- Home

- »

- Medical Devices

- »

-

Disposable Endoscopes Market Size, Industry Report, 2033GVR Report cover

![Disposable Endoscopes Market Size, Share & Trends Report]()

Disposable Endoscopes Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Laparoscopes, Arthroscopes, Ureteroscopes, Cystoscopes, Bronchoscopes), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-638-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Endoscopes Market Summary

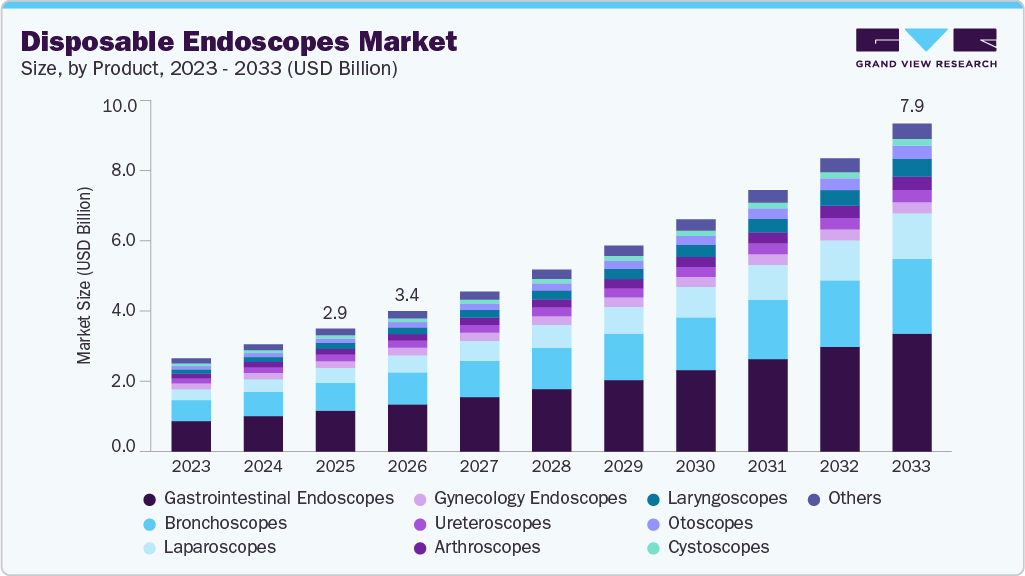

The global disposable endoscopes market size was estimated at USD 2.98 billion in 2025 and projected to reach USD 7.96 billion by 2033, growing at a CAGR of 12.87% from 2026 to 2033. The rising demand for single-use endoscopes to eliminate the risk of device-related infections is a key factor driving the global market.

Key Market Trends & Insights

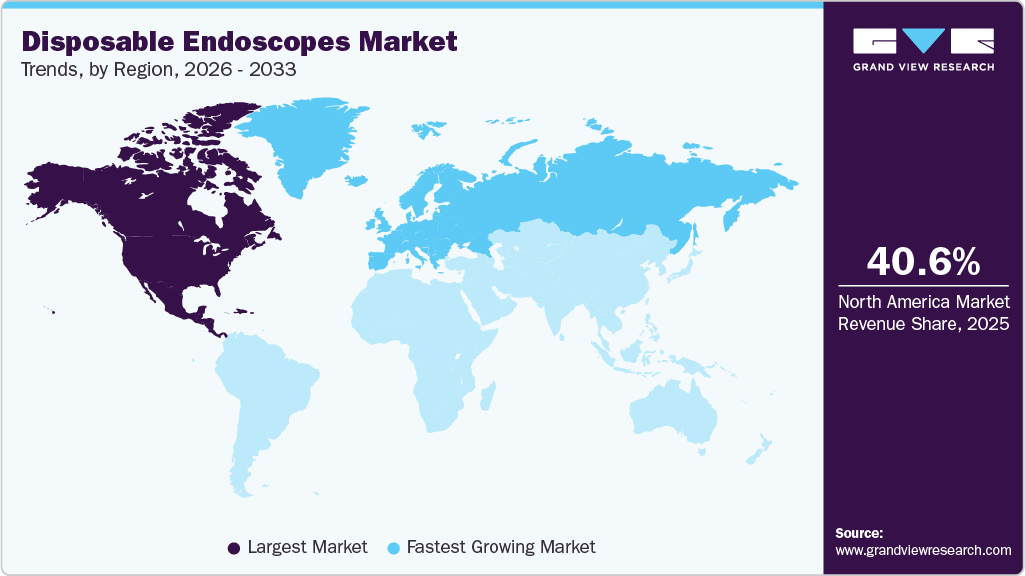

- The North America disposable endoscopes market held the largest revenue share of 40.59% in 2025.

- The disposable endoscopes industry in Canada is expected to grow at the significant CAGR from 2026 to 2033.

- By product, the gastrointestinal endoscopes segment held the highest market share of 33.33% in 2025.

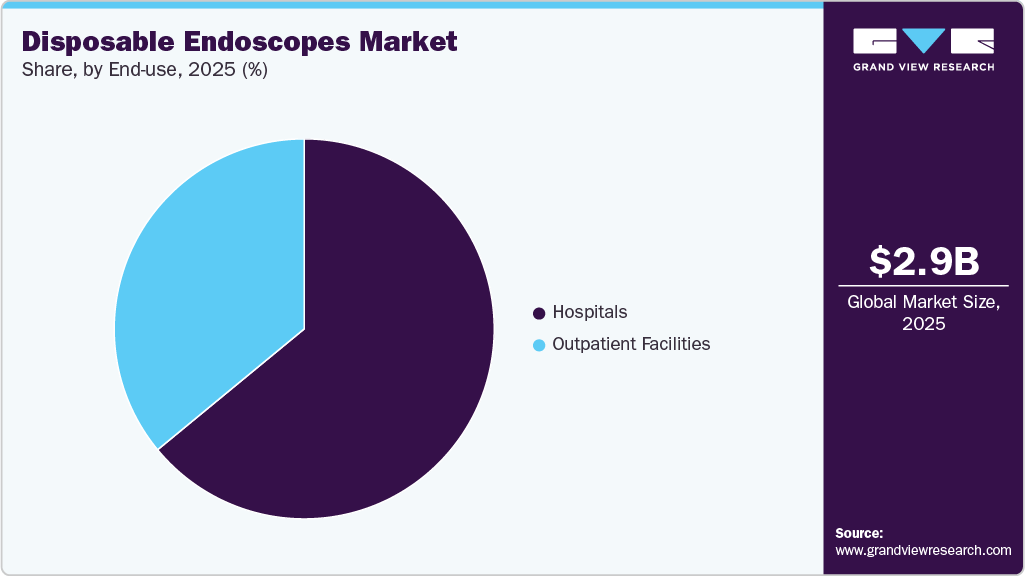

- By end-use, the hospitals segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.98 Billion

- 2033 Projected Market Size: USD 7.96 Billion

- CAGR (2026-2033): 12.87%

- North America: Largest market in 2025

- Europe: Fastest growing market

Moreover, higher patients’ preference for minimally invasive procedures, a supportive regulatory framework, and favorable reimbursement policies in developed countries are further fueling the market growth. Moreover, the increasing investments, funds, and grants from governments and other organizations to enhance healthcare infrastructure and research in endoscopy have created lucrative growth opportunities for the disposable endoscopes industry.

The rise in single-use endoscope adoption is primarily driven by concerns over hospital-acquired infections (HAIs), as studies have linked reusable endoscopes to contamination risks associated with improper sterilization. In response, the FDA has recommended the use of disposable endoscopes, particularly for high-risk procedures involving duodenoscopes and bronchoscopes, to minimize the risk of infection and cross-contamination. This has accelerated market growth, with hospitals and ASCs increasingly shifting to single-use devices for improved patient safety, operational efficiency, and regulatory compliance. Reimbursement support and ongoing innovation by companies such as Ambu and Boston Scientific further bolster this trend.

The growing adoption of minimally invasive surgery (MIS) is expected to boost the global disposable endoscopes industry over the forecast period. Key advantages include high patient acceptance rates, reduced pain, cost-effectiveness, and lower chances of complications. NIH data from January 2023 indicates an increasing trend of ambulatory minimally invasive procedures in the U.S., which raises the demand for disposable endoscopes in these settings. In addition, the demand for disposable endoscopes in hospitals & diagnostic centers, as well as the rising use of single-use endoscopy devices in ENT, bronchoscopy, & dentistry procedures, is expected to drive market growth over the forecast period.

The demand for minimally invasive endoscopic surgeries has surged with ongoing product launches and technological advancements. Notable examples include:

-

Unity Imaging Platform: Launched by Precision Optics in January 2025, this standardized CMOS endoscopic system features a modular design suitable for both reusable and single-use applications, distinguishing it from traditional custom-built options.

-

Vathin E-SteriScope: Introduced by Hunan Vathin Medical Instrument Co., Ltd. in partnership with Olympus in September 2023, this disposable electronic rhino laryngoscope is designed for diagnostic and surgical use in otolaryngology, with Olympus holding exclusive distribution rights.

The disposable endoscopes market has witnessed a significant surge in FDA approvals, CE mark approvals, and the launch of new products. This is due to the advancements in medical technology and an increasing demand for minimally invasive procedures. Moreover, innovations in imaging technology are facilitating the trend of new product launches, enhancing the precision & effectiveness of diagnostic and therapeutic procedures. The launch of new products is expanding the range of options available to healthcare providers, improving patient outcomes, and promoting competitive dynamics in the market. Thus, manufacturers are intensifying their R&D efforts to stay ahead in this rapidly evolving landscape.

List of disposable endoscopes approved by various companies

Year of Approval

Company

Product Name

Description

August 2024

Ambu A/S

Ambu aBox 2 and Ambu aScope Duodeno 2

Ambu received CE mark approval for its new-generation duodenoscopy solutions for ERCP procedures.

June 2024

Ambu A/S

aScope 5 Uretero (single-use ureteroscope), aBox 2, and a full-HD endoscopy system

Ambu received 510(k) regulatory clearance from the U.S. FDA for its ureteroscopy solution.

April 2024

Olympus

RenaFlex, a single-use ureteroscope system

Olympus received 510(k) regulatory clearance from the U.S. FDA for its RenaFlex, a single-use ureteroscope system. It is used to visualize and access the urinary tract to diagnose and treat urinary disorders and diseases, such as kidney stones.

Technological advancements play a significant role in the growth of the disposable endoscope market. For instance, in May 2021, PENTAX Medical Europe launched the PENTAX Medical ONE Pulmo, a new single-use bronchoscope that features improved suction capabilities and high-definition imaging. This device has received the CE mark and enhances clinical applications by providing both sterility and HD visualization, moving beyond the conventional disposable scopes.

Moreover, disposable endoscopes offer significant cost advantages over their reusable counterparts. While the initial purchase price may vary, the overall costs associated with maintaining and sterilizing reusable scopes are substantially higher due to ongoing expenses related to cleaning, repairs, and training staff on proper reprocessing techniques. For instance, reusable scopes cost from USD 1,400 to USD 1,900 per procedure, considering maintenance and sterilization processes. In contrast, single-use scopes typically range from USD 400 to USD 1,900 per procedure, depending on specific circumstances.

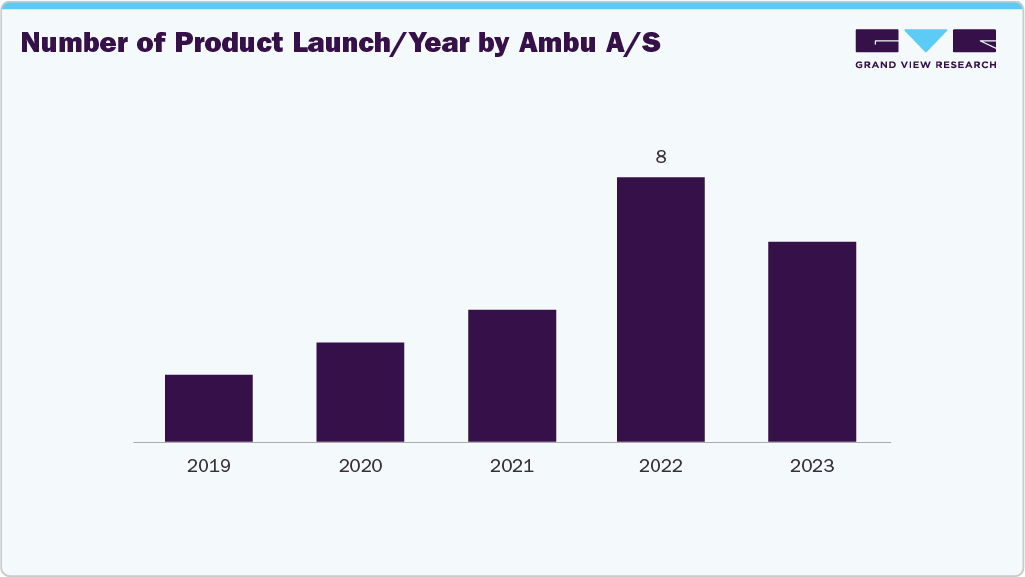

A key growth driver of the disposable endoscope industry is the steadily increasing number of product launches by major industry players, such as Ambu A/S, Boston Scientific Corporation, and Olympus, which continue to expand their portfolios of single-use endoscopes each year. This consistent introduction of new products reflects growing clinical acceptance of disposable technologies, driven by their advantages in infection control, reduced need for reprocessing, and improved workflow efficiency. As companies such as Ambu A/S accelerate innovation to meet rising demand across specialties, healthcare facilities are more inclined to adopt disposable solutions, further strengthening market growth.

Market Concentration & Characteristics

The global disposable endoscopes market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced regularly. Companies continually introduce advanced technologies to enhance diagnostic and therapeutic capabilities. Advanced features, such as improved imaging and ergonomic designs, characterize the latest disposable endoscope models. In April 2025, IQ Endoscopes developed a single-use endoscopy device designed to address significant challenges faced by the National Health Service (NHS) in the UK, representing a strategic response to pressing healthcare demands within the NHS framework by leveraging innovative technology that complements existing medical practices while addressing critical issues such as waiting times and patient access.

The disposable endoscopes market is characterized by medium partnerships & collaborationsactivity, owing to several factors, including the desire to expand the business to cater to the growing demand for disposable endoscopes to maintain a competitive edge. For instance, in May 2021, Pentax Medical & Jiangsu Vedkang Medical Science and Technology collaborated and developed disposable therapeutic products for flexible endoscopy. Under this joint venture, Pentax Medical would offer its sales & distribution network, and Jiangsu Vedkang would utilize its production & R&D capabilities.

Companies actively invest resources in clinical trials and regulatory submissions to obtain regulatory approval for novel products. This may result in increasing the cost of developing novel endoscopic technologies. For instance, the European Union (EU) has recently introduced laws and guidelines that may impact endoscopists and patients. The new regulations increase the requirements for clinical trials and observational studies for both new and existing uses of endoscopic devices, ensuring therapeutic benefit and minimizing patient harm.

The degree of product substitutes in the disposable endoscope market is moderate to high, influenced by various factors, including technological advancements, patient preferences, and regulatory frameworks. Traditional reusable endoscopes serve as primary substitutes; however, their associated risks of cross-contamination and infection have led to a growing preference for single-use devices. The COVID-19 pandemic further accelerated this shift, highlighting the need for safer options that minimize infection risks.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in June 2024, Ambu received 510(k) regulatory clearance from the U.S. FDA for its ureteroscopy solution, which includes aScope 5 Uretero (single-use ureteroscope), aBox 2, and a full-HD endoscopy system.

Product Insights

The gastrointestinal endoscopes segment held a significant revenue share of 33.33% in 2025.This is attributed to the increasing prevalence of gastrointestinal disorders, such as colorectal cancer, inflammatory bowel disease, and other chronic conditions, which necessitate regular diagnostic procedures. For instance, according to the American Cancer Society, approximately 26,500 new cases of stomach cancer were expected in 2023 alone, highlighting the urgent need for effective diagnostic tools such as endoscopes.

Moreover, the growth of the gastroenterology market is driven by increased research and development efforts. For instance, an article published in 2022 under the title "Disposable versus reusable gastroscopes: a prospective randomized noninferiority trial" introduced disposable gastroscopes aimed at minimizing the risk of infection associated with contaminated reusable devices. These disposable options present a safe alternative for routine examinations, demonstrating comparable technical performance to their reusable counterparts. As awareness of the benefits of disposable gastroscopes grows, fueled by such research initiatives, their adoption is expected to enhance market growth significantly.

The laparoscopes segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing prevalence of conditions requiring laparoscopic procedures, such as obesity and various gastrointestinal disorders, which have heightened the need for effective diagnostic and surgical tools. Moreover, growing investments and advancements in technology have led to improved imaging capabilities and functionality of disposable laparoscopes, making them more appealing to healthcare providers. The cost-effectiveness associated with single-use devices plays a crucial role. Procedures utilizing disposable laparoscopes are significantly less expensive than those involving reusable instruments when considering sterilization costs and potential complications from infections. For instance, in April 2023, Xenocor, a medical device company, raised USD 10 million in Series A funding led by GenHenn Venture Fund I and other investors, including Patel Family Investment, Barvest Ventures, Inc., and Baranco Investments, Inc.

End-use Insights

The hospitals segment dominated the disposable endoscopes market, accounting for a revenue share of 64.03% in 2025. A favorable reimbursement scenario, a high number of hospitals performing endoscopic procedures, and a high preference for minimally invasive procedures among hospitals are the factors responsible for the high revenue growth of the hospital segment. In addition, the higher adoption of single-use endoscopes in hospitals to reduce the chances of infection and leakage is also catering to the segment demand. Moreover, technological advancements, coupled with the high sensitivity of disposable endoscopes, are providing momentum to the segment's expansion. The number of hospitals is increasing in most countries, including Canada, the U.S., the UK, Spain, Italy, India, China, Japan, Thailand, Brazil, South Africa, the UAE, and Argentina. According to the American Hospital Association, there were 6,120 hospitals in the U.S. in 2024. Similarly, in 2021, there were 1,300 hospitals in Canada. The European Union has around 15,000 hospitals. Moreover, the UK has 1148 hospitals as of August 2023

The outpatient facilities segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing number of outpatient facilities performing endoscopic procedures is the crucial factor driving the segment demand. Moreover, certain benefits, such as easy accessibility to outpatient facilities and cost-effective services, are supporting market expansion. Furthermore, government initiatives to strengthen healthcare infrastructure are projected to fuel segment growth over the forecast period.

Regional Insights

North America dominated the disposable endoscopes market, accounting for a 40.59% revenue share in 2025, primarily due to the presence of a large number of market players and various strategic initiatives undertaken by them. Within North America, the U.S. is the largest market, as the majority of players initially sought U.S. FDA approval to launch their products in the country. Moreover, increasing awareness about cost-effective single-use endoscopes and high per capita health expenditure is another factor fueling the regional market growth. Furthermore, advanced healthcare infrastructure, supportive government initiatives, and optimum treatment coverage are also contributing to the growth.

U.S. Disposable Endoscopes Market Trends

The U.S. disposable endoscopes industry led North America in 2025, driven by growing product approvals. For instance, in July 2022, Zsquare received FDA 510(k) clearance to market its first product, the Zsquare ENT-Flex Rhinolaryngoscope, which is a high-performance single-use endoscope designed for diagnostic procedures in the ear, nose, and throat (ENT) field. The endoscope aims to enhance patient comfort and improve diagnostic quality while significantly reducing costs associated with single-use devices. The company plans to pilot launch this product in leading hospitals and physician offices across the U.S. This milestone is seen as a pivotal step towards transforming the endoscopy market by promoting affordable and effective single-use endoscopes across various medical indications.

Europe Disposable Endoscopes Market Trends

The disposable endoscopes industry in Europe is expected to grow at the fastest CAGR over the forecast period. The growing preference for minimizing the risk of infection and maximizing better clinical outcomes has led to an increase in the adoption of disposable endoscopes and their accessories in Europe. Furthermore, the growing incidence of functional gastrointestinal disorders and several other chronic diseases, such as diabetes, cancer, and cardiovascular disorders, has increased the diagnosis rate over the years, which, in turn, is anticipated to boost market growth. For instance, according to an article published by the European Commission in January 2024, in 29 European countries, an estimated 23.7 million individuals faced a cancer diagnosis in their lifetime.

The disposable endoscopes market in the UKis expected to experience significant growth during the forecast period. The high prevalence of cancer & chronic diseases and the growing geriatric population are expected to drive market growth in the country. According to Macmillan Cancer Support, in October 2022, there were approximately 3 million cancer patients in the UK, and 5.3 million patients are expected to be diagnosed with cancer in the country by 2040. The introduction of the National Awareness and Early Diagnosis Initiative has facilitated early diagnoses of cancer and increased access to optimal treatment, thereby playing a vital role in driving the market.

Asia Pacific Disposable Endoscopes Market Trends

The Asia Pacific disposable endoscopes industry is expected to witness a significant CAGR throughout the forecast period. This growth is attributed to the high burden of target diseases, and a large patient population is expected to provide traction for the region's expansion. The improving healthcare infrastructure and rising investments from market players, driven by the flourishing demand for medical devices in the APAC region, have propelled the region's growth to a certain extent. Furthermore, the region's greater transition from reusable to disposable endoscopes and increased epidemiological factors hold high promise for the region's growth.

The India disposable endoscopes market is anticipated to register considerable growth over the forecast period, due to the increasing product developments and innovations in the country. For instance, in December 2024, AIG Hospitals in Hyderabad recently hosted the Indian debut of the PillBot, a revolutionary disposable endoscopy device developed by the US-based medical company Endiatx. This innovative technology represents a significant advancement in non-invasive diagnostic procedures for gastrointestinal health.

Latin America Disposable Endoscopes Market Trends

The Latin America disposable endoscopes industry is expected to witness considerable growth over the forecast period, driven by the overall increase in healthcare expenditure and investments in medical infrastructure within Latin American countries, which support the adoption of advanced medical technologies, including disposable endoscopes. As hospitals seek to enhance patient safety and improve clinical outcomes, the shift towards disposable solutions is expected to drive growth in this medical device market segment.

The Brazil disposable endoscopes market is anticipated to register considerable growth during the forecast period. For instance, in September 2024, the latest-generation Olympus endoscopy system, known as the EVIS X1, launched in Brazil. This advanced system represents Olympus' most sophisticated technology for gastrointestinal endoscopy to date. The EVIS X1 system is equipped with two compatible gastrointestinal endoscopes: the GIF-1100 for upper digestive tract examinations and the CF-HQ1100DL/I for lower digestive tract procedures. The ergonomic design of these endoscopes aims to enhance user comfort and improve procedural efficiency.

Middle East & Africa Disposable Endoscopes Market Trends

The Middle East and Africa disposable endoscopes industry is anticipated to witness considerable growth over the forecast period. The market growth is driven by theincreasing prevalence of chronic diseases, particularly gastrointestinal disorders and cancers, which necessitate more diagnostic procedures that utilize endoscopy. Government initiatives to increase reimbursement coverage are a key factor expected to boost market growth during the forecast period. Moreover, the Gulf Cooperation Council (GCC) is experiencing rapid growth, which indicates the development of technologically advanced medical devices and healthcare infrastructure. The UAE, Saudi Arabia, and Qatar are the three largest medical device markets in this region. Growing disease burden, increasing healthcare expenditure, and expanding healthcare privatization are expected to drive the market in the coming years.

The South Africa disposable endoscopes market is anticipated to register considerable growth during the forecast period. The South African healthcare sector is evolving, with a strong focus on providing high-quality services and accurate diagnoses. The medical device industry in this region is highly influenced by the African National Congress (ANC) and government policies concerning National Health Insurance (NHI). The presence of companies such as Olympus Corporation; Fujifilm Holdings Corporation; HOYA Corporation; Advanced Sterilization Products Services, Inc.; and KARL STORZ GmbH & Co. KG provides this region with future growth opportunities.

Key Disposable Endoscopes Company Insights

Key participants in the disposable endoscopes industry focus on devising innovative business growth strategies, including expanding their product portfolios, forming partnerships and collaborations, engaging in mergers and acquisitions, and expanding their business footprints.

Key Disposable Endoscopes Companies:

The following are the leading companies in the disposable endoscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Ambu A/S

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- CooperSurgical, Inc.

- OTU Medical

- Flexicare (Group) Limited

- Verathon Inc.

- Arthrex GmbH

- STERIS plc.

Recent Developments

-

In September 2025, Olympus, a medical technology company, announced a global distribution agreement with MacroLux Medical Technology Co., Ltd. for single-use urology products. The agreement covers single-use ureteroscopes, cystoscopes, and suction access sheaths. These devices provide access and visualization of the bladder and urinary tract, enabling the diagnosis and treatment of conditions such as kidney stones.

-

In June 2025, Ambu A/S secured FDA 510(k) clearance for its aScope 5 Cysto HD, marking it as the first disposable flexible cysto-nephroscope approved for percutaneous nephrolithotomy (PCNL) procedures in the U.S.

-

In April 2024, Olympus received U.S. FDA 510(k) clearance for its first single-use flexible ureteroscope system, named RenaFlex. This innovative device is designed to assist healthcare professionals in diagnosing and treating urinary diseases and disorders, such as kidney stones. The RenaFlex system allows for visualization of the urinary tract, including the urethra, bladder, ureter, calyces, and renal papillae, through both transurethral and percutaneous access routes.

-

In October 2023, EndoSound and AdaptiveEndo entered a partnership to develop a novel endoscopy device aimed at enhancing procedures such as Endoscopic Ultrasound (EUS) and Endoscopic Retrograde Cholangiopancreatography (ERCP). This collaboration aims to develop a single-use device that enhances the efficiency and safety of these complex medical procedures.

Disposable Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.41 billion

Revenue forecast in 2033

USD 7.96 billion

Growth rate

CAGR of 12.87% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion, unit volume in thousands, procedure volume in thousands and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ambu A/S, Olympus Corporation, Boston Scientific Corporation, PENTAX Medical (Hoya Corporation), FUJIFILM Holdings Corporation, Karl Storz GmbH & Co., KG, CooperSurgical, Inc., OTU Medical, Flexicare (Group) Limited, Verathon Inc., Arthrex GmbH, STERIS plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Disposable Endoscopes Market Report Segmentation

This report forecasts revenue growth and provides at the global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global disposable endoscopes market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

Product Outlook (Procedure Volume, In Thousands, 2021 - 2033)

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

Product Outlook (Unit Volume, In Thousands, 2021 - 2033)

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Unit Volume, In Thousands; Procedure Volume, In Thousands; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disposable endoscopes market size was valued at USD 2.98 billion in 2025 and is expected to reach USD 3.41 billion in 2026.

b. The global disposable endoscope market is expected to grow at a compound annual growth rate of 12.87% from 2026 to 2033, reaching USD 7.96 billion by 2033.

b. Gastrointestinal endoscopes dominated the disposable endoscopes market with a share of 40.59% in 2025. This is attributable to the increasing prevalence of gastrointestinal disorders, such as colorectal cancer, inflammatory bowel disease, and other chronic conditions, necessitates regular diagnostic procedures.

b. Some key players operating in the disposable endoscopes market include Ambu A/S, Boston Scientific Corporation, obp Surgical Corporation, COOPERSURGICAL, INC., Flexicare medical Limited, Welch Allyn (Hill Rom), HOYA Corporation, KARL STORZ, Olympus Corporation, and OTU Medical.

b. Rising demand for single use endoscopes for eliminating the risk of device-related infection is a key factor driving the global market. Moreover, higher patient’s preference for minimally invasive procedures, supportive regulatory framework, and favorable reimbursement policies in developed countries are further fueling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.