- Home

- »

- Plastics, Polymers & Resins

- »

-

Ethylene Copolymers Market Size & Share Report, 2030GVR Report cover

![Ethylene Copolymers Market Size, Share & Trends Report]()

Ethylene Copolymers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Hot Melt Adhesives, Asphalt Modifications), By End Use (Packaging, Automotive, Textiles), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-630-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethylene Copolymers Market Size & Trends

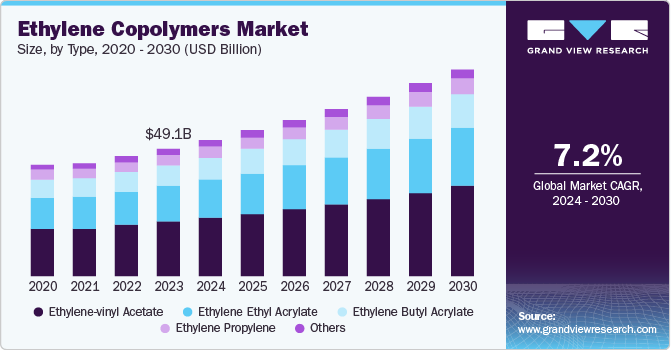

The global ethylene copolymers market size was valued at USD 49.01 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. A steadily increasing demand for these polymers from various critical industries, technological advancements in polymer engineering, and stringent environmental regulations have led to market growth. Due to their excellent barrier properties, flexibility, and durability, ethylene copolymers are widely used in packaging applications, such as flexible packaging, shrink wrap, and stretch film.

Additionally, a heightened demand for these products in developing economies such as India, China, and Vietnam have established localized research & development and production facilities in these countries. For instance, Celanese Corporation, a leading name in this market, in May 2024 announced the opening of two new facilities in India, located in Silvassa and Hyderabad. This development is expected to create a new regional consumer base, driving further market growth.

Ethylene copolymers are used in various automotive components, such as vehicle bumpers, dashboards, and fuel tanks, due to their high impact resistance and chemical and weather resistance. As the global demand for automobiles rises, a proportional increase in demand for ethylene copolymers is expected in the coming years. Moreover, these copolymers are increasingly used in construction applications such as waterproofing membranes, roofing materials, and flooring, owing to their excellent durability, flexibility, and resistance to extreme temperatures. The increasing pace of construction activities and urbanization in rapidly developing economies, such as Brazil, China, and India, presents promising growth prospects for this market.

Due to their biocompatibility, sterile nature, and resistance to chemicals and abrasion, ethylene copolymers are also extensively utilized in medical devices, such as tubing, catheters, and implantable devices. Continuous innovations in polymer engineering enable the development of ethylene copolymers with highly customized properties, thus expanding their application range. For instance, in June 2024, ExxonMobil introduced the Enable 1617 performance polyethylene resin for thin-gauge hand wrap applications. Additionally, growing environmental concerns are driving the development of recycling technologies for ethylene copolymers, thereby promoting sustainability and circular economy principles. For instance, Westlake Corporation, in September 2023, introduced the PIVOTAL polyethylene resin made from 45% recycled material. Such advancements are expected to affect market growth positively.

Type Insights

In terms of type, ethylene-vinyl acetate (EVA) led the market with the highest revenue share of 42.4% in 2023. Due to EVA's distinctive properties, such as flexibility, toughness, adhesive characteristics, and compatibility with other polymers, it is highly suitable for a diverse range of end-use industries. For instance, EVA's applicability extends across sectors, including packaging, footwear, wire and cable, adhesives, and solar panels, driving robust and consistent demand. This material is found widely in sports, leisure, and footwear applications. EVA's low-temperature resistance and high flexibility in the packaging sector have highlighted its demand as a viable sealant solution.

Meanwhile, ethylene ethyl acrylate (EEA) is expected to register a substantial CAGR over the forecast period. EEA's exceptional compatibility with various substrates and ability to enhance flexibility, toughness, and adhesion properties have made it an increasingly sought-after material in producing adhesives, sealants, and coatings. Furthermore, EEA's resistance to UV degradation, low temperatures, and chemicals has expanded its utility in outdoor and industrial applications, fueling its demand and contributing to its high growth rate in the global industry. EEA copolymers are used in hot melt adhesive formulations, cable & wire compounds, compatibilizers, and carrier resins for concentrates, showcasing their versatility and reliability.

Application Insights

Hot melt adhesives accounted for the highest market revenue share in 2023. It is attributed to their widespread adoption across various major industries such as packaging, automotive, construction, and textiles. The superior bonding strength, rapid set times, and versatility of hot melt adhesives have made them essential in manufacturing processes, enabling efficient and high-volume production. They also offer a cost-effective and environmentally friendly alternative to traditional solvent-based adhesives, as they do not emit volatile organic compounds (VOCs) and have a longer shelf life. An increasing demand for high-strength bonding solutions is expected to drive segment growth.

The asphalt modifications segment is expected to register a notable growth rate from 2024 to 2030. It is owing to the increasing demand for long-lasting, reliable, and high-performance road infrastructure globally. Incorporating ethylene copolymers in asphalt formulations enhances the material's binding properties, flexibility, and resistance to deformation, thereby extending the lifespan of roads and pavements and reducing maintenance costs. Furthermore, a growing focus on sustainable construction practices has led to adopting polymer-modified asphalts, which offer improved elasticity and reduced thermal susceptibility. As governments worldwide invest in infrastructure development and rehabilitation projects, the demand for ethylene copolymer-based asphalt modifications is expected to rise steadily, sustaining its high growth pace during the forecast period.

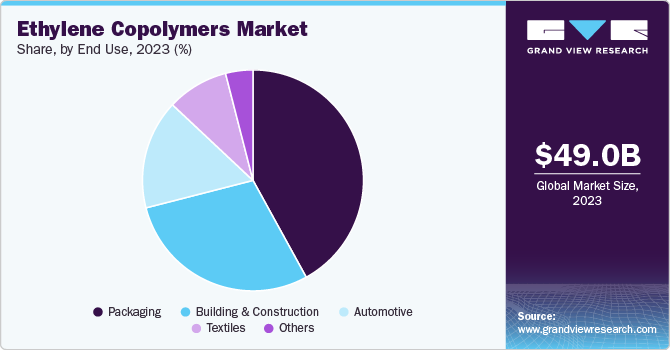

End Use Insights

The packaging end-use segment held the highest revenue share in 2023. It is attributed to the unique combination of flexibility, toughness, and barrier properties offered by ethylene copolymers, making them an ideal material for producing flexible packaging, shrink films, and containers. The growing demand for convenient, lightweight, and sustainable packaging solutions has driven the adoption of ethylene copolymers in this industry, particularly in the food and beverage sector. Furthermore, a sharp rise in the popularity of e-commerce and online shopping trends has led to a surge in demand for protective packaging materials, further solidifying the position of the packaging industry as the largest end-user of ethylene copolymers.

The building and construction segment is expected to register a significant CAGR during the forecast period. The demand for durable, flexible, and weather-resistant materials in construction projects has led to the widespread use of ethylene copolymers in roofing, waterproofing, and insulation systems and in producing pipes, fittings, and other plumbing components. Furthermore, the growing trend towards sustainable and energy-efficient buildings has fueled the demand for ethylene copolymer-based materials, which offer improved thermal insulation, reduced energy consumption, and extended lifespan of structures. As the global construction industry continues to expand, driven by urbanization and infrastructure development, this segment is expected to maintain its high growth rate.

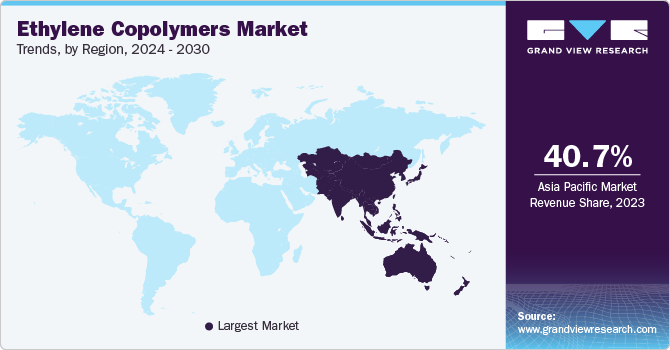

Regional Insights

North America held a notable share of the global market in 2023. The high demand for ethylene copolymers in the packaging, automotive, and construction industries, driven by the region's large consumer market and extensive infrastructure development, has mainly contributed to this region's significant market share. Additionally, a stringent regulatory environment and emphasis on sustainability have driven the adoption of high-performance and environment-friendly ethylene copolymer-based products, thereby leading to the region's high share in the global market.

U.S. Ethylene Copolymers Market Trends

The U.S. accounted for a significant revenue share of the North American market, which is largely due to the economy's well-developed manufacturing industry base. Prominent ethylene copolymer-producing companies such as Dow, DuPont, Exxon Mobil Corporation, Westlake Corporation, and many others are continuously involved in research and development activities to develop innovative applications for these compounds in manufacturing and other industries. Anticipating market potential, ExxonMobil, in September 2023, opened two chemical production units at its Baytown, Texas-based facility.

Asia Pacific Ethylene Copolymers Market Trends

Asia Pacific led the market with the largest revenue share of 40.7% in 2023. This dominance is attributed to the rapid industrialization and urbanization in economies such as China, India, and South Korea, which has led to strong growth in the packaging, automotive, and construction sectors. The region's large population base, increasing disposable income levels, and rising demand for consumer goods have driven the adoption of ethylene copolymers in applications such as packaging, adhesives, and asphalt modifications. Furthermore, a vast manufacturing base, favorable government policies, and infrastructure development initiatives have made the region an attractive hub for ethylene copolymer production and consumption.

China accounted for the highest share of the regional market in 2023. It is owing to the presence of a highly developed manufacturing industry in China, which has fueled substantial demand for ethylene copolymers due to their physical and chemical properties. In addition, multinational chemical companies are forming strategic alliances with local manufacturers to open research & development and production facilities in the economy. For instance, in July 2024, Borealis, Borouge, ADNOC, and China's Wanhua Chemical Group signed a project partnership agreement to develop an advanced polyolefins facility in Fuzhou, China. Such initiatives are expected to drive market expansion in the country.

Europe Ethylene Copolymers Market Trends

Europe held a substantial market share in 2023. This prominent position can be attributed to the region's highly developed manufacturing sector, particularly in countries such as Germany, France, and Italy, which are home to a large number of major ethylene copolymer producers and converters such as BASF SE, Arkema, and Repsol, among others. Additionally, the region's strong focus on innovation, product development, and environmental stewardship has driven the adoption of high-performance and eco-friendly ethylene copolymer-based products. For instance, the French gas utility network operator GRDF, in January 2024, utilized bio-based high-density polyethylene, made by INEOS, in the city of Clermont-Ferrand to build the world's first completely sustainable gas pipeline. These developments are expanding Europe's high share in the global market.

The UK accounted for a notable share of the European ethylene copolymer market in 2023. This is owing to polyethylene's expanding application base and increased research and development efforts to find sustainably manufactured and environment-friendly polymers. Additionally, innovative applications of these materials in construction and asphalt modifications have presented newer growth avenues for the market in this country.

Key Ethylene Copolymers Company Insights

Some key companies involved in the ethylene copolymers market include Borealis AG, Exxon Mobil Corporation, and Dow, among others.

-

Borealis AG is an Austrian manufacturer and marketer of polyolefins and base chemicals. Its product portfolio comprises plastomers, elastomers, PO compounds, polyethylene, polypropylene, recyclates, acetone, propylene, specialty copolymers, and others. These products are utilized in the automotive, energy, textiles, healthcare, consumer goods packaging, pipes, appliances, and houseware industries, to name a few. The company offers its products in over 120 countries and has entered into joint ventures with TotalEnergies in the U.S. to form Baystar and with ADNOC in UAE to form Borouge.

-

Exxon Mobil Corporation is a U.S.-based multinational oil and gas company headquartered in Houston, Texas. ExxonMobil has a diverse brand portfolio encompassing several products and services. Some key brands under ExxonMobil's portfolio include Exxon, Mobil, Esso, and XTO. The company has organized its business into three categories: upstream, low carbon solutions, and product solutions, which ensure a comprehensive approach to meet global energy and material needs. The company offers a variety of polyethylene products such as Exceed S, Exceed XP, Exceed, and Enable performance polyethylene (PE) resins, which are used across different industries.

Key Ethylene Copolymers Companies:

The following are the leading companies in the ethylene copolymers market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Dow

- DuPont

- Exxon Mobil Corporation

- Arkema

- Westlake Corporation

- Celanese Corporation

- LyondellBasell Industries Holdings B.V.

- Braskem

- Repsol

- SABIC

- Borealis AG

- Sumitomo Chemical Co., Ltd.

- LG Chem

- INEOS

Recent Developments

-

In May 2024, INEOS, through its INEOS Oxide business unit, announced the strategic acquisition of LyondellBasell’s Ethylene Oxide & Derivatives business in Texas. This planned move is expected to augment INEOS’s efforts toward increasing the production capacity of Ethylene Oxide and associated derivatives in the North American market while also supporting the company’s Ethanolamine production facility based in Louisiana.

-

In October 2023, Borealis AG and TotalEnergies announced the start of operations at their joint venture partnership, Baystar’s Borstar polyethylene production facility in Texas. With this new unit, the current production capacity of Baystar in Texas is expected to double, rising to a total of more than one million tons annually.

Ethylene Copolymers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 52.30 billion

Revenue Forecast in 2030

USD 79.22 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; Japan; Australia; South Korea; India; Indonesia; Vietnam; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BASF SE; Dow; DuPont; Exxon Mobil Corporation; Arkema; Westlake Corporation; Celanese Corporation; LyondellBasell Industries Holdings N.V.; Braskem; Repsol; SABIC; Borealis AG; Sumitomo Chemical Co., Ltd.; LG Chem; INEOS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

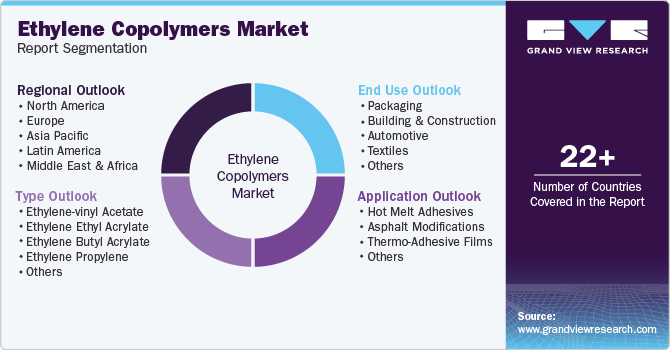

Global Ethylene Copolymers Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the ethylene copolymers market report based on type, application, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ethylene-vinyl acetate

-

Ethylene ethyl acrylate

-

Ethylene butyl acrylate

-

Ethylene propylene

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hot Melt Adhesives

-

Asphalt Modifications

-

Thermo-Adhesive Films

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Building & Construction

-

Automotive

-

Textiles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.