- Home

- »

- Drilling & Extraction Equipments

- »

-

Europe Oilfield Equipment Market Size, Industry Report 2030GVR Report cover

![Europe Oilfield Equipment Market Size, Share & Trends Report]()

Europe Oilfield Equipment Market Size, Share & Trends Analysis Report By Product (Drilling Equipment, Pumps & Valves), By Application (Onshore, Offshore), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-723-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Europe Oilfield Equipment Market Trends

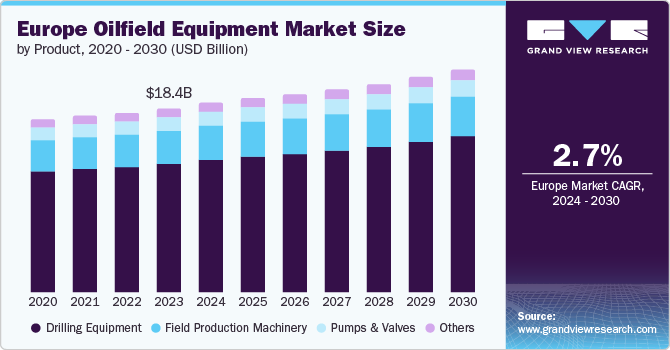

The Europe oilfield equipment market size was valued at USD 18.38 billion in 2023 and is projected to grow at a CAGR of 2.7% from 2024 to 2030. The market growth is driven by some prominent factors, including increasing energy requirements in the region and the growing number of activities in oil exploration. Rising industrialization, urbanization, and transportation needs are also contributing to the rising demand for fossil fuels. Furthermore, exploring unconventional oil reserves such as shale and deepwater sources requires specialized equipment and investments in advanced extraction technologies intended for market growth.

The continuous demand for innovative, efficient, and environmentally sustainable alternatives, as previous equipment becomes unproductive, pushes companies to invest in modernized and enhanced equipment. In addition, geopolitical factors and strategic initiatives by oil-producing nations also play a role in influencing market expansion.

Furthermore, various significant elements contribute to the market growth, including advancements and rapid technological innovations for oilfield equipment and the development of shale oil and gas formations, enabled by techniques such as hydraulic fracturing and horizontal drilling by crucial companies in European countries. Oil and gas companies are consequently working towards improving production efficacy while minimizing operational or production costs, focusing on unconventional and deep hydrocarbon reservoirs such as tight gas, shale gas, etc., further fueling the demand for oilfield equipment.

Product Insights

Drilling equipment dominated the market and accounted for a revenue share of 69.1% in 2023. This growth is attributed to the rise in offshore drilling operations, particularly in deepwater and ultra-deepwater areas. It is expected to boost the need for top-notch drilling technologies further. In addition, innovations towards enhancing drilling effectiveness and cutting down operational expenses also have a significant influence on changing the market scenario for the growth of drilling equipment

Pumps and valves are expected to grow at a CAGR of experienced growth with a CAGR of 2.5% over the forecast years. Pumps and valves are pivotal in oilfield activities, accountable for moving fluids, regulating pressure, and ensuring operational safety. The demand for these components is expected to increase as oil and gas companies aim to improve production efficacy and minimize environmental threats. Upgrades in infrastructure by investments and maintenance in current oilfields, combined with innovations in pump and valve technology, are likely to contribute to the segment expansion.

Application Insights

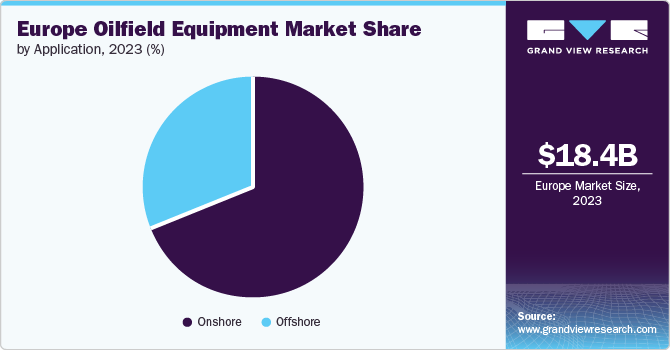

The onshore application dominated the market with a share of 69.2% in 2023. The onshore sector maintains a leading position in the oilfield equipment market in Europe. The prominence of the onshore sector is linked to the abundance of well-established oilfields on land and the comparatively lower expenses related to onshore drilling and production. Onshore operations typically entail drilling vertical wells, and the equipment essential for onshore purposes, including drilling rigs, wellheads, and production tools, are widely utilized due to the ease of access and existing infrastructure on land.

The offshore application segment is expected to grow at a CAGR of 2.4% over the forecast years owing to the escalating demand for oil and gas reserves situated in offshore basins and the exploration of previously unexplored reserves. Specialized equipment such as subsea production systems, offshore drilling rigs, floating production storage and offloading (FPSO) vessels are often required by offshore drilling. Furthermore, offshore activities encompass exploration, production, and extraction operations carried out in marine environments, usually in shallow or deepwater areas. The surge in the offshore segment is attributed to

Regional Insights & Trends

The oilfield equipment market in Europe accounted for a revenue share of USD 18.38 billion in 2023. The growth in crude field production in the region, due to the discovery of oil and gas reservoirs beneath the North Sea and the need for crude oil, has spurred oil exploration and production in Europe. Various companies are involved in significant drilling activities in both offshore and on-shore locations. In addition, several major oil and gas exploration firms are expanding their operations through strategic partnership contracts.

Russia Oilfield Equipment Market Trends

The oilfield equipment market in Russia accounted for the largest revenue share in 2023. This growth is driven by the country's vast hydrocarbon reserves and ongoing exploration and development activities in challenging environments. In addition, there is a need for advanced drilling and extraction technologies to access hard-to-reach oil and gas deposits, as well as the increasing demand for efficient and reliable oilfield equipment to support production from both onshore and offshore fields, further boosting the market's growth.

UK Oilfield Equipment Market Trends

The oilfield equipment market in UK is expected to grow at a CAGR of 3.1% over the forecast period owing to its well-established oil and gas sector; robust developments and technological upgradation have led to market expansion. The UK’s North Sea oil reserves provide a significant source of revenue generation. The assistance of the government in creating policies and tax concessions for oil and gas exploration and production drives the demand in the country. In addition, the best oil and gas infrastructures with pipelines, refineries, and terminals require continuous upgradation, further driving the oil equipment market.

Norway Oilfield Equipment Market Trends

The oilfield equipment market in Norway is expected to experience a significant transformation in exploration, development, and production in recent times. Consequently, exploration endeavors in the region are anticipated to pivot towards the Barents Sea, where approximately two-thirds of Norway's untapped resources are present. In addition, Norway is projected to uphold its leadership in the area during the projected timeframe. The growing demand for oil and gas firms to enhance and develop their operations with constrained budgets and improve cost-effectiveness is expected to contribute to market growth.

Key Europe Oilfield Equipment Company Insights

Some of the key companies in the Europe oilfield equipment market include Transocean Ltd.; Valaris Ltd.; Noble Corporation, Weatherford; Superior Energy Services; Schlumberger NV; Expro International Group Holding NV; Wireline Engineering Ltd.; and Oil States International, Inc. among others. These players are focusing on development to gain a competitive edge in the industry.

-

Transocean Ltd. is an offshore drilling contractor that operates mobile units and inland drilling barges to aid offshore drilling activities globally. The company focuses on technically demanding sections of the offshore drilling business, including deep water and harsh environment drilling services.

-

Valaris Ltd. offers offshore drilling services over the world’s oil and gas industry. It operates a fleet of drillships, semisubmersibles, moored semisubmersibles, premium jack-ups, and deepwater-managed units.

Key Europe Oilfield Equipment Companies:

- Transocean Ltd.

- Seadrill Ltd.

- Valaris Ltd.

- Noble Corporation

- Weatherford

- Superior Energy Services

- Schlumberger NV

- Expro International Group Holding NV

- Wireline Engineering Ltd.

- Oil States International, Inc.

Recent Developments

-

In June 2024, Seadrill Limited completed the sale of three of its jack-up rigs, the West Telesto, the West Castor, and the West Tucana, as well as its 50% equity stake in the joint venture functioning these rigs to its partner Gulf Drilling International for USD 338 million in cash proceeds. This divestment is part of Seadrill's efforts to streamline its business and focus on its core deepwater drilling operations.

-

In June 2024, Transocean Ltd. has secured a 365-day contract extension for its deepwater Asgard rig with an autonomous operator offshore the U.S. This extension is expected to add approximately USD 188 million to Transocean's backlog, including additional services.

Europe Oilfield Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.81 billion

Revenue forecast in 2030

USD 22.10 billion

Growth rate

CAGR of 2.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional scope

Europe

Country scope

UK, Germany, Norway, Russia, Italy

Key companies profiled

Transocean LTD; Seadrill Ltd.; Valaris Ltd.; Noble Corporation; Weatherford; Superior Energy Services; Schlumberger NV; Expro International Group Holding NV; Wireline Engineering Ltd.; Oil States International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Oilfield Equipment Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe oilfield equipment market report based on product, application, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Drilling Equipment

-

Pumps and Valves

-

Field Production Machinery

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

Norway

-

Russia

-

Italy

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."