Ltd.; LG Life Sciences Ltd.; Biocon Limited; Intas Pharmaceuticals Ltd.; Sun Pharmaceutical Industries Ltd.; Dr. Reddy’s Laboratories Ltd.

b. Key factors that are driving the market growth include the introduction of new erythropoietin drugs, increasing incidence of chronic diseases, and increasing R&D activities for the development of novel drugs.

b. The global erythropoietin drugs market size was estimated at USD 6,871.37 million in 2022 and is expected to reach USD 7.0 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."