- Home

- »

- Medical Devices

- »

-

Europe Disposable Endoscopes Market Report, 2030GVR Report cover

![Europe Disposable Endoscopes Market Size, Share & Trends Report]()

Europe Disposable Endoscopes Market Size, Share & Trends Analysis Report By Application (Bronchoscopy, Urologic Endoscopy, Arthroscopy, GI Endoscopy, ENT Endoscopy), By End Use, By Country, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-919-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

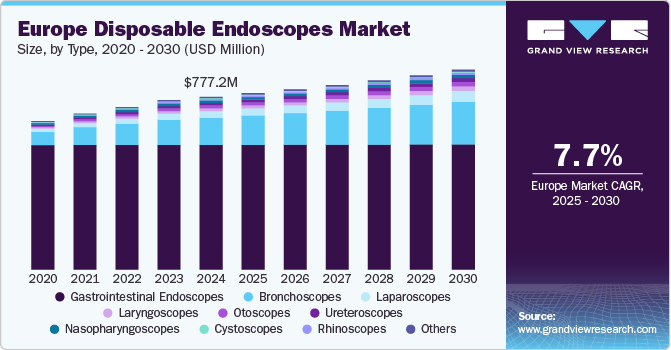

The Europe disposable endoscopes market size was valued at USD 438.7 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.9% from 2022 to 2030. Growing preference to minimize the risk of infection and maximize better clinical outcomes has increased the adoption of disposable endoscopes and their accessories in Europe. Furthermore, the growing incidence of functional gastrointestinal disorders and several other chronic diseases such as diabetes, cancer, and cardiovascular disorders has increased the diagnosis rate over the year, which, in turn, is anticipated to boost the market growth. For instance, according to Globocan 2020 estimates, the number of cancer cases was about 4.39 million in Europe and the number of deaths was about 1.95 million. In addition, the number of colorectal cancer cases was about 11.8% of the total cancer cases in Europe in 2020, which was 11.6% in 2018, which is thereby expected to increase the number of endoscopic procedures and disposable endoscopy use.

Moreover, several government initiatives to promote the use of disposable endoscopes to reduce the chances of cross-contamination favor the growth of the market. For instance, in 2014, the European Union sponsored a project called 'Design of a Disposable Use Endoscopy Tool' (DUET) to mitigate contamination scenarios. Increasing contamination cases due to the use of reusable endoscopes and growing demand for cost-effective endoscopic procedures are further anticipated to drive the market. For instance, a study published in 2018 in the journal BMJ Journals reported that 22% of reprocessed duodenoscope were found to have bacterial contamination from 39% of Dutch ERCP centers. The inadequate cleaning process of reusable endoscopes may cause life-threatening infections due to the compromise in sterility, which is thereby anticipated to increase the adoption of disposable endoscopes.

Moreover, single-use endoscopes are rapidly adopted by healthcare institutions to perform endoscopic procedures for disease diagnosis and treatment. The increase in the adoption is due to their benefits such as no maintenance costs, ready availability, no breakages, and no need for reprocessing between procedures. In addition, reprocessing reusable endoscopes is a challenge for many healthcare facilities. Multiple studies reported a high rate of contamination after endoscope reprocessing, which further supports the adoption of disposable endoscopic devices. For instance, in 2020, one Italian study on duodenoscopes contamination published in the International Journal of Environmental Research and Public Health stated that 75% of the reusable samples were positive for high-concern microorganisms. Therefore, the increase in endoscopy contamination can lead to post endoscopic infections and compromise patient safety, which is further anticipated to drive the disposable endoscope adoption during the forecast period.

COVID-19 Europe disposable endoscopes market impact: 31.7% increase in revenue growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The Europe disposable endoscopes market increased by around 31.7% from 2020 to 2021.

The market is projected to witness a year-on-year growth of approximately 15% to 20% in the coming 5 years.

Growing adoption of disposable endoscopes over the conventional reusable ones by the healthcare institutions to eliminate cross-contamination chances and related infections is driving the market during COVID-19.

Growing chronic and respiratory disease burden and increasing preference among the endoscopic procedure facilities to use minimally invasive, contamination-free, cost-effective disposable endoscopes are the major factors anticipated to propel the market growth over the forecast years.

Time efficiency, lower post-procedure infections, and lower procedure costs are some of the major factors supporting the high adoption of single-use endoscopes during the pandemic.

Furthermore, increasing industry consolidation activities by the manufacturers such as mergers, collaborations, acquisitions, and new product launches are anticipated to accelerate the market growth during the post-pandemic period.

Furthermore, increasing investment by the manufacturers and technological advancements to develop new and innovative disposable endoscopes are anticipated to accelerate the market growth over the years. For instance, in May 2021, PENTAX Medical Europe launched its PulmoONE single-use bronchoscope and obtained a CE mark. This bronchoscope has best in class HD image quality and superior suction power. Similarly, in June 2021, PENTAX and Jiangsu Vedkang Medical Science and Technology formed a joint venture for single-use, flexible medical endoscopic device development. The increase in focus by these companies on the development of single-use devices that could benefit physicians, patients, and medical care systems by reducing the complexity and cost of procedures with the improved recovery time for patients also supports the growth of the market.

The rapid spread of life-threatening COVID-19 disease-induced a considerable degree of fear, concern, and worry among the population with underlying health conditions. Several reports on the cross-contamination of reusable endoscopic devices have limited their use during the COVID-19 pandemic. Healthcare providers are increasingly adopting single-use endoscopes and accessories to reduce the chance of contamination during endoscopic procedures. Furthermore, the increasing benefits of disposable endoscopes such as lower infection chances, better sterility, safety, and lower cost due to no need for reprocessing further drove their adoption during the COVID-19 pandemic. In addition, growing promotion by the government authorities to use disposable endoscopes to reduce the contamination chances and the shortage of medical staff during the pandemic supported the growth of the market.

Application Insights

The bronchoscopy segment accounted for the largest revenue share of over 25.0% in 2021. The increasing prevalence of chronic respiratory disorders adversely impacts the individual's quality of life and potentially leads to premature death. For instance, according to data published in the Journal of Aerosol Medicine and Pulmonary Drug Delivery, in 2020, 15% of deaths were estimated due to respiratory diseases in Europe, which is approximately 600,000 people every year. The increase in the number of the most common respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, respiratory allergies, pulmonary hypertension, and occupational lung diseases, in turn, requires minimally invasive and contamination-free diagnostic procedures, which, in turn, are expected to boost the single-use bronchoscopy adoption.

The ENT endoscopy segment is expected to witness the fastest growth during the forecast period. The increasing cases of ear, nose, and throat infections and high preference for the adoption of single-use endoscopic devices for better diagnosis and treatment without any chances of cross-contamination are anticipated to drive the segment over the years. For instance, the study published in the European Journal of Anaesthesiology in 2019, stated that the ear, nose, and throat (ENT) surgery is the most frequently performed surgical procedure among European children. In addition, an increase in technological advancement and growing awareness regarding the usage of disposable ENT endoscopes for better post-procedure outcomes are expected to boost the growth of the segment over the forecast period.

End-use Insights

The hospital segment dominated the market with a revenue share of over 45.0% in 2021 owing to the increasing number of hospitals performing endoscopic surgical procedures in Europe. Moreover, increasing patient visits for chronic disease diagnosis and surgical procedures to the hospitals are supporting the revenue growth of the segment. In addition, growing preference by the physicians and patients in the hospitals for the use of the disposable endoscopic device to eliminate the chance of contamination is propelling the segment growth. Lower procedure costs and favorable reimbursement provided by the government hospitals are further anticipated to accelerate the segment growth.

The clinics segment is expected to witness significant growth during the forecast period. The growth of the segment is attributed to the increasing adoption of disposable endoscopic devices by the clinics due to their low chance of cross-contamination and cost-effectiveness for better patient engagement. In addition, quick recovery time, short clinical stays, and low post-procedural complications of single-use endoscopic procedures increase their adoption by the clinics. Moreover, the increasing number of clinics performing endoscopic procedures in Europe is expected to accelerate the segment growth over the coming years.

Country Insights

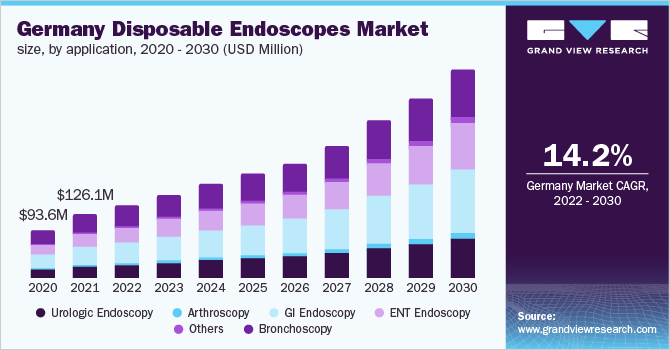

Germany held the largest revenue share of over 25.0% in 2021 owing to the increasing chronic disease patient population and growing awareness regarding the usage of disposable endoscopic devices. For instance, according to a European Commission report in 2019, about 58% of Germans aged over 65 are suffering from at least one chronic disorder, and this proportion is slightly higher than in other European countries. In addition, the increasing number of endoscopic device manufacturers present in Germany and the rise in disposable endoscopic devices product development activities are driving the market in the region.

The U.K. is expected to witness the fastest growth over the forecast period. The growing awareness and preference among physicians and patients to use disposable endoscopic devices to improve post-procedural outcomes and reduce the chances of cross-contamination are some of the major factors anticipated to drive the segment over the years. In addition, the growing chronic disease patient population, which requires the minimally invasive surgical procedure for disease diagnosis and treatment, fuels the market growth in this region. For instance, as per the European Commission report in 2019, more than 40% of the U.K. population aged over 65 reported having at least one chronic disease and more than 15% having at least two.

Key Companies & Market Share Insights

Growing preference for the usage of disposable endoscopic devices by medical professionals over conventional ones increases the competition among market players to hold a better position in the market. Several key business strategies such as acquisitions, mergers, and collaborations are followed by the leading market players to increase their product reach and portfolio. The existing endoscope manufacturers are also looking forward to developing new innovative disposable products as per the patient's need to expand their consumer base and increase market share. For instance, in May 2020, Ambu A/S, a Danish medical device manufacturer, launched its advanced display unit “Ambu aView 2” for use with single-use endoscopes in Europe and the U.S. Some prominent players in the Europe disposable endoscopes market include:

-

Ambu A/S

-

Prosurg Inc. (Neoscape, Inc.)

-

AirStrip Technologies

-

Boston Scientific Corporation

-

Parburch Medical

-

OBP Medical Corporation

-

Welch Allyn (Hill-Rom Services Inc.)

-

Allscripts Healthcare Solutions

-

Flexicare Medical Limited

-

Timesco Healthcare Ltd.

-

Sunmed

Europe Disposable Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 527.1 million

Revenue forecast in 2030

USD 1.8 billion

Growth rate

CAGR of 16.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2014 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, country

Regional scope

Europe

Country scope

U.K.; Germany; France; Italy; Spain; Russia; Switzerland; Denmark

Key companies profiled

Ambu A/S; Prosurg Inc. (Neoscape, Inc.); AirStrip Technologies; Boston Scientific Corporation; Parburch Medical; OBP Medical Corporation; Welch Allyn (Hill-Rom Services Inc.); Allscripts Healthcare Solutions; Flexicare Medical Limited; Timesco Healthcare Ltd.; Sunmed

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the Europe disposable endoscopes market report based on application, end-use, and country:

-

Application Outlook (Revenue, USD Million, 2014 - 2030)

-

Bronchoscopy

-

Urologic Endoscopy

-

Arthroscopy

-

GI Endoscopy

-

ENT Endoscopy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2030)

-

Hospitals

-

Clinics

-

Diagnostic Centers

-

- Country Outlook (Revenue, USD Million, 2014 - 2030)

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Switzerland

-

Denmark

-

Frequently Asked Questions About This Report

b. The Europe disposable endoscopes market size was valued at USD 438.7 million in 2021 and is expected to reach USD 527.1 million in 2022.

b. The Europe disposable endoscopes market is expected to grow at a compound annual growth rate of 16.9% from 2022 to 2030 to reach USD 1.8 billion by 2030.

b. Hospitals dominated the Europe disposable endoscopes market with a share of 47.5% in 2021. This is attributable to the high usage of these devices in hospital settings for various diagnostic and therapeutic procedures.

b. Some key players operating in the Europe disposable endoscopes market include Boston Scientific Corporation, Inc.; Flexicare Medical Ltd; Ambu A/S; Hill Rom Holdings.; and OBP Medical.

b. The bronchoscopy application segment dominated the Europe disposable endoscopes market and held the largest revenue share of 29.3% in 2021.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."