- Home

- »

- Medical Devices

- »

-

Europe Fill Finish Pharmaceutical Contract Manufacturing Market Report, 2030GVR Report cover

![Europe Fill Finish Pharmaceutical Contract Manufacturing Market Size, Share & Trends Report]()

Europe Fill Finish Pharmaceutical Contract Manufacturing Market Size, Share & Trends Analysis Report By Product (Prefilled Syringes, Vials, Cartridges), By Molecule, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-050-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

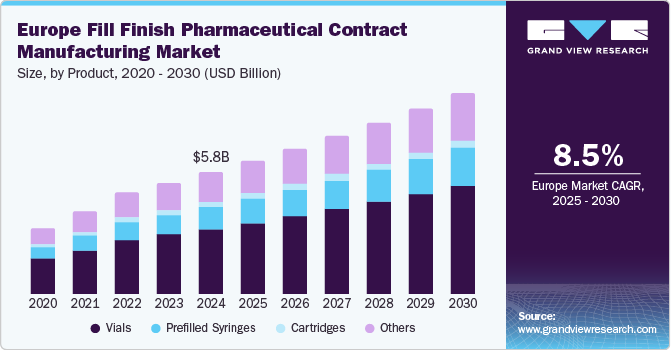

The Europe fill finish pharmaceutical contract manufacturing market size was estimated at USD 5.81 billion in 2024 and is projected to grow at a CAGR of 8.5% from 2025 to 2030. The UK, with a population of approximately 69 million and a median age of 40, reflects a demographic shift that intensifies the demand for pharmaceutical products, particularly sterile injectables required for chronic disease management. Similarly, aging populations in countries such as Germany, Spain, and Italy are further fueling this demand and emphasizing the critical need for efficient fill-finish processes.

The shifting trend toward outsourcing manufacturing operations to Contract Manufacturing Organizations (CMOs) allows pharmaceutical companies to focus on their core competencies while benefiting from cost efficiencies and expertise offered by specialized contract manufacturers. As CMOs enhance their capabilities, pharmaceutical firms, including many small and mid-sized companies, are increasingly leveraging these services to bring their products to market faster. This is particularly evident in Spain and Italy, where smaller biotech firms are harnessing contract manufacturing to streamline their production processes amid rising costs and regulatory complexities.

The favorable regulatory environment within Europe also plays a crucial role in propelling the fill-finish contract manufacturing market forward. Countries such as Denmark and France have implemented regulations that expedite approval processes for innovative therapies while prioritizing patient safety and data integrity. France’s initiatives to streamline advanced therapy medicinal products (ATMPs) and the EU’s establishment of the European Health Data Space (EHDS) enhance data sharing, fostering pharmaceutical research and development while ensuring compliance with GDPR for patient data protection.

Moreover, technological advancements in fill-finish processes signify another vital driver for market growth. Continuous improvements, particularly in aseptic filling and finishing technologies, empower manufacturers to produce complex biologics and vaccines more efficiently. As regulatory scrutiny increases, companies that adopt advanced technologies can enhance their production capabilities to meet rising demands, as witnessed during the COVID-19 pandemic. This dual focus on technological innovation and regulatory adaptation positions the European industry for sustained growth and competitiveness.

Product Insights

Vials dominated the market and accounted for a share of 53.4% in 2024, fueled by the rising production of biologics and vaccines, primarily packaged in vials to ensure safety and efficacy. Advanced vial filling technologies improve efficiency and minimize contamination risks, while the trend of outsourcing fill-finish processes to specialized CMOs is aiding industry growth.

Prefilled syringes are expected to grow at the fastest CAGR of 9.6% over the forecast period. Prefilled syringes enhance patient compliance by minimizing contamination and dosing errors. The rising incidence of chronic diseases drives their adoption due to the need for frequent medication administration. Innovation in self-administration technologies and a focus on healthcare delivery systems solidify prefilled syringes’ role in modern pharmaceutical manufacturing.

Molecule Insights

Large molecules led the market with a revenue share of 67.3% in 2024, driven by the rising prevalence of chronic diseases and the demand for biologics, necessitating specialized fill-finish processes for sterility and efficacy. The outsourcing trend to CMOs allows pharmaceutical companies to enhance focus while benefiting from CMO expertise and technological advancements in large molecule production.

Small molecules are projected to grow rapidly over the forecast period. Small molecules are generally simpler to formulate and manufacture than large biologics, facilitating quicker market entry. The increasing trend of outsourcing to CMOs allows pharmaceutical firms to concentrate on research and development while capitalizing on CMO expertise in efficient fill-finish processes, supported by a strong pipeline of late-stage small molecule drugs.

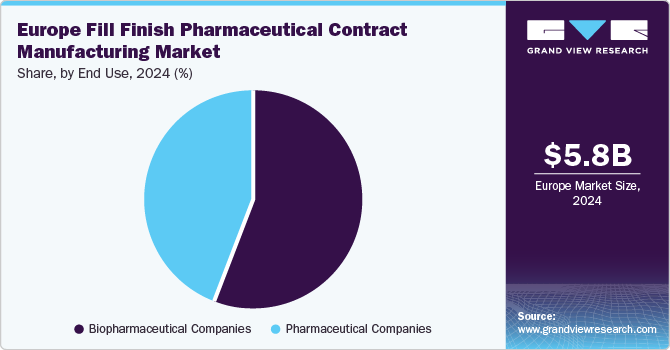

End Use Insights

Biopharmaceutical companies held the largest revenue share of 35.9% in 2024, propelled by a heightened emphasis on biologics and biosimilars, with biopharmaceutical companies significantly investing in research and development to create innovative therapies for chronic and complex diseases. Specialized fill-finish services are essential for ensuring sterility and regulatory compliance, while outsourcing manufacturing to CMOs enhances efficiency and accelerates time-to-market.

Pharmaceutical companies are anticipated to grow lucratively over the forecast period. Pharmaceutical companies are increasingly outsourcing fill-finish operations to CMOs to concentrate on their core competencies, such as research and development. This trend allows access to specialized expertise and advanced facilities, enhancing efficiency and reducing costs, particularly amidst the growing complexity of biologics and personalized medicines.

Country Insights

UK Fill Finish Pharmaceutical Contract Manufacturing Market Trends

The UK fill-finish pharmaceutical contract manufacturing market held the largest market share of 20.3% in 2024 in the Europe market. The UK boasts a robust pharmaceutical industry, featuring a strong pipeline of innovative drugs and rising demand for biologics and sterile injectables. Its favorable regulatory environment and advanced manufacturing capabilities make it an attractive hub for contract manufacturing, enabling companies to outsource fill-finish processes and concentrate on core activities.

Germany Fill Finish Pharmaceutical Contract Manufacturing Market Trends

The fill-finish pharmaceutical contract manufacturing market in Germany is expected to grow at the fastest CAGR of 11.0% over the forecast period. Germany’s strong pharmaceutical sector benefits from substantial investments in research and development, particularly in biologics and advanced therapies. Its central location in Europe enhances distribution efficiency, while stringent regulatory standards uphold production quality, positioning Germany’s fill-finish capabilities for significant growth amid rising demand for innovative therapies.

Key Europe Fill Finish Pharmaceutical Contract Manufacturing Company Insights

Some key companies operating in the market include Thermo Fisher Scientific Inc., Sartorius AG, Boehringer Ingelheim International GmbH, and Catalent, Inc. (acquired by Novo Holdings A/S). Companies are pursuing acquisitions and partnerships while investing in advanced technologies and flexible manufacturing solutions to enhance services, expand market share, and meet rising demand for biologics and sterile injectables.

-

Sartorius AG delivers equipment and services to facilitate biopharmaceutical development and manufacturing. Their innovative bioprocessing solutions, including single-use technologies and automation systems, enhance efficiency and compliance in fill-finish operations while supporting pharmaceutical companies in optimizing sterile product production processes.

-

Baxter specializes in sterile contract manufacturing injectable pharmaceuticals, including biologics, cytotoxics, and vaccines. They offer customized fill/finish services using advanced facilities, ensuring regulatory compliance and supporting clients throughout the drug development lifecycle from clinical trials to commercial production.

Key Europe Fill Finish Pharmaceutical Contract Manufacturing Companies:

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Boehringer Ingelheim International GmbH

- Catalent, Inc (acquired by Novo Holdings A/S)

- Societal CDMO (Recro Pharma, Inc)

- Baxter

- Eurofins Scientific

- Symbiosis Pharmaceutical Services Ltd

- MabPlex International Co. Ltd.

- Recipharm AB

- Fresenius Kabi, USA LLC

- Lonza

View a comprehensive list of companies in the Europe Fill Finish Pharmaceutical Contract Manufacturing Market

Recent Developments

-

In October 2024, Symbiosis Pharmaceutical Services Ltd acquired new premises in Stirling, Scotland, doubling its manufacturing capacity and enhancing its commercial services to expedite sterile injectable drug product delivery.

-

In October 2024, Thermo Fisher Scientific launched its Accelerator Drug Development services at CPHI Milan, enhancing its contract development and manufacturing organization and contract research organization capabilities following earlier expansions.

-

In February 2024, Novo Holdings announced its acquisition of Catalent in an all-cash transaction valued at USD 16.5 billion, enhancing its investment strategy in established life science companies.

Europe Fill-finish Pharmaceutical Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.34 billion

Revenue forecast in 2030

USD 9.54 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, molecule, end use, region

Regional scope

Europe

Country scope

UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway

Key companies profiled

Thermo Fisher Scientific Inc.; Sartorius AG; Boehringer Ingelheim International GmbH; Catalent, Inc (acquired by Novo Holdings A/S); Societal CDMO (Recro Pharma, Inc); Baxter; Eurofins Scientific; Symbiosis Pharmaceutical Services Ltd; MabPlex International Co. Ltd.; Recipharm AB; Fresenius Kabi, USA LLC; Lonza

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Fill Finish Pharmaceutical Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe fill-finish pharmaceutical contract manufacturing market report based on product, molecule, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prefilled Syringes

-

Vials

-

Cartridges

-

Others

-

-

Molecule Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Molecules

-

Small Molecules

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Companies

-

Pharmaceutical Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe fill finish pharmaceutical contract manufacturing market size was estimated at USD 5.81 billion in 2024 and is expected to reach USD 6.34 billion in 2025.

b. The Europe fill finish pharmaceutical contract manufacturing market witnessed a moderate growth rate of 8.5% from 2025 to 2030 to, reach USD 9.54 billion by 2030.

b. By product type, the vials segment dominated the market with a share of 53.39% in 2024. This is attributable to the increasing production of biologics that are majorly commercialized in the vials form.

b. Some key players operating in the Europe fill-finish pharmaceutical contract manufacturing market include Thermo Fisher Scientific, Inc., Boehringer Ingelheim, Catalent Inc, Baxter BioPharma Solutions, Eurofins Scientific, and a few others.

b. Growing technological advancements across the fill-finish lines to enhance its efficacy and turn around time, coupled with an increasing number of CMOs focusing on the expansion of fill-finish manufacturing plants, are the major growth driving factors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."