- Home

- »

- Food Safety & Processing

- »

-

Europe Food Cans Market Size And Share, Report, 2030GVR Report cover

![Europe Food Cans Market Size, Share & Trends Report]()

Europe Food Cans Market Size, Share & Trends Analysis Report By Product (Aluminum, Steel), By Application (Meat, Ready Meals, Vegetables, Fish, Fruits, Powder Products), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-724-7

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Europe Food Cans Market Size & Trends

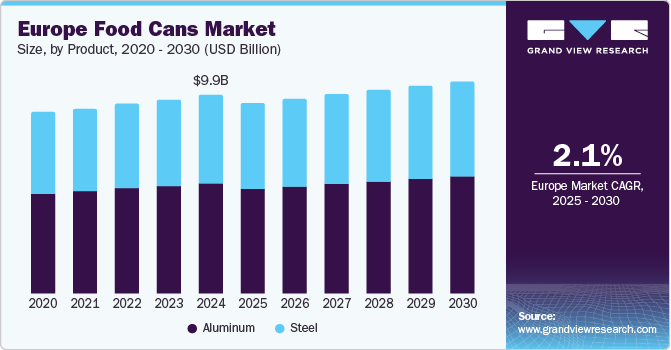

The Europe food cans market size was estimated at USD 9.96 billion in 2024 and is projected to grow at a CAGR of 2.1% from 2025 to 2030. This growth is driven by the increased demand for packaged and processed foods as consumers seek convenient and long-lasting food options. Urbanization and the fast-paced lifestyle of consumers contribute to the growing preference for ready-to-eat and easy-to-prepare food products. Expanding convenient food options and the rising demand for milk-based products further fuel market growth.

The recyclable nature of metal cans is becoming increasingly important, where environmental concerns are at the forefront of consumer decision-making. As awareness about sustainability grows, consumers are actively seeking packaging solutions that minimize environmental impact. Metal cans, particularly those made from aluminum and steel, stand out. Their recyclability allows for multiple reuse cycles and requires less energy to produce new cans from recycled materials compared to manufacturing them from raw resources. This inherent sustainability makes food cans more appealing, especially as consumers shift away from single-use plastics, which contribute significantly to pollution and landfill waste.

Product Insights

The aluminum segment accounted for 42.7% of the European food cans market in 2024 due to its lightweight properties, superior strength, and excellent barrier properties against light, moisture, and oxygen, which help preserve the quality and freshness of food products. Additionally, aluminum is highly recyclable, making it an environmentally friendly option that resonates with consumers' growing sustainability concerns. The ease of printing on aluminum cans and the ability to modify can designs contribute to their popularity in the market.

The steel segment is projected to grow at a CAGR of 1.9% from 2025 to 2030 due to its durability and strength, which make it suitable for packaging heavier and bulkier food items. While steel cans are slightly heavier than aluminum, they offer cost advantages and are highly recyclable. The demand for steel cans is driven by their use in larger food service applications and the need for robust packaging solutions that can withstand transportation and storage challenges.

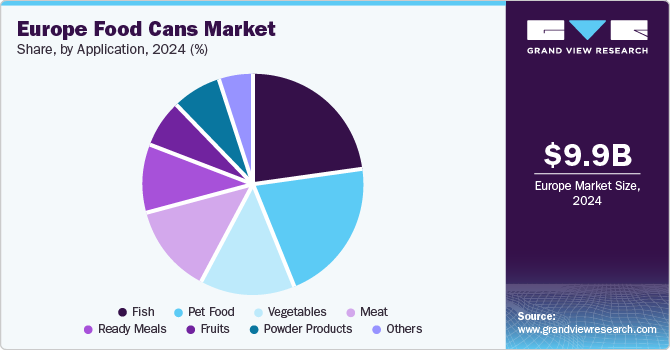

Application Insights

The fish segment held the largest revenue share in 2024, driven by the high demand for canned fish products, which are popular for their convenience, long shelf life, and nutritional value. European consumers' preference for ready-to-eat fish products, such as sardines, tuna, and mackerel, contributes significantly to this segment's growth. Countries like Spain and Italy, known for their large-scale production and high import of canned fish, play a crucial role in this market.

The meat segment is projected to witness the fastest growth from 2025 to 2030 due to the increasing consumer reliance on processed and packaged food with extended shelf life. Canned meat products, including corned beef, ham, and chicken, are gaining popularity due to their convenience and long-term storage capabilities. The rising demand for organic and sustainably sourced meat products also contributes to the growth of this segment as consumers become more health-conscious and environmentally aware.

Country Insights

Germany Food Cans Market Trends

Germany held the 10.7% market share in the European food cans market in 2024. The country’s strong manufacturing base and emphasis on sustainability contribute to this robust market presence. German consumers increasingly favor eco-friendly packaging, driving demand for recyclable metal cans.

France Food Cans Market Trends

France's food cans market is expected to grow at a CAGR of 3.1% from 2025 to 2030. The French market is characterized by a blend of traditional and innovative canned products, with a notable focus on quality and gourmet options. As culinary trends evolve, there is likely to be an uptick in demand for both local and international specialty canned foods, which could further enhance market growth.

Spain Food Cans Market Trends

Spain's food cans market accounted for 8.0% revenue share in 2024,due to a vibrant food culture that embraces canned products, particularly seafood. The country's culinary heritage and increasing imports of exotic canned fish position Spain as a growing market for diverse canned offerings. This trend is supported by the rising popularity of Mediterranean diets, which often include canned fish as a staple ingredient.

Russia Food Cans Market Trends

Russia dominated the European food cans market in 2024, driven by a large population and increasing consumer interest in convenience foods. The country’s focus on local sourcing and production helps meet the demand for affordable and readily available canned options.

Turkey Food Cans Market Trends

Turkey’s food cans market is projected to grow at the fastest rate in the region over the forecast period. This expansion can be attributed to changing consumer lifestyles and a growing inclination toward convenient, ready-to-eat meals. As urbanization increases and the population becomes more health-conscious, the demand for nutritious, easy-to-prepare canned options is likely to rise.

Key Europe Food Cans Company Insights

Some of the key players operating in the market include BASF SE, Evonik, Solvay, and SABIC:

-

Ardagh Group operates twelve advanced production facilities throughout Europe, specializing in manufacturing a diverse array of beverage cans and ends. The company focuses on high-volume application segments, including beer, wine, water, and energy drinks, leveraging innovative processes to effectively meet the demands of these sectors.

-

Ball Corporation is a prominent contender in the European food can sector, with established operations across key markets, including Germany, France, Great Britain, the Netherlands, Poland, and Serbia.

Key Europe Food Cans Companies:

- Ardagh Group

- Ball Corporation

- Can-Pack S.A.

- CPMC Holdings Limited

- Crown Holdings Inc.

- Nestlé S.A.

- Zwanenberg Food Group

- Silgan Holdings Inc.,

- Lucky Star Ltd. (Glenryck)

- Sarten Romania SRL

View a comprehensive list of companies in the Europe Food Cans Market

Recent Developments

- In June 2024, Sonoco Products Company announced its acquisition of Eviosys, a leading European manufacturer specializing in food can production, including ends and closures. This strategic move is part of Sonoco's initiative to enhance its footprint in the metal can sector. The integration of Eviosys into Sonoco's existing operations is projected to optimize operational efficiency and expand market reach.

Europe Food Cans Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.58 billion

Revenue forecast in 2030

USD 10.64 billion

Growth Rate

CAGR of 2.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in million units, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

Germany; UK; France; Italy; Spain; Netherlands; Russia; Turkey

Key companies profiled

Ardagh Group; Ball Corporation; Can-Pack S.A.; CPMC Holdings Limited; Crown Holdings Inc.; Nestlé S.A.; Zwanenberg Food Group; Silgan Holdings Inc.; Lucky Star Ltd. (Glenryck); Sarten Romania SRL.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Food Cans Market Report Scope

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe food cans market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Steel

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat

-

Ready Meals

-

Vegetables

-

Fish

-

Fruits

-

Powder Products

-

Pet food

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

Turkey

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."