- Home

- »

- Animal Health

- »

-

Europe Dog Dewormers Market Size & Growth Report, 2030GVR Report cover

![Europe Dog Dewormers Market Size, Share & Trends Report]()

Europe Dog Dewormers Market Size, Share & Trends Analysis Report By Distribution Channel (Veterinary Clinics, Retail/Pet Stores, E-commerce), By Country (Spain, Germany, Portugal, Romania, Slovakia), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-947-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

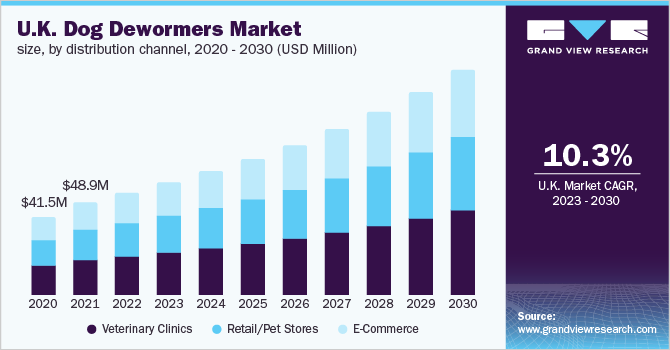

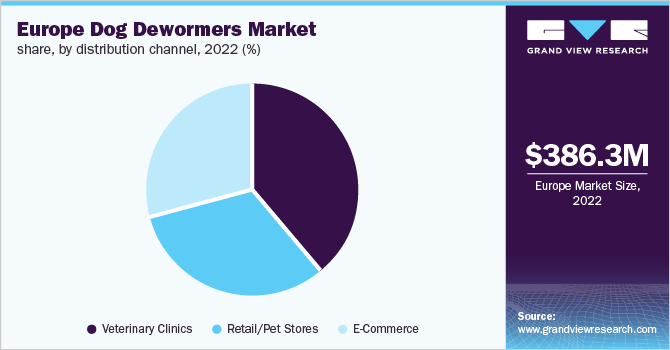

The Europe dog dewormers market size was valued at USD 386.27 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 10.67% from 2023 to 2030. Increasing healthcare expenditure on dogs and the rising adoption of e-commerce websites to order supplies for pets are some of the major factors driving the market growth. Furthermore, the high canine population and its ownership are also expected to fuel market growth. According to FEDIAF’s 2022 report, the Europe region had nearly 312 million pets, with 92.9 million dogs as of 2021.

The spread of the COVID-19 pandemic brought the region to a halt, affecting research and development activities, medical supply, and vet services in almost every part of Europe. After the declaration of COVID-19 as a pandemic by WHO due to its widespread, European countries such as Russia, the U.K., and Germany, among others announced a complete lockdown to curb the spread. Due to this, similar to several other industries, the animal healthcare industry has been significantly affected.

Some of the accountable impacts of COVID-19 on the market include a decline in veterinary clinics' admission rates and dewormer products’ supply chain disruptions. However, with the support of e-commerce channels, the ease of COVID-19 restrictions, and the resumption of veterinary services in late 2020, the dog dewormer market regained growth in Europe.

The growing dog population is expected to boost the need for veterinary healthcare services and increase the overall expenditure on them. In October 2020, N26 GmbH, an insurance serving company in Germany, stated that around USD 16 to USD 53 (i.e. EUR 15-50) per month is invested in dog insurance, based on the type of animal breed. As per the same source, USD 52.8 to USD 63.36 is spent on routine veterinary care per visit.

Similarly, the People’s Dispensary for Sick Animals PDSA 2022, reported that dog owners in the U.K. spend around USD 6,122 to USD 14,937, over their lifetime. Furthermore, according to a report published by EAE Business School in July 2017, the average annual spending on dogs in Spain was around USD 121.95 (EUR 130) per household. Therefore, the willingness of people to spend more on their dog’s healthcare is propelling the industry’s growth.

Market players are investing more time and money in R&D activities and developing new as well as advancing existing products for better animal health outcomes. In 2021, Dechra Pharmaceuticals reported their recent acquisition of Mirataz, Osumia and 15% of Medical Ethics has strengthened their pipeline activities.

Norbrook launched five R&D projects in the last 12 months, with plans to develop 10 more products in the next 2 years. Elanco, in its investor presentations, reported a shift in purchasing behavior of veterinarians, farmers, as well as pet parents to online channels. The company has thus identified continuous digital ecosystem enhancement as a key growth driver.

Distribution Channel Insights

The veterinary clinic’s segment is estimated to hold the largest revenue share of around 39% in 2022 owing to its rising adoption of pet animals, especially dogs, which has increased the number of veterinary clinic services in Europe. The growing population rate of dogs in the region is further boosting the market growth.

According to the European Pet Food Industry 2022, the dog population rate in Europe was estimated to be 92.9 million in 2021, with nearly 90 million households in Europe owning a pet. The retail/pet stores segment is also expected to grow at a significant rate. With an increased number of European households owning pet animals, their demand for convenient access to numerous pet products is increasing.

The e-commerce segment is anticipated to witness the fastest growth rate of 11.08% over the projected period. Online sales of dog dewormer products have grown widely during the COVID-19 pandemic. E-commerce has become a convenient and easily accessible platform for pet care products. These online platforms provide a wide range of dewormers in different flavors, sizes, and quantities at affordable prices. These platforms enable consumers to shop quicker and faster in the most efficient way. In addition, subscription plans enabled by famous e-commerce sites such as My Lovely Dog (Poland) have unveiled better opportunities for segment growth.

Country Insights

The U.K. is anticipated to dominate the Europe market with a share of around 14% in 2022. The implementation of various rules and guidelines by the U.K. government, to prevent parasitic infections among dogs is the major key factor driving the growth of the market. According to a study published in April 2020 by the Springer Nature Journals, dogs in the U.K. are widely exposed to internal parasite infections caused by roundworms, tapeworms, and lungworms, thereby posing risks to the health of pets and their owners. The ESCCAP UK, recommends deworming more frequently (up to monthly) for certain parasite infection risk grouped animals. Moreover, according to FEDIAF 2022, the country has over 12 million dogs owned in households.

The market in Norway is anticipated to witness the fastest growth rate during the forecast period. In Norway, all dogs that are imported must be treated for Echinococcus, which is a fox dwarf tapeworm. This infection among dogs might not cause a severe threat to animals but can pose a higher risk to humans. Norway’s local news reported that in 2019, the country’s dog population was hit by a mysterious intestinal disease that caused diarrhea and vomiting. The country also has registered a moderate prevalence rate of intestinal parasitic infections in dogs for years. In addition, the country’s dog population has significantly increased from 452 thousand in 2010 to 490 thousand in 2021. These factors are fairly contributing to the estimated growth rate for the market.

Key Companies & Market Share Insights

The market is competitive. Key companies deploy strategic initiatives, such as product development and launches, sales & marketing strategies to increase product awareness, regional expansion, and partnerships to strengthen their market share. For instance, in January 2021, Boehringer Ingelheim International GmbH announced marketing authorization approval in Europe for NexGard products, which are used as antiparasitics in dogs and cats. The approval was granted by European Medicines Agency (EMA) and European Commission. Some prominent players in the Europe dog dewormers market include:

-

Merck & Co., Inc.

-

Boehringer Ingelheim International GmbH

-

Virbac

-

Elanco

-

Ceva

-

Zoetis

-

PetIQ, LLC

-

Sava Healthcare Limited

Europe Dog Dewormers Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 424.90 million

The revenue forecast in 2030

USD 864.18 million

Growth rate

CAGR of 10.67% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, region

Country scope

Spain; Germany; Portugal; Romania; Slovakia; Czech; Hungary; Poland; Italy; Ireland; U.K.; France; Denmark; Sweden; Norway; Rest of Europe

Key companies profiled

Merck & Co., Inc.; Boehringer Ingelheim International GmbH; Virbac; Elanco; Ceva; Zoetis; PetIQ, LLC; Sava Healthcare Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Dog Dewormers Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe dog dewormers market report based on distribution channel and country:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Clinics

-

Retail/Pet Stores

-

E-Commerce

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

Italy

-

Spain

-

Portugal

-

Romania

-

Slovakia

-

Czech

-

Hungary

-

Poland

-

Ireland

-

U.K.

-

France

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

Frequently Asked Questions About This Report

b. The Europe dog dewormers market size was estimated at USD 386.27 million in 2022 and is expected to reach USD 424.90 million in 2023.

b. The Europe dog dewormers market is expected to grow at a compound annual growth rate (CAGR) of 10.67% from 2023 to 2030 to reach USD 864.18 million by 2030.

b. The veterinary clinics’ segment dominated the Europe dog dewormers market with a share of over 38% in 2022. This is attributable to the increasing deworming admission rates for pet dogs in European veterinary clinics coupled with the growing number of establishments.

b. Some key players operating in the Europe dog dewormers market include Boehringer Ingelheim International GmbH; Zoetis; Merck & Co., Inc.; Virbac; Elanco, Ceva, PetIQ, and Sava Healthcare Ltd.

b. Key factors that are driving the market growth include increasing dog ownership rates coupled with rising veterinary healthcare expenditure in the region. In addition, the rising adoption of e-commerce channels for pet dewormer product purchases is further propelling the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."