- Home

- »

- Homecare & Decor

- »

-

Europe Glassware Market Size, Share, Industry Report, 2030GVR Report cover

![Europe Glassware Market Size, Share & Trends Report]()

Europe Glassware Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Wine Glass, Beer Glass), By Distribution Channel (Specialty Stores, Online Retail), By Branding, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-351-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Glassware Market Size & Trends

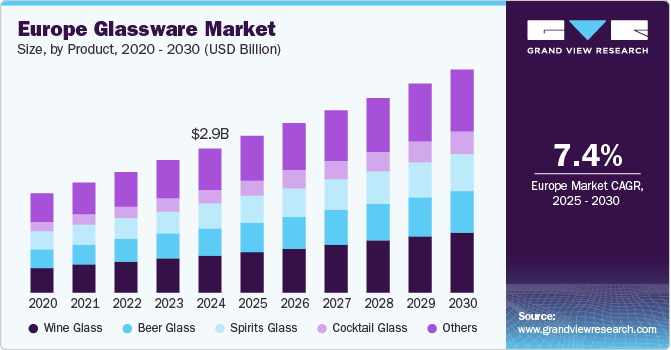

The Europe glassware market size was valued at USD 2.96 billion in 2024 and is expected to expand at a CAGR of 7.4% from 2025 to 2030. The rising disposable income and changing lifestyles increase consumer spending on glassware. Expanding residential and commercial spaces, particularly in the hospitality sector, contributes to the market's growth. The growing emphasis on sustainability and eco-friendly products has also encouraged consumers to opt for reusable glass items, such as water bottles and straws.

Advancements in glassware production technologies are providing new opportunities for market expansion. In addition, the rich cultural heritage and traditions associated with glassware in various European countries are fostering a strong demand for high-quality and artisanal glass products. Continuous innovations in glassware design and functionality, such as ergonomic shapes, multifunctional items, and smart glassware with integrated technology, attract consumers looking for convenience and modernity. For instance, beamian, innovation and technology driven company, introduced its latest smart wine glass, in partnership with key online wine-commerce platform, adegga. This advanced glass features a built-in chip that allows users to record wine information simply by touching the glass to an electronic identifier at each producer’s table.

The growing awareness of health and hygiene, especially post-pandemic, led consumers to prefer glass to plastic due to its non-toxic and easy-to-clean properties. This shift is driving the demand for glassware in households and commercial settings. For instance, Glassette, the homeware marketplace co-founded by Laura Jackson, introduced its inaugural own-brand collection, featuring an elegant assortment of everyday drinking glasses. The five-piece range, inspired by Parisian café culture, includes the popular Frenchette bistro glass, an oversized variant, two tumblers, and a refined champagne coupe.

Product Insights

Wine glasses dominated the market, with a revenue share of 25.9% in 2024. The increasing trend of wine-tasting events, home entertainment and the rising disposable income of consumers have all contributed to the demand for high-quality wine glasses. Additionally, the emphasis on aesthetics and the desire for premium, stylish glassware for special occasions have further boosted the market for wine glasses.

The cocktail glass is expected to grow at a significant CAGR of 7.5% over the forecast period. This growth is attributed to the rising popularity of cocktail culture and mixology. Furthermore, the increasing number of bars, restaurants, and home cocktail enthusiasts are driving the demand for stylish and functional cocktail glasses. Additionally, the growing trend of social gatherings and entertaining at home has contributed to the market's expansion. The emphasis on presentation and the desire for premium, high-quality glassware for special occasions also play a crucial role.

Distribution Channel Insights

Specialty stores dominated the market with the largest revenue share in 2024. This growth is attributed to their unique and high-quality products, which attract consumers looking for premium and artisanal glassware. Specialty stores often provide a curated selection of glass items, including wine glasses, cocktail glasses, and other specialty glassware, which appeals to consumers seeking distinctive and stylish products for their homes or businesses.

The online retail segment is expected to grow at the fastest CAGR over the forecast period. Consumers are turning to online platforms to purchase glassware due to the wide variety of products available, competitive pricing, and the ease of comparing options. The rise of e-commerce giants and specialized online retailers has made it easier for consumers to find and purchase high-quality glassware. In addition, the growing trend of home entertaining and the desire for unique, premium glass items have also contributed to the popularity of online retail for glassware.

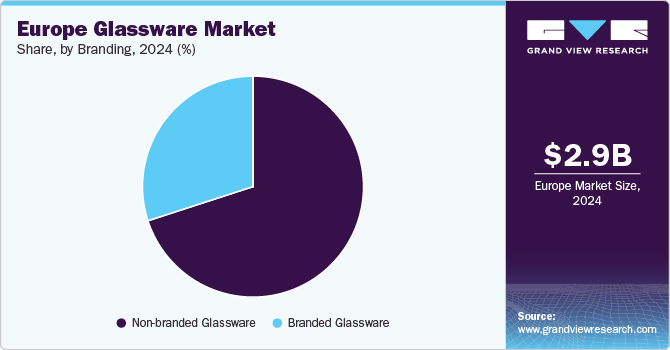

Branding Insights

Non-branded dominated the market with the largest revenue share of 63.4% in 2024. The affordability and wide availability of non-branded products are the significant drivers for the segment. Consumers often seek cost-effective alternatives to branded glassware, making non-branded options more attractive. Additionally, increasing online retailers and discount stores offering non-branded glassware has contributed to its market dominance. The trend towards minimalism and the preference for simple, functional designs over branded logos have also played a role in the popularity of non-branded glassware.

The branded segment is expected to grow at the fastest CAGR over the forecast period. Consumers are increasingly seeking trusted and reliable brands that offer high-quality glassware products. The emphasis on brand reputation and quality assurance drives consumer preference for branded items. Additionally, branded glassware often comes with warranties and customer support, which adds value for consumers. Furthermore, the growing trend of gifting branded glassware for special occasions and the influence of marketing and advertising campaigns also contribute to the segment's growth. In addition, expanding e-commerce platforms have made it easier for consumers to access and purchase branded glassware products online.

Country Insights

The UK glassware industry dominated the European market with the largest revenue share of 16.6% in 2024. The presence of renowned glassware manufacturers and artisans has contributed to UK-produced glassware's high quality and craftsmanship. Additionally, the strong domestic demand for premium and artisanal glass products, coupled with the influence of British culture and lifestyle, has played a significant role in the market's growth. The UK's strategic location and well-established distribution networks have also facilitated the export of glassware to other European countries, further boosting its market share. In September 2024, Crystal Image, a prominent glassware manufacturer, unveiled a Birmingham-themed glassware collection for summer 2024. This exquisite range, handcrafted by skilled local engravers in Stourbridge, showcases notable historical and iconic landmarks from Birmingham's City Centre.

Germany Glassware Market Trends

Germany's glassware industry held a considerable share in 2024. Germany is known for its long-standing tradition of glassmaking and craftsmanship, which has contributed to the high quality and innovation of its glassware products. The strong domestic demand for premium glassware and the country's reputation for producing durable and stylish glass items has played a significant role in its market share. Additionally, Germany's strategic location in Europe and its well-established export capabilities have facilitated the distribution of its glassware products to other European countries, further boosting its market presence.

Spain Glassware Market Trends

Spain's glassware industry is expected to grow at a significant CAGR of 8.6% over the forecast period. This growth is attributed to several factors, including the flourishing hospitality and tourism industry, For instance, Spain ranks second most visited place after France, foreign visitors improved by 10% compared to 2023, which drives demand for high-quality glassware in restaurants, bars, and hotels. Additionally, emphasizing presentation and aesthetics in the food and beverage sector contributes to the market's expansion. The increasing consumer preference for eco-friendly and sustainable glass products, along with the rising disposable incomes, is also playing a crucial role in driving the growth of the Spain glassware industry.

Key Europe Glassware Company Insights

Some key companies in the Europe glassware market include Sisecam, Villeroy & Boch Group AG, Fiskars Group, Lifetime Brands, Inc., Ritzenhoff Cristal GmbH, Steelite International, and others.

-

Ritzenhoff produces a wide range of glassware products, including drinking glasses, stemware, and specialty glass items. The company's commitment to quality and sustainability is evident in its production processes, which combine traditional glassblowing techniques with modern technology. Ritzenhoff serves both the B2B and B2C markets, offering customized solutions for the international beverage industry and high-quality products for end consumers through its online store and specialist retailers.

-

Steelite specializes in producing high-quality porcelain, melamine, stoneware, and glass tableware designed to enhance the dining experience. The company's innovative designs and commitment to durability and hygiene standards have made it a preferred choice for restaurants, cafes, and hotels worldwide.

Key Europe Glassware Companies:

- Sisecam

- Villeroy & Boch Group AG

- Fiskars Group

- Lifetime Brands, Inc.

- Ritzenhoff Cristal GmbH

- Steelite International

- Alessi SpA

- ARC International

- Joh. Oertel & Co. Kristallglas

- Bormioli Luigi S.p.A.

Europe Glassware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.21 billion

Revenue forecast in 2030

USD 4.58 billion

Growth Rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, Branding and Region

Regional scope

Europe

Country scope

UK, Germany, France, Italy, Spain, Benelux, Russia

Key companies profiled

Sisecam; Villeroy & Boch Group AG; Fiskars Group; Lifetime Brands, Inc.; Ritzenhoff Cristal GmbH; Steelite International; Alessi SpA; ARC International; Joh. Oertel & Co. Kristallglas; Bormioli Luigi S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Glassware Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe glassware market report based on product, distribution channel, branding, and country

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Beer Glass

-

Wine Glass

-

Cocktail Glass

-

Spirits Glass

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

-

Branding Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Glassware

-

Non-branded Glassware

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Benelux

-

Spain

-

Russia

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.