- Home

- »

- Advanced Interior Materials

- »

-

Europe Industrial Air Filtration Market Size, Report, 2030GVR Report cover

![Europe Industrial Air Filtration Market Size, Share & Trends Report]()

Europe Industrial Air Filtration Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dust Collectors, Mist Collectors), By End Use (Cement), By Distribution Channel (OEM, Aftermarket), By Country, And Segment Forecasts

- Report ID: 978-1-68038-350-8

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Industrial Air Filtration Market Trends

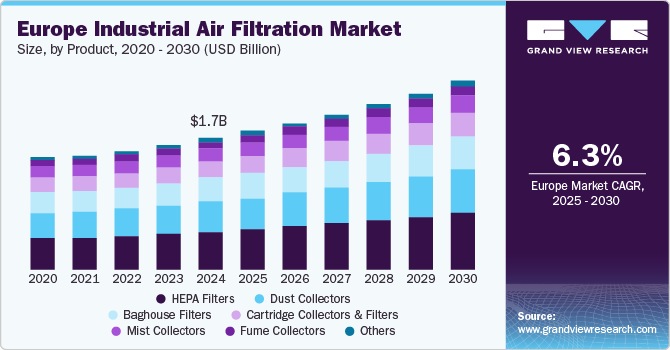

The Europe industrial air filtration market size was valued at USD 1.66 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. This growth is driven by stringent government regulations to reduce industrial emissions and improve air quality. In addition, technological advancements in filtration technologies have led to the development of more efficient and cost-effective solutions, further boosting market demand. The increasing awareness of environmental health and the need to ensure safe working conditions for employees also contribute significantly to market growth. Moreover, the expansion of various end-use industries, such as pharmaceuticals, food and beverage, and chemicals requiring stringent air quality control, is expected to propel the market forward.

The European industrial air filtration market is significantly influenced by the Industrial Emissions Directive (IED), which sets strict limits on emissions from industrial installations, and the National Emission Ceilings Directive (NECD), which mandates national limits on certain air pollutants. The Integrated Pollution Prevention and Control (IPPC) framework, now part of the IED, requires industries to implement Best Available Techniques (BAT) to minimize emissions. Additionally, the EN ISO 16890 standard for particulate air filters is crucial in ensuring high performance and efficiency in air filtration systems. These regulations collectively drive the adoption of advanced air filtration technologies.

Product Insights

The High-Efficiency Particulate Air (HEPA) filters segment accounted for 29.9% of the total revenue generated in the market in 2024. HEPA filters’ high efficiency makes them indispensable in industries where air quality is critical, such as pharmaceuticals, healthcare, and food processing. Stringent regulatory standards and the need for contamination control in these sensitive environments drive the demand for HEPA filters. Additionally, the rising awareness of indoor air quality and its impact on health has led to increased adoption of HEPA filters in commercial and residential settings, further boosting their market share.

The dust collectors segment is expected to grow at a CAGR of 6.6% over the forecast period. Dust collectors are essential in industries such as manufacturing, mining, and woodworking, where large volumes of dust and particulate matter are generated. The increasing emphasis on workplace safety and compliance with occupational health regulations fuels the growth in this segment. The expansion of industrial activities and the need for effective dust management solutions are key factors contributing to the segment’s anticipated growth.

End Use Insights

The food & beverage segment held the largest market share of 22.6% in 2024 attributed to the stringent hygiene and safety standards required in food processing and production environments. Air filtration systems in this segment are crucial for preventing contamination and ensuring the quality and safety of food products. The demand for high-efficiency filtration solutions is driven by regulations such as the European Union’s Food Safety Standards, which mandate strict control over airborne contaminants.

The pharmaceutical segment is expected to register the fastest growth during the forecast period. This growth is driven by the critical need for maintaining sterile and contaminant-free environments in pharmaceutical manufacturing and research facilities. Air filtration systems are essential in this segment to protect against airborne contaminants that could compromise the quality and efficacy of pharmaceutical products. The stringent regulatory requirements, such as those imposed by the European Medicines Agency (EMA) and Good Manufacturing Practices (GMP), necessitate the use of high-performance air filtration solutions.

Distribution Channel Insights

The aftermarket segment accounted for the largest revenue share in 2024, primarily due to the ongoing need to maintain, replace, and upgrade air filtration systems across various industries. Aftermarket products, including replacement filters and parts, are essential for ensuring the continued efficiency and compliance of existing filtration systems. The demand in this segment is driven by the high operational standards required in industries such as pharmaceuticals, food and beverage, and manufacturing, where maintaining optimal air quality is critical. In addition, the increasing awareness of the importance of regular maintenance to prevent system failures and ensure worker safety further boosts the aftermarket segment. The availability of a wide range of aftermarket products and services, coupled with the growing emphasis on sustainability and cost-effectiveness, contributes to the segment’s substantial revenue share.

The OEM (Original Equipment Manufacturer) segment is expected to grow steadily over the forecast period attributed to the rising demand for new and advanced air filtration systems in various industrial applications. OEMs provide customized and integrated filtration solutions that meet specific industry requirements, offering high efficiency and reliability. The expansion of industrial activities and establishing new manufacturing facilities across Europe are key factors driving the demand for OEM air filtration systems. Moreover, technological advancements and innovations in filtration technologies by OEMs are expected to enhance the performance and efficiency of these systems, further propelling market growth. The steady growth of the OEM segment is also supported by the increasing adoption of automation and smart technologies in industrial processes, which require sophisticated and reliable air filtration solutions.

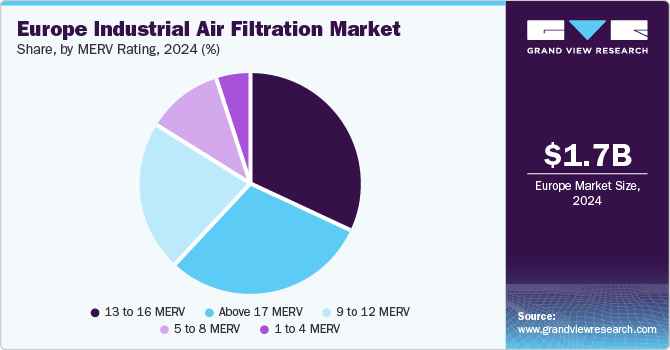

MERV Rating Insights

The 13 to 16 MERV segment dominated the Europe industrial air filtration market in 2024. MERV (Minimum Efficiency Reporting Value) ratings in this range are known for their high efficiency in capturing airborne particles, including dust, pollen, mold spores, and even some bacteria. Filters with MERV ratings of 13 to 16 are commonly used in environments where superior air quality is essential, such as hospitals, laboratories, and cleanrooms. The dominance of this segment is driven by the stringent air quality standards and regulations in Europe, which mandate the use of high-efficiency filters to ensure a safe and healthy environment. Additionally, the increasing awareness of the health impacts of poor air quality and the need to protect sensitive processes and products from contamination further boost the demand for filters in this MERV range.

The Above 17 MERV segment is projected to grow at the fastest rate over the forecast period. Filters with MERV ratings above 17, including HEPA and ULPA (Ultra-Low Penetration Air) filters, offer the highest level of filtration efficiency, capable of capturing the smallest particles, including viruses and fine particulate matter. The rapid growth of this segment is driven by the increasing demand for ultra-clean environments in critical applications such as semiconductor manufacturing, biotechnology, and advanced research facilities. The ongoing advancements in these high-tech industries necessitate using the most efficient air filtration systems to maintain stringent cleanliness standards.

Europe Industrial Air Filtration Market Trends

Some of the key companies in the European industrial air filtration market include Honeywell International, Inc., MANN+HUMMEL, Daikin Industries, Ltd., Danaher Corporation, Donaldson Company Inc., SPX Corporation, Lydall Inc., and others.

-

SPX Corporation provides specialized air filtration solutions for various industrial applications in Europe. The company’s products are designed to meet the specific needs of industries such as power generation, oil and gas, and manufacturing.

-

Lydall Inc. specializes in advanced filtration materials and systems for the European industrial air filtration market. Their offerings include high-performance filter media designed for various applications, including HVAC and industrial processes.

Key Europe Industrial Air Filtration Companies:

- Honeywell International, Inc.

- MANN+HUMMEL

- Daikin Industries, Ltd.

- Danaher Corporation

- Donaldson Company Inc.

- SPX Corporation

- Lydall Inc.

- AAF International

- Industrial Air Filtration, Inc

- Parker Hannifin Corporation

- Camfil Group

- Freudenberg & Co. Kg.

- Filtration Group

- Testori SpA

- Eaton Corporation plc

Recent Developments

-

In January 2024, SF-Filter Group successfully acquired Hermans Brems NV, a longstanding distribution partner in Belgium. This strategic acquisition reinforces the Group's position as a premier independent distributor of mobile and industrial filters within the European market, expanding its geographic footprint to include the Belgian Flanders region.

-

In October 2023, Hengst unified expertise in industrial air filtration by merging the DELBAG and Nordic Air Filtration brands under the overarching Hengst Filtration umbrella.

Europe Industrial Air Filtration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.75 billion

Revenue forecast in 2030

USD 2.38 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, MERV rating, region

Key companies profiled

Honeywell International, Inc., MANN+HUMMEL, Daikin Industries, Ltd., Danaher Corporation, Donaldson Company Inc., SPX Corporation, Lydall Inc., AAF International, Industrial Air Filtration, Inc., Parker Hannifin Corporation, Camfil Group, Freudenberg & Co. Kg., Filtration Group, Testori SpA. Eaton Corporation plc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Industrial Air Filtration Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe industrial air filtration market report based on product, end use, distribution channel, MERV rating, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dust Collectors

-

Mist Collectors

-

Fume Collectors

-

HEPA Filters

-

Cartridge Collectors & Filters

-

Baghouse Filters

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cement

-

Food & Beverage

-

Metal

-

Power

-

Pharmaceutical

-

Chemical & Petrochemical

-

Paper & Wood Processing

-

Agriculture

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

MERV Rating Outlook (Revenue, USD Million, 2018 - 2030)

-

1 to 4 MERV

-

5 to 8 MERV

-

9 to 12 MERV

-

13 to 16 MERV

-

Above 17 MERV

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.