- Home

- »

- Advanced Interior Materials

- »

-

Europe Dehumidifier Market Size And Share, Report, 2030GVR Report cover

![Europe Dehumidifier Market Size, Share & Trends Report]()

Europe Dehumidifier Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Refrigerative Dehumidifier, Desiccant Dehumidifier), By Product (Portable, Fixed), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-061-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Dehumidifier Market Size & Trends

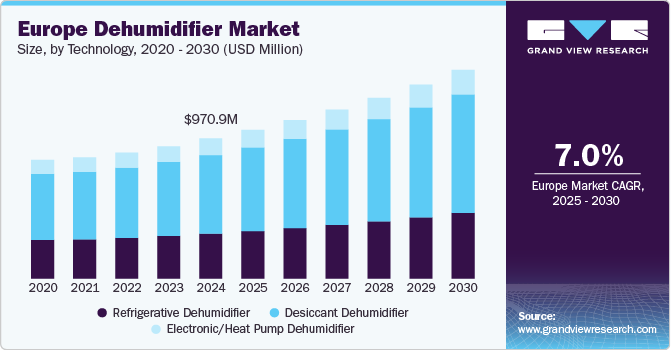

The Europe dehumidifier market size was estimated at USD 970.9 million in 2024 and is expected to grow at a CAGR of 7.0% from 2025 to 2030.Increasing awareness of indoor air quality has prompted consumers and businesses to seek solutions that can effectively manage humidity levels, thereby improving overall comfort and health. Rising concerns about mold growth and respiratory issues linked to excessive moisture motivate residential and commercial sectors to invest in dehumidification technologies.

Seasonal factors also play a significant role in market dynamics, with higher humidity levels during certain months leading to increased demand for dehumidifiers in residential and commercial applications.

Drivers, Opportunities & Restraints

The ongoing energy efficiency trend in building design is enhancing the demand for dehumidifiers, as these systems can contribute to maintaining optimal indoor conditions without excessive energy consumption. This aligns with European Union regulations to reduce energy use and promote sustainable building practices.

A significant factor is the high initial cost of advanced dehumidifiers, which can deter consumers and businesses. In addition, the energy consumption of some models raises concerns about operational costs and environmental impact, leading some users to hesitate to adopt these devices.

The growing trend of smart home technology presents an opportunity to develop innovative dehumidifiers equipped with IoT capabilities, allowing for better control and monitoring of humidity levels. Furthermore, the rising emphasis on energy-efficient appliances provides a platform for manufacturers to design eco-friendly dehumidifiers that align with consumer preferences for sustainability.

Technology Insights

“The demand for the desiccant dehumidifier segment is expected to grow at a significant CAGR of 7.2% from 2025 to 2030 in terms of revenue.”

Desiccant Dehumidifiers have gained widespread acceptance in various commercial and industrial contexts, particularly when specific humidity levels are crucial. These systems find applications in sectors like food processing, pharmaceuticals, and storage facilities. Increasing the construction of manufacturing plants, storage areas, water treatment plants, and lithium-ion battery factories is likely to boost the demand for desiccant dehumidifiers.

In 2024, the refrigerative dehumidifiers segment represented 32.1% of the market's revenue. These dehumidifiers are favored across industrial, commercial, and residential sectors for their cost-effectiveness and ease of use. The market segment for refrigerative dehumidifiers is expanding due to continuous innovation and the introduction of new products worldwide. Investments in research and development for more efficient technologies by manufacturers are propelling revenue growth by launching new products.

Application Insights

“The growth of the residential segment is expected to grow at a fast-paced CAGR of 7.4% from 2025 to 2030 in terms of revenue.”

Demand for dehumidifiers in residential applications is driven by increasing awareness of indoor air quality and its impact on health. Homeowners are more concerned about mold growth, allergens, and respiratory problems associated with high humidity levels. As a result, many seek effective solutions to maintain optimal humidity in living spaces. Seasonal changes, particularly in regions with humid climates, also boost demand as people look for ways to enhance comfort and protect their homes from moisture-related damage.

In 2024, the commercial segment emerged as the dominant market segment, capturing a 32.6% overall revenue share. In commercial applications, demand for dehumidifiers is influenced by the need to maintain optimal conditions in various environments, such as offices, warehouses, and manufacturing facilities. Businesses recognize that high humidity can negatively affect equipment, inventory, and overall operational efficiency. Furthermore, healthcare and food storage industries require strict humidity control to meet regulatory standards and ensure safety.

Product Insights

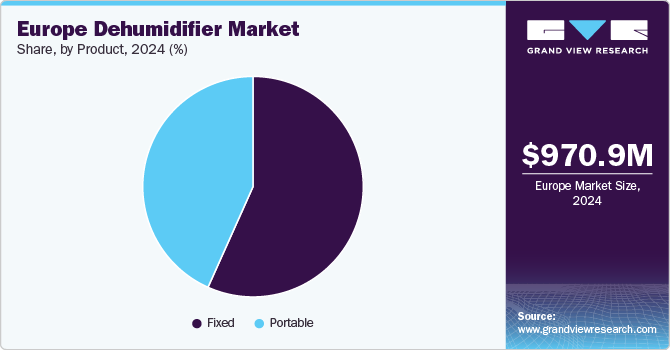

“The growth of the portable segment is expected to grow at a rapid CAGR of 7.3% from 2025 to 2030 in terms of revenue.”

Demand for portable dehumidifiers is primarily driven by their versatility and convenience. Homeowners often seek solutions that can be easily moved from room to room, allowing for targeted humidity control based on specific needs. This is particularly appealing in smaller living spaces, where moisture issues vary by area. The growing trend of home improvement and renovation projects has also increased the need for portable units, which can help manage humidity during construction or remodeling. Moreover, portable dehumidifiers are popular in rental properties and seasonal homes, where flexibility is essential and permanent installations are not feasible.

The fixed dehumidifiers segment accounted for 56.7% of the revenue share in 2024. The demand is driven by the need for more comprehensive and long-term humidity control solutions. These systems are often installed in basements, crawl spaces, and larger commercial spaces where consistent humidity management is crucial to prevent mold growth and protect structural integrity. The increasing focus on energy efficiency and building sustainability has led to a preference for fixed systems integrated into existing HVAC systems, providing seamless operation and improved indoor air quality.

Country Insights

German Dehumidifier Market Trends

The German dehumidifier market is projected to expand at a significant CAGR of 7.6% over the forecast period. The rise in demand for dehumidifiers in Germany can be ascribed to the increased awareness of health and fitness across populations. Customers are actively concerned about maintaining a healthy living environment at home, which increases the need for dehumidifiers to improve indoor air quality. Furthermore, due to an increase in allergy susceptibility of adults and infants, household dehumidifiers are gaining market traction.

France Dehumidifier Market Trends

The dehumidifier market in France held 18.5% of the region’s market share in 2024. France is one of the largest bread and bakery product markets in the European region. Dehumidifiers reduce the moisture content of the surrounding air while maintaining relative humidity (RH) at a constant level during production, storage, and packing to preserve the freshness of processed food and improve the quality for a longer period. Food's moisture content influences its taste, look, and shelf life. Correctly managing the air moisture and humidity inside a food and beverage manufacturing plant will not only result in the optimization of production processes but will also result in a sanitary and safe working environment. The growing food and beverage industry is expected to boost the demand for dehumidifiers over the forecast period.

Key Europe Dehumidifier Company Insights

Some key players operating in the market include Whirlpool Corporation and Honeywell International Inc.

-

Whirlpool Corporation is a leading global manufacturer of home appliances, founded in 1911 and headquartered in Benton Harbor, Michigan. It operates globally, with a significant presence across various regions. Among various other products, it offers a diverse range of dehumidifiers that enhance home comfort by effectively reducing humidity levels. Its headquarters in Benton Harbor serves as the hub for strategic operations, while it has manufacturing facilities in multiple countries to effectively cater to local markets.

-

Honeywell International Inc. operates through four business segments: aerospace, performance Materials & Technologies, Honeywell Building Technologies, and Safety & Productivity Solutions. Its dehumidifier products are offered in the Honeywell Building Technologies business segment. The company sells and distributes its products through distributors, wholesalers, retailers, and various e-commerce websites.

Key Europe Dehumidifier Companies:

- Desiccant Technologies Group

- Honeywell International Inc.

- De’Longhi Appliances S.r.l.

- Danby Products Ltd

- Whirlpool Corporation

- Munters Group

- STULZ Air Technology Systems, Inc.

- CondAir Group

- MICROWELL, spol. s r.o.

- Preair

- FRAL SRL

Recent Developments

-

In August 2022, Atlas Copco completed its acquisition of LEWA GmbH and Geveke B.V. for around USD 685 million. LEWA GmbH specializes in chemical injection skids and diaphragm metering pumps. This all-cash deal strengthened Atlas Copco's Power and Flow division within its Power Technique Business Area. LEWA GmbH’s expertise in diaphragm metering pumps and complete metering systems aligns well with the growing applications of chemical injection skids, especially for corrosion inhibition and water treatment processes. Integrating LEWA's technologies into Atlas Copco's portfolio will likely strengthen its competitive position in this expanding market, catering to diverse industrial needs and improving operational efficiencies across various sectors.

-

In June 2023, Euro Mechanical launched a Chemical Injection Skid Package featuring a modular design for fixed and mobile applications. The package ensures enhanced performance and safety by utilizing advanced 3D modeling and stress analysis. It complies with industry standards like AWS D1.1 and ASME B31.3, and the company’s certified fabrication facility in Abu Dhabi maintains high-quality and environmental standards. Euro Mechanical is set to deliver eight units to a major offshore energy client, each with DNV 2.7-1 structural frames and storage vessels, highlighting their custom solution capabilities.

Europe Dehumidifier Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1030.8 million

Revenue forecast in 2030

USD 1.45 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application,country

County scope

UK; Germany; France; Italy; Spain

Regional scope

Europe

Key companies profiled

Desiccant Technologies Group; Honeywell International Inc.; De’Longhi Appliances S.r.l.; Danby Products Ltd; Whirlpool Corporation; Munters Group; STULZ Air Technology Systems, Inc.; CondAir Group; MICROWELL, spol. s r.o.; Preair; FRAL SRL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Dehumidifier Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe dehumidifier market report based on technology, product,application and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerative Dehumidifier

-

Desiccant Dehumidifier

-

Electronic/Heat Pump Dehumidifier

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Fixed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Frequently Asked Questions About This Report

b. The Europe dehumidifier market size was estimated at USD 970.9 million in 2024 and is expected to be USD 1,030.8 million in 2025.

b. The dehumidifier market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 1.45 billion by 2030

b. Germany dominated the dehumidifier market with a revenue share of 25.4% in 2024. The extensive industrial manufacturing, the strong establishment of commercial businesses, and growing awareness among the homeowners attributed to the position the market holds in the country.

b. Some of the key players operating in the Dehumidifier Market include Desiccant Technologies Group, Honeywell International Inc., De’Longhi Appliances S.r.l., Danby Products Ltd, Whirlpool Corporation, Munters Group, STULZ Air Technology Systems, Inc., CondAir Group, MICROWELL, spol. s r.o., Preair, and FRAL SRL.

b. Key factors driving market growth for dehumidifiers in Europe include increasing regulatory requirements for humidity control in industries like pharmaceuticals and food processing, as well as rising awareness of health and safety concerns related to indoor air quality. Technological advancements in energy-efficient and smart dehumidification solutions further bolster demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.